Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

16 February 2024 - 8:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

ZeroFox Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange

Act Rules 14a–6(i)(1) and 0–11 |

The following FAQs were made available to all employees of ZeroFox Holdings, Inc. on February 15,

2024:

Employee FAQ

Proposed Acquisition of ZeroFox by Haveli Investments

| |

1. |

What did ZeroFox announce? |

| |

a. |

ZeroFox announced that we entered into a definitive merger agreement to be acquired by Haveli Investments, a

technology-focused private equity firm. |

| |

b. |

Under the terms of the merger agreement, Haveli Investments will acquire ZeroFox in an all-cash transaction at an enterprise value of approximately $350 million. ZeroFox stockholders will receive $1.14 per share in cash upon completion of the transaction. |

| |

c. |

At the close of the transaction, which is anticipated to occur in the first half of this year, ZeroFox will

become a private company. |

| |

2. |

Why did we agree to partner with Haveli Investments and agree to become a private company again?

|

| |

a. |

We believe that Haveli is the right strategic partner to help drive our next phase of growth. The Haveli team

has significant experience working with high growth technology companies and shares the same level of passion and commitment as we do about external cybersecurity. |

| |

b. |

We believe that operating as a private company will strengthen our ability to accelerate our growth and scale,

as well as provide us with greater agility and flexibility. It will allow us to expand our platform capabilities and invest in our go-to-market strategy.

|

| |

c. |

We believe that Haveli can provide us with significant resources and expertise as we execute on our next phase

of growth. Their decision to invest in ZeroFox validates the fundamental strength of our business and the growth opportunity ahead. |

| |

d. |

We are not changing our focus or who we are as a company. We’ll remain laser-focused on our customers

– providing them with a best-in-class cybersecurity platform and associated services to protect them from the growing array of external cyber threats.

|

| |

3. |

Who is Haveli Investments? |

| |

a. |

Haveli Investments was founded in 2021 by Brian Sheth. The firm received a $500 million investment in 2022

from Apollo, a leading global investment manager, and is in the midst of making strategic investments in the software space. |

| |

b. |

The Haveli team has deep expertise and experience in software and security, having come from some of the

world’s leading private equity firms including Vista Capital Partners and Bain Capital. The team’s strong experience and resources will add significant value during this exciting next phase for ZeroFox. |

| |

c. |

Haveli takes a highly collaborative and partner-centric approach to working with companies. Through operational

and strategic support, Haveli enables its portfolio companies to focus on driving innovation and increasing growth, scale and profitability. |

| |

4. |

What does it mean to be a private company? Does this mean we are a private company today?

|

| |

a. |

Shares and other securities of private companies are not publicly traded. |

| |

b. |

When the transaction closes, ZeroFox’s common stock will no longer be listed on Nasdaq and each ZeroFox

stockholder will receive $1.14 in cash for each share of ZeroFox stock owned. |

| |

c. |

The February 6th announcement was the first step in this process. Several customary closing conditions must be

satisfied before the transaction can be completed. |

| |

d. |

Until then, we will remain a publicly traded company, and our common stock will continue to trade on Nasdaq.

|

| |

5. |

Will our business strategy change because of this transaction? |

| |

a. |

This transaction will result in a change of ownership, but not a change in who we are as a company. It is

business as usual at ZeroFox. |

| |

b. |

Haveli’s approach is to bring further expertise and resources to the table to help companies build

stronger businesses. With their partnership, we believe we will be able to accelerate ZeroFox’s growth and scale at a faster pace. |

| |

6. |

Once the transaction closes, how will Haveli work with ZeroFox moving forward? |

| |

a. |

Haveli is an experienced partner that shares our vision and can provide us with additional resources and

expertise to realize our goals. |

| |

b. |

Haveli believes in external cybersecurity and is excited about the growth opportunity. Haveli also values a

people-centric approach, and shares our commitment to innovation. |

| |

c. |

The Haveli team approaches their partnerships with a dual focus on collaboration and a commitment to

innovation. Together, we believe we can build an even stronger company and achieve both our operational and market ambitions more quickly for our customers’ benefit. |

| |

7. |

What does this mean for our Foxes? |

| |

a. |

It is business as usual for all Foxes. |

| |

b. |

It is important to remember that this announcement is just the first step toward completing this transaction,

and that it is business as usual at work. Our leadership team remains committed to ZeroFox and to being as transparent as possible. |

| |

c. |

This transaction aims to accelerate growth and scale the business while continuing to improve profitability. We

believe that this partnership will make ZeroFox stronger and can introduce many exciting career development opportunities. |

| |

8. |

What happens between now and close? |

| |

a. |

The initial announcement is one step in a multi-step process. There are still a number of customary closing

conditions that must be satisfied before the transaction can be completed such as the approval by our stockholders and receipt of regulatory approvals. |

| |

9. |

When do you expect the transaction to close? |

| |

a. |

The transaction is expected to close in the first half of this year. |

| |

b. |

Until then, we will remain a publicly traded company, and it is business as usual at ZeroFox.

