UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to § 240.14a-12 |

ZYVERSA

THERAPEUTICS, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box)

| ☒ |

No

fee required. |

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED MARCH 8, 2024

ZYVERSA

THERAPEUTICS, INC.

2200

N. Commerce Parkway, Suite 208

Weston,

Florida 33326

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on April 17, 2024

Dear

Stockholder:

You

are cordially invited to attend the special meeting of stockholders (the “Special Meeting”) of ZyVersa Therapeutics, Inc.,

a Delaware corporation. The meeting will be held in a virtual-only format via live webcast on April 17, 2024, at 9:00a.m. Eastern

Time. To access the webcast and a list of stockholders entitled to vote at the meeting, please visit http://www.virtualshareholdermeeting.com/ZVSA2024SM

and enter the 16-digit control number included on your on your proxy card, or in the instructions that accompanied your proxy materials.

The purposes of the Special Meeting are as follows:

| 1. |

To

adopt and approve an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of

our issued shares of common stock at a ratio within the range of not less than 1-for-2 and not greater than 1-for-50, with the exact

ratio within such range to be determined at the sole discretion of our board of directors, without further approval or authorization

of our stockholders before the filing of an amendment to the Second Amended and Restated Certificate of Incorporation effecting the

proposed reverse stock split. |

| |

|

| 2. |

The

approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote

of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Second Amended and Restated

Certificate of Incorporation to effect the reverse stock split. |

Please

monitor the Investor Relations section of our website at https://investors.zyversa.com for updated information regarding the Special

Meeting. If you are planning to attend our Special Meeting virtually, please check the website one week prior to the Special Meeting

date. As always, we encourage you to submit a proxy to vote your shares prior to the Special Meeting.

These

items of business are more fully described in the Proxy Statement accompanying this notice.

The

record date for the Special Meeting is March 5, 2024. Only stockholders of record at the close of business on that date may vote at the

meeting or any adjournment thereof.

By

Order of the Board of Directors

Stephen

C. Glover

Chief

Executive Officer, President, and Chairman of the Board of Directors

Weston,

Florida

March

__, 2024

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on April 17, 2024: Pursuant to

the rules of the Securities and Exchange Commission, with respect to the Special Meeting, we have elected to utilize the “full

set delivery” option of providing paper copies of all of our proxy materials by mail.

Whether

or not you expect to attend the meeting electronically, please submit a proxy for your shares promptly using the directions on your proxy

card, by one of the following methods: (1) over the

internet at http://www.proxyvote.com, (2) by telephone by calling the toll-free number 1-800-690-6903, or (3) by marking, dating, and

signing your proxy card and returning it in the accompanying postage-paid envelope. Even if you have submitted a proxy, you may still

vote electronically if you attend the virtual meeting, in which case only your vote cast at the virtual meeting will be counted. Please

note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you must

obtain a proxy issued in your name from that record holder.

TABLE

OF CONTENTS

PRELIMINARY

PROXY STATEMENT, SUBJECT TO COMPLETION, DATED MARCH 8, 2024

ZYVERSA

THERAPEUTICS, INC.

2200

N. Commerce Parkway, Suite 208

Weston,

Florida 33326

PROXY

STATEMENT

FOR

THE 2024 SPECIAL MEETING OF STOCKHOLDERS

April

17, 2024

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

This

proxy statement (the “Proxy Statement”) is furnished to stockholders of ZyVersa Therapeutics, Inc., a Delaware corporation

(the “Company,” “we,” “us,” or “our”), in connection with the solicitation of proxies

by our board of directors for use at a special meeting of stockholders to be held on April 17, 2024, and at any adjournment or postponement

thereof (our “Special Meeting”). Our Special Meeting will be held at 9a.m. Eastern time via a live webcast at www.virtualshareholdermeeting.com/ZVSA2024SM.

On

or about March 22, 2024, we will commence mailing of the proxy materials which are also available at www.proxyvote.com. The proxy

materials are being sent to stockholders who owned our common stock at the close of business on March 5, 2024, the record date for the

Special Meeting (the “Record Date”). This Proxy Statement contains important information for you to consider when deciding

how to vote on the matters brought before the meeting. Please read it carefully.

Why

am I receiving these materials?

We

sent you this Proxy Statement because our board of directors is soliciting your proxy to vote at our Special Meeting. This Proxy Statement

summarizes the information you need to vote at our Special Meeting. You do not need to attend our Special Meeting to vote your shares.

What

am I voting on?

There

are two matters scheduled for a vote:

●

|

Proposal

No. 1 - To adopt and approve an amendment to our Second Amended and Restated Certificate

of Incorporation to effect a reverse stock split of our issued shares of common stock at

a ratio within the range of not less than 1-for-2 and not greater than 1-for-50, with the

exact ratio within such range to be determined at the sole discretion of our board of directors,

without further approval or authorization of our stockholders before the filing of an amendment

to the Second Amended and Restated Certificate of Incorporation effecting the proposed reverse

stock split.

|

| ● |

Proposal

No. 2 - To approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Second Amended and

Restated Certificate of Incorporation to effect the reverse stock split. |

How

do I attend the Special Meeting?

The

meeting will be held in a virtual-only format via live webcast on April 17, 2024, at 9:00 a.m. Eastern Time at http://www.virtualshareholdermeeting.com/ZVSA2024SM.

Information on how to vote electronically at the Special Meeting is discussed below. You will also be able to listen and participate

in the Special Meeting as well as vote and submit your questions during the live webcast of the meeting by visiting http://www.virtualshareholdermeeting.com/ZVSA2024SM

and entering the 16-digit control number included on your proxy card, or in the instructions that accompanied your proxy

materials. As always, we encourage you to submit a proxy to vote your shares prior to the Special Meeting.

What

if another matter is properly brought before the meeting?

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are

properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance

with their best judgment.

How

do I vote?

Proposal

1: You may vote “For” or “Against” or abstain from voting on the proposals to adopt and approve an amendment

to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued shares of common stock

at a ratio within the range of not less than 1-for-2 and not greater than1-for-50, with the exact ratio within such range to be determined

at the sole discretion of our board of directors (Proposal 1).

