Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

22 November 2024 - 8:29AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Dated November 21, 2024

Registration Statement on Form F-3 (No. 333-272650)

Relating to the

Preliminary Prospectus Supplement dated November 21, 2024

to the Prospectus dated June 26, 2023

Aspen Insurance Holdings Limited

8,000,000 Depositary Shares,

Each Representing a 1/1,000th Interest in a Share of

7.00% Perpetual Non-Cumulative Preference Shares

PRICING TERM SHEET

This pricing term sheet should be read in conjunction with the preliminary prospectus supplement dated November 21, 2024 (the “preliminary prospectus supplement”) and the accompanying prospectus dated June 26, 2023.

| | | | | | | | |

| Issuer: | | Aspen Insurance Holdings Limited, an exempted company incorporated under the laws of Bermuda (the “Issuer”) |

| | |

| Security Type: | | Depositary shares (the “Depositary Shares”), each representing a 1/1,000th interest in a share of 7.00% Perpetual Non-Cumulative Preference Shares (the “Preference Shares”) |

| | |

| Amount: | | $200,000,000 / 8,000,000 Depositary Shares |

| | |

Over-allotment Option: | | The Issuer has granted to the underwriters an option, exercisable for 30 days from the Trade Date, to purchase up to an additional 1,200,000 Depositary Shares at the Public Offering Price, less $0.7875 per Depositary Share to cover over-allotments, if any. |

| | |

| Liquidation Preference: | | $25,000 per Preference Share (equivalent to $25 per Depositary Share) |

| | |

| Expected Ratings*: | | Moody’s: Ba1 (Stable) / S&P: BB+ (Stable) |

| | |

| Legal Format: | | SEC Registered |

| | |

| | | | | | | | |

| Dividend Rate: | | 7.00% per annum on the $25,000 liquidation preference per each Preference Share from the Settlement Date, payable on a non-cumulative basis only when, as and if declared by the Issuer’s board of directors. |

| | |

| Dividend Payment Dates: | | January 1, April 1, July 1 and October 1 |

| | |

| First Dividend Payment Date: | | April 1, 2025 |

| | |

| Term: | | Perpetual |

| | |

| Optional Redemption: | | On November 30, 2029 and at any time thereafter, the Issuer may redeem the Preference Shares, in whole or from time to time in part, at a cash redemption price of $25,000 per Preference Share (equivalent to $25 per Depositary Share), plus an amount equal to the portion of the quarterly dividend declared and attributable to the then-current dividend period, if any, to, but excluding, the date of redemption, without accumulation of any undeclared dividends. The Preference Shares are not redeemable prior to November 30, 2029, except as described below. At any time prior to November 30, 2029, the Issuer may redeem the Preference Shares, in whole or from time to time in part, at a cash redemption price of $25,000 per Preference Share (equivalent to $25 per Depositary Share), plus an amount equal to the portion of the quarterly dividend declared and attributable to the then-current dividend period, if any, to, but excluding, the date of redemption, without accumulation of any undeclared dividends: •within 90 days of the date on which the Issuer has reasonably determined that a capital disqualification redemption event (as defined in the preliminary prospectus supplement) has occurred; and •at any time following the occurrence of a tax event (as defined in the preliminary prospectus supplement). |

| | | | | | | | |

| | At any time prior to November 30, 2029, if the Issuer submits to the holders of its ordinary shares a proposal for an amalgamation or merger or if the Issuer submits any proposal for any other matter that requires, as a result of any change in Bermuda law after the date of the preliminary prospectus supplement, for its validation or effectuation an affirmative vote of the holders of the Preference Shares at the time in issue, the Issuer will have the option to redeem all of the issued Preference Shares at a cash redemption price of $26,000 per Preference Share (equivalent to $26 per Depositary Share), plus an amount equal to the portion of the quarterly dividend declared and attributable to the then-current dividend period, if any, to, but excluding, the date of redemption, without accumulation of any undeclared dividends. At any time prior to November 30, 2029, the Preference Shares are redeemable at the Issuer’s option, in whole, at a cash redemption price of $25,500 per Preference Share (equivalent to $25.50 per Depositary Share), plus an amount equal to the portion of the quarterly dividend declared and attributable to the then-current dividend period, if any, to, but excluding, the date of redemption, without accumulation of any undeclared dividends, within 90 days after the occurrence of a rating agency event (as defined in the preliminary prospectus supplement). Any redemption or repurchase of the Preference Shares by the Issuer occurring prior to November 30, 2029 will be subject to BMA Approval (as defined in the preliminary prospectus supplement) (provided that, if under the Applicable Supervisory Regulations (as defined in the preliminary prospectus supplement), BMA Approval is not required at the time in order for the Preference Shares to qualify or continue to qualify as Tier 2 capital securities under then-applicable Capital Adequacy Regulations (as defined in the preliminary prospectus supplement) imposed upon the Issuer by the BMA (as defined in the preliminary prospectus supplement), such BMA Approval will not be required). |

