UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2015

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

1-2116 |

|

23-0366390 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2500 Columbia Avenue P.O. Box 3001

Lancaster, Pennsylvania |

|

17603 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (717) 397-0611

NA

(Former name or

former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 - Financial Information

| Item 2.02 |

Results of Operations and Financial Condition. |

On July 30, 2015, Armstrong World Industries, Inc.

(the “Company”) issued a press release announcing its second quarter 2015 consolidated financial results. The full text of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into

any filing under the Securities Act of 1933, as amended (the “Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Section 7 – Regulation FD

| Item 7.01 |

Regulation FD Disclosure. |

On July 30, 2015, the Company issued a press release announcing that it

will report its second quarter 2015 consolidated financial results via a webcast and conference call on Thursday, July 30, 2015 at 11:00 a.m. Eastern Time which can be accessed through the “For Investors” section of the Company’s

website, www.armstrong.com. During this report, the Company will reference a slide presentation, a copy of which is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K is being furnished herewith and shall not be deemed “filed” for the purposes of

Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Act, or the Exchange Act, except as expressly set forth by specific reference in

such filing.

Section 9 – Financial Statements and Exhibits

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

|

|

| No. 99.1 |

|

Press Release of Armstrong World Industries, Inc. dated July 30, 2015 |

|

|

| No. 99.2 |

|

Earnings Call Presentation Second Quarter 2015 dated July 30, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

| By: |

|

/s/ Mark A. Hershey |

|

|

Mark A. Hershey |

|

|

Senior Vice President, General Counsel and Chief Compliance Officer |

Date: July 30, 2015

3

Exhibit 99.1

Armstrong World Industries

Reports Second Quarter 2015 Results

Key Highlights

| |

• |

|

Second quarter operating income from continuing operations of $63.1 million, down 1% over the 2014 period impacted by separation costs and higher non-cash U.S. Pension expense |

| |

• |

|

Second quarter adjusted EBITDA from continuing operations of $112 million, up 8% over the 2014 period |

| |

• |

|

Upon completion of the separation, Brian MacNeal to become CFO of Armstrong World Industries and Jay Thompson to become CFO of Armstrong Flooring |

| |

• |

|

Upon completion of the separation, Dave Schulz to become COO of Armstrong Flooring |

LANCASTER, Pa.,

July 30, 2015 —Armstrong World Industries, Inc. (NYSE: AWI), a global leader in the design and manufacture of floors and ceilings systems, today reported second quarter 2015 results.

Second Quarter Results from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions except per share data) |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Net sales |

|

$ |

632.7 |

|

|

$ |

659.1 |

|

|

|

(4.0 |

%) |

| Operating income |

|

|

63.1 |

|

|

|

63.6 |

|

|

|

(0.8 |

%) |

| Net income |

|

|

29.9 |

|

|

|

26.6 |

|

|

|

12.4 |

% |

| Diluted earnings per share |

|

$ |

0.53 |

|

|

$ |

0.48 |

|

|

|

10.4 |

% |

Excluding the unfavorable impact from foreign exchange of $24 million, consolidated net sales decreased 0.4% compared to the

prior year period, driven by lower volumes primarily in the Wood business and Building Products in EMEA, which more than offset the impact from favorable price and mix.

Operating income declined compared to the prior year period driven by higher non-cash U.S. pension expense, costs associated with the previously announced

separation project and the margin impact of lower volumes; which were only partially offset by lower input costs, favorable price and mix and improvements in productivity. Higher SG&A expense, primarily to support go-to-market initiatives in the

Americas Resilient business, also negatively impacted operating income. Net income improved driven by the favorable impact from transactional foreign exchange.

“The majority of the sales decline in the second quarter was caused by foreign exchange movements,”

said Matt Espe, CEO. “Despite the muted top line performance in the first half of the year impacted by foreign exchange headwinds and market related softness, we’re maintaining our adjusted EBITDA and adjusted EPS guidance for the full

year 2015, which remain unchanged at the midpoint.”

Additional (non-GAAP*) Financial Metrics from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions except per share data) |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Adjusted operating income |

|

$ |

82 |

|

|

$ |

73 |

|

|

|

13 |

% |

| Adjusted net income |

|

$ |

45 |

|

|

$ |

37 |

|

|

|

24 |

% |

| Adjusted diluted earnings per share |

|

$ |

0.81 |

|

|

$ |

0.66 |

|

|

|

23 |

% |

| Free cash flow |

|

$ |

77 |

|

|

$ |

9 |

|

|

|

Favorable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

| Building Products |

|

$ |

81 |

|

|

$ |

83 |

|

|

|

(2 |

%) |

| Resilient Flooring |

|

|

32 |

|

|

|

29 |

|

|

|

8 |

% |

| Wood Flooring |

|

|

11 |

|

|

|

8 |

|

|

|

42 |

% |

| Unallocated Corporate |

|

|

(12 |

) |

|

|

(16 |

) |

|

|

23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Adjusted EBITDA |

|

$ |

112 |

|

|

$ |

104 |

|

|

|

8 |

% |

| * |

The Company uses the above non-GAAP adjusted measures, as well as other non-GAAP measures mentioned below, in managing the business and believes the adjustments provide meaningful comparisons of operating performance

between periods. Adjusted operating income, adjusted EBITDA, adjusted net income, and adjusted EPS exclude the impact of foreign exchange, restructuring charges and related costs, impairments, the non-cash impact of the U.S. pension plan, separation