Proposal

2: You may vote “For” or “Against” or abstain from voting on the proposals to approve of the adjournment

of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there

are not sufficient votes in favor of the amendment to the Company’s Second Amended and Restated Certificate of Incorporation to

effect the reverse stock split (Proposal 2).

The

procedures for voting are fairly simple:

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote electronically at the virtual Special Meeting, vote by proxy at the meeting, submit a proxy

to vote at the meeting through the internet by visiting http://www.virtualshareholdermeeting.com/ZVSA2024SM and entering the 16-digit

control number included on your proxy card, or submit a proxy to vote your shares by using a proxy card or by telephone or the

internet. Whether or not you plan to attend the virtual meeting, we urge you to submit a proxy to ensure your vote is counted. You may

still attend the meeting virtually and vote electronically even if you have already submitted a proxy to vote, in which case only your

vote cast at the virtual meeting will be counted.

| ● |

To

vote electronically at the virtual Special Meeting, visit http://www.virtualshareholdermeeting.com/ZVSA2024SM and enter the 16-digit

control number included in your Proxy Card. |

| ● |

To

submit a proxy card that was mailed to you, simply complete, sign, and date the proxy card, and return it promptly in the envelope

provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you return your signed proxy card

to us before the Special Meeting, the proxyholders named therein will vote your shares as you direct. |

| |

|

| ● |

To

submit a proxy over the telephone, dial toll-free at 1-800-690-6903 using a touch-tone phone and follow the recorded instructions.

You will be asked to provide your unique 16-digit number and control number that appears on your proxy card or other proxy

materials. Your telephone vote should be received by 11:59 p.m., Eastern Time on April 16, 2024 in order to ensure that it is counted. |

| |

|

| ● |

To

submit a proxy through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked

to provide your unique 16-digit number and control number that appears on your proxy card or other proxy materials. Your

proxy submitted by internet should be received by 11:59 p.m., Eastern Time on April 16, 2024 in order to ensure that it is counted. |

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a full set

of proxy materials containing voting instructions from that organization rather than from the Company. Simply follow the voting instructions

in the proxy materials to ensure that your vote is counted. To vote online at the Special Meeting, you must obtain a valid proxy from

your broker, bank, or other agent. Follow the instructions from your broker, bank, or other agent included with these proxy materials

or contact your broker, bank, or other agent to request a proxy form.

The

ability to submit a proxy via the internet allows you to submit a proxy to vote your shares online, with procedures designed to ensure

the authenticity and correctness of your proxy vote instructions. If you choose to submit a proxy to vote your shares online via the

internet, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access

providers and telephone companies.

How

many votes do I have?

On

each matter to be voted upon, you have one vote for each share of common stock you hold as of the Record Date, March 5, 2024.

What

happens if I do not vote?

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record and do not submit a proxy by completing and delivering your proxy card or through the internet or telephone,

and do not vote electronically at the virtual Special Meeting, your shares will not be voted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your

broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange, or NYSE, deems the particular

proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares

with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under

the rules and interpretations of NYSE, which apply regardless of whether an issuer is listed on the NYSE or Nasdaq, “non-routine”

matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections

of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and

on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported.

Accordingly, your broker or nominee may vote your shares on Proposal No. 1 or No. 2 even in the absence of your instruction.

What

if I return a proxy card or otherwise submit a proxy to vote but do not make specific choices?

If

you return a signed and dated proxy card or otherwise submit a proxy to vote without marking voting selections, your shares will be voted,

as applicable:

●

|

“For”

the approval and adoption of an amendment to our Second Amended and Restated Certificate

of Incorporation to effect a reverse stock split of our issued shares of common stock at

a ratio within the range of not less than 1-for-2 and not greater than 1-for-50, with the

exact ratio within such range to be determined at the sole discretion of our board of directors,

without further approval or authorization of our stockholders before the filing of an amendment

to the Second Amended and Restated Certificate of Incorporation effecting the proposed reverse

stock split.

|

| |

|

| ● |

“For”

the approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Second Amended and

Restated Certificate of Incorporation to effect the reverse stock split. |

If

any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your

shares using your proxyholder’s best judgment.

Who

is paying for this proxy solicitation?

We

will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit

proxies in person or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting

proxies. We may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

We have retained Morrow Sodali LLC to aid in the solicitation of proxies. Morrow Sodali LLC will receive a fee of approximately $15,000,

as well as reimbursement for certain costs and out-of-pocket expenses incurred by them in connection with their services, all of which

will be paid by us.

Can

I change my vote after submitting my proxy?

Stockholder

of Record: Shares Registered in Your Name

Yes.

You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke

your proxy in any one of the following ways:

| ● |

You

may submit another properly completed proxy card with a later date. |

| |

|

| ● |

You

may grant a subsequent proxy by telephone or through the internet. |

| |

|

| ● |

You

may send a timely written notice that you are revoking your proxy to our Secretary at 2200 N. Commerce Parkway, Suite 208, Weston,

Florida 33326. |

| |

|

| ● |

You

may attend the Special Meeting virtually and vote electronically by visiting http://www.virtualshareholdermeeting.com/ZVSA2024SM

and entering the 16-digit control number included in your on your proxy card, or in the instructions that accompanied your

proxy materials. Simply attending or participating in the Special Meeting will not, by itself, revoke your proxy. |

Your

latest proxy card or other proxy is the one that is counted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank

to revoke your proxy.

How

are votes counted?

Votes

will be counted by the inspector of elections appointed for the meeting, who will separately count votes “For” and “Against,”

abstentions and, if applicable, broker non-votes. Assuming a quorum is present, abstentions and broker non-votes, if any, will have no

effect on the outcome of Proposal No. 1 and No. 2. Because Proposal No. 1 and No. 2 are “routine,” we do not expect that

any broker non-votes will occur with respect to those proposals.

What

are “broker non-votes”?

As

discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee does not have

discretionary authority to vote the shares. When there is at least one “routine” matter to be considered at a meeting, and

a broker exercises its discretionary authority on any such “routine matter” with respect to any uninstructed shares, “broker

non-votes” occur with to the “non-routine” matters for which the broker lacks discretionary authority to vote such

uninstructed shares.

