0001698530false12/3100016985302024-08-202024-08-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 20, 2024

____________________

EXICURE, INC.

(Exact name of Registrant as specified in its charter)

____________________

| | | | | | | | |

| Delaware | 001-39011

| 81-5333008 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

2430 N. Halsted St.

Chicago, IL 60614

(Address of principal executive offices)

Registrant’s telephone number, including area code: (847) 673-1700

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | XCUR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.03 Material Modification to Rights of Security Holders.

The information under Item 5.03 below is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On August 26, 2024, Exicure, Inc. (the “Company”) filed a Certificate of Amendment (the “Amendment”) to its Amended and Restated Certificate of Incorporation, as amended, with the Secretary of State of the State of Delaware to effect a one-for-five (1-for-5) reverse stock split of its outstanding common stock (the “Reverse Stock Split”). The Amendment will be effective at 5:00 p.m. Eastern Time on August 27, 2024. A series of alternate amendments to effect a reverse stock split was approved by the Company’s stockholders at the Company’s Special Meeting of Stockholders held on August 20, 2024, and the specific one-for-five (1-for-5) reverse stock split was subsequently approved by the Company’s board of directors on August 20, 2024.

The Amendment provides that, at the effective time of the Amendment, every five (5) shares of the Company’s issued and outstanding common stock will automatically be combined into one (1) issued and outstanding share of common stock, without any change in par value per share. The Reverse Stock Split will not affect the number of authorized shares of common stock.

No fractional shares will be issued as a result of the Reverse Stock Split. Stockholders will receive a full share in lieu of fractional shares. The Reverse Stock Split will affect all stockholders proportionately and will not affect any stockholder’s percentage ownership of the Company’s common stock (except to the extent resulting from the treatment of fractional shares).

The Company’s common stock will begin trading on The Nasdaq Capital Market on a split-adjusted basis when the market opens on August 28, 2024. The new CUSIP number for the Company’s common stock following the Reverse Stock Split is 30205M309.

Additional information on the Reverse Stock Split can be found in the Company’s definitive proxy statement filed with the SEC on July 30, 2024.

The Amendment is filed as Exhibit 3.1 to this report and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On August 20, 2024, the Company held its Special Meeting. A total of 8,561,148 shares of the Company’s common stock were entitled to vote as of July 26, 2024, the record date for the Annual Meeting, of which 4,372,927 shares were represented in person or by proxy at the Special Meeting. At the Special Meeting, the stockholders of the Company voted on the following proposal:

1.the approval to amend the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the outstanding shares of the Company’s common stock, at a split ratio of between 1-for-2 and 1-for-15 as determined by the Board of Directors in its sole discretion (the “Reverse Stock Split Proposal”).

Proposal 1 – Reverse Stock Split of Outstanding Shares

The voting results with respect to the Reverse Stock Split Proposal were as follows:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 4,108,023 | 228,956 | 35,948 | N/A |

Accordingly, the Company’s stockholders approved the Reverse Stock Split Proposal. No other matters were submitted to a vote of stockholders at the Special Meeting.

Item 7.01 Regulation FD Disclosure.

On August 26, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 3.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: August 26, 2024 | EXICURE, INC. |

| | |

| By: | /s/ Paul Kang |

| | Paul Kang |

| | Chief Executive Officer |

| | |

Exhibit 3.1

Execution Version

CERTIFICATE OF AMENDMENT

Exicure, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), does hereby certify as follows:

1. The name of the Corporation is Exicure, Inc. The Certificate of Incorporation of the Corporation was originally filed with the Secretary of State of the State of Delaware on February 6, 2017 under the original name of the Corporation, Max-1 Acquisition Corporation, and was amended by the Certificate of Amendment filed with the Secretary of State of the State of Delaware on September 26, 2017. An Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on November 15, 2017, and was amended by the Certificate of Amendment filed with the Secretary of State of the State of Delaware on June 29, 2022 (the “Certificate of Incorporation”).

2. The Board of Directors of the Corporation (the “Board”), acting in accordance with the provisions of Sections 141 and 242 of the DGCL, adopted resolutions amending the Certificate of Incorporation, as follows:

Effective as of the effective time of 5:00 p.m., Eastern Time, on August 27, 2024 (the “Effective Time”), each five (5) shares of the Corporation’s Common Stock, par value $0.0001 per share, issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the Corporation or the respective holders thereof, be combined into one (1) share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the “Reverse Split”). No fractional shares shall be issued in connection with the Reverse Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock shall be entitled to receive such additional fraction of a share of Common Stock as is necessary to increase the fractional shares to a full share. Each certificate or book-entry position that immediately prior to the Effective Time represented shares of Common Stock, shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by such certificate or book-entry position shall have been combined, subject to the treatment of fractional shares as described above.

