false00002035960000203596us-gaap:CommonStockMember2024-01-312024-01-3100002035962024-01-312024-01-310000203596wsbc:DepositarySharesMember2024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 31, 2024 |

WESBANCO, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

West Virginia |

001-39442 |

55-0571723 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 Bank Plaza |

|

Wheeling, West Virginia |

|

26003 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 304 234-9000 |

Former Name or Former Address, if Changed Since Last Report : Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock $2.0833 Par Value |

|

WSBC |

|

Nasdaq Global Select Market |

Depositary Shares (each representing 1/40th interest in a share of 6.75% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A) |

|

WSBCP |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

In accordance with general instruction B.2. of Form 8-K, the following information is furnished and shall not be deemed filed for the purpose of Section 18 of the Securities Exchange Act of 1934.

Representatives of the Registrant are scheduled to make various investor presentations during the first quarter of 2024. A copy of this presentation is being furnished as Exhibit 99.1 in this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

99.1 - Presentation on fourth quarter 2023 results by Wesbanco, Inc., at various investor conferences or other events in the first quarter of 2024.

104 – Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Wesbanco, Inc.

(registrant) |

|

|

|

|

Date: |

January 31, 2024 |

By: |

/s/ Daniel K. Weiss, Jr. |

|

|

|

Daniel K. Weiss, Jr.

Executive Vice President and

Chief Financial Officer

|

Investor Presentation�(Q1 2024)�(WSBC financials as of the three months ended 31 December 2023) John Iannone Senior Vice President, Investor Relations 304-905-7021

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s Form 10-K for the year ended December 31, 2022 and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC”), including WesBanco’s Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.WesBanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements, including, without limitation, the effects of changing regional and national economic conditions, changes in interest rates, spreads on earning assets and interest-bearing liabilities, and associated interest rate sensitivity; sources of liquidity available to WesBanco and its related subsidiary operations; potential future credit losses and the credit risk of commercial, real estate, and consumer loan customers and their borrowing activities; actions of the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Consumer Financial Protection Bureau, the SEC, the Financial Institution Regulatory Authority, the Municipal Securities Rulemaking Board, the Securities Investors Protection Corporation, and other regulatory bodies; potential legislative and federal and state regulatory actions and reform, including, without limitation, the impact of the implementation of the Dodd-Frank Act; adverse decisions of federal and state courts; fraud, scams and schemes of third parties; cyber-security breaches; competitive conditions in the financial services industry; rapidly changing technology affecting financial services; marketability of debt instruments and corresponding impact on fair value adjustments; and/or other external developments materially impacting WesBanco’s operational and financial performance. WesBanco does not assume any duty to update forward-looking statements. In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), WesBanco's management uses, and this presentation contains or references, certain non-GAAP financial measures, such as pre-tax pre-provision income, tangible common equity/tangible assets; net income excluding after-tax restructuring and merger-related expenses; efficiency ratio; return on average assets; and return on average tangible equity. WesBanco believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although WesBanco believes that these non-GAAP financial measures enhance investors' understanding of WesBanco's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the Quarterly Reports on Forms 10-Q for WesBanco and its subsidiaries, as well as other filings that the company has made with the SEC.

Strong and balanced market presence across diverse geographies that supports disciplined organic growth Granular core deposit funding base supports robust commercial and consumer business model Diversified revenue streams built upon unique long-term advantages Distinct long-term growth strategies built upon prudent credit, capital, and risk management Diversified business model with strong market presence Note: loan and deposit data as of 12/31/2023; location data as of 1/31/2024 (LPOs indicated by red dots); market share based on 2023 state deposit rankings (except Pittsburgh which is MSA) (exclusions: Pittsburgh MSA – BNY Mellon, Raymond James; MD – Forbright, Capital Funding; OH – National Consumer Cooperative Bank) (source: S&P Capital IQ as of 10/13/2022) Premier Regional Financial Services Institution #14 in MD #15 in OH #12 in KY #3 in WV #10 Pgh MSA Strong Market Presence in Major Markets Broad and Balanced Market Distribution