How

many votes are needed to approve each proposal?

● |

Proposal

No. 1 – To adopt and approve an amendment to our Second Amended and Restated Certificate

of Incorporation to effect a reverse stock split of our issued shares of common stock at

a ratio within the range of not less than 1-for-2 and not greater than 1-for-50, with the

exact ratio within such range to be determined at the sole discretion of our board of directors,

without further approval or authorization of our stockholders before the filing of an amendment

to the Second Amended and Restated Certificate of Incorporation effecting the proposed reverse

stock split, the proposal must be approved by the holders of a majority in voting power of

the votes cast on such proposal. Abstentions and broker non-votes, if any, will have no effect

on this proposal. Because this proposal is “routine,” we do not expect that any

broker non-votes will occur with respect to this proposal.

|

| |

|

| ● |

Proposal

2 – To approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Second Amended and

Restated Certificate of Incorporation to effect the reverse stock split, the proposal must be approved by the holders of a majority

in voting power of the votes cast on such proposal. Abstentions and broker non-votes, if any, will have no effect on this proposal.

Because this proposal is “routine,” we do not expect that any broker non-votes will occur with respect to this proposal. |

What

is the quorum requirement?

A

quorum of stockholders is generally required to hold a valid meeting of stockholders. A quorum is present if the holders of thirty-three

and one-third percent (33 1/3%) of the voting power of the stock issued and outstanding and entitled to vote at a meeting are present

in person (virtually, in the case of this virtual Special Meeting) or submitted a proxy.

Any

shares that you hold of record will be counted towards the establishment of a quorum only if you submit a valid proxy or if you or your

proxy attend the meeting virtually. If you are a beneficial holder of shares held through a broker, bank, or other nominee, your shares

will be counted towards the establishment of a quorum if you provide voting instructions with respect to such shares, if you obtain a

proxy to vote such shares and attend the meeting virtually, or if you fail to provide voting instructions with respect to such shares.

Shares

for which abstentions or broker non-votes occur on any proposal will be counted towards the establishment of a quorum.

How

can I find out the results of the voting at the Special Meeting?

Preliminary

voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form

8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time

to file a current report on Form 8-K within four business days after the meeting, we intend to file a current report on Form 8-K to publish

preliminary results and, within four business days after the final results are known to us, file an additional current report on Form

8-K to publish the final results.

What

can I do if I need technical assistance during the meeting?

If

you encounter any difficulties accessing the virtual meeting during the meeting time, please call the technical support number that will

be posted on the live webcast log-in page.

If

I can’t attend the meeting, how do I vote or listen to it later?

You

do not need to attend the virtual meeting to vote if you submitted a proxy to vote in advance of the meeting. A replay of the meeting,

including the questions answered during the meeting, will be available on www.virtualshareholdermeeting.com/ZVSA2024SM for one year following

the meeting date.

What

happens if a change to the Special Meeting is necessary due to exigent circumstances?

We

intend to hold the Special Meeting in a virtual-format only via live webcast. Please monitor the Investor Relations section of our website

or at www.virtualshareholdermeeting.com/ZVSA2024SM for updated information. If you are planning to attend our Special Meeting

virtually, please check the website one week prior to the Special Meeting date. As always, we encourage you to vote your shares prior

to the Special Meeting.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which

are subject to the “safe harbor” created by those sections, concerning our business, operations, and financial performance

and condition as well as our plans, objectives, and expectations for business operations and financial performance and condition. Any

statements contained herein that are not of historical facts may be deemed to be forward-looking statements. You can identify these statements

by words such as “anticipate,” “assume,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “should,” “will,” “would,”

and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are

based on current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s

beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties,

and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this proxy

statement may turn out to be inaccurate. Factors that could materially affect our business operations and financial performance and condition

include, but are not limited to, those risks and uncertainties described herein, under “Item 1A – Risk Factors” in

our Annual Report on Form 10-K for the year ended December 31, 2022, and any risk factors disclosed in subsequent Quarterly Reports on

Form 10-Q. You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place

undue reliance on the forward-looking statements. The forward-looking statements are based on information available to us as of the filing

date of this proxy statement. Unless required by law, we do not intend to publicly update or revise any forward-looking statements to

reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in the reports we

will file from time to time with the SEC after the date of this proxy statement.

This

proxy statement also contains market data related to our business and industry. These market data include projections that are based

on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these

assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow

at these projected rates may harm on our business, results of operations, financial condition, and the market price of our common stock.

PROPOSALS

Proposal

No. 1: To Adopt and Approve an Amendment to Our Second Amended and Restated Certificate of Incorporation to Effect a Reverse Stock

Split of our Issued Shares of Common Stock at a Ratio Within the Range of Not Less Than 1-for-2 and Not Greater Than 1-for-50, with the

Exact Ratio Within Such Range to be Determined at the Sole Discretion of our Board of Directors, Without Further Approval or Authorization

of our Stockholders Before the Filing of an Amendment to the Second Amended and Restated Certificate of Incorporation Effecting the Proposed

Reverse Stock Split.

| What

am I voting on? |

|

Adoption

and approval of an amendment to our Second Amended and Restated Certificate of Incorporation

to effect a reverse stock split of our issued shares of common stock at a ratio within the

range of not less than 1-for-2 and not greater than 1-for-50, with the exact ratio within

such range to be determined at the sole discretion of our board of directors, without further

approval or authorization of our stockholders before the filing of an amendment to the Second

Amended and Restated Certificate of Incorporation effecting the proposed reverse stock split.

|

| |

|

|

| Vote

recommendation: |

|

“FOR”

the adoption and approval of the amendment to our Second Amended and Restated Certificate

of Incorporation to effect the proposed reverse stock split.

|

| |

|

|

| Vote

required: |

|

The

affirmative vote of the holders of a majority of the votes cast on the proposal.

|

| |

|

|

| Effect

of abstentions: |

|

None. |

| |

|

|

Effect

of broker non-votes: |

|

None. |

General

At

the Special Meeting, stockholders will be asked to adopt and approve an amendment (attached as Annex A to this proxy statement;

the “Reverse Split Charter Amendment”) to our Second Amended and Restated Certificate of Incorporation to effect a reverse

stock split (the “Reverse Split”) of the Company’s common stock at a ratio within the range of not less than 1-for-2

and not greater than 1-for-50 (the “Split Range”), with the exact ratio within such range to be determined at the sole discretion

of our board of directors, without further approval or authorization of our stockholders before the filing of the Reverse Split Charter

Amendment effecting the proposed Reverse Split. As set forth on Annex A, by adoption and approval of this Proposal No. 1, the stockholders

will be deemed to have adopted and approved an amendment to effect the Reverse Split at each of the ratios between and including 1-for-2

and 1-for-50.

