false

0001569994

0001569994

2023-10-24

2023-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of Earliest Event Reported): |

October 24, 2023 |

Waterstone Financial, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

001-36271 |

90-1026709 |

|

(State or other jurisdiction of

incorporation)

|

(Commission File

Number)

|

(I.R.S. Employer Identification No.)

|

11200 W Plank Ct, Wauwatosa, Wisconsin 53226

(Address of principal executive offices)

414-761-1000

Registrant’s telephone number, including area code:

Not Applicable

Former name or former address, if changed since last report

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.01 Par Value |

|

WSBF |

|

The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities and Exchange Act of 1934.

|

☐

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 2.02 Results of Operations and Financial Condition.

On October 24, 2023, Waterstone Financial, Inc. issued a press release announcing its financial results for the quarter and nine months ended September 30, 2023. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 attached to this report and incorporated by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Waterstone Financial, Inc. |

|

| |

|

|

|

| Date: October 24, 2023 |

|

/s/ Mark R. Gerke |

|

| |

|

Name: Mark R. Gerke |

|

| |

|

Title: Chief Financial Officer |

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press release of Waterstone Financial, Inc. issued October 24, 2023. |

| |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

Waterstone Financial, Inc. Announces Results of Operations for the Quarter and Nine Months Ended September 30, 2023.

WAUWATOSA, WI – 10/24/2023 – Waterstone Financial, Inc. (NASDAQ: WSBF), holding company for WaterStone Bank, reported net income of $3.3 million, or $0.16 per diluted share for the quarter ended September 30, 2023 compared to $5.3 million, or $0.25 per diluted share for the quarter ended September 30, 2022. Net income per diluted share was $0.46 for the nine months ended September 30, 2023 compared to net income per diluted share of $0.83 for the nine months ended September 30, 2022.

“We continue to navigate the challenges that have resulted from a rapid rise in interest rates and an inverted yield curve,” said Douglas Gordon, Chief Executive Officer of Waterstone Financial, Inc. “The Community Banking Segment continues to maintain strong asset quality metrics and we achieved growth in both loans held for investment and deposits during the quarter. The Mortgage Banking segment results continue to be negatively impacted by a challenging industry as inventory, housing affordability, and escalating interest rates have slowed mortgage origination volumes and compressed margins. We continue to try and find efficiencies in this environment. During the quarter, we were pleased to return $9.6 million back to shareholders through share repurchases and dividends declared.”

Highlights of the Quarter Ended September 30, 2023

Waterstone Financial, Inc. (Consolidated)

| ● |

Consolidated net income of Waterstone Financial, Inc. totaled $3.3 million for the quarter ended September 30, 2023, compared to $5.3 million for the quarter ended September 30, 2022. |

| ● |

Consolidated return on average assets was 0.58% for the quarter ended September 30, 2023 compared to 1.08% for the quarter ended September 30, 2022. |

| ● |

Consolidated return on average equity was 3.63% for the quarter ended September 30, 2023 and 5.38% for the quarter ended September 30, 2022. |

| ● |

Dividends declared during the quarter ended September 30, 2023 totaled $0.15 per common share. |

| ● |

We repurchased approximately 516,000 shares at a cost (including the excise tax) of $6.7 million, or $12.94 per share, during the quarter ended September 30, 2023. |

| ● |

Nonperforming assets as percentage of total assets was 0.20% at September 30, 2023, 0.19% at June 30, 2023, and 0.27% at September 30, 2022. |

| ● |

Past due loans as a percentage of total loans was 0.53% at September 30, 2023, 0.50% at June 30, 2023, and 0.48% at September 30, 2022. |

| ● |

Book value per share was $16.60 at September 30, 2023 and $16.71 at December 31, 2022. Book value per share increased approximately $0.10 during the quarter ended September 30, 2023 and approximately $0.18 during the year ended September 30, 2023 due to our share repurchase activity. |

Community Banking Segment

| ● |

Pre-tax income totaled $5.7 million for the quarter ended September 30, 2023, which represents a $2.9 million, or 33.8%, decrease compared to $8.5 million for the quarter ended September 30, 2022.

