Brandywine Realty Trust Announces Tax Characteristics of Its 2024 Distributions

23 January 2025 - 4:49AM

Brandywine Realty Trust (NYSE: BDN) announced today the tax

characteristics of its 2024 distributions. The tax reporting will

be done on Form 1099-DIV and shareholders are encouraged to consult

with their personal tax advisors as to the specific tax treatment

of dividends. The characteristics of the Company’s distributions

are as follows:

Common Shares of Beneficial Interest (CUSIP

105368203)

| 2024

Dividend Dates |

Record 1/4Payment 1/18 |

Record 4/4Payment 4/18 |

Record 7/3Payment 7/18 |

Record 10/9Payment 10/24 |

Totals |

% of Annual Total |

|

Gross Distribution Per Share(Boxes 1a+2a+3) |

$ |

0.150000 |

$ |

0.150000 |

$ |

0.150000 |

$ |

0.150000 |

$ |

0.600000 |

100.0 |

% |

| |

|

|

|

|

|

|

| Taxable Ordinary Dividend(Box

1a) |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.231984 |

38.6 |

% |

| |

|

|

|

|

|

|

| Qualified Dividend Income(Box

1b) |

$ |

0 |

$ |

0 |

$ |

0 |

$ |

0 |

$ |

0 |

|

| |

|

|

|

|

|

|

| Total Capital Gain

Distribution(Box 2a) |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.029100 |

4.9 |

% |

| |

|

|

|

|

|

|

| Total Unrecaptured Sec. 1250

Gain(Box 2b) |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.020876 |

|

| |

|

|

|

|

|

|

| Section 897 Ordinary Dividend(Box

2e) |

$ |

0 |

$ |

0 |

$ |

0 |

$ |

0 |

$ |

0 |

|

| |

|

|

|

|

|

|

| Section 897 Capital Gain(Box

2f) |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.005219 |

$ |

0.020876 |

|

| |

|

|

|

|

|

|

| Non-dividend Distribution(Box

3) |

$ |

0.084729 |

$ |

0.084729 |

$ |

0.084729 |

$ |

0.084729 |

$ |

0.338916 |

56.5 |

% |

| |

|

|

|

|

|

|

| Section 199A Dividend(Box 5) |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.057996 |

$ |

0.231984 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to Treas. Reg. § 1.1061-6(c), the Company reports the

following for purposes of section 1061 of the Internal Revenue

Code:

| 2024

Dividend Dates |

Record 1/4Payment 1/18 |

Record 4/4Payment 4/18 |

Record 7/3Payment 7/18 |

Record 10/9Payment 10/24 |

Totals |

|

One-Year Distributive Amounts |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.029100 |

|

Three-Year Distributive Amounts |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.007275 |

$ |

0.029100 |

|

|

|

|

|

|

|

|

|

|

|

|

A full tax report is available on our website at

www.brandywinerealty.com - Investor Relations - 1099

Reporting.

About Brandywine Realty

Trust

Brandywine Realty Trust (NYSE: BDN) is one of

the largest, publicly traded, full-service, integrated real estate

companies in the United States with a core focus in the

Philadelphia and Austin markets. Organized as a real estate

investment trust (REIT), we own, develop, lease and manage an

urban, town center and transit-oriented portfolio comprising 147

properties and 21.1 million square feet as of September 30, 2024.

Our purpose is to shape, connect and inspire the world around us

through our expertise, the relationships we foster, the communities

in which we live and work, and the history we build together. For

more information, please visit www.brandywinerealty.com.

Company / Investor Contact:

Tom WirthEVP & CFO610-832-7434

tom.wirth@bdnreit.com

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Dec 2024 to Jan 2025

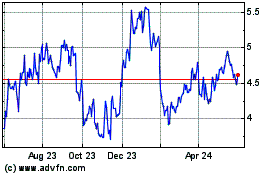

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Jan 2024 to Jan 2025