Notwithstanding

the foregoing, no such amendment or any Reverse Split will occur until the Reverse Split Charter Amendment in the form attached to this

proxy statement as Annex A is filed with the Secretary of State of the State of Delaware and becomes effective. If Proposal No.

1 is adopted and approved and the board of directors decides to proceed with the Reverse Split, the board of directors will determine

the exact reverse split ratio within the Split Range, which ratio will be included in a public announcement made prior to the effectiveness

of the Reverse Split Charter Amendment, and any amendment to effect the Reverse Split at the other ratios within the Split Range adopted

and approved by the board of directors and stockholders will be abandoned. The Company may effect only one reverse stock split in connection

with this proposal. Upon the effectiveness of the Reverse Split Charter Amendment effecting the Reverse Split (the “Split Effective

Time”), the issued shares of our common stock immediately prior to the Split Effective Time will be reclassified into a smaller

number of shares of common stock within the specified range, such that a holder of common stock of the Company will own one share of

our common stock for the specified number of shares of common stock held by that stockholder immediately prior to the Split Effective

Time, which number will be determined by the board of directors within the Split Range.

The

form of the Reverse Split Charter Amendment to effect the Reverse Split, as more fully described below, will affect the Reverse Split

but will not change the number of authorized shares of common stock or preferred stock, or the par value of the Company’s common

Stock or preferred stock.

Purpose

Our

board of directors approved the proposal approving the Reverse Split Charter Amendment effecting the Reverse Split because it believes

that:

| ● |

seeking

stockholders approval and adoption of the Reverse Split Charter Amendment to effect the Reverse Split at the discretion of the board

of directors is advisable and in the best interests of the Company and its stockholders; |

| |

|

| ● |

effecting

the Reverse Split may be an effective means of avoiding a delisting of the Company’s common stock from Nasdaq in the future; |

| |

|

| ● |

an

investment in the Company’s common stock may not appeal to brokerage firms that are reluctant to recommend lower priced securities

to their clients and investors may also be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a

percentage of the total transaction, tend to be higher for such stocks; |

| |

|

| ● |

analysts

at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks and that most investment

funds are reluctant to invest in lower priced stocks; and |

| |

|

| ● |

a

higher stock price may help generate investor interest in the Company and help the Company attract and retain employees. |

If

the Reverse Split successfully increases the per share price of our common stock, the board of directors believes this increase may increase

trading volume in our common stock and facilitate future financings by the Company.

Nasdaq

Requirements for Continued Listing

Our

common stock is listed on The Nasdaq Capital Market under the symbol “ZVSA.” On February 29, 2024, the Company

received approval from Nasdaq to transfer the listing of the Company’s Common Stock from the Nasdaq Global Market to the Nasdaq

Capital Market, as further described below.

On

June 9, 2023, we received a letter from the Listing Qualifications Staff of Nasdaq indicating that, based upon the closing bid price

of the Company’s common stock for the last 30 consecutive business days, the Company was not currently in compliance with the requirement

to maintain a minimum bid price of $1.00 per share for continued listing on The Nasdaq Global Market (the “Minimum Bid Price

Requirement”), as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Nasdaq Notice”).

The

Nasdaq Notice had no immediate effect on the continued listing status of the Company’s common stock on The Nasdaq Capital

Market, and, therefore, the Company’s listing remains fully effective.

The

Company was provided a compliance period of 180 calendar days from the date of the Nasdaq Notice, or until December 6, 2023, to regain

compliance with the Minimum Bid Price Requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A). On November 14, 2023, Nasdaq issued

a letter to the Company that as of November 13, 2023, it determined that the Company’s securities had a closing bid price of $0.10

or less for ten consecutive trading days. Accordingly, the Company is subject to the provisions contemplated under Listing Rule 5810(c)(3)(A)(iii)

(the “Low Priced Stock Rule”). To regain compliance with the Minimum Bid Price Requirement, the Company effected a reverse

stock split at a ratio of 1-for-35 on December 5, 2023 (the “2023 Reverse-Stock-Split”). The 2023 Reverse Stock Split caused

the Company’s common stock to trade above $1.00, however, it dropped below $1.00 and the common stock did not close at a price

of over $1.00 for 10 consecutive trading days in order to regain compliance with the Minimum Bid Price Requirement. Following the 2023

Reverse Stock Split, the Company regained compliance with the Low Priced Stock Rule.

The

Company subsequently requested and received a hearing (the “Nasdaq Hearing”) from the Nasdaq Hearings Panel (the “Panel”).

Following the Nasdaq Hearing, which was held on January 25, 2024, The Panel, by written decision dated February 5, 2024, granted the

Company’s request for an exception to the Minimum Bid Price Requirement until May 3, 2024.

On February

29, 2024, the Company received approval from Nasdaq to transfer the listing of the Company’s Common Stock from the Nasdaq

Global Market to the Nasdaq Capital Market. The Company’s Common Stock was transferred to the Nasdaq Capital Market effective as

of the open of business on March 1, 2024, and continues to trade under the symbol “ZVSA.” As a result of the transfer to

the Nasdaq Capital Market, the Company is no longer required to meet the minimum Market Value of Publicly Held Shares of $5,000,000 for

continued listing on the Nasdaq Global Market, as set forth in Nasdaq Listing Rule 5450(b)(1)(C), which the Company was previously not

in compliance with.