Balanced loan and deposit distribution across contiguous eight state footprint, with complementary loan production office strategy Full suite of commercial and consumer banking capabilities, complemented by a $5.4B wealth management business with a 100+ year track-record of success Robust legacy deposit base provides core funding and pricing advantages Streamlining through digitization and technology investments Unique advantages, sustainable growth, shareholder focus Note: trust assets under management as of 12/31/2023 Investment Rationale Balanced and Diversified with Unique Long-Term Advantages Disciplined Growth from Distinct Long-Term Growth Strategies Legacy of Credit Quality, Risk Management, and Shareholder Focus Organic growth-oriented business model supported by strategic acquisition and loan and production office strategies that support positive operating leverage Relationship-focused model that meets customer needs efficiently and effectively Leveraging digital capabilities to drive customer relationship value Focus on positive operating leverage built upon a culture of expense management Uncompromising approach to risk management, regulatory compliance, credit underwriting, and capital management Eight consecutive “outstanding” CRA ratings from the FDIC since 2003 Senior unsecured debt ratings of BBB+ to WesBanco, Inc. and A- to WesBanco Bank, Inc., with “Positive” outlook for all ratings, from Kroll Bond Rating Agency Critical, long-term focus on shareholder return through earnings growth and effective capital management

Strategies for Long-Term Success

Organic growth-oriented business model Long-Term Growth Strategies Focus on Delivering Positive Operating Leverage Strong Legacy of Credit, Capital, and Risk Management Diversified Loan Portfolio Built upon a Relationship Focused Model Distinct Revenue Capabilities, Led by 100+ Year Wealth Management Business Digital Banking Service Strategies and Core Funding Advantage Franchise-Enhancing Expansion through LPO Strategy and Targeted Acquisitions Add TM slide in Q2/Q3

Focus on strategic diversification, growth, and credit quality Balance disciplined loan origination with prudent underwriting standards Focus on relationship lending, especially for C&I Key offerings include loan swaps, treasury management, foreign exchange, cyber security, and lockbox services Strong residential mortgage program, including home equity lending Loan production office strategy Focus on balanced loan growth with strong underwriting standards Note: loan and deposit data as of quarter ending 12/31/2023; loan-to-value and debt service coverage as of 9/30/2023; office investment portfolio includes just one high-pass rated office investment loan within Washington D.C. and excludes owner-occupied Diversified Loan Portfolio $11.6 Billion Loan Portfolio Average loans to average deposits ratio of 87.1% provides opportunity for continued loan growth Peer-leading non-interest bearing deposit levels drives competitive funding advantage Manageable lending exposures De-emphasized consumer and several CRE categories in recent years Office investment loan portfolio ~$390 million, representing 3% of the total loan portfolio Geographically diverse (no Tier 1 cities); >98% “pass” risk grade classifications Average loan-to-value ~61%; average debt service coverage ratio ~1.7x

Trust & Investments $5.4B of trust and mutual fund assets under management 6,700+ relationships Legacy market private wealth management growth opportunities Expansion opportunities in the Mid-Atlantic market WesMark Funds – six proprietary funds across equities, bonds, and tactical assets Strong capabilities built upon a century of success Note: assets, loans, deposits, and clients as of 12/31/2023; chart financials as of 12/31 unless otherwise stated Wealth Management $100 $365 $770 $1,050 Private Banking Loans and Deposits (as of 12/31) ($MM) CAGR 30% Trust Assets (Market Value as of 12/31) ($B) CAGR 4.1% 12/31 12/31 Securities Brokerage Securities investment sales Licensed banker program Investment advisory services Regional player/coach program Expand external business development opportunities Expansion opportunities in KY, IN, and Mid-Atlantic Insurance Personal, commercial, title, health, and life Expand title business in all markets Digital insurance agency for both personal and commercial property & casualty Third-party administrator (TPA) services for small business healthcare plans Private Banking $1.4B in private client loans and deposits 5,000+ relationships Private wealth management growth opportunities across all markets $1,420

Digital banking utilization ~72% of retail customers utilize online digital banking services ~4.7 million web and mobile logins per month Mobile ~50% of total, with an average of 17 monthly logins per customer >185,000 mobile wallet transactions, ~30,000 mobile deposits, and >30,000 Zelle® payments per month Digital acquisition ~50% of residential mortgage applications submitted via online portal ~300 deposit accounts opened online per month WesBanco Insurance Services launched white-label insurance capabilities with a web-based term-life insurance platform, and a fully-integrated digital property and casualty insurance for consumers and small businesses State-of-the-art core banking software system Omni-channel presence – real-time account activity across all channels Improved customer service through reduced manual activities More efficient processing cost structure Cloud-based architecture utilization Early adoption to leverage modernized data and application platforms, combined with significant expense and performance benefits Actively harnessing advanced artificial intelligence (AI) and robotic process automation (RPA) technologies to automate business processes Leveraging digital to drive customer value and enterprise efficiency Note: digital statistics as of 4Q2023 year-to-date (“YTD”); Zelle® payment service added August 2021; online residential mortgage applications and deposit account opening capabilities launched July 2019; WesBanco Insurance Services online term-life and P&C insurance capabilities launched November 2020 and January 2021, respectively; core banking software system upgraded 8/2/2021 Robust Digital Capabilities