|

| |

10. |

I’m a hiring manager. What do I tell someone who has accepted a position with ZeroFox but hasn’t

started yet? |

| |

a. |

You can advise pending new hires that nothing changes with respect to the offer of employment and we look

forward to each of them starting per the terms of their offer. |

| |

b. |

You can advise pending new hires that ZeroFox has entered into a definitive agreement to be acquired by Haveli

Investments, a technology-focused private equity firm. |

| |

c. |

Haveli’s investment in ZeroFox validates the value that we have all created to date and is a signal to

customers of our desire to grow our business. |

| |

d. |

We remain focused on delivering on our commitments to all of our stakeholders – our customers, our

partners, and our fellow Foxes. We will continue to execute in our roles to sustain our momentum and improve our position in the external cybersecurity space. |

| |

11. |

I own ZeroFox stock. What will happen? |

| |

a. |

Upon closing of the transaction, employees who are stockholders of ZeroFox will receive $1.14 in cash for each

share of ZeroFox that they own. |

| |

b. |

Until the transaction closes, our stock will continue to trade on Nasdaq. |

| |

12. |

What happens to my employee stock options and RSUs? |

| |

a. |

We will remain a public company until the transaction closes. In the interim, stock options and restricted

stock units (RSUs) that have been granted will continue to vest on their normal vesting schedule. |

| |

b. |

Shares of common stock from RSU awards that have vested but not yet been settled prior to the time of closing

of the transaction will be paid out in cash at $1.14 per share. Following the closing, all outstanding unvested RSUs are converted into a conditional right to receive a cash payment equal to $1.14 per RSU (subject to tax withholding) at the time of

vesting. Your RSU vesting schedule will continue without change and you generally must remain employed for vesting to continue. In other words, your RSUs will continue to vest and instead of receiving shares of ZeroFox at the time of vesting you

will receive $1.14 per RSU (subject to tax withholding). |

| |

c. |

Vested and unexercised stock options with an exercise price less than $1.14 per share will be cashed out at the

time of closing of the transaction. The amount to be received will equal the difference between $1.14 and the stock option exercise price, multiplied by the number of shares underlying such stock option (i.e., [$1.14—exercise price ($)]

x [number of shares]), subject to tax withholding. Similar to RSUs, unvested stock options with an exercise price less than $1.14 per share will continue to vest while you remain employed and be paid out over time under the existing vesting schedule

in accordance with the same formula referenced above. |

| |

d. |

All outstanding vested and unvested stock options with an exercise price equal to or greater than $1.14 per

share will be canceled at the time of closing of the transaction and forfeited. |

| |

e. |

The payouts for RSUs and stock options will be subject to normal tax withholding and will be made as part of

the payroll process. |

| |

13. |

Will I continue to be subject to trading windows? |

| |

a. |

Yes, you will be subject to trading windows until the transaction closes. Since we will continue to operate as

a public company, all trading windows and our Insider Trading Policy will still apply. |

| |

14. |

What do I tell customers and partners? |

| |

a. |

This transaction is intended to give us the agility and flexibility we need to aggressively invest in the

business from an innovation and go-to-market standpoint. Haveli’s experience and resources will better position ZeroFox to execute on our next phase of growth.

Customers and partners can expect ZeroFox to continue to deliver innovation and further expand our external cybersecurity platform capabilities as we look to protect our customers from increasing growth in sophisticated cyber threats.

|

| |

b. |

Our goal is to accelerate our pace of innovation and provide more comprehensive external cybersecurity platform

capabilities to protect our customers. Our strategic partnership with Haveli will strengthen our ability to protect and serve our customers. |

| |

c. |

Customers and partners are going to want to know what this means to them. They received an email message from

Foster directly on February 6th. Please reach out to your manager if you have further questions about how to handle specific customer or partner inquiries. When appropriate, we will provide additional communications as we get closer to the closing

of the transaction. |

| |

d. |

We remain laser-focused on continuing to protect our customers and providing the exceptional level of service

and support they and our partners expect from ZeroFox. |

| |

e. |

We are excited about this transaction and look forward to its closing. Until then, it is business as usual, and

ZeroFox will operate independent of Haveli. |

| |

15. |

What should I do if I am contacted by the media or third parties about the transaction?

|

| |

a. |

Please do not respond to any inquiries and instead direct them to press@zerofox.com.