|

| ● |

Past due loans at the community banking segment was $6.7 million at September 30, 2023, $5.7 million at June 30, 2023, and $4.6 million at September 30, 2022. |

| ● |

Net interest income totaled $12.4 million for the quarter ended September 30, 2023, which represents a $3.1 million, or 19.8%, decrease compared to $15.5 million for the quarter ended September 30, 2022. |

| ● |

Average loans held for investment totaled $1.63 billion during the quarter ended September 30, 2023, which represents an increase of $316.3 million, or 24.1%, compared to $1.31 billion for the quarter ended September 30, 2022. The increase was primarily due to increases in the single-family and multi-family mortgages. Average loans held for investment increased $40.3 million compared to $1.59 billion for the quarter ended June 30, 2023. The increase was primarily due to an increase in the single-family, multi-family, construction, and commercial real estate mortgages. |

| ● |

Net interest margin decreased 108 basis points to 2.26% for the quarter ended September 30, 2023 compared to 3.34% for the quarter ended September 30, 2022, which was a result of an increase in weighted average cost of deposits and borrowings as the federal funds rate increases resulted in increased funding rates. Net interest margin decreased 21 basis points compared to 2.47% for the quarter ended June 30, 2023, driven by an increase in weighted average cost of deposits and borrowings as the federal funds rate increases resulted in increased funding rates. |

| ● |

The segment had a provision for credit losses related to funded loans of $206,000 for the quarter ended September 30, 2023 compared to a provision for credit losses related to funded loans of $262,000 for the quarter ended September 30, 2022. The current quarter increase was primarily due to an increase in originations and loan balance. The provision for credit losses related to unfunded loan commitments was $239,000 for the quarter ended September 30, 2023 compared to a negative provision for credit losses related to unfunded loan commitments of $28,000 for the quarter ended September 30, 2022. The increase for the quarter ended September 30, 2023 was due primarily to an increase of loans in the loan commitment pipeline as loan activity increased during the quarter.

|

| ● |

The efficiency ratio, a non-GAAP ratio, was 54.43% for the quarter ended September 30, 2023, compared to 47.16% for the quarter ended September 30, 2022. |

| ● |

Average deposits (excluding escrow accounts) totaled $1.20 billion during the quarter ended September 30, 2023, an increase of $6.0 million, or 0.5%, compared to $1.19 billion during the quarter ended September 30, 2022. Average deposits increased $15.4 million, or 5.2% annualized, compared to the $1.18 billion for the quarter ended June 30, 2023. |

| ● |

Other noninterest expense decreased $774,000 to $703,000 during the quarter ended September 30, 2023 compared to $1.5 million during the quarter ended September 30, 2022. The decrease was driven by fees paid to the mortgage banking segment for the purchase of single-family adjustable rate mortgage loans. These fees totaled $188,000 during the quarter ended September 30, 2023 compared to $1.0 million during the quarter ended September 30, 2022. |

Mortgage Banking Segment

| ● |

Pre-tax loss totaled $2.1 million for the quarter ended September 30, 2023, compared to $1.8 million of pre-tax loss for the quarter ended September 30, 2022.

|

| ● |

Loan originations decreased $132.3 million, or 18.1%, to $597.6 million during the quarter ended September 30, 2023, compared to $729.9 million during the quarter ended September 30, 2022. Origination volume relative to purchase activity accounted for 95.4% of originations for the quarter ended September 30, 2023 compared to 94.2% of total originations for the quarter ended September 30, 2022. |

| ● |

Mortgage banking non-interest income decreased $5.9 million, or 21.4%, to $21.5 million for the quarter ended September 30, 2023, compared to $27.3 million for the quarter ended September 30, 2022. |

| ● |

Gross margin on loans sold decreased to 3.62% for the quarter ended September 30, 2023, compared to 3.70% for the quarter ended September 30, 2022. |

| ● |

Total compensation, payroll taxes and other employee benefits decreased $4.7 million, or 21.4%, to $17.2 million during the quarter ended September 30, 2023 compared to $21.9 million during the quarter ended September 30, 2022. The decrease primarily related to decreased commission expense and salary expense driven by decreased loan origination volume and reduced employee headcount. |

About Waterstone Financial, Inc.

Waterstone Financial, Inc. is the savings and loan holding company for WaterStone Bank. WaterStone Bank was established in 1921 and offers a full suite of personal and business banking products. The Bank has branches in Wauwatosa/State St, Brookfield, Fox Point/North Shore, Franklin/Hales Corners, Germantown/Menomonee Falls, Greenfield/Loomis Rd, Milwaukee/Oklahoma Ave, Oak Creek/27th St, Oak Creek/Howell Ave, Oconomowoc/Lake Country, Pewaukee, Waukesha, West Allis/Greenfield Ave, and West Allis/National Ave, Wisconsin. WaterStone Bank is the parent company to Waterstone Mortgage, which has the ability to lend in 48 states. For more information about WaterStone Bank, go to http://www.wsbonline.com.

