| | | | | | | | | | | | | | |

| Prospectus Supplement No. 12 | | | | Filed pursuant to Rule 424(b)(3) |

| (To Prospectus dated September 29, 2023) | | | | Registration No. 333-274329 |

Wheeler Real Estate Investment Trust, Inc.

This is Prospectus Supplement No. 12 (this “Prospectus Supplement”) to our Prospectus, dated September 29, 2023 (the “Prospectus”), relating to the issuance from time to time by Wheeler Real Estate Investment Trust, Inc. of up to 101,100,000 shares of our common stock, par value $0.01 (“Common Stock”). Terms used but not defined in this Prospectus Supplement have the meanings ascribed to them in the Prospectus.

We have attached to this Prospectus Supplement our Current Report on Form 8-K filed on February 6, 2024. The attached information updates and supplements, and should be read together with, the Prospectus, as supplemented from time to time.

Investing in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 4 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is February 6, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): February 5, 2024

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 1.01. Entry into a Material Definitive Agreement

Item 8.01 of this Current Report on Form 8-K as to the redemptions by holders (collectively, the “Series D Preferred Holders”) of Wheeler Real Estate Investment Trust, Inc.’s (the “Company”) Series D Cumulative Convertible Preferred Stock (the “Series D Preferred Stock”) is incorporated herein by reference.

As previously disclosed in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on December 6, 2023, in connection with the December 2023 Series D Preferred Stock redemptions, (a) on December 4, 2023, the Company’s Board of Directors (the “Board”), under the terms of the Company’s charter, created a Capital Stock Excepted Holder Limit of 55% and a Common Stock Excepted Holder Limit of 86% (collectively, the “Prior Excepted Holder Limits”) for each of Stilwell Activist Investments, L.P., Stilwell Activist Fund, L.P., Stilwell Value Partners VII, L.P., and Stillwell Associates, L.P. (collectively, the “Investors”), and (b) on December 5, 2023, the Company entered into an Excepted Holder Agreement with the Investors with respect to such limits. Joseph Stilwell, a member of the Company’s Board of Directors, is the managing member and owner of Stilwell Value LLC, which is the general partner of each of the Investors.

Following the transfer of common stock, par value $0.01 (“Common Stock”) to the Investors in consideration of the February 2024 Series D Preferred Stock redemptions made by the Investors, the Investors would have beneficially owned or constructively owned an amount of Capital Stock in excess of the Prior Excepted Holder Limits. On February 5, 2024, the Board agreed to increase the Prior Excepted Holder Limits to permit this additional ownership and, accordingly, the Company entered into an amendment to the Excepted Holder Agreement with the Investors (the “Excepted Holder Amendment”) under which the Company increased the Capital Stock Excepted Holder Limit granted to Investors under the Excepted Holder Agreement to 60% and the Common Stock Excepted Holder Limit to 90%. The Excepted Holder Amendment does not otherwise alter or affect the rights and obligations of the parties to the Excepted Holder Agreement.

The foregoing description of the Excepted Holder Amendment is qualified in its entirety by the full text of that agreement, which is attached hereto as Exhibit 10.1, and is incorporated by reference herein.

Item 3.03. Material Modifications to Rights of Security Holders

Adjustment to Conversion Price of 7.00% Subordinated Convertible Notes due 2031

Item 8.01 of this Current Report on Form 8-K as to the redemptions by the Series D Preferred Holders of the Series D Preferred Stock is incorporated herein by reference.

As of January 5, 2024, the Conversion Price for the Company’s 7.00% Subordinated Convertible Notes due 2031 (the “Notes”) was approximately $0.17 per share of the Company’s Common Stock (approximately 148.24 shares of Common Stock for each $25.00 of principal amount of the Notes being converted).

For the February 2024 redemptions, the lowest price at which any Series D Preferred Stock was converted by a holder into Common Stock was approximately $0.22.

Accordingly, pursuant to Section 14.02 (Optional Conversion) of the indenture governing the Notes, the Conversion Price for the Notes was further adjusted to approximately $0.12 per share of Common Stock (approximately 209.84 shares of Common Stock for each $25.00 of principal amount of the Notes being converted), representing a 45% discount to $0.22.

Item 8.01 Other Events

Results of February 2024 Series D Preferred Stock Redemptions

•The fifth monthly “Holder Redemption Date” occurred on February 5, 2024.

•The Company processed redemption requests from five Series D Preferred Holders, collectively redeeming 74,718 shares of Series D Preferred Stock for a redemption price of approximately $37.83 per share ($25.00 per share plus the amount of all accrued but unpaid dividends to and including the February 5, 2024 Holder Redemption Date) (the “Redemption Price”).

•The Company settled the Redemption Price in Common Stock.

•The volume weighted average of the closing sales price, as reported on the Nasdaq Capital Market, per share of Common Stock for the ten consecutive trading days immediately preceding, but not including, the February 5, 2024 Holder Redemption Date was approximately $0.22.

•Accordingly, the Company issued 13,048,169 shares of unregistered Common Stock in settlement of an aggregate Redemption Price of approximately $2.8 million.

