New Share Buy-Back of up to 2 Billion Euros Announced

February 28, 2025

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250227046273/en/

Oliver Bäte, Chief Executive Officer of

Allianz SE (Photo: Allianz SE)

12M 2024:

- Total business volume rises 11.2 percent to 179.8 billion

euros

- Operating profit increases by 8.7 percent to 16.0 billion euros

supported by all business segments

- Shareholders’ core net income advances 10.1 percent to 10.0

billion euros

- Strong Solvency II capitalization ratio of 209 percent

4Q 2024:

- Total business volume advances 16.0 percent to 45.9 billion

euros

- Operating profit increases 10.9 percent and reaches 4.2 billion

euros, mainly attributable to very good results in the

Property-Casualty segment

- Shareholders’ core net income rises 3.5 percent to 2.4 billion

euros

Outlook:

- For 2025, Allianz targets an operating profit of 16.0 billion

euros, plus or minus 1 billion euros1

Other:

- Management to propose a dividend per share of 15.40 euros, an

increase of 11.6 percent from 2023

- A new share buy-back program of up to 2 billion euros has been

announced

1 As always, natural catastrophes and

adverse developments in the capital markets, as well as factors

stated in our cautionary note regarding forward-looking statements

may severely affect the operating profit and/or net income of our

operations and the results of the Allianz Group.

“In 2024, Allianz delivered another set of record financial

results, which are underpinned by strong performance across all

segments, consistently high customer satisfaction, and record

employee engagement. Allianz remains the trusted partner of choice

for our customers in a global context in which above-average levels

of natural catastrophes, armed conflicts, and deepening

polarization continue to create considerable volatility.

These conditions elevate the need for what Allianz offers its

customers and the world: a more secure future that translates into

greater prosperity. Our renewed strategy, recently announced at our

Capital Markets Day, underscores our conviction in growth and our

confidence in our resilience and our capabilities. As we realize

the value of our deepening customer relationships, we lift our

ambitions to deliver even higher capital-efficient growth in the

quarters and years ahead.”

- Oliver Bäte, Chief Executive Officer of

Allianz SE

FINANCIAL HIGHLIGHTS

Total business volume

12M 2024: Total business volume increased strongly by

11.2 percent to 179.8 billion euros. Adjusted for foreign currency

translation and consolidation effects, internal growth was 11.9

percent. Our Life/Health business was the main growth driver, with

strong contribution also from our Property-Casualty segment.

4Q 2024: Total business volume growth of 16.0 percent to

45.9 billion euros was excellent. Adjusted for foreign currency

translation and consolidation effects, internal growth reached 16.2

percent, further accelerating from an already strong performance in

the first nine months (9M 2024: 11.1 percent). The Life/Health

segment was the main growth driver, while our Property-Casualty

business also contributed strongly.

Earnings

12M 2024: Operating profit was excellent at 16.0 (12M

2023: 14.7) billion euros, an increase of 8.7 percent. All business

segments contributed, with our Property-Casualty business being the

main driver.

Shareholders’ core net income advanced by 10.1 percent to a very

strong level of 10.0 billion euros, driven by operating profit

growth and a higher non-operating result.

Net income attributable to shareholders increased by 16.3

percent to 9.9 (8.5) billion euros.

Core earnings per share (EPS)2 rose to 25.42 (22.61) euros.

The core return on equity (RoE)2 improved to 16.9 percent (16.1

percent).

The Board of Management proposes a dividend per share of 15.40

euros for 2024, an increase of 11.6 percent from 2023.

On February 27, 2025, Allianz has announced a new share buy-back

program of up to 2 billion euros.

4Q 2024: Operating profit was excellent at 4.2 (4Q 2023:

3.8) billion euros. The strong increase of 10.9 percent was

primarily driven by the Property-Casualty business but all segments

contributed.

Shareholders’ core net income was 2.4 (2.4) billion euros, an

increase of 3.5 percent.

Net income attributable to shareholders rose to 2.5 (2.2)

billion euros, driven by a higher operating profit and a better

non-operating result.

2 Core EPS and core RoE calculation based

on shareholders‘ core net income.

Solvency II capitalization ratio

The Solvency II capitalization ratio remained at a strong level

of 209 percent at the end of 2024 (3Q 2024: 209 percent3).

3 Based on quarterly dividend accrual;

additional accrual to reflect FY dividend would impact Solvency II

capitalization ratio by -3%-p as of September 30, 2024.

SEGMENTAL HIGHLIGHTS

“Allianz’s excellent results for 2024 and the consistency of our

delivery once again underline our ability to create sustainable

value for all the stakeholders invested in our success.

In an environment of muted economic growth and significant

levels of natural catastrophes we have achieved record operating

profit and net income. All segments finished the year above their

operating profit target mid-points, which demonstrates the

resilience of our business model.