costs and certain other nonrecurring gains and losses. Free cash flow is defined as cash from operations and dividends received from the WAVE joint venture, less expenditures for property and equipment, less restricted cash, and is adjusted to

remove the impact of cash used or proceeds received for acquisitions and divestitures. The company believes free cash flow is useful because it provides insight into the amount of cash that the Company has available for discretionary uses, after

expenditures for capital commitments and adjustments for acquisitions/divestitures. Adjusted figures are reported in comparable dollars using the budgeted exchange rate for 2015, and are reconciled to the most comparable GAAP measures in tables at

the end of this release. |

Adjusted operating income and adjusted EBITDA improved by 13% and 8%, respectively, in the second quarter of 2015

when compared to the prior year period. The improvement in adjusted EBITDA was driven by lower manufacturing and input costs and favorable price and mix, which were only partially offset by higher SG&A spending and the margin impact of lower

volumes. Adjusted earnings per share is calculated using a 39% adjusted tax rate in both periods. The increase in free cash flow was driven by improvements in working capital, lower capital expenditures and higher cash earnings.

Second Quarter Segment Highlights

Building Products

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Total segment net sales |

|

$ |

306.1 |

|

|

$ |

323.5 |

|

|

|

(5.4 |

%) |

| Operating income |

|

$ |

64.2 |

|

|

$ |

64.9 |

|

|

|

(1.1 |

%) |

Excluding the unfavorable impact of foreign exchange of approximately $20 million, net sales increased slightly as favorable

price and mix offset the impact of lower volumes, primarily in EMEA. Operating income declined in the second quarter of 2015, as the margin impact of lower volumes and higher SG&A expenses were only partially offset by favorable price and mix

and lower manufacturing and input costs.

Resilient Flooring

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Total segment net sales |

|

$ |

199.9 |

|

|

$ |

196.2 |

|

|

|

1.9 |

% |

| Operating income |

|

$ |

23.2 |

|

|

$ |

20.7 |

|

|

|

12.1 |

% |

Net sales increased driven by strong volume growth in the Americas commercial business, which was only partially offset by

unfavorable price and mix. Volume improvement in the Americas commercial business was partially aided by favorable market share shifts as a result of competitive product availability issues and our service proposition relative to competition.

Operating income improved as productivity, lower input costs and the margin impact of higher volumes more than offset increased SG&A expenses to support go-to-market initiatives in the Americas and the unfavorable impact from price and mix.

Wood Flooring

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Total segment net sales |

|

$ |

126.7 |

|

|

$ |

139.4 |

|

|

|

(9.1 |

%) |

| Operating income (loss) |

|

$ |

2.5 |

|

|

($ |

2.6 |

) |

|

|

Favorable |

|

Net sales decreased driven by volume declines caused by market share shifts as a result of prior year price and mix

optimization actions, inventory adjustments at home centers, and engineered wood product availability challenges. Operating income improved driven by lower manufacturing and input costs which more than offset the margin impact of lower volumes,

unfavorable price and mix and a slight increase in SG&A expense. The comparison was also impacted by $4 million of expense recorded in the second quarter of 2015 resulting from new duty rates assigned to separate rate importers of multilayered

hardwood flooring from China by the U.S. Department of Commerce in connection with its second annual administrative review of its 2010 anti-dumping and countervailing duty orders. The comparison was also impacted by $4 million of idle equipment

impairment charges and $3 million of severance and other charges associated with the closure of our engineered wood flooring plant in Kunshan China that were recorded in the second quarter of 2014.

Corporate

Unallocated corporate expense of $26.8

million increased from $19.4 million in the prior year due to increased U.S. pension costs of $7 million and separation costs of $5 million, which more than offset expense reductions across corporate functions.

Year to Date Results from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in millions) |

|

Six Months Ended June 30, |

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

| Net sales (as reported) |

|

$ |

1,184.1 |

|

|

$ |

1,249.1 |

|

|

|

(5.2 |

%) |

| Operating income (as reported) |

|

|

98.9 |

|

|

|

117.4 |

|

|

|

(15.8 |

%) |

| Adjusted EBITDA |

|

|

186 |

|

|

|

187 |

|

|

|

0 |

% |

| Free cash flow |

|

|

35 |

|

|

|

(45 |

) |

|

|

Favorable |

|

Excluding the unfavorable impact from foreign exchange of $43 million, consolidated net sales decreased compared to the prior

year period as volume declines were only partially offset by favorable price and mix.

Operating income declined by 16% driven primarily by higher non-cash U.S. pension costs and costs associated

with the previously announced separation project. Adjusted EBITDA was essentially unchanged when compared to the prior year period as lower manufacturing and input costs and favorable price and mix offset the margin impact of lower volumes, higher

SG&A expenses and lower earnings from WAVE. The increase in free cash flow was driven by improvements in working capital and lower capital expenditures, which were only partially offset by lower cash earnings and dividends from the WAVE joint

venture.

Market Outlook and 2015 Guidance (1)

“Primarily due to foreign exchange headwinds and restrained market activity in Europe and U.S. repair and remodel, we now expect full year sales to be in

the $2.4 to $2.5 billion range,” said Dave Schulz, CFO.