Accordingly,

we believe that the Reverse Split is our best option for meeting the Minimum Bid Price Requirement for continued listing on The Nasdaq

Capital Market. A decrease in the number of outstanding shares of our common stock resulting from the Reverse Split should, absent

other factors, assist in ensuring that the per share market price of our common stock remains above the requisite price for continued

listing. However, we cannot provide any assurance that our minimum bid price would remain over the Minimum Bid Price Requirement of The

Nasdaq Capital Market following the Reverse Split.

Potential

Increased Investor Interest

On

March 6, 2024, the closing price of a share of our common stock on Nasdaq was $0.7689 per share. An investment in our common

stock may not appeal to brokerage firms that are reluctant to recommend lower priced securities to their clients. Investors may also

be dissuaded from purchasing lower priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to

be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage

of lower priced stocks. Also, our board of directors believes that most investment funds are reluctant to invest in lower priced stocks.

There

are risks associated with the Reverse Split, including that the Reverse Split may not result in an increase in the per share price of

our common stock.

We

cannot predict whether the Reverse Split will increase the market price for our common stock in the future. The history of similar stock

split combinations for companies in like circumstances is varied. For example, our prior reverse stock split in December 2023 was not

successful in gaining compliance with the Minimum Bid Price Requirement. There is no assurance that:

| ● |

the

market price per share of our common stock after the Reverse Split will rise in proportion to the reduction in the number of shares

of our common stock outstanding before the Reverse Split; |

| |

|

| ● |

the

Reverse Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; |

| |

|

| ● |

the

Reverse Split will result in a per share price that will increase the ability of the Company to attract and retain employees; or |

| |

|

| ● |

the

market price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by Nasdaq for continued

listing, or that we will otherwise meet the requirements of Nasdaq for inclusion for trading on Nasdaq. |

The

market price of our common stock will also be based on performance of the Company and other factors, some of which are unrelated to the

number of shares outstanding. If the Reverse Split is effected and the market price of our common stock declines, the percentage decline

as an absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur in the

absence of a reverse stock split. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of

shares that would be outstanding after the Reverse Split.

Principal

Effects of the Reverse Split

The

Reverse Split Charter Amendment to effect the Reverse Split is set forth in Annex A to this proxy statement.

The

Reverse Split will be effected simultaneously for all issued shares of our common stock. The Reverse Split will affect all of the Company’s

stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except with respect

to the treatment of fractional shares. The Reverse Split will not change the terms of our common stock. Additionally, the Reverse Split

will have no effect on the number of shares of common stock that we are authorized to issue. After the Reverse Split, the shares of common

stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common

stock now authorized. Shares of our common stock issued pursuant to the Reverse Split will remain fully paid and nonassessable. The Reverse

Split will not affect the Company continuing to be subject to the periodic reporting requirements of the Exchange Act. If after aggregating

any stockholder’s shares of common stock following the Reverse Split any stockholder would otherwise be entitled to receive a fractional

share of common stock as a result of the Reverse Split, we will issue an additional fraction of a share of common stock to such holder,

which fraction, when combined with the fraction resulting from the Reverse Split, will equal a whole share of common stock, such that

no holder will continue to hold fractional shares following the Reverse Split.

Procedure

for Effecting the Reverse Split and Exchange of Stock Certificates

If

our common stockholders approve the Reverse Split Charter Amendment, and if our board of directors still believes that a reverse stock

split is in the best interests of the Company, we will file the Reverse Split Charter Amendment with the Secretary of State of the State

of Delaware at such time as our board of directors has determined to be the appropriate Split Effective Time. Our board of directors

may delay effecting the Reverse Split without resoliciting stockholder adoption and approval thereof. Beginning at the Split Effective

Time, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

As

soon as practicable after the Split Effective Time, our stockholders will be notified that the Reverse Split has been effected. We do

not have physical certificates for our common stock and, as such, no exchange of such certificates will be necessary.

Fractional

Shares

If

after aggregating any stockholder’s shares of common stock following the Reverse Split any stockholder would otherwise be entitled

to receive a fraction of a share of common stock as a result of the Reverse Split, we will issue an additional fraction of a share of

common stock to such holder, which fraction, when combined with the fraction resulting from the Reverse Split, will equal a whole share

of common stock, such that no holder will continue to hold fractional shares following the Reverse Split.

By

approving the Reverse Split Charter Amendment, stockholders will be approving the combination of a whole number of shares of the Company’s

common stock not less than 1-for-2 and not greater than 1-for-50 into one share of the Company’s common stock, with the amendment

setting forth the actual ratio to be determined by our board of directors. Furthermore, by adoption and approval of this Proposal No.

1, the stockholders will be deemed to have adopted and approved an amendment to effect the Reverse Split at each of the ratios between

and including 1-for-2 and 1-for-50.

Potential

Anti-Takeover Effect

Although

the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect

(for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition

of the Company’s board of directors or contemplating a tender offer or other transaction for the combination of the Company with

another company), the Reverse Split proposal is not being proposed in response to any effort of which the Company is aware to accumulate

shares of our common stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar

amendments to the Company’s board of directors and stockholders. Other than the proposals being submitted to our common stockholders

for their consideration at the Special Meeting, the Company’s board of directors does not currently contemplate recommending the

adoption of any other actions that could be construed to affect the ability of third parties to take over or change control of the Company.

Material

U.S. Federal Income Tax Consequences of the Reverse Split

The

following is a summary of the material anticipated Federal income tax consequences of the Reverse Split to our stockholders. This summary

is based on the Federal income tax laws as now in effect and as currently interpreted; it does not take into account possible changes

in the tax laws or interpretations, including amendments to applicable statutes, regulations and proposed regulations or changes in judicial

or administrative rulings, some of which may have retroactive effect. This summary does not purport to address all aspects of the possible

Federal income tax consequences of the Reverse Split and is not intended as tax advice to any person. In particular, and without limiting

the foregoing, this summary does not consider the Federal income tax consequences to stockholders in light of their individual investment

circumstances or to holders subject to special treatment under the Federal income tax laws (for example, life insurance companies, financial

institutions, tax-exempt organizations, regulated investment companies and foreign taxpayers).

The

summary does not address any consequence of the Reverse Split under any state, local, or foreign tax laws.