Forward-Looking Statements

This press release contains statements or information that may constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements regarding expected financial and operating activities and results that are preceded by, followed by, or that include words such as “may,” “expects,” “anticipates,” “estimates” or “believes.” Any such statements are based upon current expectations that involve a number of risks and uncertainties and are subject to important factors that could cause actual results to differ materially from those anticipated by the forward-looking statements. Factors that might cause such a difference include changes in interest rates; demand for products and services; the degree of competition by traditional and nontraditional competitors; changes in banking regulation or actions by bank regulators; changes in tax laws; the impact of technological advances; governmental and regulatory policy changes; the outcomes of contingencies; trends in customer behavior as well as their ability to repay loans; changes in local real estate values; changes in the national and local economies; and other factors, including risk factors referenced in Item 1A. Risk Factors in Waterstone’s most recent Annual Report on Form 10-K and as may be described from time to time in Waterstone’s subsequent SEC filings, which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect only Waterstone’s belief as of the date of this press release.

Non-GAAP Financial Measures

Management uses non-GAAP financial information in its analysis of the Company's performance. Management believes that this non-GAAP measure provides a greater understanding of ongoing operations and enhance comparability of results of operations with prior periods. The Company’s management believes that investors may use this non-GAAP measure to analyze the Company's financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. Limitations associated with non-GAAP financial measures include the risks that persons might disagree as to the appropriateness of items included in this measure and that different companies might calculate this measure differently.

WATERSTONE FINANCIAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| |

|

For The Three Months Ended September 30,

|

|

|

For The Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(In Thousands, except per share amounts)

|

|

|

Interest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans

|

|

$ |

23,825 |

|

|

$ |

16,235 |

|

|

$ |

65,860 |

|

|

$ |

44,281 |

|

|

Mortgage-related securities

|

|

|

1,060 |

|

|

|

903 |

|

|

|

2,972 |

|

|

|

2,326 |

|

|

Debt securities, federal funds sold and short-term investments

|

|

|

1,492 |

|

|

|

987 |

|

|

|

3,682 |

|

|

|

2,964 |

|

|

Total interest income

|

|

|

26,377 |

|

|

|

18,125 |

|

|

|

72,514 |

|

|

|

49,571 |

|

|

Interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

7,442 |

|

|

|

981 |

|

|

|

17,485 |

|

|

|

2,511 |

|

|

Borrowings

|

|

|

6,946 |

|

|

|

1,746 |

|

|

|

16,570 |

|

|

|

5,717 |

|

|

Total interest expense

|

|

|

14,388 |

|

|

|

2,727 |

|

|

|

34,055 |

|

|

|

8,228 |

|

|

Net interest income

|

|

|

11,989 |

|

|

|

15,398 |

|

|

|

38,459 |

|

|

|

41,343 |

|

|

Provision for credit losses

|

|

|

445 |

|

|

|

332 |

|

|

|

1,091 |

|

|

|

304 |

|

|

Net interest income after provision for loan losses

|

|

|

11,544 |

|

|

|

15,066 |

|

|

|

37,368 |

|

|

|

41,039 |

|

|

Noninterest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on loans and deposits

|

|

|

450 |

|

|

|

529 |

|

|

|

1,491 |

|

|

|

1,705 |

|

|

Increase in cash surrender value of life insurance

|

|

|

334 |

|

|

|

354 |

|

|

|

1,373 |

|

|

|

1,394 |

|

|

Mortgage banking income

|

|

|

21,172 |

|

|

|

26,064 |

|

|

|

59,856 |

|

|

|

83,749 |

|

|

Other

|

|

|

274 |

|

|

|

457 |

|

|

|

1,589 |

|

|

|

1,612 |

|

|

Total noninterest income

|

|

|

22,230 |

|

|

|

27,404 |

|

|

|

64,309 |

|

|

|

88,460 |

|

|

Noninterest expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation, payroll taxes, and other employee benefits