The Company is reiterating and narrowing its expected ranges for full year 2015 adjusted

EBITDA and adjusted earnings per share, and now expects adjusted EBITDA to be in the $355 to $385 million range and adjusted EPS to be in the range of $2.05 to $2.35 per diluted share.

| (1) |

Sales guidance includes the impact of foreign exchange. Guidance metrics, other than sales, are presented using 2015 budgeted foreign exchange rates. Adjusted EPS guidance for 2015 is calculated based on an adjusted

effective tax rate of 39%. |

Earnings Webcast

Management will host a live Internet broadcast beginning at 11:00 a.m. Eastern time today, to discuss second quarter 2015 results, market outlook and 2015

guidance. During the earnings webcast, the appointments of MacNeal, Thompson and Schulz will be discussed. This event will be broadcast live on the Company’s Web site. To access the call and accompanying slide presentation, go to

www.armstrong.com and click “For Investors.” The replay of this event will also be available on the Company’s Web site for up to one year after the date of the call.

Uncertainties Affecting Forward-Looking Statements

Disclosures in this release, including without limitation, those relating to future financial results guidance and our plan to separate our Flooring business

from our Ceilings (Building Products) business and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those statements provide our future

expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,”

“target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future

operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain

and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected

results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the

“Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of

the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law.

About Armstrong and Additional Information

More details

on the Company’s performance can be found in its quarterly report on Form 10-Q for the quarter ended June 30, 2015 that the Company expects to file with the SEC today.

Armstrong World Industries, Inc. is a global leader in the design and manufacture of floors and ceilings. In 2014, Armstrong’s consolidated net sales

from continuing operations totaled approximately $2.5 billion. As of June 30, 2015, Armstrong operated 32 plants in nine countries and had approximately 7,600 employees worldwide.

Additional forward looking non-GAAP metrics are available on the Company’s web site at http://www.armstrong.com/ under the Investor Relations tab. The

website is not part of this release and references to our website address in this release are intended to be inactive textual references only.

As Reported Financial Highlights

FINANCIAL HIGHLIGHTS

Armstrong

World Industries, Inc. and Subsidiaries

(amounts in millions, except for per-share amounts, quarterly and year to date data is unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net Sales |

|

$ |

632.7 |

|

|

$ |

659.1 |

|

|

$ |

1,184.1 |

|

|

$ |

1,249.1 |

|

| Costs of goods sold |

|

|

474.8 |

|

|

|

512.1 |

|

|

|

896.7 |

|

|

|

960.0 |

|

| Selling general and administrative expenses |

|

|

106.1 |

|

|

|

100.2 |

|

|

|

209.1 |

|

|

|

203.3 |

|

| Separation costs |

|

|

5.1 |

|

|

|

— |

|

|

|

9.4 |

|

|

|

— |

|

| Goodwill impairment |

|

|

— |

|

|

|

0.8 |

|

|

|

— |

|

|

|

0.8 |

|

| Equity (earnings) from joint venture |

|

|

(16.4 |

) |

|

|

(17.6 |

) |

|

|

(30.0 |

) |

|

|

(32.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

63.1 |

|

|

|

63.6 |

|

|

|

98.9 |

|

|

|

117.4 |

|

|

|

|

|

|

| Interest expense |

|

|

11.4 |

|

|

|

11.8 |

|

|

|

22.6 |

|

|

|

23.4 |

|

| Other non-operating expense |

|

|

0.2 |

|

|

|

1.2 |

|

|

|

1.5 |

|

|

|

6.6 |

|

| Other non-operating (income) |

|

|

(3.6 |

) |

|

|

(0.6 |

) |

|

|

(4.2 |

) |

|

|

(1.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations before income taxes |

|

|

55.1 |

|

|

|

51.2 |

|

|

|

79.0 |

|

|

|

88.6 |

|

| Income tax expense |

|

|

25.2 |

|

|

|

24.6 |

|

|

|

45.3 |

|

|

|

43.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations |

|

$ |

29.9 |

|

|

$ |

26.6 |

|

|

$ |

33.7 |

|

|

$ |

44.7 |

|

| Net (loss) from discontinued operations, net of tax (benefit) of $-, $-, $- and $- |

|

|

— |

|

|

|

(5.6 |

) |

|

|

— |

|

|

|

(6.8 |

) |

| (Loss) earnings from disposal of discontinued business, net of tax (benefit) of ($-), ($1.2), ($43.4) and ($1.2) |

|

|

(0.3 |

) |

|

|

(2.1 |

) |

|

|

42.5 |

|

|

|

(2.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings from discontinued operations |

|

|

(0.3 |

) |

|

|

(7.7 |

) |

|

|

42.5 |

|

|

|

(8.9 |

) |

| Net earnings |

|

$ |

29.6 |

|

|

$ |

18.9 |

|

|

$ |

76.2 |

|

|

$ |

35.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

7.4 |

|

|

|

4.5 |

|

|

|

(7.9 |

) |

|

|

4.1 |

|

| Derivative (loss) |

|

|

(0.6 |

) |

|

|

(5.6 |

) |

|

|

(1.1 |

) |

|

|

(6.2 |

) |

| Pension and postretirement adjustments |

|

|

9.2 |

|

|

|

5.7 |

|

|

|

21.1 |

|

|

|

12.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other comprehensive income |

|

|

16.0 |

|

|

|

4.6 |

|

|

|

12.1 |

|

|

|

10.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income |

|

$ |

45.6 |

|

|

$ |

23.5 |

|

|

$ |

88.3 |

|

|

$ |

46.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share of common stock, continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.53 |

|

|

$ |

0.48 |

|

|

$ |

0.60 |

|

|

$ |

0.81 |

|

| Diluted |

|

$ |

0.53 |

|

|

$ |

0.48 |

|

|

$ |

0.60 |

|

|

$ |

0.80 |

|

| (Loss) earnings per share of common stock, discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

