Alcoa Corporation President and Chief Executive Officer William

F. Oplinger will participate in a webcast session at the Bank of

America Global Metals, Mining & Steel Conference in Miami,

Florida, on Tuesday, May 14, 2024.

At 3:00 p.m. EDT, Oplinger will deliver a presentation regarding

Alcoa’s business, the announced acquisition of Alumina Limited, and

outlook in the current market, including factors that could affect

the Company’s present quarter’s financial results. His presentation

will be followed by a brief question-and-answer session.

A slide presentation, which will be used in connection with the

May conference and investor meetings, will be available on the

“Investors” section of the Company’s website at www.alcoa.com

beginning at approximately 7:00 a.m. EDT on Tuesday, May 14,

2024.

A live audio webcast of the session will be available on the

“Investors” section of Alcoa’s website, www.alcoa.com. A transcript

and audio replay will also be available after the session on the

“Investors” section of www.alcoa.com.

About Alcoa Corporation

Alcoa (NYSE: AA) is a global industry leader in bauxite,

alumina, and aluminum products with a vision to reinvent the

aluminum industry for a sustainable future. With a values-based

approach that encompasses integrity, operating excellence, care for

people and courageous leadership, our purpose is to Turn Raw

Potential into Real Progress. Since developing the process that

made aluminum an affordable and vital part of modern life, our

talented Alcoans have developed breakthrough innovations and best

practices that have led to greater efficiency, safety,

sustainability, and stronger communities wherever we operate.

Dissemination of Company Information

Alcoa intends to make future announcements regarding company

developments and financial performance through its website,

www.alcoa.com, as well as through press releases, filings with the

Securities and Exchange Commission, conference calls and

webcasts.

Forward-Looking Statements

This session will contain statements that relate to future

events and expectations and as such constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as "aims," "ambition," "anticipates,"

"believes," "could," "develop," "endeavors," "estimates,"

"expects," "forecasts," "goal," "intends," "may," "outlook,"

"potential," "plans," "projects," "reach," "seeks," "sees,"

"should," "strive," "targets," "will," "working," "would," or other

words of similar meaning. All statements by Alcoa Corporation

("Alcoa") that reflect expectations, assumptions or projections

about the future, other than statements of historical fact, are

forward-looking statements, including, without limitation,

statements regarding the proposed transaction; the ability of the

parties to complete the proposed transaction; the expected benefits

of the proposed transaction, the competitive ability and position

following completion of the proposed transaction; forecasts

concerning global demand growth for bauxite, alumina, and aluminum,

and supply/demand balances; statements, projections or forecasts of

future or targeted financial results, or operating performance

(including our ability to execute on strategies related to

environmental, social and governance matters); statements about

strategies, outlook, and business and financial prospects; and

statements about capital allocation and return of capital. These

statements reflect beliefs and assumptions that are based on

Alcoa's perception of historical trends, current conditions, and

expected future developments, as well as other factors that

management believes are appropriate in the circumstances.

Forward-looking statements are not guarantees of future performance

and are subject to known and unknown risks, uncertainties, and

changes in circumstances that are difficult to predict. Although

Alcoa believes that the expectations reflected in any

forward-looking statements are based on reasonable assumptions, it

can give no assurance that these expectations will be attained and

it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties. Such risks and uncertainties include, but

are not limited to: (1) the non-satisfaction or non-waiver, on a

timely basis or otherwise, of one or more closing conditions to the

proposed transaction; (2) the prohibition or delay of the

consummation of the proposed transaction by a governmental entity;

(3) the risk that the proposed transaction may not be completed in

the expected time frame or at all; (4) unexpected costs, charges or

expenses resulting from the proposed transaction; (5) uncertainty

of the expected financial performance following completion of the

proposed transaction; (6) failure to realize the anticipated

benefits of the proposed transaction; (7) the occurrence of any

event that could give rise to termination of the proposed

transaction; (8) potential litigation in connection with the

proposed transaction or other settlements or investigations that

may affect the timing or occurrence of the contemplated transaction

or result in significant costs of defense, indemnification and

liability; (9) the impact of global economic conditions on the

aluminum industry and aluminum end-use markets; (10) volatility and

declines in aluminum and alumina demand and pricing, including

global, regional, and product-specific prices, or significant

changes in production costs which are linked to LME or other

commodities; (11) the disruption of market-driven balancing of

global aluminum supply and demand by non-market forces; (12)

competitive and complex conditions in global markets; (13) our

ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (14) rising energy costs and

interruptions or uncertainty in energy supplies; (15) unfavorable

changes in the cost, quality, or availability of raw materials or

other key inputs, or by disruptions in the supply chain; (16) our

ability to execute on our strategy to be a lower cost, competitive,

and integrated aluminum production business and to realize the

anticipated benefits from announced plans, programs, initiatives

relating to our portfolio, capital investments, and developing

technologies; (17) our ability to integrate and achieve intended

results from joint ventures, other strategic alliances, and

strategic business transactions; (18) economic, political, and

social conditions, including the impact of trade policies and

adverse industry publicity; (19) fluctuations in foreign currency

exchange rates and interest rates, inflation and other economic

factors in the countries in which we operate; (20) changes in tax

laws or exposure to additional tax liabilities; (21) global

competition within and beyond the aluminum industry; (22) our

ability to obtain or maintain adequate insurance coverage; (23)

