Current Report Filing (8-k)

06 March 2019 - 12:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 1, 2019

|

|

|

|

|

|

|

|

|

BARNES & NOBLE EDUCATION, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

|

|

1-37499

|

|

46-0599018

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

120 Mountain View Blvd., Basking Ridge, NJ

|

|

07920

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

Registrant’s telephone number, including area code: (908) 991-2665

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

□

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

□

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

□

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

□

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

□

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

□

Item 1.01 Entry into a Material Definitive Agreement.

On March 1, 2019, Barnes & Noble Education, Inc. (the “Company”) entered into a Second Amendment, Waiver and Consent to Credit Agreement (the “Second Amendment”) to the Credit Agreement, dated as of August 3, 2015 (as amended prior to the Second Amendment, the “Credit Agreement”), among the Company, as the lead borrower, the other borrowers party thereto, the lenders party thereto and Bank of America, N.A., as administrative agent and collateral agent for the lenders.

The Second Amendment extends the maturity date of the Credit Agreement to five years from the date of the Second Amendment, or March 1, 2024. The applicable margin for credit extensions of revolving LIBO rate loans under the Credit Agreement was amended to include three levels based on average daily availability: (i) at less than 33% of the Loan Cap (as defined in the Credit Agreement), the applicable margin for LIBO rate loans is 1.75%, (ii) at greater than 33% of the Loan Cap but less than 66% of the Loan Cap, the applicable margin for LIBO rate loans is 1.50% and (iii) at greater than 66% of the Loan Cap, the applicable margin for LIBO rate loans is 1.25%. The applicable margin for credit extensions of LIBO rate loans under the first-in-last-out facility (the “FILO Facility”) under the Credit Agreement was reduced to 2.75%.

The Second Amendment also restores the aggregate commitment of the FILO Facility to $100 million, subject to the following reductions: (i) reduction to $75 million on August 1, 2019, (ii) reduction to $50 million on August 1, 2020, (iii) reduction to $25 million on August 1, 2021 and (iv) reduction to $0 on August 1, 2022.

The foregoing description is qualified in its entirety by reference to the Second Amendment, a copy of which is attached as Exhibit 10.1 and incorporated by reference in its entirety in this Item 1.01.

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2019, the Company issued a press release announcing its financial results for the third quarter ended January 26, 2019 (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1.

The information in this Form 8-K and the Exhibit attached hereto pertaining to the Company’s financial results shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth above under Item 1.01 is incorporated by reference.

Item 9.01.

Financial Statements and Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Second Amendment, dated as of March 1, 2019, among Barnes & Noble Education, Inc., as the lead borrower, the other borrowers party thereto, the lenders party thereto and Bank of America, N.A., as administrative agent and collateral agent for the lenders, to the Credit Agreement, dated as of August 3, 2015.

|

|

|

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: March 5, 2019

BARNES & NOBLE EDUCATION, INC.

By:

/s/ Thomas D. Donohue

Name: Thomas D. Donohue

Title: Chief Financial Officer

BARNES & NOBLE EDUCATION, INC.

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Second Amendment, dated as of March 1, 2019, among Barnes & Noble Education, Inc., as the lead borrower, the other borrowers party thereto, the lenders party thereto and Bank of America, N.A., as administrative agent and collateral agent for the lenders, to the Credit Agreement, dated as of August 3, 2015.

|

|

|

|

|

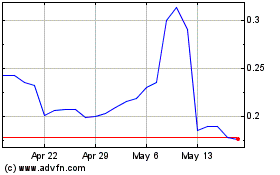

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jun 2024 to Jul 2024

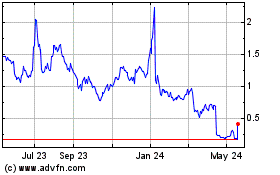

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jul 2023 to Jul 2024