($ |

0.01 |

) |

|

($ |

0.14 |

) |

|

$ |

0.76 |

|

|

($ |

0.16 |

) |

| Diluted |

|

($ |

0.01 |

) |

|

($ |

0.14 |

) |

|

$ |

0.76 |

|

|

($ |

0.16 |

) |

| Net earnings per share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.53 |

|

|

$ |

0.34 |

|

|

$ |

1.36 |

|

|

$ |

0.65 |

|

| Diluted |

|

$ |

0.53 |

|

|

$ |

0.34 |

|

|

$ |

1.36 |

|

|

$ |

0.64 |

|

| Average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

55.5 |

|

|

|

54.8 |

|

|

|

55.4 |

|

|

|

54.8 |

|

| Diluted |

|

|

55.8 |

|

|

|

55.3 |

|

|

|

55.8 |

|

|

|

55.2 |

|

SEGMENT RESULTS

Armstrong World Industries, Inc. and Subsidiaries

(amounts in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Building Products |

|

$ |

306.1 |

|

|

$ |

323.5 |

|

|

$ |

598.1 |

|

|

$ |

631.7 |

|

| Resilient Flooring |

|

|

199.9 |

|

|

|

196.2 |

|

|

|

356.7 |

|

|

|

359.9 |

|

| Wood Flooring |

|

|

126.7 |

|

|

|

139.4 |

|

|

|

229.3 |

|

|

|

257.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

$ |

632.7 |

|

|

$ |

659.1 |

|

|

$ |

1,184.1 |

|

|

$ |

1,249.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Building Products |

|

$ |

64.2 |

|

|

$ |

64.9 |

|

|

$ |

124.0 |

|

|

$ |

122.7 |

|

| Resilient Flooring |

|

|

23.2 |

|

|

|

20.7 |

|

|

|

29.1 |

|

|

|

31.1 |

|

| Wood Flooring |

|

|

2.5 |

|

|

|

(2.6 |

) |

|

|

1.3 |

|

|

|

2.5 |

|

| Unallocated Corporate (expense) |

|

|

(26.8 |

) |

|

|

(19.4 |

) |

|

|

(55.5 |

) |

|

|

(38.9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Income |

|

$ |

63.1 |

|

|

$ |

63.6 |

|

|

$ |

98.9 |

|

|

$ |

117.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Information

(amounts in millions)

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2015 |

|

|

December 31, 2014 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

$ |

860.0 |

|

|

$ |

811.5 |

|

| Property, plant and equipment, net |

|

|

1,068.3 |

|

|

|

1,062.4 |

|

| Other noncurrent assets |

|

|

729.6 |

|

|

|

732.3 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,657.9 |

|

|

$ |

2,606.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

410.9 |

|

|

$ |

388.1 |

|

| Noncurrent liabilities |

|

|

1,499.7 |

|

|

|

1,569.0 |

|

| Equity |

|

|

747.3 |

|

|

|

649.1 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

2,657.9 |

|

|

$ |

2,606.2 |

|

|

|

|

|

|

|

|

|

|

Selected Cash Flow Information

(amounts in millions)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Net income |

|

$ |

76.2 |

|

|

$ |

35.8 |

|

| Other adjustments to reconcile net income to net cash provided by operating activities |

|

|

12.8 |

|

|

|

68.5 |

|

| Changes in operating assets and liabilities, net |

|

|

(30.1 |

) |

|

|

(81.9 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

58.9 |

|

|

|

22.4 |

|

| Net cash (used for) investing activities |

|

|

(24.3 |

) |

|

|

(67.8 |

) |

| Net cash (used for) provided by financing activities |

|

|

(15.0 |

) |

|

|

61.3 |

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(3.3 |

) |

|

|

1.5 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

16.3 |

|

|

|

17.4 |

|

| Cash and cash equivalents, beginning of period |

|

|

185.3 |

|

|

|

135.2 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

201.6 |

|

|

$ |

152.6 |

|

| Cash and cash equivalents at end of period of discontinued operations |

|

|

— |

|

|

($ |

7.1 |

) |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period of continuing operations |

|

$ |

201.6 |

|

|

$ |

159.7 |

|

|

|

|

|

|

|

|

|

|

Supplemental Reconciliations of GAAP to non-GAAP Results (unaudited)

(Amounts in millions, except per share data)

To supplement its

consolidated financial statements presented in accordance with accounting principles generally accepted in the United States (GAAP), the Company provides additional measures of performance adjusted to exclude the impact of foreign exchange,

restructuring charges and related costs, impairments, the non-cash impact of the U.S. pension plan, separation costs and certain other gains and losses. Adjusted figures are reported in comparable dollars using the budgeted exchange rate for 2015.

The Company uses these adjusted performance measures in managing the business, including communications with its Board of Directors and employees, and believes that they provide users of this financial information with meaningful comparisons of

operating performance between current results and results in prior periods. The Company believes that these non-GAAP financial measures are appropriate to enhance understanding of its past performance, as well as prospects for its future

performance. A reconciliation of these adjustments to the most directly comparable GAAP measures is included in this release and on the Company’s website. These non-GAAP measures should not be considered in isolation or as a substitute for the

most comparable GAAP measures. Non-GAAP financial measures utilized by the Company may not be comparable to non-GAAP financial measures used by other companies.