| | |

| Trade Date: | | November 21, 2024 |

| | |

Settlement Date (T+3): | | November 26, 2024.** |

| | |

| | | | | | | | |

| Listing: | | The Issuer intends to apply to list the Depositary Shares on the New York Stock Exchange under the symbol “AHLPRF.” If the application is approved, the Issuer expects trading to commence within 30 days after the Settlement Date. |

| | |

| Public Offering Price: | | $25 per Depositary Share |

| | |

| Underwriting Discount: | | $0.7875 per Depositary Share (retail), $3,764,250 total (not including over-allotment option) / $0.5000 per Depositary Share (institutional), $1,610,000 total (not including over-allotment option) |

| | |

| Estimated Net Proceeds to Issuer, After Deducting Underwriting Discount and Before Offering Expenses: | | $194,625,750 (not including over-allotment option) |

| | |

| CUSIP/ISIN: | | G05384 170 / BMG053841703 |

| | |

| Joint Book-Running Managers: | | Wells Fargo Securities, LLC BofA Securities, Inc. Morgan Stanley & Co. LLC |

| | |

| Joint Lead Managers: | | Barclays Capital Inc. Citigroup Global Markets Inc. Goldman Sachs & Co. LLC |

| | |

| Senior Co-Managers: | | Apollo Global Securities, LLC |

| | |

| Co-Managers: | | BMO Capital Markets Corp. Deutsche Bank Securities Inc. HSBC Securities (USA) Inc. Lloyds Securities Inc. nabSecurities, LLC Natixis Securities Americas LLC |

| | |

| | | | | | | | |

| Conflicts of Interest: | | Affiliates of Apollo Global Securities, LLC own in excess of 10% of the Issuer’s issued ordinary shares. Because Apollo Global Securities, LLC is an underwriter in this offering and its affiliates own in excess of 10% of the Issuer’s issued ordinary shares, Apollo Global Securities, LLC is deemed to have a “Conflict of Interest” with the Issuer under Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering will be conducted in accordance with FINRA Rule 5121. The appointment of a “qualified independent underwriter” is not required in connection with this offering as the members primarily responsible for managing the public offering do not have a conflict of interest, are not affiliates of any member that has a conflict of interest and meet the requirements of FINRA Rule 5121. Apollo Global Securities, LLC will not confirm sales to any account over which it exercises discretionary authority without the specific written approval of the account holder. |

| | |

*A securities rating is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time and should be evaluated independently of any other rating.

** It is expected that delivery of the Depositary Shares will be made against payment therefor on or about November 26, 2024, which is the third business day following the Trade Date (such settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in one business day unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Depositary Shares before the business day prior to the Settlement Date will be required, by virtue of the fact that the Depositary Shares initially will settle in T+3, to specify an alternative settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Depositary Shares who wish to trade the Depositary Shares during such period should consult their own advisors.

The Issuer has filed a registration statement (including a preliminary prospectus supplement and accompanying prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and accompanying prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the preliminary prospectus supplement and accompanying prospectus if you request it by calling Wells Fargo Securities, LLC, toll-free at 1-800-645-3751, BofA Securities, Inc., toll-free at 1-800-294-1322 or Morgan Stanley & Co. LLC, toll-free at 1-866-718-1649.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

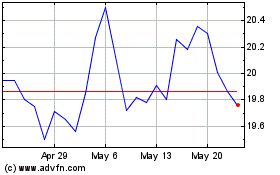

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Jan 2025 to Feb 2025

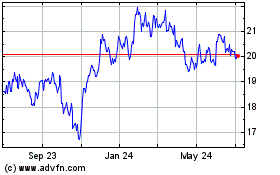

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Feb 2024 to Feb 2025