|

| |

16. |

What should I do if I am contacted by an investor about the transaction? |

| |

a. |

Please do not respond to any inquiries and instead direct them to investor@zerofox.com.

|

| |

17. |

What can I share on social media? |

| |

a. |

At this time, we are still a public company and are subject to various company policies and related regulatory

requirements. Given this, ZeroFox employees should not create, share, or comment on any social media posts related to the Haveli acquisition. |

| |

b. |

ZeroFox will continue to leverage social media as a core component of our day-to-day marketing efforts and employees are encouraged to continue amplifying our corporate social media posts not related to the Haveli transaction. |

Additional Information and Where to Find It

This

communication relates to the proposed transaction involving ZeroFox. This communication does not constitute a solicitation of any vote or approval. In connection with the proposed transaction, ZeroFox plans to file with the U.S. Securities and

Exchange Commission (the “SEC”) a proxy statement on Schedule 14A (the “Proxy Statement”) relating to a special meeting of its stockholders and may file other documents with the SEC relating to the proposed transaction. This

communication is not a substitute for the Proxy Statement or any other document that ZeroFox may file with the SEC or send to its stockholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS OF ZEROFOX

ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at a stockholder meeting of ZeroFox to approve the proposed transaction or related

matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Proxy Statement. Investors and security holders will be able to obtain the Proxy Statement and other documents

ZeroFox files with the SEC (when available) free of charge at the SEC’s website (http://www.sec.gov) or at ZeroFox’s investor relations website at: https://ir.zerofox.com/ or by emailing investor@ZeroFox.com.

Participants in the Solicitation

ZeroFox and its directors and executive officers may be deemed to be participants in the solicitation of proxies from ZeroFox’s stockholders in connection

with the proposed transaction. Information regarding ZeroFox’s directors and executive officers and their ownership of ZeroFox’s common stock is set forth in the definitive proxy statement for ZeroFox’s 2023 Annual Meeting of

Stockholders, which was filed with the SEC on May 15, 2023. To the extent the holdings of ZeroFox’s securities by ZeroFox’s directors and executive officers have changed since the amounts set forth in the Company’s proxy

statement for ZeroFox’s 2023 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become

available. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

Forward-Looking

Statements

This communication contains forward-looking statements that involve risks and uncertainties, including statements regarding the proposed

transaction, including the anticipated timing of closing of the transaction. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements.

These risks and uncertainties include, but are not limited to, the following: the ability of ZeroFox to meet expectations regarding the timing and completion of the proposed transaction; the possibility that the conditions to the closing of the

proposed transaction are not satisfied, including the risk that the required regulatory approvals are not obtained or that ZeroFox’s stockholders do not approve the proposed transaction; the occurrence of any event, change or other

circumstances that could result in the merger agreement being terminated or the proposed transaction not being completed on the terms reflected in the merger agreement, or at all; the risk that the merger agreement may be terminated in circumstances

that require us to pay a termination fee; potential litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have adverse effects on the market price of ZeroFox’s common stock; the

ability of each party to consummate the proposed transaction; risks related to the possible disruption of management’s attention from ZeroFox’s ongoing business operations due to the proposed transaction; the effect of the announcement of

the proposed transaction on the ability of ZeroFox to retain and hire key personnel and maintain relationships with customers and business partners; the risk of unexpected costs or expenses resulting from the proposed transaction; and other risks

and uncertainties detailed in the periodic reports that ZeroFox files with the SEC, including ZeroFox’s Annual Report on Form 10-K filed with the SEC on March 30, 2023, as updated by its subsequent

Quarterly Reports on Form 10-Q. If any of these risks or uncertainties materialize, or if any of ZeroFox’s assumptions prove incorrect, ZeroFox’s actual results could differ materially from the

results expressed or implied by these forward-looking statements. In addition, other unpredictable or unknown factors not discussed in this document could also have material adverse effects on forward-looking statements. All forward-looking

statements in this communication are based on information available to ZeroFox as of the date of this communication, and ZeroFox does not assume any obligation to update the forward-looking statements provided to reflect events that occur or

circumstances that exist after the date on which they were made, except as required by law.

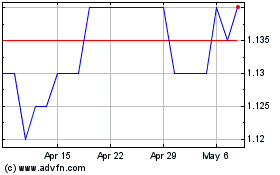

ZeroFox (NASDAQ:ZFOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

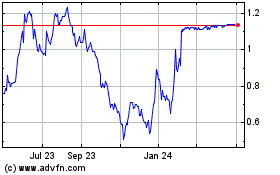

ZeroFox (NASDAQ:ZFOX)

Historical Stock Chart

From Apr 2023 to Apr 2024