CONSOLIDATED RESULTS FROM CONTINUING OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Adjusted EBITDA |

|

$ |

112 |

|

|

$ |

104 |

|

|

$ |

186 |

|

|

$ |

187 |

|

| D&A/Fx* |

|

|

(30 |

) |

|

|

(31 |

) |

|

|

(58 |

) |

|

|

(59 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Adjusted |

|

$ |

82 |

|

|

$ |

73 |

|

|

$ |

128 |

|

|

$ |

128 |

|

| Non-cash impact of U.S. Pension |

|

|

6 |

|

|

|

— |

|

|

|

13 |

|

|

|

— |

|

| Separation costs |

|

|

5 |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

| Cost reduction initiatives expenses (income) |

|

|

— |

|

|

|

7 |

|

|

|

(1 |

) |

|

|

7 |

|

| Multilayered Wood flooring duties |

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

| Impairment |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

| Foreign exchange impact |

|

|

4 |

|

|

|

1 |

|

|

|

4 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Reported |

|

$ |

63 |

|

|

$ |

64 |

|

|

$ |

99 |

|

|

$ |

117 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Excludes accelerated depreciation associated with cost reduction initiatives reflected below. Actual D&A as reported is; $28.9 million for the three months ended June 30, 2015, $32.7 million for the three

months ended June 30, 2014, $57.4 million for the six months ended June 30, 2015, and $62.7 million for the six months ended June 30, 2014. |

BUILDING PRODUCTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Adjusted EBITDA |

|

$ |

81 |

|

|

$ |

83 |

|

|

$ |

158 |

|

|

$ |

157 |

|

| D&A/Fx |

|

|

(17 |

) |

|

|

(17 |

) |

|

|

(34 |

) |

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Adjusted |

|

$ |

64 |

|

|

$ |

66 |

|

|

$ |

124 |

|

|

$ |

125 |

|

| Foreign exchange impact |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Reported |

|

$ |

64 |

|

|

$ |

65 |

|

|

$ |

124 |

|

|

$ |

123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESILIENT FLOORING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Adjusted EBITDA |

|

$ |

32 |

|

|

$ |

29 |

|

|

$ |

43 |

|

|

$ |

47 |

|

| D&A/Fx |

|

|

(7 |

) |

|

|

(6 |

) |

|

|

(13 |

) |

|

|

(14 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Adjusted |

|

$ |

25 |

|

|

$ |

23 |

|

|

$ |

30 |

|

|

$ |

33 |

|

| Cost reduction initiatives expenses (income) |

|

|

— |

|

|

|

2 |

|

|

|

(1 |

) |

|

|

2 |

|

| Foreign exchange impact |

|

|

2 |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Reported |

|

$ |

23 |

|

|

$ |

21 |

|

|

$ |

29 |

|

|

$ |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WOOD FLOORING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Adjusted EBITDA (1) |

|

$ |

11 |

|

|

$ |

8 |

|

|

$ |

13 |

|

|

$ |

16 |

|

| D&A/Fx |

|

|

(3 |

) |

|

|

(5 |

) |

|

|

(6 |

) |

|

|

(8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Adjusted (1) |

|

$ |

8 |

|

|

$ |

3 |

|

|

$ |

7 |

|

|

$ |

8 |

|

| Cost reduction initiatives expenses |

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

5 |

|

| Multilayered Wood flooring duties |

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

| Impairment |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

| Foreign exchange impact |

|

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income (Loss), Reported(1) |

|

$ |

3 |

|

|

($ |

3 |

) |

|

$ |

1 |

|

|

$ |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Includes a $4 million charge recorded in the second quarter of 2015 resulting from new duty rates assigned by the U.S. Department of Commerce on multilayered wood importers and a $1 million gain recorded in the second

quarter of 2014 related to a refund of previously paid duties on imports of engineered wood flooring. |

UNALLOCATED CORPORATE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Adjusted EBITDA |

|

($ |

12 |

) |

|

($ |

16 |

) |

|

($ |

28 |

) |

|

($ |

33 |

) |

| D&A/Fx |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(5 |

) |

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (Loss), Adjusted |

|

($ |

15 |

) |

|

($ |

19 |

) |

|

($ |

33 |

) |

|

($ |

38 |

) |

| Non-cash impact of U.S. Pension |

|

|

6 |

|

|

|

— |

|

|

|

13 |

|

|

|

— |

|

| Separation costs |

|

|

5 |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

| Foreign exchange impact |

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (Loss), Reported |

|

($ |

27 |

) |

|

($ |

19 |

) |

|

($ |

55 |

) |

|

($ |

39 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| CASH FLOW(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash from operations |

|

$ |

93 |

|

|

$ |

55 |

|

|

$ |

59 |

|

|

$ |

22 |

|

| Less: net cash (used for) investing |

|

|

(16 |

) |

|

|

(46 |

) |

|

|

(24 |

) |

|

|

(68 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add back (subtract) adjustments to reconcile to free cash flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

|

$ |

77 |

|

|

$ |

9 |

|

|

$ |

35 |

|

|

($ |

45 |

) |

| (1) |

Cash flow includes cash flows attributable to European Flooring business |

CONSOLIDATED RESULTS FROM CONTINUING OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