|

|

|

21,588 |

|

|

|

26,174 |

|

|

|

64,035 |

|

|

|

77,502 |

|

|

Occupancy, office furniture, and equipment

|

|

|

1,993 |

|

|

|

2,296 |

|

|

|

6,302 |

|

|

|

6,540 |

|

|

Advertising

|

|

|

916 |

|

|

|

1,137 |

|

|

|

2,749 |

|

|

|

3,004 |

|

|

Data processing

|

|

|

1,229 |

|

|

|

1,084 |

|

|

|

3,441 |

|

|

|

3,430 |

|

|

Communications

|

|

|

243 |

|

|

|

302 |

|

|

|

719 |

|

|

|

900 |

|

|

Professional fees

|

|

|

745 |

|

|

|

393 |

|

|

|

1,779 |

|

|

|

1,203 |

|

|

Real estate owned

|

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

6 |

|

|

Loan processing expense

|

|

|

722 |

|

|

|

1,120 |

|

|

|

2,672 |

|

|

|

3,685 |

|

|

Other

|

|

|

2,584 |

|

|

|

3,187 |

|

|

|

8,350 |

|

|

|

9,408 |

|

|

Total noninterest expenses

|

|

|

30,021 |

|

|

|

35,694 |

|

|

|

90,050 |

|

|

|

105,678 |

|

|

Income before income taxes

|

|

|

3,753 |

|

|

|

6,776 |

|

|

|

11,627 |

|

|

|

23,821 |

|

|

Income tax expense

|

|

|

500 |

|

|

|

1,506 |

|

|

|

2,212 |

|

|

|

5,269 |

|

|

Net income

|

|

$ |

3,253 |

|

|

$ |

5,270 |

|

|

$ |

9,415 |

|

|

$ |

18,552 |

|

|

Income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.16 |

|

|

$ |

0.25 |

|

|

$ |

0.46 |

|

|

$ |

0.84 |

|

|

Diluted

|

|

$ |

0.16 |

|

|

$ |

0.25 |

|

|

$ |

0.46 |

|

|

$ |

0.83 |

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

19,998 |

|

|

|

21,342 |

|

|

|

20,420 |

|

|

|

22,193 |

|

|

Diluted

|

|

|

20,022 |

|

|

|

21,454 |

|

|

|

20,473 |

|

|

|

22,323 |

|

WATERSTONE FINANCIAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

Assets

|

|

(In Thousands, except per share amounts)

|

|

|

Cash

|

|

$ |

55,796 |

|

|

$ |

33,700 |

|

|

Federal funds sold

|

|

|

6,237 |

|

|

|

10,683 |

|

|

Interest-earning deposits in other financial institutions and other short term investments

|

|

|

260 |

|

|

|

2,259 |

|

|

Cash and cash equivalents

|

|

|

62,293 |

|

|

|

46,642 |

|

|

Securities available for sale (at fair value)

|

|

|

194,499 |

|

|

|

196,588 |

|

|

Loans held for sale (at fair value)

|

|

|

157,421 |

|

|

|

131,188 |

|

|

Loans receivable

|

|

|

1,651,093 |

|

|

|

1,510,178 |

|

|

Less: Allowance for credit losses ("ACL") - loans

|

|

|

18,553 |

|

|

|

17,757 |

|

|

Loans receivable, net

|

|

|

1,632,540 |

|

|

|

1,492,421 |

|

| |

|

|

|

|

|

|

|

|

|

Office properties and equipment, net

|

|

|

20,040 |

|

|

|

21,105 |

|

|

Federal Home Loan Bank stock (at cost)

|

|

|

23,414 |

|

|

|

17,357 |

|

|

Cash surrender value of life insurance

|

|

|

67,522 |

|

|

|

66,443 |

|

|

Real estate owned, net

|

|

|

372 |

|

|

|

145 |

|

|

Prepaid expenses and other assets

|

|

|

63,257 |

|

|

|

59,783 |

|

|

Total assets

|

|

$ |

2,221,358 |

|

|

$ |

2,031,672 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Demand deposits

|

|

$ |

189,954 |

|

|

$ |

230,596 |

|

|

Money market and savings deposits

|

|

|

281,958 |

|

|

|

326,145 |

|

|

Time deposits

|

|

|

733,250 |

|

|

|

642,271 |

|

|

Total deposits

|

|

|

1,205,162 |

|

|

|

1,199,012 |

|

| |

|

|

|

|

|

|

|

|

|

Borrowings

|

|

|

587,917 |

|

|

|

386,784 |

|

|

Advance payments by borrowers for taxes

|

|

|

28,238 |

|

|

|

5,334 |

|

|

Other liabilities

|

|

|

53,715 |

|

|

|

70,056 |

|

|

Total liabilities

|

|

|

1,875,032 |

|

|

|

1,661,186 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

- |

|

|

|

- |

|

|

Common stock

|

|

|

209 |

|

|

|

222 |

|

|

Additional paid-in capital

|

|

|

110,020 |

|

|

|

128,550 |

|

|

Retained earnings

|

|

|

272,535 |

|

|

|

274,246 |

|

|

Unearned ESOP shares

|

|

|

(12,166 |

) |

|

|

(13,056 |

) |

|

Accumulated other comprehensive loss, net of taxes

|

|

|

(24,272 |

) |

|

|

(19,476 |

) |

|

Total shareholders' equity

|

|

|

346,326 |

|

|

|

370,486 |

|

|

Total liabilities and shareholders' equity

|

|

$ |

2,221,358 |

|

|

$ |

2,031,672 |

|

| |

|

|

|

|

|

|

|

|

|

Share Information

|

|

|

|

|

|

|

|

|

|

Shares outstanding

|

|

|

20,860 |

|

|

|

22,174 |

|

|

Book value per share

|

|

$ |

16.60 |

|

|

$ |

16.71 |

|

WATERSTONE FINANCIAL, INC. AND SUBSIDIARIES

SUMMARY OF KEY QUARTERLY FINANCIAL DATA

(Unaudited)