Building on our strong foundations, we enter 2025 with

confidence. We have lifted our ambitions at our Capital Markets Day

in December and are committed to continue generating attractive

returns for our shareholders.”

- Claire-Marie Coste-Lepoutre, Chief

Financial Officer of Allianz SE

Property-Casualty insurance: Double-digit operating profit

growth

12M 2024: Total business volume increased by 8.3 percent

to 82.9 (76.5) billion euros. Adjusted for foreign currency

translation and consolidation effects, internal growth was very

good at 8.2 percent.

Retail, SME & Fleet achieved strong internal growth of 9

percent, lifting total business volume to 50.2 (45.9) billion euros

while Commercial advanced 7 percent, increasing total business

volume to 32.7 (30.3) billion euros.

Operating profit rose by 14.3 percent to an excellent level of

7.9 (6.9) billion euros, well exceeding the operating profit

outlook mid-point of 7.3 billion euros. A better operating

insurance service result and a higher operating investment result

were the main drivers.

The combined ratio improved to 93.4 percent (93.8 percent). The

loss ratio was 69.3 percent (69.3 percent) as lower natural

catastrophe losses and underlying improvements were offset by less

run-off. The expense ratio developed favorably by 0.4 percentage

points to 24.2 percent and continued its positive trajectory.

In Retail, SME & Fleet, the combined ratio improved by 1.7

percentage points to 94.1 percent. The Commercial combined ratio

was at a very good level of 92.2 percent (90.5 percent).

4Q 2024: Total business volume rose by 11.0 percent to

19.5 (17.6) billion euros. Adjusted for foreign currency

translation and consolidation effects, internal growth was strong

at 10.9 percent.

Retail, SME & Fleet and Commercial achieved excellent

internal growth of 11 percent and 14 percent, respectively,

generating total business volumes of 12.1 (11.0) billion euros in

Retail, SME & Fleet and 7.4 (6.5) billion euros in

Commercial.

Operating profit increased by 21.2 percent to 1.9 (1.6) billion

euros mainly driven by higher operating investment and insurance

service results.

The combined ratio improved to 94.7 percent (94.9 percent). The

loss ratio developed favorably and reached 70.7 percent (71.4

percent), supported by a very good attritional loss ratio. The

expense ratio was 24.1 percent (23.5 percent).

In Retail, SME & Fleet, the combined ratio developed

favorably by 2.4 percentage points to 94.0 percent. In Commercial

it reached 96.6 percent (92.9 percent).

Life/Health insurance: Excellent performance

12M 2024: PVNBP, the present value of new business

premiums, increased strongly by 21.6 percent to 81.8 (67.3) billion

euros, driven by growth in almost all entities.

The new business margin (NBM) was attractive at 5.7 percent (5.9

percent) and the value of new business (VNB) advanced to 4.7 (4.0)

billion euros.

Operating profit increased to a strong level of 5.5 (5.2)

billion euros, surpassing the operating profit outlook mid-point of

5.2 billion euros. This performance was supported by positive

developments in most regions.

Contractual Service Margin (CSM) advanced from 52.6 billion

euros at the end of 2023 to 55.6 billion euros4, mainly due to

strong normalized CSM growth of 6.1 percent5.

4Q 2024: PVNBP rose significantly by 26.9 percent to 21.2

(16.7) billion euros, driven by higher volumes in most

entities.

The new business margin was healthy at 5.5 percent (5.9

percent), and the value of new business grew strongly to 1.2 (1.0)

billion euros.

Operating profit was at an excellent level of 1.4 (1.4) billion

euros.

Contractual Service Margin rose from 54.2 billion euros4 at the

end of the third quarter to 55.6 billion euros4 mainly driven by a

good normalized CSM growth of 1.4 percent5.

4 Includes gross CSM of 0.8 billion euros

(as of September 30, 2024, and as of December 31, 2024), for

UniCredit Allianz Vita S.p.A., which was classified as held for

sale in the third quarter of 2024.

5 Excluding effects from a fund merger in

Italy.

Asset Management: Strong net inflows and third-party AuM

growth

12M 2024: Operating revenues increased to 8.3 (8.1)

billion euros, internal growth was at 3.1 percent. This was driven

by higher AuM-driven revenues.

Operating profit rose to a good level of 3.2 (3.1) billion

euros, up 3.6 percent, and exceeding the full-year outlook

mid-point of 3.1 billion euros. Adjusted for foreign currency

translation effects, operating profit advanced by 3.7 percent.

Excluding the impact from performance fees, the operating profit

increases strongly by 11 percent.

The cost-income ratio (CIR) improved to 61.1 percent (61.3

percent).

