Lawmaker To Revisit Taxing Of Frequent Flier Miles

01 February 2012 - 3:43AM

Dow Jones News

Even harder than racking up enough frequent flier miles to earn

a free flight may be figuring out how they're taxed. Sen. Sherrod

Brown (D., Ohio), chairman of the Senate Banking Subcommittee on

Financial Institutions and Consumer Protection, plans to revisit

the guidelines over taxing frequent flier miles after a letter he

sent to Citibank (C)triggered confusion and highlighted the issue's

complexity.

In a letter sent Monday to Citibank's chief executive, Vikram

Pandit, Brown urged the bank to stop sending tax forms to its

customers encouraging them to report their frequent-flier miles as

income that can be taxed. Calling Citibank's interpretation of tax

laws "incorrect," Brown wrote that "the last thing Citibank should

be doing is creating baseless fear in middle class families, or

placing a nonexistent tax burden on the backs of families who are

already struggling to make ends meet." But Brown's reading of the

law may not have applied in this situation, in which Citibank

awarded the miles to customers who opened bank accounts.

Brown pointed to a 2002 IRS announcement stating that someone

who earns frequent flier miles while traveling for business or

"official" travel generally doesn't need to pay taxes on them.

However, in this case, Citibank noted that the frequent flier miles

were distributed as a bonus for starting an account, making them a

taxable gift.

"When a customer receives a gift for opening a bank

account--whether cash, a toaster or airline miles--the value of

that gift is generally treated as income and subject to reporting,"

Citibank spokeswoman Catherine Pulley said in a statement. Citibank

declined to say how many of its customers received the tax

forms.

The IRS said earlier this year that a taxpayer who earns more

than $600 in "prizes and awards" must pay taxes on them. And in a

statement provided Monday, the tax agency specified that someone

who received frequent flyer miles as an incentive for opening a

bank account may have to pay taxes on them.

The agency's 2002 announcement "focused on a specific area

involving the receipt or use of frequent flyer miles attributable

to a taxpayer's business or official travel," the IRS said in the

statement. "That guidance does not address the issues raised when

frequent flyer miles are given as a premium for opening a financial

account."

A spokeswoman for Brown said the senator's office had contacted

the IRS before sending the letter to Citibank. An IRS

representative had said the 2002 guidance still stood and the

agency did not plan to give any further guidance, according to

Brown's staff. The IRS did not return a request for comment on this

exchange.

"Sen. Brown intends to follow-up with IRS to seek greater

clarification as to why it would apply a different standard to

frequent flier miles accrued through professional versus personal

travel," his spokeswoman said.

-By Kristina Peterson, Dow Jones Newswires; 347-882-7215;

kristina.peterson@dowjones.com

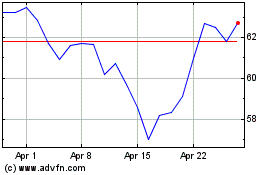

Citigroup (NYSE:C)

Historical Stock Chart

From Nov 2024 to Dec 2024

Citigroup (NYSE:C)

Historical Stock Chart

From Dec 2023 to Dec 2024