| |

|

At or For the Three Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2022

|

|

| |

|

(Dollars in Thousands, except per share amounts)

|

|

|

Condensed Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$ |

11,989 |

|

|

$ |

12,675 |

|

|

$ |

13,795 |

|

|

$ |

15,611 |

|

|

$ |

15,398 |

|

|

Provision for credit losses

|

|

|

445 |

|

|

|

186 |

|

|

|

460 |

|

|

|

664 |

|

|

|

332 |

|

|

Total noninterest income

|

|

|

22,230 |

|

|

|

23,525 |

|

|

|

18,554 |

|

|

|

17,095 |

|

|

|

27,404 |

|

|

Total noninterest expense

|

|

|

30,021 |

|

|

|

30,922 |

|

|

|

29,107 |

|

|

|

31,384 |

|

|

|

35,694 |

|

|

Income before income taxes

|

|

|

3,753 |

|

|

|

5,092 |

|

|

|

2,782 |

|

|

|

658 |

|

|

|

6,776 |

|

|

Income tax (benefit) expense

|

|

|

500 |

|

|

|

1,085 |

|

|

|

627 |

|

|

|

(277 |

) |

|

|

1,506 |

|

|

Net income

|

|

$ |

3,253 |

|

|

$ |

4,007 |

|

|

$ |

2,155 |

|

|

$ |

935 |

|

|

$ |

5,270 |

|

|

Income per share – basic

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

$ |

0.10 |

|

|

$ |

0.04 |

|

|

$ |

0.25 |

|

|

Income per share – diluted

|

|

$ |

0.16 |

|

|

$ |

0.20 |

|

|

$ |

0.10 |

|

|

$ |

0.04 |

|

|

$ |

0.25 |

|

|

Dividends declared per common share

|

|

$ |

0.15 |

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

|

$ |

0.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Ratios (annualized):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets - QTD

|

|

|

0.58 |

% |

|

|

0.74 |

% |

|

|

0.43 |

% |

|

|

0.19 |

% |

|

|

1.08 |

% |

|

Return on average equity - QTD

|

|

|

3.63 |

% |

|

|

4.41 |

% |

|

|

2.35 |

% |

|

|

0.99 |

% |

|

|

5.38 |

% |

|

Net interest margin - QTD

|

|

|

2.26 |

% |

|

|

2.47 |

% |

|

|

2.88 |

% |

|

|

3.29 |

% |

|

|

3.34 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets - YTD

|

|

|

0.59 |

% |

|

|

0.59 |

% |

|

|

0.43 |

% |

|

|

0.96 |

% |

|

|

1.22 |

% |

|

Return on average equity - YTD

|

|

|

3.46 |

% |

|

|

3.37 |

% |

|

|

2.35 |

% |

|

|

4.91 |

% |

|

|

6.09 |

% |

|

Net interest margin - YTD

|

|

|

2.53 |

% |

|

|

2.67 |

% |

|

|

2.88 |

% |

|

|

3.00 |

% |

|

|

2.90 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Past due loans to total loans

|

|

|

0.53 |

% |

|

|

0.50 |

% |

|

|

0.64 |

% |

|

|

0.41 |

% |

|

|

0.48 |

% |

|

Nonaccrual loans to total loans

|

|

|

0.25 |

% |

|

|

0.26 |

% |

|

|

0.29 |

% |

|

|

0.29 |

% |

|

|

0.37 |

% |

|

Nonperforming assets to total assets

|

|

|

0.20 |

% |

|

|

0.19 |

% |

|

|

0.22 |

% |

|

|

0.22 |

% |

|

|

0.27 |

% |

|

Allowance for credit losses - loans to loans receivable

|

|

|

1.12 |

% |

|

|

1.14 |

% |

|

|

1.14 |

% |

|

|

1.18 |

% |

|

|

1.29 |

% |

WATERSTONE FINANCIAL, INC. AND SUBSIDIARIES

SUMMARY OF QUARTERLY AVERAGE BALANCES AND YIELD/COSTS

(Unaudited)

| |

|

At or For the Three Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2022

|

|

|

Average balances

|

|

(Dollars in Thousands)

|

|

|

Interest-earning assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable and held for sale