3. The foregoing amendment to the Certificate of Incorporation was duly approved by the Board.

4. Thereafter, pursuant to a resolution of the Board, this Certificate of Amendment was submitted to the stockholders of the Corporation for their approval, and was duly adopted in accordance with the provisions of Section 242 of the DGCL.

5. This amendment to the Certificate of Incorporation shall be effective on and as of as of the effective time of 5:00 p.m., Eastern Time, on August 27, 2024.

IN WITNESS WHEREOF, the undersigned has caused this Certificate of Amendment to be signed by its duly authorized officer on the 26th day of August, 2024.

/s/ Paul Kang

Paul Kang

Chief Executive Officer

Exicure, Inc. Announces 1-for-5 Reverse Stock Split

CHICAGO, IL. – August 26, 2024 - Exicure, Inc. (Nasdaq: XCUR, “the Company”), today announced that it will effect a 1-for-5 reverse stock split of its outstanding shares of common stock (the “Reverse Stock Split”). The Company expects that the Reverse Stock Split will become effective at 5:00 pm on Tuesday, August 27, 2024, and its common stock will begin trading on a split-adjusted basis at the open of trading on Wednesday, August 28, 2024 under the new CUSIP number 30205M 309. Exicure’s common stock will continue to trade on the NASDAQ Capital Market under the symbol “XCUR”. The Reverse Stock Split is an effort to regain compliance with Nasdaq’s listing rules.

The Reverse Stock Split was approved by the Company’s stockholders at its Special Meeting of Stockholders held on August 20, 2024, to be effected by the Company’s Board of Directors within approved parameters. The Company’s Board of Directors approved the Reverse Stock Split at a ratio of 1-for-5 on August 20, 2024.

As a result of the Reverse Stock Split, each 5 shares of the Company’s issued and outstanding common stock will be automatically combined and converted into 1 issued and outstanding share of common stock, resulting in the number of outstanding shares of Exicure’s common stock being reduced from approximately 8.65 million to approximately 1.73 million immediately following the effectiveness of the Reverse Stock Split. The Reverse Stock Split will affect all holders of shares of our common stock uniformly and each stockholder will hold the same percentage of our common stock outstanding immediately following the reverse stock split as that stockholder held immediately prior to the reverse stock split, except for adjustments that may result from the treatment of fractional shares as described below. The Reverse Stock Split will not affect the number of authorized shares of common stock or the par value of the common stock.

Stockholders holding their shares in book-entry form will not need to take any action in connection with the Reverse Stock Split. Stockholders will not receive fractional shares of common stock in connection with the Reverse Stock Split. Instead, stockholders who would have been entitled to a fractional share will receive such additional fraction of a share of common stock as is necessary to increase the fractional share to which they were entitled to a full share.

Additional information on the Reverse Stock Split can be found in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on July 30, 2024, which is available on the SEC’s website at www.sec.gov and on the Company’s website, www.exicuretx.com.

About Exicure, Inc.

Exicure, Inc. has historically been an early-stage biotechnology company focused on developing nucleic acid therapies targeting ribonucleic acid against validated targets. Following its recent restructuring and suspension of clinical and development activities, the Company is exploring strategic alternatives to maximize stockholder value, both with respect to its historical biotechnology assets and more broadly. For further information, see www.exicuretx.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. There can be no assurance regarding our ability to comply with the Panel’s decision and the applicable listing criteria by the deadline or thereafter. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual outcomes to differ materially from the outcomes expressed or implied by this report. Such risks include, among others, the possibility we will not be able to cure existing listing deficiencies, the possibility of additional deficiencies, the risk that the Company may not adequately comply with the terms of the Panel’s decision, and the risk that Nasdaq will ultimately delist the Company’s common stock. All such factors are difficult to predict and may be beyond the Company’s control. The Company undertakes no obligation and does not intend to update or revise any forward-looking statements contained herein, except as required by law or regulation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Media Contact:

Josh Miller

847-673-1700

media@exicuretx.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

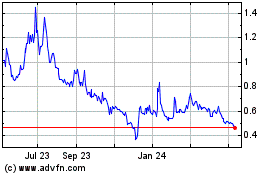

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

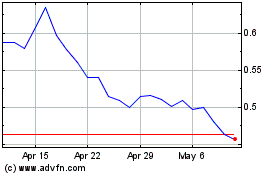

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Dec 2023 to Dec 2024