Cumulative Series D Preferred Stock Redemption Information

•To date, the Company has processed 182 redemption requests, collectively redeeming 948,631 shares of Series D Preferred Stock.

•Accordingly, the Company has issued 67,042,618 shares of Common Stock in settlement of an aggregate Redemption Price of approximately $35.9 million.

•As of February 5, 2024, the Company had 68,023,718 shares of Common Stock and 2,577,240 shares of Series D Preferred Stock outstanding.

March 2024 Redemptions

•The deadline for the next monthly round of Series D Preferred Stock redemptions is February 25, 2024.

•The next monthly Holder Redemption Date will occur on March 5, 2024.

•Required redemption forms and a list of frequently asked questions can each be found on the Company’s website at https://ir.whlr.us/series-d/series-d-redemption.

Information contained on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and should not be considered to be part of this Current Report on Form 8-K.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | Excepted Holder Amendment, by and among Wheeler Real Estate Investment Trust, Inc., Stilwell Activist Investments, L.P., Stilwell Activist Fund, L.P., Stilwell Value Partners VII, L.P. and Stilwell Associates, L.P., dated as of February 5, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: February 6, 2024

February 5, 2024

Stilwell Activist Investments, L.P.

Stilwell Activist Fund, L.P.

Stilwell Value Partners VII, L.P.

Stilwell Associates, L.P.

c/o Stilwell Value LLC

200 Calle del Santo Cristo

Segundo Piso

San Juan, Puerto Rico 00901

Ladies and Gentlemen:

Reference is hereby made to that certain Excepted Holder Agreement (the “Excepted Holder Agreement”) dated as of December 5, 2023, by and among Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Company”), Stilwell Activist Investments, L.P., a Delaware limited partnership, Stilwell Activist Fund, L.P., a Delaware limited partnership, Stilwell Value Partners VII, L.P., a Delaware limited partnership, and Stilwell Associates, L.P., a Delaware limited partnership (each an “Investor” and, collectively, the “Investors”). Capitalized terms not defined herein shall have the meanings assigned thereto in the Excepted Holder Agreement.

For purposes of the February 2024 monthly redemption cycle, Investors will redeem an additional 74,678 shares of Series D Preferred Stock. The Company has elected to redeem such shares of Series D Preferred Stock for 13,041,184 shares of Common Stock.

In connection with such redemption, the parties to this Letter Agreement agree as follows:

1.Investors represent and warrant to the Company that (a) the information provided by Investors in the most recent Ownership Statement delivered to the Company was true, correct and complete and (b) to the knowledge of Investors, no Individual will be treated as Beneficially Owning more than 9.8% of the Capital Stock or Common Stock of the Company as a result of the transaction contemplated by this Letter Agreement or otherwise (following such transaction) by reason of Investors’ Beneficial Ownership of Capital Stock of the Company; and

2.the Capital Stock Excepted Holder Limit granted to Investors under the Excepted Holder Agreement shall be increased to 60% and the Common Stock Excepted Holder Limit granted to Investors under the Excepted Holder Agreement shall be increased to 90%.

Except as otherwise expressly provided herein, this Letter Agreement shall not alter or otherwise affect the rights and obligations of the parties to the Excepted Holder Agreement. This Letter Agreement shall be governed by, and construed in accordance with, the laws of the State of Maryland, without giving effect to the conflicts of law provisions thereof. This Letter Agreement may be signed by the parties in separate counterparts, each of which when so signed and delivered shall be an original, but all such counterparts shall together constitute one and the same instrument.

[Remainder of page intentionally blank. Signature page follows.]

This Letter Agreement (together with the Excepted Holder Agreement) constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, both oral and written, between the parties with respect to the subject matter hereof.

Very truly yours,

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

By: /s/ M. Andrew Franklin

Name: M. Andrew Franklin

Title: Chief Executive Officer

Accepted and agreed as of the date first written above:

STILWELL ACTIVIST INVESTMENTS, L.P.

By: /s/ Joseph Stilwell_________________

Name: Joseph Stilwell

Title: Managing Member of the General Partner, Stilwell Value LLC

STILWELL ACTIVIST FUND, L.P.

By: /s/ Joseph Stilwell_________________

Name: Joseph Stilwell

Title: Managing Member of the General Partner, Stilwell Value LLC

STILWELL VALUE PARTNERS VII, L.P.

By: /s/ Joseph Stilwell_________________

Name: Joseph Stilwell

Title: Managing Member of the General Partner, Stilwell Value LLC

STILWELL ASSOCIATES, L.P.

By: /s/ Joseph Stilwell_________________

Name: Joseph Stilwell

Title: Managing Member of the General Partner, Stilwell Value LLC

[Signature Page to Letter Agreement]

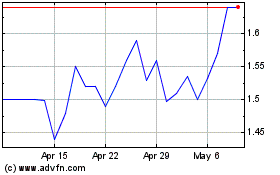

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

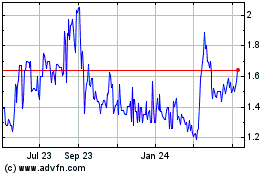

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Historical Stock Chart

From Apr 2023 to Apr 2024