Differentiated and peer-leading deposit profile Note: quarterly financial data; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 1/30/2024) and represent simple averages; total deposits funding cost includes non-interest bearing deposits Core Deposit Funding and Pricing Advantages Granular core deposit funding base supports diversified commercial and retail strategy Peer-leading non-interest bearing deposit levels drives competitive funding advantage Total demand deposits (~56% of total deposits) and non-interest bearing demand deposits (~30% of total deposits) have grown organically 7% and 6%, respectively (5-year CAGR) Average loans to average deposits ratio of 87.1% provides opportunity for continued loan growth Q4 Q4

Targeted acquisitions in existing markets and new higher-growth metro areas, as well as a complementary loan production office (“LPO”) strategy Long-term focus on appropriate capital management to enhance shareholder value Strong capital and liquidity, along with strong regulatory compliance processes, provides ability to execute transactions quickly Diligent efforts to maintain a community bank-oriented, value-based approach to our markets History of successful acquisitions that have improved earnings Franchise-Enhancing Expansion Loan Production Office Strategy and Targeted Acquisitions Note: AmTrust was an acquisition of five branches; Loan Production Office strategy indicated by red dots Franchise-Enhancing Expansion Contiguous Markets Expansion YCB FFKT FTSB OAKF ESB & FSBI OLBK AmTrust Franchise-Enhancing Expansion Mergers OLBK FFKT FTSB YCB ESB FSBI AmTrust OAKF Announced Jul-19 Apr-18 Nov-17 May-16 Oct-14 Jul-12 Jan-09 Jul-07 Closed Nov-19 Aug-18 Apr-18 Sep-16 Feb-15 Nov-12 Mar-09 Nov-07 Loan Production Offices Akron Canton (2Q2016) Northern VA (3Q2021) Nashville (1Q2022) Indianapolis (2Q2022) Cleveland (3Q2022) Chattanooga (3Q2023)

(1) Track-record of expense control with on-going enhancement efforts Note: financial data as of 12/31; current data as of 12/31/2023 (operating leverage YTD); balance sheet data as of period ends (1) Non-GAAP measure – please see reconciliation in appendix; non-interest expense does not exclude restructuring and merger-related expenses Delivering Positive Operating Leverage ESB Merger (Feb-15) Fidelity Merger (Nov-12) YCB Merger (Sep-16) FTSB (Apr-18) & FFKT (Aug-18) Mergers OLBK Merger (Nov-19) Track-record of disciplined growth, balanced by a fundamental focus on expense management and supported by franchise-enhancing acquisitions, in order to deliver positive operating leverage and enhance shareholder value

Strong legacy of credit and risk management and regulatory compliance Based upon conservative underwriting standards and approval processes supported by centralized back-office and loan funding functions Mature enterprise risk management program headed by Chief Risk Officer addressing key risks in all business lines and functional areas Enhanced compliance and risk management system and testing platform Strong and scalable BSA/AML function Examined by CFPB for consumer compliance supervision Eight consecutive “outstanding” CRA ratings since 2003 Strong regulatory capital ratios significantly above regulatory requirements Capital ratios above both regulatory and well-capitalized levels Note: capital ratios enhanced by August 2020 issuance of $150MM of preferred stock; effective 4Q2019, as required by the Dodd-Frank Act for financial institutions with total assets >$15B, Tier 1 Capital Ratios negatively impacted by the movement of ~$130MM of TruPS from Tier 1 to Tier 2 risk-based capital Strong Risk Management and Capital Position memo Well-Capitalized 8.0% Required 6.0% memo Well-Capitalized 5.0% Required 4.0% Tier 1 Leverage Capital Ratio Tier 1 Risk-Based Capital Ratio