|

|

$ |

1,797,233 |

|

|

$ |

1,759,001 |

|

|

$ |

1,654,942 |

|

|

$ |

1,578,790 |

|

|

$ |

1,492,462 |

|

|

Mortgage related securities

|

|

|

174,202 |

|

|

|

171,938 |

|

|

|

170,218 |

|

|

|

170,209 |

|

|

|

172,807 |

|

|

Debt securities, federal funds sold and short term investments

|

|

|

132,935 |

|

|

|

123,195 |

|

|

|

115,962 |

|

|

|

130,973 |

|

|

|

162,211 |

|

|

Total interest-earning assets

|

|

|

2,104,370 |

|

|

|

2,054,134 |

|

|

|

1,941,122 |

|

|

|

1,879,972 |

|

|

|

1,827,480 |

|

|

Noninterest-earning assets

|

|

|

105,714 |

|

|

|

108,320 |

|

|

|

107,009 |

|

|

|

122,643 |

|

|

|

114,274 |

|

|

Total assets

|

|

$ |

2,210,084 |

|

|

$ |

2,162,454 |

|

|

$ |

2,048,131 |

|

|

$ |

2,002,615 |

|

|

$ |

1,941,754 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand accounts

|

|

$ |

90,623 |

|

|

$ |

69,147 |

|

|

$ |

68,564 |

|

|

$ |

75,449 |

|

|

$ |

75,058 |

|

|

Money market, savings, and escrow accounts

|

|

|

306,806 |

|

|

|

305,576 |

|

|

|

322,220 |

|

|

|

349,820 |

|

|

|

398,643 |

|

|

Certificates of deposit

|

|

|

719,708 |

|

|

|

695,310 |

|

|

|

648,531 |

|

|

|

628,375 |

|

|

|

586,012 |

|

|

Total interest-bearing deposits

|

|

|

1,117,137 |

|

|

|

1,070,033 |

|

|

|

1,039,315 |

|

|

|

1,053,644 |

|

|

|

1,059,713 |

|

|

Borrowings

|

|

|

584,764 |

|

|

|

551,545 |

|

|

|

441,716 |

|

|

|

333,249 |

|

|

|

296,111 |

|

|

Total interest-bearing liabilities

|

|

|

1,701,901 |

|

|

|

1,621,578 |

|

|

|

1,481,031 |

|

|

|

1,386,893 |

|

|

|

1,355,824 |

|

|

Noninterest-bearing demand deposits

|

|

|

106,042 |

|

|

|

130,291 |

|

|

|

143,296 |

|

|

|

177,217 |

|

|

|

153,591 |

|

|

Noninterest-bearing liabilities

|

|

|

46,805 |

|

|

|

46,446 |

|

|

|

51,840 |

|

|

|

63,866 |

|

|

|

43,683 |

|

|

Total liabilities

|

|

|

1,854,748 |

|

|

|

1,798,315 |

|

|

|

1,676,167 |

|

|

|

1,627,976 |

|

|

|

1,553,098 |

|

|

Equity

|

|

|

355,336 |

|

|

|

364,139 |

|

|

|

371,964 |

|

|

|

374,639 |

|

|

|

388,656 |

|

|

Total liabilities and equity

|

|

$ |

2,210,084 |

|

|

$ |

2,162,454 |

|

|

$ |

2,048,131 |

|

|

$ |

2,002,615 |

|

|

$ |

1,941,754 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Yield/Costs (annualized)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable and held for sale