We

will not obtain a ruling from the Internal Revenue Service (the “IRS”) regarding the Federal income tax consequences to our

stockholders as a result of the Reverse Split. Accordingly, WE ENCOURAGE EACH STOCKHOLDER TO CONSULT THEIR TAX ADVISOR REGARDING THE

SPECIFIC TAX CONSEQUENCES OF THE POTENTIAL REVERSE SPLIT, INCLUDING THE APPLICATION AND EFFECT OF STATE, LOCAL, AND FOREIGN INCOME AND

OTHER TAX LAWS.

The

Reverse Split is intended to qualify as a “recapitalization” as described in Section 368(a)(1) of the Internal Revenue Code

of 1986, as amended (the “Code”). Consequently, neither we nor any stockholder will recognize any gain or loss. For exchanging

stockholders, the aggregate basis of the shares of common stock received in the Reverse Split will be the same as the aggregate basis

of the shares of common stock reclassified into such shares of common stock in the Reverse Split. Similarly, the holding period for common

stock received as a result of the Reverse Split will include the holding period of the shares of common stock surrendered in exchange

thereof.

Reporting

Requirements

If

the Reverse Split qualifies as a recapitalization within the meaning of Section 368(a)(1)(E) of the Code, each Company U.S. holder who

receives shares of our common stock in the Reverse Split is required to retain permanent records pertaining to the Reverse Split, and

make such records available to any authorized IRS officers and employees. Such records should specifically include information regarding

the amount, basis, and fair market value of all transferred property, and relevant facts regarding any liabilities assumed or extinguished

as part of such reorganization. Additionally, Company U.S. holders who owned immediately before the Reverse Split at least five percent

(by vote or value) of the total outstanding stock of the Company are required to attach a statement to their tax returns for the year

in which the Reverse Split is consummated that contains the information listed in Treasury Regulation Section 1.368-3(b). Such statement

must include the Company U.S. holder’s tax basis in such holder’s our common stock surrendered in the Reverse Split, the

fair market value of such stock, the date of the Reverse Split and the name and employer identification number of the Company. Company

U.S. holders are urged to consult with their tax advisors to comply with these rules.

Information

Reporting and Backup Withholding

A

Company U.S. holder may be subject to information reporting and backup withholding for U.S. federal income tax purposes in connection

with the Reverse Split. Backup withholding should not apply, however, to a U.S. holder who (i) furnishes a correct taxpayer identification

number, certifies that the holder is not subject to backup withholding on IRS Form W-9 or a substantially similar form and otherwise

complies with all the applicable requirements of the backup withholding rules, or (ii) certifies that the holder is otherwise exempt

from backup withholding. If a U.S. holder does not provide a correct taxpayer identification number on IRS Form W-9 or other proper certification,

the stockholder may be subject to penalties imposed by the IRS. Any amounts withheld under the backup withholding rules are not an additional

tax and generally may be refunded or allowed as a credit against the federal income tax liability of a Company U.S. holder, if any, provided

the required information is timely furnished to the IRS. Company U.S. holders should consult their tax advisors regarding their qualification

for an exemption from backup withholding, the procedures for obtaining such an exemption, and in the event backup withholding is applied,

to determine if any tax credit, tax refund, or other tax benefit may be obtained.

The

foregoing summary is of a general nature only and is not intended to be, and should not be construed to be, legal, business, or tax advice

to any particular Company U.S. holder. This summary does not take into account your particular circumstances and does not address consequences

that may be particular to you. Therefore, you should consult your tax advisor regarding the particular U.S. federal income tax consequences

of the Reverse Split to you, including any tax consequences arising under U.S. federal estate or gift tax rules, or under the laws of

any state, local, foreign or other taxing jurisdiction or under any applicable tax treaty.

THE

BOARD OF DIRECTORS RECOMMENDS THAT THE COMPANY’S COMMON STOCKHOLDERS VOTE “FOR” PROPOSAL NO. 1 TO ADOPT AND APPROVE

AN AMENDMENT TO THE SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF THE COMPANY EFFECTING THE REVERSE SPLIT OF THE COMPANY’S

COMMON STOCK AT A RATIO WITHIN THE RANGE OF NOT LESS THAN 1-FOR-2 AND NOT GREATER THAN 1-for-50

to be Determined at the Sole Discretion of the Board of Directors, Without Further Approval or Authorization of Stockholders Before the

Filing of an Amendment to the Second Amended and Restated Certificate of Incorporation Effecting the Proposed Reverse Stock Split.

Proposal

2: Approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and

vote of proxies in the event there are not sufficient votes in favor of the amendment to the Company’s Second Amended and Restated

Certificate of Incorporation to effect the reverse stock split.

| What

am I voting on? |

|

Approval

of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit

further solicitation and vote of proxies in the event there are not sufficient votes in favor

of the amendment to the Company’s Second Amended and Restated Certificate of Incorporation

to effect the reverse stock split.

|

| |

|

|

| Vote

recommendation: |

|

“FOR”

the Approval of the adjournment of the Special Meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies.

|

| |

|

|

| Vote

required: |

|

The

affirmative vote of the holders of a majority of the votes cast on the proposal.

|

| |

|

|

| Effect

of abstentions: |

|

None. |

| |

|

|

Effect

of broker non-votes: |

|

None. |

General

If,

at the Special Meeting, the number of shares of our common stock present or represented and voting in favor of Proposal No. 1 is insufficient

to approve such proposal, the Chief Executive Officer or the Chairman of our board of directors, in such person’s reasonable discretion,

may move to adjourn the Special Meeting in order to enable our board of directors to continue to solicit additional proxies in favor

of Proposal No. 1.

Our

board of directors believes that if the number of shares of our common stock cast at the Special Meeting is insufficient to approve Proposal

No. 1, it is in the best interests of our stockholders to enable our board of directors to continue to seek to obtain a sufficient number

of additional votes to approve Proposal No. 1.

In

this Proposal No. 2, we are asking stockholders to authorize the holder of any proxy solicited by our board of directors to vote in favor

of adjourning or postponing the Special Meeting or any adjournment or postponement thereof. If our stockholders approve this Proposal

No. 2, we could adjourn or postpone the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time

to solicit additional proxies in favor of the Proposal No. 1.