disruptions in the global economy caused by ongoing regional

conflicts; (24) legal proceedings, investigations, or changes in

foreign and/or U.S. federal, state, or local laws, regulations, or

policies; (25) climate change, climate change legislation or

regulations, and efforts to reduce emissions and build operational

resilience to extreme weather conditions; (26) our ability to

achieve our strategies or expectations relating to environmental,

social, and governance considerations; (27) claims, costs and

liabilities related to health, safety, and environmental laws,

regulations, and other requirements, in the jurisdictions in which

we operate; (28) liabilities resulting from impoundment structures,

which could impact the environment or cause exposure to hazardous

substances or other damage; (29) our ability to fund capital

expenditures; (30) deterioration in our credit profile or increases

in interest rates; (31) restrictions on our current and future

operations due to our indebtedness; (32) our ability to continue to

return capital to our stockholders through the payment of cash

dividends and/or the repurchase of our common stock; (33) cyber

attacks, security breaches, system failures, software or

application vulnerabilities, or other cyber incidents; (34) labor

market conditions, union disputes and other employee relations

issues; (35) a decline in the liability discount rate or

lower-than-expected investment returns on pension assets; and (36)

the other risk factors discussed in Part I Item 1A of Alcoa's

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and other reports filed by Alcoa with the SEC. These risks, as

well as other risks associated with the proposed transaction, will

be more fully discussed in the proxy statement. Alcoa cautions

readers not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. Alcoa

disclaims any obligation to update publicly any forward-looking

statements, whether in response to new information, future events

or otherwise, except as required by applicable law. Market

projections are subject to the risks described above and other

risks in the market. Neither Alcoa nor any other person assumes

responsibility for the accuracy and completeness of any of these

forward-looking statements and none of the information contained

herein should be regarded as a representation that the

forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This session does not constitute an offer to buy or sell or the

solicitation of an offer to buy or sell any securities. This

session relates to the proposed transaction. In connection with the

proposed transaction, Alcoa plans to file with the SEC a proxy

statement on Schedule 14A (the “Proxy Statement”). This session is

not a substitute for the Proxy Statement or any other document that

Alcoa may file with the SEC and send to its stockholders in

connection with the proposed transaction. The issuance of the stock

consideration in the proposed transaction will be submitted to

Alcoa’s stockholders for their consideration. The Proxy Statement

will contain important information about Alcoa, the proposed

transaction and related matters. Before making any voting decision,

Alcoa’s stockholders should read all relevant documents filed or to

be filed with the SEC completely and in their entirety, including

the Proxy Statement, as well as any amendments or supplements to

those documents, when they become available, because they will

contain important information about Alcoa and the proposed

transaction. Alcoa’s stockholders will be able to obtain a free

copy of the Proxy Statement, as well as other filings containing

information about Alcoa, free of charge, at the SEC’s website

(www.sec.gov). Copies of the Proxy Statement and other documents

filed by Alcoa with the SEC may be obtained, without charge, by

contacting Alcoa through its website at

https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons

related to Alcoa may be deemed to be participants in the

solicitation of proxies from Alcoa’s stockholders in connection

with the proposed transaction. Information about the directors and

executive officers of Alcoa and their ownership of common stock of

Alcoa is set forth in the section entitled “Information about our

Executive Officers” included in Alcoa’s annual report on Form 10-K

for the fiscal year ended December 31, 2023, which was filed with

the SEC on February 21, 2024 (and which is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm),

and in the sections entitled “Director Nominees” and “Stock

Ownership of Directors and Executive Officers” included in its

proxy statement for its 2024 annual meeting of stockholders, which

was filed with the SEC on March 19, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1675149/000119312524071354/d207257ddef14a.htm).

Additional information regarding the persons who may, under the

rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, will be included in the Proxy

Statement and other relevant materials to be filed with the SEC in

connection with the proposed transaction when they become

available. Free copies of these documents may be obtained as

described in the preceding paragraph.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502391261/en/

Investor Contact: James Dwyer 412-992-5450

James.Dwyer@alcoa.com

Media Contact: Paul Connolly 412-315-2909

Paul.Connolly@alcoa.com

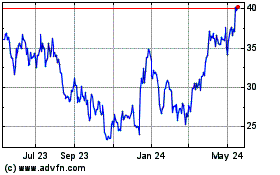

Alcoa (NYSE:AA)

Historical Stock Chart

From Feb 2025 to Mar 2025

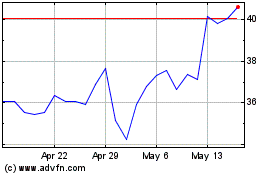

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Mar 2025