Total |

|

|

Per

Share |

|

|

Total |

|

|

Per

Share |

|

|

Total |

|

|

Per

Share |

|

|

Total |

|

|

Per

Share |

|

| Adjusted EBITDA |

|

$ |

112 |

|

|

|

|

|

|

$ |

104 |

|

|

|

|

|

|

$ |

186 |

|

|

|

|

|

|

$ |

187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| D&A as reported |

|

|

(29 |

) |

|

|

|

|

|

|

(33 |

) |

|

|

|

|

|

|

(57 |

) |

|

|

|

|

|

|

(63 |

) |

|

|

|

|

| Fx/Accelerated Deprecation |

|

|

(1 |

) |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

(1 |

) |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income, Adjusted |

|

$ |

82 |

|

|

|

|

|

|

$ |

73 |

|

|

|

|

|

|

$ |

128 |

|

|

|

|

|

|

$ |

128 |

|

|

|

|

|

| Other non-operating (expense) |

|

|

(8 |

) |

|

|

|

|

|

|

(13 |

) |

|

|

|

|

|

|

(20 |

) |

|

|

|

|

|

|

(29 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Before Taxes, Adjusted |

|

|

74 |

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

108 |

|

|

|

|

|

|

|

99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted tax (expense) @ 39% for 2015 and 2014 |

|

|

(29 |

) |

|

|

|

|

|

|

(23 |

) |

|

|

|

|

|

|

(42 |

) |

|

|

|

|

|

|

(38 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings, Adjusted |

|

$ |

45 |

|

|

$ |

0.81 |

|

|

$ |

37 |

|

|

$ |

0.66 |

|

|

$ |

66 |

|

|

$ |

1.18 |

|

|

$ |

61 |

|

|

$ |

1.10 |

|

|

|

|

|

|

|

|

|

|

| Pre-tax adjustment items |

|

|

(13 |

) |

|

|

|

|

|

|

(9 |

) |

|

|

|

|

|

|

(16 |

) |

|

|

|

|

|

|

(11 |

) |

|

|

|

|

| Non-cash impact of U.S. Pension |

|

|

(6 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(13 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

| Reversal of adjusted tax expense @ 39% for 2015 and 2014 |

|

|

29 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

42 |

|

|

|

|

|

|

|

38 |

|

|

|

|

|

| Ordinary tax |

|

|

(17 |

) |

|

|

|

|

|

|

(15 |

) |

|

|

|

|

|

|

(24 |

) |

|

|

|

|

|

|

(27 |

) |

|

|

|

|

| Unbenefitted foreign losses |

|

|

(7 |

) |

|

|

|

|

|

|

(9 |

) |

|

|

|

|

|

|

(16 |

) |

|

|

|

|

|

|

(16 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax adjustment items |

|

|

(1 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

(5 |

) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Earnings, Reported |

|

$ |

30 |

|

|

$ |

0.53 |

|

|

$ |

27 |

|

|

$ |

0.48 |

|

|

$ |

34 |

|

|

$ |

0.60 |

|

|

$ |

45 |

|

|

$ |

0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Armstrong World Industries

|

Earnings Call Presentation 2 nd Quarter 2015 July 30, 2015 Exhibit 99.2 |

|

2 Our disclosures in this presentation, including without limitation, those relating to future financial results

guidance and the possible separation of our flooring business from our building

products business, and in our other public documents and comments contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act. Those statements provide our future

expectations or forecasts and can be identified by our use of words such

as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," "target," "predict," "may," "will," "would," "could," "should,"

"seek," and other words or phrases of similar meaning in

connection with any discussion of future operating or financial performance or the separation of our businesses. Forward-looking statements, by their nature, address matters that are uncertain and involve

risks because they relate to events and depend on circumstances that may or may not

occur in the future. As a result, our actual results may differ

materially from our expected results and from those expressed in our

forward-looking statements. A more detailed discussion of the risks and

uncertainties that may affect our ability to achieve the projected

performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the SEC. Forward-looking statements speak

only as of the date they are made. We undertake no obligation to update any

forward-looking statements beyond what is required under applicable

securities law. In addition, we will be referring to non-GAAP

financial measures within the meaning of SEC Regulation G. A

reconciliation of the differences between these measures with the most directly

comparable financial measures calculated in accordance with GAAP are

included within this presentation and available on the Investor

Relations page of our website at www.armstrong.com.

The guidance in this presentation is only effective as of the date given, July 30,

2015, and will not be updated or affirmed unless and until we publicly

announce updated or affirmed guidance. Safe Harbor

Statement 2 |

|

3 All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding.

• When reporting our financial results within this presentation, we make several adjustments.

Management uses the non-GAAP measures below in managing the business and believes

the adjustments provide meaningful comparisons of operating performance

between periods. As reported results will be footnoted throughout

the presentation. Basis of Presentation Explanation

• We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2015 is used for all currency translations in 2015 and prior years. Guidance is presented using the 2015 budgeted exchange rate for the year. • We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, separation costs and other large unusual items. We also remove the non- cash impact of our U.S. Pension Plan. • Taxes for normalized Net Income and EPS are calculated using a constant 39% for 2015 guidance, and 2015 and 2014 results, which are based on the expected full year historical tax rate. What Items Are Adjusted Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No No Return on Capital Yes Yes EBITDA Yes Yes |

|

4 Key Metrics – Second Quarter 2015 (1) As reported Net Sales: $633 million in 2015 and $659 million in 2014 (2) As reported Operating Income: $63 million in 2015 and $64 million in 2014 (3) As reported EPS: $0.53 in 2015 and $0.48 in 2014 (4) Unadjusted 2015 2014 Variance Net Sales (1) $649 $652 (0.4%) Operating Income (2) 82 73 13.1% % of Sales 12.7% 11.2% 150 bps EBITDA 112 104 7.7% % of Sales 17.2% 15.9% 130 bps Earnings Per Share (3) $0.81 $0.66 22.5% Free Cash Flow 77 9 Favorable Net Debt 823 963 (140) ROIC (4) 6.6% 8.4% (180 bps) |