|

|

|

5.26 |

% |

|

|

5.05 |

% |

|

|

4.87 |

% |

|

|

4.69 |

% |

|

|

4.32 |

% |

|

Mortgage related securities

|

|

|

2.41 |

% |

|

|

2.26 |

% |

|

|

2.25 |

% |

|

|

2.13 |

% |

|

|

2.07 |

% |

|

Debt securities, federal funds sold and short term investments

|

|

|

4.45 |

% |

|

|

3.67 |

% |

|

|

3.71 |

% |

|

|

3.35 |

% |

|

|

2.41 |

% |

|

Total interest-earning assets

|

|

|

4.97 |

% |

|

|

4.73 |

% |

|

|

4.57 |

% |

|

|

4.36 |

% |

|

|

3.93 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand accounts

|

|

|

0.11 |

% |

|

|

0.09 |

% |

|

|

0.08 |

% |

|

|

0.08 |

% |

|

|

0.08 |

% |

|

Money market and savings accounts

|

|

|

1.54 |

% |

|

|

1.42 |

% |

|

|

1.26 |

% |

|

|

0.67 |

% |

|

|

0.21 |

% |

|

Certificates of deposit

|

|

|

3.43 |

% |

|

|

2.80 |

% |

|

|

1.92 |

% |

|

|

1.10 |

% |

|

|

0.51 |

% |

|

Total interest-bearing deposits

|

|

|

2.64 |

% |

|

|

2.23 |

% |

|

|

1.60 |

% |

|

|

0.89 |

% |

|

|

0.37 |

% |

|

Borrowings

|

|

|

4.71 |

% |

|

|

4.08 |

% |

|

|

3.68 |

% |

|

|

3.23 |

% |

|

|

2.34 |

% |

|

Total interest-bearing liabilities

|

|

|

3.35 |

% |

|

|

2.86 |

% |

|

|

2.22 |

% |

|

|

1.45 |

% |

|

|

0.80 |

% |

COMMUNITY BANKING SEGMENT

SUMMARY OF KEY QUARTERLY FINANCIAL DATA

(Unaudited)

| |

|

At or For the Three Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2022

|

|

| |

|

(Dollars in Thousands)

|

|

|

Condensed Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$ |

12,431 |

|

|

$ |

13,238 |

|

|

$ |

14,008 |

|

|

$ |

15,737 |

|

|

$ |

15,507 |

|

|

Provision for credit losses

|

|

|

445 |

|

|

|

158 |

|

|

|

388 |

|

|

|

624 |

|

|

|

234 |

|

|

Total noninterest income

|

|

|

966 |

|

|

|

1,540 |

|

|

|

987 |

|

|

|

1,033 |

|

|

|

1,116 |

|

|

Noninterest expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation, payroll taxes, and other employee benefits

|

|

|

4,618 |

|

|

|

4,683 |

|

|

|

5,168 |

|

|

|

4,781 |

|

|

|

4,424 |

|

|

Occupancy, office furniture and equipment

|

|

|

852 |

|

|

|

873 |

|

|

|

1,031 |

|

|

|

877 |

|

|

|

955 |

|

|

Advertising

|

|

|

200 |

|

|

|

230 |

|

|

|

184 |

|

|

|

203 |

|

|

|

213 |

|

|

Data processing

|

|

|

672 |

|

|

|

602 |

|

|

|

601 |

|

|

|

551 |

|

|

|

539 |

|

|

Communications

|

|

|

70 |

|

|

|

72 |

|

|

|

78 |

|

|

|

92 |

|

|

|

108 |

|

|

Professional fees

|

|

|

176 |

|

|

|

146 |

|

|

|

218 |

|

|

|

153 |

|

|

|

123 |

|

|

Real estate owned

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

13 |

|

|

|

1 |

|

|

Loan processing expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Other

|

|

|

703 |

|

|

|

1,641 |

|

|

|

896 |

|

|

|

2,468 |

|

|

|

1,477 |

|

|

Total noninterest expense

|

|

|

7,292 |

|

|

|

8,248 |

|

|

|

8,177 |

|

|

|

9,138 |

|

|

|

7,840 |

|

|

Income before income taxes

|

|

|

5,660 |

|

|

|

6,372 |

|

|

|

6,430 |

|

|

|

7,008 |

|

|

|

8,549 |

|

|

Income tax expense

|

|

|

1,121 |

|

|

|

1,182 |

|

|

|

1,600 |

|

|

|

1,308 |

|

|

|

1,983 |

|

|

Net income

|

|

$ |

4,539 |

|

|

$ |

5,190 |

|

|

$ |

4,830 |

|

|

$ |

5,700 |

|

|

$ |

6,566 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio - QTD (non-GAAP)

|

|

|

54.43 |

% |

|

|

55.81 |

% |

|

|

54.53 |

% |

|

|

54.49 |

% |

|

|

47.16 |

% |

|

Efficiency ratio - YTD (non-GAAP)

|

|

|

54.94 |

% |

|

|

55.17 |

% |

|

|

54.53 |

% |

|

|

52.10 |

% |

|

|

51.20 |

% |

MORTGAGE BANKING SEGMENT

SUMMARY OF KEY QUARTERLY FINANCIAL DATA

(Unaudited)

| |

|

At or For the Three Months Ended |

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2022

|

|

| |

|

(Dollars in Thousands)

|

|

|

Condensed Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest loss

|

|

$ |

(550 |

) |

|

$ |

(622 |

) |

|

$ |

(282 |

) |

|

$ |

(241 |

) |

|

$ |

(155 |

) |

|

Provision for credit losses

|

|

|

- |

|

|

|

28 |

|

|

|

72 |

|

|

|

40 |

|

|

|

98 |

|

|

Total noninterest income

|

|

|

21,452 |

|

|

|

23,041 |

|

|

|

17,951 |

|

|

|

18,066 |

|

|

|

27,305 |

|

|

Noninterest expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation, payroll taxes, and other employee benefits