THE

BOARD OF DIRECTORS RECOMMENDS THAT THE COMPANY’S COMMON STOCKHOLDERS VOTE “FOR” PROPOSAL NO. 2 TO ADOPT THE ADJOURNMENT

OF THE SPECIAL MEETING TO A LATER DATE OR DATES, IF NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THERE

ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSAL NO. 1.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth beneficial ownership of the Company’s common stock as of March 6, 2024 by:

| ● |

each

of the Company’s executive officers, directors, and director nominees; |

| |

|

| ● |

all

of the Company’s executive officers, directors, and director nominees as a group; and |

| |

|

| ● |

each

person known to be the beneficial owner of more than 5% of the outstanding common stock of the Company. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she, or it possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes

securities that the individual or entity has the right to acquire, such as through the exercise of warrants or stock options or the vesting

of restricted stock units, within 60 days of March 6, 2024. Shares subject to warrants or options that are currently exercisable

or exercisable within 60 days of March 6, 2024 or subject to restricted stock units that vest within 60 days of March 6,

2024 are considered outstanding and beneficially owned by the person holding such warrants, options, or restricted stock units for the

purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage

ownership of any other person.

Certain

beneficial owners of our common stock own warrants to purchase shares of our common stock that contain blockers preventing the holder

from exercising its warrants if as a result of such exercise the holder would beneficially own more than 4.99% or 9.99%, as applicable,

of our common stock. In preparing the table below, we have given affect to those blockers where applicable. Except as noted by footnote,

and subject to community property laws where applicable, based on the information provided to the Company, the persons and entities named

in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise

indicated, the business address of each beneficial owner listed in the table below is c/o ZyVersa Therapeutics, Inc., 2200 N. Commerce

Parkway, Suite 208, Weston, Florida 33326.

The

beneficial ownership of our Common Stock is based on 7,594,863 shares of Common Stock issued and outstanding on March 6,

2024.

| Name and Address of Beneficial Owner | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Beneficially Owned | |

| Directors and executive officers | |

| | | |

| | |

| Stephen C. Glover(1) | |

| 41,981 | | |

| * | |

| Min Chul Park, Ph.D.(2) | |

| 1,040 | | |

| * | |

| Robert G. Finizio(3) | |

| 1,608 | | |

| * | |

| Peter Wolfe(4) | |

| 4,534 | | |

| * | |

| Karen Cashmere(5) | |

| 2,743 | | |

| * | |

| Pablo A. Guzman, M.D(6) | |

| 4,041 | | |

| * | |

| James Sapirstein | |

| - | | |

| - | |

| Gregory Freitag | |

| - | | |

| - | |

| All directors and executive officers as a group (8 individuals) | |

| 55,947 | | |

| * | |

| Other 5% beneficial owners | |

| | | |

| | |

| Anson Investments Master Fund LP(7) | |

| 825,103 | | |

| 9.99 | % |

| Armistice Capital Master Fund Ltd.(8) | |

| 842,936 | | |

| 9.99 | % |

| Walleye Opportunities Master Fund (9) | |

| 424,213 | | |

| 5.31 | % |

| * |

Indicates

beneficial ownership of less than 1%. |

| (1) |

Includes

18,190 shares of Common Stock held by Stephen C. Glover and affiliates, consisting of (i) 13,076 shares of Common Stock held of record

by Stephen C. Glover; (ii) 1,253 shares of Common Stock held of record by MedicaRx Inc.; (iii) 2,442 shares of common stock held

of record by Asclepius Life Sciences Fund, LP; and (iv) 1,419 shares of Common Stock held of record by Asclepius Master Fund, LTD.

The amount also includes options and warrants that are exercisable as of or within 60 days of March 6, 2024 for 21,477 and

2,314, respectively, shares of Common Stock. Mr. Glover is the managing director of MedicaRx Inc., the managing director of Asclepius

Master Fund, LTD, and the managing member of Asclepius Life Sciences Fund, LP. |

| |

|

| (2) |

Represents

options that are exercisable as of or within 60 days of March 6, 2024 for 1,040 shares of Common Stock. |

| |

|

| (3) |

Represents

options that are exercisable as of or within 60 days of March 6, 2024 2023 for 1,608 shares of Common Stock. |

| |

|

| (4) |

Represents:

(i) 1,275 shares of Common Stock; and (ii) options and warrants that are exercisable as of or within 60 days of March 6, 2024

for 2,743 and 516, respectively, shares of common stock. |

| |

|

| (5) |

Represents

options that are exercisable as of or within 60 days of March 6, 2024 for 2,743 shares of Common Stock. |

| |

|

| (6) |

Represents:

(i) 744 shares of Common Stock; and (ii) options and warrants that are exercisable as of or within 60 days of March 6, 2024

for 3,039 and 258, respectively, shares of Common Stock. |

| |

|

| (7) |

Consists

of (i) 160,671 shares of Common Stock as disclosed in a Schedule 13G filed on February

14, 2024 and (ii) warrants to purchase 664,432 shares of Common Stock,

but excludes warrants to purchase 2,655,568 shares of Common Stock that are not currently

exercisable as a result of the 9.99% beneficial ownership limitation blocker contained in

such warrants but given the increase in outstanding shares of the Company since such filing,

all warrants held are disclosed here. The securities are held of record by Anson Investments

Master Fund LP. Amin Nathoo and Moez Kassam are directors of Anson Advisors, Inc., and Tony

Moore is principal of Anson Fund Management LP, each has voting and dispositive power over

the securities held by Anson Investments Master Fund LP. The business address for Anson Investments

Master Fund LP is 181 Bay Street, Suite 4200, Toronto, ON, M5J 2T3.

|

| |

|

| (8) |

Consists

of warrants to purchase 842,936 shares of Common Stock but excludes warrants to purchase 1,550,064 shares of Common

Stock that are not currently exercisable as a result of the 9.99% beneficial ownership limitation blocker contained in such warrants

but given the increase in outstanding shares of the Company since such filing, all warrants held are disclosed here. The securities

are held of record by Armistice Capital Master Fund Ltd. Steve Boyd is the CIO of Armistice Capital, LLC and has sole voting and

dispositive power over the securities held by Armistice Capital Master Fund Ltd. The business address for Armistice Capital Master

Fund Ltd.is 510 Madison Avenue, 7th Floor, New York NY 10022. |

| |

|

| (9) |

Consists

of (i) 25,864 shares of Common Stock, per

S-1/A filing on December 6, 2023 and (ii) warrants that are exercisable as of or within 60 days of March 6, 2024 for 398,349

shares of Common Stock. The securities are held of record by Walleye Opportunities Master Fund. William England, Chief Investment

Officer of the Member of Walleye Opportunities Master Fund Ltd, has sole voting and dispositive power over the securities held by

Walleye Opportunities Master Fund Ltd. The business address for Walleye Opportunities Master Fund is 190 Elgin Ave., George Town,

Grand Cayman KY-9008, Cayman Islands. |

OTHER

MATTERS

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are

properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance

with their best judgment.