|

5 Second Quarter 2015 vs. PY– Adjusted EBITDA to Reported Net Income 2015 2014 V EBITDA– Adjusted $112 $104 $8 Depreciation and Amortization (30) (31) 1 Operating Income – Adjusted $82 $73 $9 Non-cash Impact of U.S. Pension 6 - 6 Separation Expenses 5 - 5 Multilayered Wood Flooring Duty 4 - 4 Cost Reduction Initiatives - 7 (7) Impairment - 1 (1) Foreign Exchange Movements 4 1 3 Operating Income – As Reported $63 $64 ($1) Interest/Other (Expense) (8) (13) 5 EBT $55 $51 $4 Tax (Expense) (25) (24) (1) Net Income $30 $27 $3 |

|

6 Second Quarter Sales and EBITDA by Segment – 2015 vs. Prior Year 3 3 (2) 4 4% (8%) 1% (10%) (5%) 0% 5% 10% (10) (5) - 5 10 Resilient Flooring Wood Flooring Building Products Corporate EBITDA Change (Left -hand scale) % Change in Sales (Right-hand scale) |

|

7 • On a comparable foreign exchange basis sales increased slightly as favorable price and mix performance offset volume declines predominantly in EMEA markets • Reflects impact of prior price increases and continued strong mix performance • Driven by lower volumes in EMEA and the Americas • Reflects the benefit of lower freight costs and productivity in the Americas • Driven by inflation and higher marketing collateral expense Building Products Second Quarter Results Volume declines and higher SG&A expenses pressure margins despite favorable price and mix performance $205 $198 $77 $83 $36 $35 Q2 2015 Q2 2014 Net Sales Americas EMEA Pacific Rim $318

$316 Key Highlights Q2 2014 Adjusted EBITDA $ 83M Price & Mix 6 Volume (5) Manufacturing & Input Costs 1 SG&A (3) WAVE (1) Q2 2015 Adjusted EBITDA $ 81M |

|

8 • Sales increased driven by strong volume growth in the Americas commercial business that was partially aided by favorable market share shifts as a result of competitive product availability issues and our service proposition relative to competition • On a comparable foreign exchange basis sales in the Pacific Rim increased slightly driven by growth in India • Driven by unfavorable price and mix performance in residential flooring in the Americas • Volume growth driven by U.S. commercial • Reflects the benefit of favorable input costs • Higher SG&A expense to support go-to-market initiatives Resilient Second Quarter Results Strong commercial volumes in the Americas and favorable input costs drive margin performance $177 $172 $26 $24 Q2 2015 Q2 2014 Net Sales Americas Pacific Rim $203

$196 Key Highlights Q2 2014 Adjusted EBITDA $ 29M Price & Mix (3) Volume 5 Manufacturing & Input Costs 8 SG&A (7) Q2 2015 Adjusted EBITDA $ 32M |

|

• Despite improvements in mix sales declined driven primarily by lower volumes • Volume declines were caused by market share shifts as a result of prior year price and mix optimization actions, inventory adjustments at home centers, and engineered wood product availability challenges • Driven by unfavorable price, despite mix improvement • Due to engineered wood product availability challenges and share loss at opening price points • Reflects the benefit of favorable input costs Wood Second Quarter Results Favorable input costs and manufacturing productivity drive margin improvement $128 $140 Q2 2015 Q2 2014 Net Sales Americas $128

$140 Key Highlights Q2 2014 Adjusted EBITDA $ 8M Price & Mix (1) Volume (4) Manufacturing & Input Costs 11 SG&A (1) D&A/Other (2) Q2 2015 Adjusted EBITDA $ 11M 9 |

|

10 $3 $17 $3 $104 $0 $20 $40 $60 $80 $100 $120 $140 2014 Price/Mix Volume Input Costs Mfg Cost SG&A WAVE Change in D&A 2015 ($1) $112 ($1) ($8) EBITDA Bridge – Second Quarter 2015 vs. Prior Year ($5) |

|

11 $7 $33 $32 $0 $77 $9 $0 $20 $40 $60 $80 $100 2014 Cash Earnings Working Capital Capex Interest Expense WAVE Dividends Other 2015 ($3) ($1) Free Cash Flow – Second Quarter 2015 vs. Prior Year |

|

12 Key Metrics – 1 st Half 2015 (1) As reported Net Sales: $1,184 million in 2015 and $1,249 million in 2014 (2) As reported Operating Income: $99 million in 2015 and $117 million in 2014 (3) As reported EPS: $0.60 in 2015 and $0.80 in 2014 (4) Unadjusted 2015 2014 Variance Net Sales (1) $1,214 $1,236 (1.8%) Operating Income (2) 128 128 (0.1%) % of Sales 10.5% 10.4% 10 bps EBITDA 186 187 (0.3%) % of Sales 15.4% 15.1% 30 bps Earnings Per Share (3) $1.18 $1.10 7.9% Free Cash Flow 35 (45) Favorable |

|

13 (4) (3) 1 5 1% (10%) 1% (15%) (10%) (5%) 0% 5% 10% (15) (10) (5) - 5 10 Resilient Flooring Wood Flooring Building Products Corporate EBITDA Change (Left-hand scale) % Change in Sales (Right-hand scale) 1H Sales and EBITDA by Segment – 2015 vs. Prior Year

|

|

14 $187 $100 $120 $140 $160 $180 $200 $220 2014 Price/Mix Volume Input Costs Mfg Cost SG&A WAVE Change in D&A 2015 $15 $186 ($3) ($11) EBITDA Bridge – 1H 2015 vs. Prior Year ($21) $14 $5 $0 |