Third-party assets under management increased by 208 billion

euros from the end of 2023 to 1.920 trillion euros as of December

31, 2024. Strong net inflows of 84.8 billion euros, almost four

times the prior year level, were the biggest contributor.

4Q 2024: Operating revenues rose to 2.4 (2.3) billion

euros, internal growth was at 1.3 percent. The increase was mainly

due to higher AuM-driven revenues.

Operating profit amounted to an excellent level of 941 (912)

million euros. Adjusted for foreign currency translation effects,

operating profit grew by 2.7 percent. Excluding the impact of

performance fees, the operating profit rose 21 percent.

The cost-income ratio (CIR) developed favorably to 60.0 percent

(60.5 percent).

Third-party assets under management increased to 1.920 trillion

euros as of December 31, 2024, up by 80 billion euros from the end

of the third quarter 2024. Favorable foreign currency translation

effects as well as good net inflows of 16.7 billion euros were the

main drivers.

4Q & FY 2024 RESULTS TABLE

Allianz Group - preliminary key figures

4th quarter and fiscal year 2024

4Q 2024

4Q 2023

Delta

12M 2024

12M 2023

Delta

Total business volume

€ bn

45.9

39.6

16.0%

179.8

161.7

11.2%

- Property-Casualty

€ bn

19.5

17.6

11.0%

82.9

76.5

8.3%

- Life/Health

€ bn

24.3

20.0

21.5%

89.3

77.9

14.7%

- Asset Management

€ bn

2.4

2.3

2.0%

8.3

8.1

3.0%

- Consolidation

€ bn

-0.3

-0.3

-12.7%

-0.7

-0.8

-6.1%

Operating profit / loss

€ mn

4,174

3,765

10.9%

16,023

14,746

8.7%

- Property-Casualty

€ mn

1,948

1,608

21.2%

7,898

6,909

14.3%

- Life/Health

€ mn

1,424

1,362

4.5%

5,505

5,191

6.0%

- Asset Management

€ mn

941

912

3.2%

3,239

3,126

3.6%

- Corporate and Other

€ mn

-140

-115

21.1%

-615

-474

29.9%

- Consolidation

€ mn

1

-1

n.m.

-4

-7

-35.5%

Net income

€ mn

2,636

2,255

16.9%

10,540

9,032

16.7%

- attributable to non-controlling

interests

€ mn

163

104

56.9%

609

491

24.0%

- attributable to shareholders

€ mn

2,472

2,151

14.9%

9,931

8,541

16.3%

Shareholders’ core net income1

€ mn

2,434

2,351

3.5%

10,017

9,101

10.1%

Core earnings per share2

€

6.31

6.00

5.1%

25.42

22.61

12.4%

Dividend per share

€

–

–

–

15.40

3

13.80

11.6%

Additional KPIs

- Group

Core return on equity4

%

–

–

–

16.9%

16.1%

0.8%

-p

- Property-Casualty

Combined ratio

%

94.7%

94.9%

-0.2%

-p

93.4%

93.8%

-0.4%

-p

- Life/Health

New business margin

%

5.5%

5.9%

-0.5%

-p

5.7%

5.9%

-0.2%

-p

- Asset Management

Cost-income ratio

%

60.0%

60.5%

-0.5%

-p

61.1%

61.3%

-0.2%

-p

12/31/2024

12/31/2023

Delta

Shareholders' equity5

€ bn

60.3

58.2

3.5%

Contractual service margin

(net)6

€ bn

34.5

32.7

5.6%

Solvency II capitalization

ratio7

%

209%

206%

3%

-p

Third-party assets under

management

€ bn

1,920

1,712

12.1%

Please note: The figures are

presented in millions of Euros, unless otherwise stated. Due to

rounding, numbers presented may not add up precisely to the totals

provided and percentages may not precisely reflect the absolute

figures.

1_

Presents the portion of shareholders’ net

income before non-operating market movements and before

amortization of intangible assets from business combinations

(including any related income tax effects).

2_

Calculated by dividing the respective

period’s shareholders' core net income, adjusted for net financial

charges related to undated subordinated bonds classified as

shareholders' equity, by the weighted average number of shares

outstanding (basic core EPS).

3_

Proposal.

4_

Represents the ratio of shareholders’ core

net income to the average shareholders’ equity at the beginning and

at the end of the year. Shareholders’ core net income is adjusted

for net financial charges related to undated subordinated bonds

classified as shareholders’ equity. From the average shareholders’

equity, undated subordinated bonds classified as shareholders’

equity, unrealized gains and losses from insurance contracts and

other unrealized gains and losses are excluded. Due to an

adjustment of prior periods comparative figures for the balance

sheet, the core RoE changed by +0.1%-p compared to the published

figure as of 31 December 2023.