By

Order of the Board of Directors

Stephen

C. Glover

Chief

Executive Officer, President, and Chairman of the Board of Directors

March

__, 2024

We

file annual and quarterly reports and other reports and information with the SEC. These reports and other information can be read over

the Internet at the SEC’s website at http://www.sec.gov or at our website at https://investors.zyversa.com/. The information

contained on, or that can be accessed through, our website is not a part of this proxy statement. We have included our website address

in this proxy statement solely as an inactive textual reference.

A

copy of the Company’s Annual Report to the U.S. Securities and Exchange Commission on Form 10-K for the year ended December 31,

2022, is available without charge upon written request to: Secretary, ZyVersa Therapeutics, Inc., 2200 N. Commerce Parkway, Suite 208,

Weston, Florida, 33326.

Annex A

CERTIFICATE

OF AMENDMENT

OF

SECOND

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

ZYVERSA

THERAPEUTICS, INC.

(Pursuant

to Section 242 of the General Corporation Law of the State of Delaware)

ZyVersa

Therapeutics, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware

(the “Corporation”), does hereby certify as follows:

| 1. |

That

a resolution was duly adopted by the Board of Directors of the Corporation pursuant to Section 242 of the General Corporation Law

of the State of Delaware setting forth an amendment to the Second Amended and Restated Certificate of Incorporation of the Corporation

and declaring said amendment to be advisable and that such amendment be submitted to the stockholders of the Corporation for their

consideration, as follows: |

RESOLVED:

That the second and third paragraphs of Article IV of the Second Amended and Restated Certificate of Incorporation of the Corporation

be and hereby is deleted in its entirety and the following is inserted in lieu thereof:

“Effective

on the filing of this Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation with the Secretary of

State of the State of Delaware (the “Reverse Stock Split Effective Time”), a one-for-[__](*) reverse stock

split of the Corporation’s Common Stock shall become effective, pursuant to which each [__](*) shares of Common Stock

issued and outstanding and held of record by each stockholder of the Corporation or issued and held by the Corporation in treasury immediately

prior to the Reverse Stock Split Effective Time shall be reclassified and combined into one (1) validly issued, fully paid and nonassessable

share of Common Stock automatically and without any action by the holder thereof upon the Reverse Stock Split Effective Time and shall

represent one share of Common Stock from and after the Reverse Stock Split Effective Time (such reclassification and combination of shares,

the “Reverse Stock Split”). If, upon aggregating all of the shares of Common Stock held by a holder of Common Stock

immediately following the Reverse Stock Split such holder would otherwise be entitled to a fractional share of Common Stock, the Corporation

shall issue to such holder an additional fraction of a share of Common Stock as is necessary to round the number of shares of Common

Stock held by such holder up to the nearest whole share, such that no person will hold fractional shares following the Reverse Stock

Split.

| (*) |

Shall

be a whole number equal to or greater than ten (2) and equal to or lesser than fifty (50) and shall include not more than four decimal

digits, which number is referred to as the “Reverse Split Factor” (it being understood that any Reverse Split Factor

within such range shall, together with the remaining provisions of this Certificate of Amendment not appearing in brackets, constitute

a separate amendment being approved and adopted by the board of directors and stockholders in accordance with Section 242 of the

Delaware General Corporation Law). |

Each

stock certificate that, immediately prior to the Reverse Stock Split Effective Time, represented shares of Common Stock that were issued

and outstanding immediately prior to the Reverse Stock Split Effective Time shall, from and after the Reverse Stock Split Effective Time,

automatically and without the necessity of presenting the same for exchange, represent that number of whole shares of Common Stock after

the Reverse Stock Split Effective Time into which the shares formerly represented by such certificate have been reclassified (including

those fractional shares issued by the Corporation in connection with the Reverse Stock Split to round the number of shares held by such

holder at the Reverse Split Effective Time up to the nearest whole share); provided, however, that each person of record holding a certificate

that represented shares of Common Stock that were issued and outstanding immediately prior to the Reverse Stock Split Effective Time

shall receive, upon surrender of such certificate, a new certificate evidencing and representing the number of whole shares of Common

Stock after the Reverse Stock Split Effective Time into which the shares of Common Stock formerly represented by such certificate shall

have been reclassified (including those fractional shares issued by the Corporation in connection with the Reverse Stock Split to round

the number of shares held by such holder at the Reverse Split Effective Time up to the nearest whole share).”

| 2. |

That,

at a special meeting of stockholders of the Corporation, the aforesaid amendment was duly adopted by the stockholders of the Corporation. |

| 3. |

That

the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the General Corporation Law

of the State of Delaware. |

IN

WITNESS WHEREOF, this Certificate of Amendment has been executed by a duly authorized officer of the Corporation on this _____ day of

_______, 20____.

| |

ZYVERSA

THERAPEUTICS, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

[Signature

Page to Certificate of Amendment]

Annex

B

PRELIMINARY

PROXY STATEMENT, SUBJECT TO COMPLETION, DATED MARCH 8, 2024

[

Insert Proxy Card ]

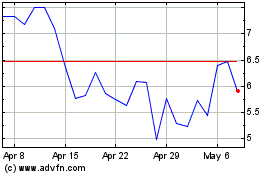

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ZyVersa Therapeutics (NASDAQ:ZVSA)

Historical Stock Chart

From Apr 2023 to Apr 2024