|

|

|

17,186 |

|

|

|

17,929 |

|

|

|

15,099 |

|

|

|

17,397 |

|

|

|

21,864 |

|

|

Occupancy, office furniture and equipment

|

|

|

1,141 |

|

|

|

1,173 |

|

|

|

1,232 |

|

|

|

1,289 |

|

|

|

1,341 |

|

|

Advertising

|

|

|

716 |

|

|

|

714 |

|

|

|

705 |

|

|

|

769 |

|

|

|

924 |

|

|

Data processing

|

|

|

551 |

|

|

|

480 |

|

|

|

516 |

|

|

|

490 |

|

|

|

543 |

|

|

Communications

|

|

|

173 |

|

|

|

153 |

|

|

|

173 |

|

|

|

197 |

|

|

|

194 |

|

|

Professional fees

|

|

|

564 |

|

|

|

466 |

|

|

|

188 |

|

|

|

453 |

|

|

|

265 |

|

|

Real estate owned

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loan processing expense

|

|

|

722 |

|

|

|

932 |

|

|

|

1,018 |

|

|

|

1,059 |

|

|

|

1,120 |

|

|

Other

|

|

|

1,935 |

|

|

|

1,914 |

|

|

|

2,403 |

|

|

|

2,584 |

|

|

|

2,571 |

|

|

Total noninterest expense

|

|

|

22,988 |

|

|

|

23,761 |

|

|

|

21,334 |

|

|

|

24,238 |

|

|

|

28,822 |

|

|

Loss before income taxes

|

|

|

(2,086 |

) |

|

|

(1,370 |

) |

|

|

(3,737 |

) |

|

|

(6,453 |

) |

|

|

(1,770 |

) |

|

Income tax benefit

|

|

|

(657 |

) |

|

|

(126 |

) |

|

|

(1,002 |

) |

|

|

(1,602 |

) |

|

|

(470 |

) |

|

Net loss

|

|

$ |

(1,429 |

) |

|

$ |

(1,244 |

) |

|

$ |

(2,735 |

) |

|

$ |

(4,851 |

) |

|

$ |

(1,300 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio - QTD (non-GAAP)

|

|

|

109.98 |

% |

|

|

105.99 |

% |

|

|

120.74 |

% |

|

|

135.98 |

% |

|

|

106.16 |

% |

|

Efficiency ratio - YTD (non-GAAP)

|

|

|

111.63 |

% |

|

|

112.49 |

% |

|

|

120.74 |

% |

|

|

104.02 |

% |

|

|

97.42 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan originations

|

|

$ |

597,562 |

|

|

$ |

623,342 |

|

|

$ |

442,710 |

|

|

$ |

546,628 |

|

|

$ |

729,897 |

|

|

Purchase

|

|

|

95.4 |

% |

|

|

96.4 |

% |

|

|

96.5 |

% |

|

|

95.6 |

% |

|

|

94.2 |

% |

|

Refinance

|

|

|

4.6 |

% |

|

|

3.6 |

% |

|

|

3.5 |

% |

|

|

4.4 |

% |

|

|

5.8 |

% |

|

Gross margin on loans sold(1)

|

|

|

3.62 |

% |

|

|

3.73 |

% |

|

|

3.78 |

% |

|

|

3.41 |

% |

|

|

3.70 |

% |

(1) Gross margin on loans sold equals mortgage banking income (excluding the change in interest rate lock value) divided by total loan originations

v3.23.3

Document And Entity Information

|

Oct. 24, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Waterstone Financial, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 24, 2023

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-36271

|

| Entity, Tax Identification Number |

90-1026709

|

| Entity, Address, Address Line One |

11200 W Plank Ct

|

| Entity, Address, City or Town |

Wauwatosa

|

| Entity, Address, State or Province |

WI

|

| Entity, Address, Postal Zip Code |

53226

|

| City Area Code |

414

|

| Local Phone Number |

761-1000

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

WSBF

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001569994

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

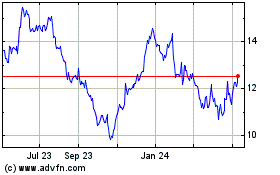

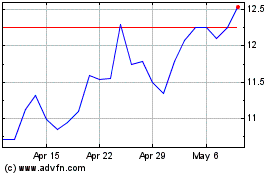

Waterstone Financial (NASDAQ:WSBF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Waterstone Financial (NASDAQ:WSBF)

Historical Stock Chart

From Apr 2023 to Apr 2024