Ensuring a strong financial institution for all of our stakeholders Note: data as of 12/31/2022 except Board diversity (as of 4/19/2023) and financial center reduction (as of 12/31/2022 and compared to 12/31/2018); “CRA” is Community Reinvestment Act; “key senior executive leadership” defined as the CEO’s direct reports and their direct reports; please visit wesbanco.com for the full sustainability report Commitment to Sustainability >6,200 jobs Created by New Markets Loan Program (Tax Credit Allocations 2004, 2007, 2017, 2018) $1.9 billion Community Development Lending (2018-2022) >$140 million Community Reinvestment Act Investments (2022) $4.3 million Community Development Philanthropic Donations (2018-2022) ~59,500 hours Community Development Service Hours (2018-2022) 8 consecutive ”Outstanding” composite ratings from the FDIC for CRA performance ~70% female Employees identifying as female, including ~54% of Bank Officers >32% female Key senior executive leadership positions identifying as female 29% diverse Board of Directors identifying as diverse (gender, ethnicity) ~10% diverse Employees identifying as ethnically diverse, including ~7% of Bank Officers 39% supplies Green office supplies (compared to <1% in 2019) ~30% facilities Converted to LED lighting; will continue conversions, over time, as remodel facilities 50% workforce Including 75% of support areas, in either a 100% remote or hybrid schedule >20% reduction In financial center footprint, while continuing to serve customers effectively 153 years Strong culture of credit quality, risk management, and compliance

Newsweek named WesBanco Bank one of America’s Best Regional Banks, based on soundness, profitability, and customer reviews WesBanco Bank was named, for the 5th year in a row, one of the World’s Best Banks in an independent ranking by Forbes, based 100% on customer satisfaction and consumer feedback High scores for ‘customer service’, ‘digital services’, ‘satisfaction’, and ‘financial advice’ For the 3rd consecutive year, WesBanco was named one of America’s Best Midsize Employers by Forbes, based on employee feedback and recommendations For the 13th time since the rankings inception in 2010, WesBanco Bank was again named one of the Best Banks in America by Forbes based on soundness, capital, credit quality, and profitability Bauer Financial again awarded WesBanco Bank their highest rating as a “five-star” bank – for the 36th consecutive quarter WesBanco Bank received the America Saves Designation of Savings Excellence for Banks, a designation from America Saves, for the 8th consecutive year and one of only six banks Kroll Bond Rating Agency affirmed senior unsecured debt ratings of BBB+ to WesBanco, Inc. and A- to WesBanco Bank, Inc., and a “Stable” outlook for all long-term ratings National accolades a testament to strong performance & foundation Note: Kroll Bond Rating Agency rating affirmation announced 8/10/2023 Commitment to Excellence

Financial Overview

Deposits increased both year-over-year and sequentially, reflecting deposit gathering and retention efforts across retail and business customers Solid loan growth reflecting the strength of our markets and lending teams, including our loan production offices Non-interest income trends up 8% year-over-year, supported by new commercial loan swap and wealth management fees Net interest margin stable to Q3 2023 Key credit quality metrics remained at low levels and favorable to peer bank averages WesBanco remains well-capitalized with solid liquidity and a strong balance sheet with capacity to fund loan growth Nationally recognized for soundness, profitability, and customer service Net Income Available to Common Shareholders and Diluted EPS(1) $32.4 million; $0.55/diluted share Total Deposits +2.4% QoQ (annualized); +0.3% YoY Total Loan Growth +11.4% QoQ (annualized); +8.7% YoY Net Interest Margin 3.02% (down 1bp sequentially) Average loans to average deposits 87.1% Non-Performing Assets to Total Assets 0.16% Tangible Common Equity to Tangible Assets(1) 7.62% Continued deposit and loan growth; stable net interest margin Note: financial and operational highlights during the quarter ended December 31, 2023 (1) Non-GAAP measure – please see reconciliation in appendix; excludes restructuring and merger-related expenses Q4 2023 Financial and Operational Highlights

+8.7% year-over-year and +2.9% (or +11.4% annualized) quarter-over-quarter Loan growth continues to demonstrate the strength of our markets and lending teams Loan production offices are contributing meaningfully to both commercial loan growth and the loan pipeline Q4 2023 loan yields above 8% C&I loans increased 5.8% year-over-year and 20.9% quarter-over-quarter annualized, reflecting strategic loan production office and lender hiring initiatives CRE loan payoffs totaled approximately $61 million and $276 million Q4 and full year 2023, respectively – as compared to an anticipated level in the $500 million range within a more normal operating environment C&I line utilization, as of 12/31/2023, declined ~270 basis points year-over-year to 32% 8.7% total loan growth year-over-year Q4 2023 Total Portfolio Loans