|

15 ($20) $42 $47 $1 ($4) $14 $35 ($45) ($80) ($60) ($40) ($20) $0 $20 $40 $60 2014 Cash Earnings Working Capital Capex Interest Expense WAVE Dividends Other 2015 Free Cash Flow – 1H 2015 vs. Prior Year |

|

16 2015 Estimate Range (1) 2014 (2) Variance Net Sales (3) 2,400 to 2,500 2,515 (5%) to (1%) Operating Income (4) 235 to 265 271 (13%) to (2%) EBITDA 355 to 385 389 (9%) to (1%) Earnings Per Share (5) $2.05 to $2.35 $2.38 (14%) to (1%) Key Metrics – Guidance 2015 (1) Guidance is presented using 2015 budgeted foreign exchange rates (2) 2014 results are presented using 2015 budgeted foreign exchange rates (3) 2015 and 2014 net sales include the impact of foreign exchange (4) As reported Operating Income: $180 - $210 million in 2015 and $239 million 2014 (5) As reported earnings per share: $1.10 - $1.35 in 2015 and $1.83 in 2014 |

|

17 2015 Financial Outlook Sales (1) $1,220-$1,270 million; EBITDA $335-$355 million Sales (1) $1,180-$1,230 million; EBITDA $85-$100 million EBITDA ($65) – ($70) $35 - $45 million; Adjusted long-term ETR of ~39% (2) $145 - $165 million Non-cash: $25 million US pension expense Cash: $20 - $40 million transaction costs ABP Segment* AFP Segment* Cash Taxes/ETR Capital Spending* Exclusions from EBITDA (1) Net sales include foreign exchange impact (2) As reported ETR of 53% for 2015 * Changed from April Outlook Corporate Segment |

|

19 1H 2015 vs. PY– Adjusted EBITDA to Reported Net Income 2015 2014 V EBITDA– Adjusted $186 $187 ($1) Depreciation and Amortization (58) (59) 1 Operating Income – Adjusted $128 $128 $ - Non-cash Impact of U.S. Pension 13 - 13 Separation Expenses 9 - 9 Multilayered Wood Flooring Duty 4 - 4 Cost Reduction Initiatives (1) 7 (8) Impairment - 1 (1) Foreign Exchange Movements 4 3 1 Operating Income – As Reported $99 $117 ($18) Interest/Other (Expense) (20) (28) 8 EBT $79 $89 ($10) Tax (Expense) (45) (44) (1) Net Income $34 $45 ($11) |

|

20 Consolidated Results Second Quarter 2015 Reported Comparability (1) Adjustments FX (2) Adj 2015 Adjusted 2014 Reported Comparability (1) Adjustments FX (2) Adj 2014 Adjusted Net Sales 633 - 16 649 659 - (7) 652 Operating Income 63 15 4 82 64 8 1 73 EPS $0.53 $0.23 $0.05 $0.81 $0.48 $0.17 $0.01 $0.66 YTD 2015 Reported Comparability (1) Adjustments FX (2) Adj 2015 Adjusted 2014 Reported Comparability (1) Adjustments FX (2) Adj 2014 Adjusted Net Sales 1,184 - 30 1,214 1,249 - (13) 1,236 Operating Income 99 25 4 128 117 8 3 128 EPS $0.60 $0.53 $0.05 $1.18 $0.80 $0.26 $0.04 $1.10 (1) See earnings press release and 10-Q for additional detail on comparability adjustments

(2) Eliminates impact of foreign exchange movements |

|

21 Segment Operating Income (Loss) Second Quarter 2015 Reported Comparability (1) Adjustments 2015 Adjusted 2014 Reported Comparability (1) Adjustments 2014 Adjusted Building Products 64 - 64 65 1 66 Resilient Flooring 23 2 25 21 2 23 Wood Flooring (2) 3 5 8 (3) 6 3 Unallocated Corporate (Expense) Income (27) 12 (15) (19) - (19) YTD 2015 Reported Comparability (1) Adjustments 2015 Adjusted 2014 Reported Comparability (1) Adjustments 2014 Adjusted Building Products 124 - 124 123 2 125 Resilient Flooring 29 1 30 31 2 33 Wood Flooring (2) 1 6 7 2 6 8 Unallocated Corporate (Expense) Income (55) 22 (33) (39) 1 (38) (1) Eliminates impact of foreign exchange movements and non-recurring items; see earnings press release and 10-Q for additional

detail. (2)

Includes a $4 million charge recorded in the second quarter of 2015 resulting from new

duty rates assigned by the U.S. Department of Commerce on multilayered wood

importers and a $1 million gain recorded in the second quarter of 2014 related to a

refund of previously paid duties on imports of engineered wood flooring. |

|

22 Cash Flow Second Quarter YTD ($ millions) 2015 2014 2015 2014 Net cash from operations $93 $55 $59 $22 Net cash (used for) investing (16) (46) (24) (68) Add back (subtract) adjustments to reconcile to free cash flow Other - - - 1 Free Cash Flow $77 $9 $35 ($45) Cash flow includes cash flows attributable to the European flooring business |

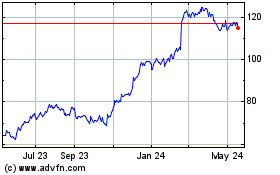

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Oct 2024 to Nov 2024

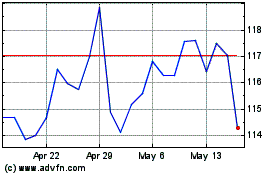

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Nov 2023 to Nov 2024