5_

Excluding non-controlling interests. In 1Q

2024 Allianz reclassified certain minority interests between equity

and liabilities. Prior periods comparative figures for the balance

sheet have been adjusted with a minor impact on shareholders’

equity only (reduced by EUR 0.2bn as of 31 December 2023).

6_

Includes net CSM of EUR 0.3bn as of 31

December 2024, for UniCredit Allianz Vita S.p.A., which was

classified as held for sale in the 3Q 2024.

7_

Risk capital figures are group diversified

at 99.5% confidence level. Including the application of

transitional measures for technical provisions, the Solvency II

capitalization ratio amounted to 229% as of 31 December 2023. As of

31 December 2024, the application of transitional measures for

technical provisions had no impact on the Solvency II

capitalization ratio.

RELATED LINKS

Annual Media Conference February 28, 2025, 11:00 AM CET:

YouTube English line

Analyst Conference February 28, 2025, 2:00 PM CET:

YouTube English line

Results The results and related documents can be found in

the download center.

UPCOMING EVENTS

Annual Report March 14, 2025

Annual General Meeting May 8, 2025

Financial Results 1Q 2025 May 15, 2025

More information can be found in the financial calendar.

About Allianz

The Allianz Group is one of the world's leading insurers and

asset managers with around 128 million* private and corporate

customers in nearly 70 countries. Allianz customers benefit from a

broad range of personal and corporate insurance services, ranging

from property, life and health insurance to assistance services to

credit insurance and global business insurance. Allianz is one of

the world’s largest investors, managing around 776 billion euros**

on behalf of its insurance customers. Furthermore, our asset

managers PIMCO and Allianz Global Investors manage about 1.9

trillion euros** of third-party assets. Thanks to our systematic

integration of ecological and social criteria in our business

processes and investment decisions, we are among the leaders in the

insurance industry in the Dow Jones Sustainability Index. In 2024,

over 156,000 employees achieved total business volume of 179.8

billion euros and an operating profit of 16.0 billion euros for the

group.

* Including non-consolidated entities with Allianz

customers.

**As of December 31, 2024.

These assessments are, as always, subject to the disclaimer

provided below.

Cautionary note regarding forward-looking statements

This document includes forward-looking statements, such as

prospects or expectations, that are based on management's current

views and assumptions and subject to known and unknown risks and

uncertainties. Actual results, performance figures, or events may

differ significantly from those expressed or implied in such

forward-looking statements.

Deviations may arise due to changes in factors including, but

not limited to, the following: (i) the general economic and

competitive situation in the Allianz’s core business and core

markets, (ii) the performance of financial markets (in particular

market volatility, liquidity, and credit events), (iii) adverse

publicity, regulatory actions or litigation with respect to the

Allianz Group, other well-known companies and the financial

services industry generally, (iv) the frequency and severity of

insured loss events, including those resulting from natural

catastrophes, and the development of loss expenses, (v) mortality

and morbidity levels and trends, (vi) persistency levels, (vii) the

extent of credit defaults, (viii) interest rate levels, (ix)

currency exchange rates, most notably the EUR/USD exchange rate,

(x) changes in laws and regulations, including tax regulations,

(xi) the impact of acquisitions including and related integration

issues and reorganization measures, and (xii) the general

competitive conditions that, in each individual case, apply at a

local, regional, national, and/or global level. Many of these

changes can be exacerbated by terrorist activities.

No duty to update

Allianz assumes no obligation to update any information or

forward-looking statement contained herein, save for any

information we are required to disclose by law.

Other

The figures regarding the net assets, financial position and

results of operations have been prepared in conformity with

International Financial Reporting Standards. Information is based

on preliminary figures. Final results for fiscal year 2024 will be

released on March 14, 2025 (publication of the Annual Report). This

is a translation of the German Quarterly and Full Year Earnings

Release of the Allianz Group. In case of any divergences, the

German original is binding.

Privacy Note

Allianz SE is committed to protecting your personal data. Find

out more in our privacy statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227046273/en/

For further information, please contact: Frank Stoffel Tel. +49

89 3800 18124 email: frank.stoffel@allianz.com Fabrizio Tolotti

Tel. +49 89 3800 14819 email: fabrizio.tolotti@allianz.com Johanna

Oltmann Tel. +49 89 3800 13346 email: johanna.oltmann@allianz.com

Ann-Kristin Manno Tel. +49 89 3800 18805 email:

ann-kristin.manno@allianz.com

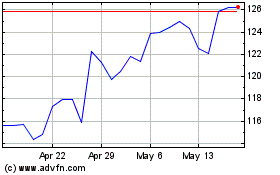

Autoliv (NYSE:ALV)

Historical Stock Chart

From Feb 2025 to Mar 2025

Autoliv (NYSE:ALV)

Historical Stock Chart

From Mar 2024 to Mar 2025