Net interest margin of 3.02%, down just 1bp quarter-over-quarter Q4 2023 net interest margin of 3.02% reflects higher funding costs from increasing deposit costs and continued remix from non-interest bearing deposits into higher tier money market and certificate of deposit accounts, partially offset by loan growth and the benefit of rising interest rates on earning assets NIM declined 47 basis points year-over-year, reflecting the 525 basis point increase in the federal funds rate since March 2022 Total deposit funding costs, including non-interest bearing deposits, were 161 basis points, increasing 25 basis points sequentially and 124 basis points year-over-year Federal Home Loan Bank borrowings totaled $1.4 billion at 12/31/2023, up $225 million from 9/30/2023 Q4 2023 Net Interest Margin (NIM)

Non-interest income increased 8% year-over-year reflecting the strength in new commercial swap fees and organic growth New swap fee and valuation income includes $2.2 million in new swap fees, up $0.5 million year-over-year Negative fair market value adjustments totaled $2.5 million, as compared to $0.7 million last year On a year-to-date basis, new swap fees of $9.0 million more than doubled the amount in the prior year Net securities gains increased from a loss of $0.6 million in the prior year period primarily due to market fluctuations of equity securities in the deferred compensation plan (offset to the expense increase within benefits expense) Bank-owned life insurance increased due to higher death benefits received during Q4 2023 $9.0MM new commercial loan swap fees during 2023 Note: OREO = other real estate owned Q4 2023 Non-Interest Income

Appropriate growth investments; focused on expense management Q4 2023 Non-Interest Expense Salaries and wages declined sequentially, as anticipated, reflecting efficiency improvements in the residential mortgage staffing model Year-over-year increase due to annual merit and new revenue-producing hires, mainly commercial bankers, during the past year Employee benefits increased year-over-year due to higher deferred compensation expense and health insurance contributions Equipment and software expense increased due to the completed upgrade of our ATM fleet with the latest technology and general inflationary cost increases for existing service agreements FDIC insurance expense increased due to an increase in the minimum rate for all banks Marketing increased in support of our deposit and loan generation campaigns

Comparable operating measures to peer bank group Note: historical data as of 12/31 YTD; current data as of 12/31/2023 YTD; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 1/30/2024 and represent simple averages; NIM (fully taxable-equivalent (FTE) and annualized basis) and non-interest expense (does not exclude restructuring & merger-related expenses) are company reported; other figures are S&P calculations); 2020 and 2021 comparability impacted by timing of the adoption of Current Expected Credit Losses (“CECL”) accounting standard and economic assumptions used by each bank (WSBC adopted January 1, 2020); please see the reconciliations in the appendix Return on Average Assets Non-Interest Expense to Total Assets Net Interest Margin Return on Average Tangible Equity Disciplined Execution upon Growth Strategies 0.77% 1.34% 0.88% 1.09% 1.40% 9.2% 15.1% 11.8% 15.2% 13.9%

Favorable asset quality measures compared to peer bank group Note: financial data as of quarter ending for dates specified; peer bank group includes all U.S. banks with total assets of $10B to $25B from S&P Capital IQ (as of 1/30/2024) and represent simple averages except criticized & classified loans as % of total loans which is a weighted average; 2020 and 2021 comparability impacted by timing of the adoption of Current Expected Credit Losses (“CECL”) accounting standard and economic assumptions used by each bank (WSBC adopted January 1, 2020) Non-Performing Assets as % of Total Assets Net Charge-Offs as % of Average Loans (YTD Annualized) Allowance for Credit Losses as % of Total Loans Criticized & Classified Loans as % of Total Loans Strong Legacy of Credit Quality

Returning value to shareholders Note: dividend through November 2023 declaration announcement; WSBC dividend yield based upon 1/29/2024 closing stock price of $31.22; peer bank group includes all U.S. banks with total assets of $10B to $25B (as of most recent period) from S&P Capital IQ (as of 1/30/2024 and represent simple average) Under the existing share repurchase authorization that was approved on February 24, 2022 by WesBanco’s Board of Directors Non-GAAP measure – please see reconciliation in appendix Focus on appropriate capital allocation to provide financial flexibility while continuing to enhance shareholder value through earnings growth and effective capital management Capital management strategy: dividends, loan growth, acquisitions, share repurchases Q4 2023 dividend yield 4.5%, compared to 3.2% for bank group ~1.0 million shares continue to remain for repurchase (as of 12/31/2023)(1) Capital Management Strategy Tangible Book Value per Share ($)(2) Quarterly Dividend per Share ($) +157% +76%

Appendix

Net interest margin of 3.02%, stable to the third quarter Note: PTPP = pre-tax, pre-provision Non-GAAP measure – please see reconciliation in appendix Excludes restructuring and merger-related expenses Q4 2023 Key Metrics

Strong team efforts drive ~1% deposit growth quarter-over-quarter Note: “uninsured deposits” are approximated; “collateralized municipal deposits” are collateralized by securities Total deposits, as of December 31, 2023, were $13.2 billion, up both year-over-year and quarter-over-quarter, reflecting deposit gathering and retention efforts by our retail and commercial teams Distribution: consumer ~53% and business ~34% (note: public funds, which are separately collateralized, ~13%) Total demand deposits represented 56% of total deposits, with the non-interest bearing component representing 30% Non-interest bearing demand deposits as a percentage of total deposits remain consistent with the percentage range since early 2020 Average loans to average deposits were 87.1%, providing continued capacity to fund loan growth Q4 2023 Total Deposits

Tangible common equity to tangible assets ratio improved 34 basis points sequentially to 7.62% Weighted average yield 2.48% vs. 2.32% last year Weighted average duration 5.2 Total unrealized securities losses (after-tax): Available for Sale (“AFS”) = $233MM Held to Maturity (“HTM”) = $99MM Note: HTM losses not recognized in accumulated other comprehensive income Securities 19.2% of assets, down 315 basis points year-over-year Note: weighted average yields have been calculated on a taxable-equivalent basis using the federal statutory rate of 21%; after-tax unrealized losses have been calculated using the Other Comprehensive Income (“OCI”) tax rate of ~24% Non-GAAP measure – please see reconciliation in appendix Q4 2023 Total Securities

Allowance coverage ratio of 1.12% Note: ACL at 12/31/2023 excludes off-balance sheet credit exposures of $8.6 million The increase in the allowance was primarily driven by the dollar change in criticized and classified loan balance, prepayment assumptions, and loan growth During Q4 2023, recorded a provision for credit losses of $4.8 million, as compared to a $3.1 million in the prior year period Allowance coverage ratio of 1.12% Excludes fair market value adjustments on previously acquired loans representing 0.12% of total portfolio loans Q4 2023 Current Expected Credit Loss (CECL)

Non-Interest Expense to Total Assets and Efficiency Ratio Reconciliation Note: “efficiency ratio” is non-interest expense excluding restructuring and merger-related expense divided by total income; FTE represents fully taxable equivalent; Old Line Bancshares merger closed November 2019; Farmers Capital Bank Corporation merger closed August 2018; First Sentry Bancshares merger closed April 2018; Your Community Bankshares merger closed September 2016; ESB Financial merger closed February 2015; Fidelity Bancorp merger closed November 2012; AmTrust 5 branch acquisition closed March 2009

Pre-Tax, Pre-Provision Income (PTPP) and Ratios Reconciliation

Net Income and Diluted Earnings per Share (EPS) Reconciliation

Tangible Book Value per Share Reconciliation

Return on Average Assets (1) Ratios are annualized by utilizing the actual numbers of days in the quarter versus the year Note: Current Expected Credit Losses (“CECL”) accounting standard adopted January 1, 2020 by WSBC; Old Line Bancshares merger closed November 2019 Reconciliation

Return on Average Tangible Equity Reconciliation (1) Amortization of intangibles tax effected at 21% for all prior periods (2) Ratios are annualized by utilizing the actual numbers of days in the quarter versus the year Note: Current Expected Credit Losses (“CECL”) accounting standard adopted January 1, 2020 by WSBC; Old Line Bancshares merger closed November 2019

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=wsbc_DepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

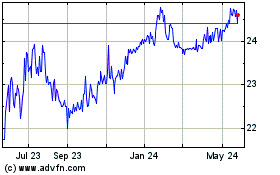

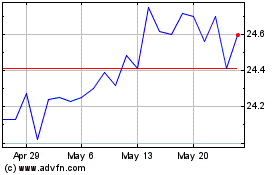

WesBanco (NASDAQ:WSBCP)

Historical Stock Chart

From Apr 2024 to May 2024

WesBanco (NASDAQ:WSBCP)

Historical Stock Chart

From May 2023 to May 2024