Coeur Announces Flow-Through Shares Private Placement to Advance Silvertip Exploration

27 February 2024 - 8:34AM

Business Wire

C$34 million of expected proceeds to fund

accelerated exploration program

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

announced that it has arranged a private placement (the “Offering”)

of 7,704,725 flow-through common shares of the Company that will

qualify as “flow-through shares” within the meaning of subsection

66(15) of the Income Tax Act (Canada) (the “flow-through shares”)

for gross proceeds of approximately $25 million (C$34 million),

resulting in a 27% premium. The offering will be subject to a

four-month hold period.

The proceeds of the Offering will be used exclusively for

qualifying Canadian Exploration Expenditures (“CEE”) (as such term

is defined in the Income Tax Act (Canada), in conducting an

exploration and mineral resource evaluation program on the

Silvertip Property in British Columbia and Yukon to determine the

existence, location, extent, and quality of the silver, lead, and

zinc on the Silvertip Property.

The flow-through shares will be privately placed with investors

in certain provinces in Canada pursuant to applicable exemptions

from the prospectus requirements. The initial Offering is expected

to close on or about March 8, 2024. The Offering will be subject to

the satisfaction or waiver of customary closing conditions.

The flow-through shares will only be offered and sold outside

the United States pursuant to Regulation S under the Securities Act

of 1933, as amended (the “U.S. Securities Act”). The Offering has

not been, and will not be, registered under the U.S. Securities Act

or any U.S. state securities laws, and may not be offered or sold

in the United States or to, or for the account or benefit of,

United States persons absent registration or any applicable

exemption from the registration requirements of the U.S. Securities

Act and applicable U.S. state securities laws.

This news release is neither an offer to sell nor a

solicitation of an offer to buy any of these securities and shall

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale is unlawful.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, the Company wholly-owns the

Silvertip silver-zinc-lead exploration project in British

Columbia.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding the Company’s Silvertip exploration

project, the proposed issuance of flow-through shares and the tax

treatment of the flow-through shares. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause Coeur’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

satisfaction of conditions and completion of the private placement;

the tax treatment of the flow-through shares; the risk that

exploration efforts will not occur on a timely basis or requires

more capital than currently anticipated; the risk that anticipated

production, cost, expenditure and expense levels at our Palmarejo,

Rochester, Wharf and Kensington mines are not attained; the risk

that our Rochester mine expansion commissioning and ramp up is not

completed; the risks and hazards inherent in the mining business

(including risks inherent in developing and expanding large-scale

mining projects, environmental hazards, industrial accidents,

weather or geologically-related conditions); changes in the market

prices of gold and silver and a sustained lower price or higher

treatment and refining charge environment; the impact of

geopolitical conditions, pandemics or epidemics, climate change,

extreme weather events and other macro conditions, including

disruptions to operations, the need for heightened health and

safety protocols, inflation, and disruptions to our vendors,

suppliers and the communities where we operate; the uncertainties

inherent in our production, exploration and development activities,

including risks relating to permitting and regulatory delays

(including the impact of government shutdowns), ground conditions,

grade and recovery variability; any future labor disputes or work

stoppages (involving us or our subsidiaries or third parties); the

risk of adverse outcomes in litigation; the uncertainties inherent

in the estimation of gold, silver, zinc and lead mineral reserves

and resources; impacts from our future acquisition of new mining

properties or businesses; the loss of access or insolvency of any

third-party refiner or smelter to whom we market our production;

the continued effects of the COVID-19 pandemic, including impacts

to workforce, materials and equipment availability; inflationary

pressures; continued access to financing sources; government orders

that may require temporary suspension of operations at one or more

of our sites and effects on our suppliers or the refiners and

smelters to whom we market our production and on the communities

where we operate; the effects of environmental and other

governmental regulations and government shut-downs; the risks

inherent in the ownership or operation of or investment in mining

properties or businesses in foreign countries; and our ability to

raise additional financing necessary to conduct our business, make

payments or refinance our debt, as well as other uncertainties and

risk factors set out in filings made from time to time with the

United States Securities and Exchange Commission, and the Canadian

securities regulators, including, without limitation, Coeur’s most

recent report on Form 10-K. Actual results, developments and

timetables could vary significantly from the estimates presented.

Readers are cautioned not to put undue reliance on forward-looking

statements. Coeur disclaims any intent or obligation to update

publicly such forward-looking statements, whether as a result of

new information, future events or otherwise. Additionally, Coeur

undertakes no obligation to comment on analyses, expectations or

statements made by third parties in respect of Coeur, its financial

or operating results or its securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226585753/en/

For Additional Information Coeur Mining, Inc. 200 S.

Wacker Drive, Suite 2100 Chicago, Illinois 60606 Attention: Jeff

Wilhoit, Director, Investor Relations Phone: (312) 489-5800

www.coeur.com

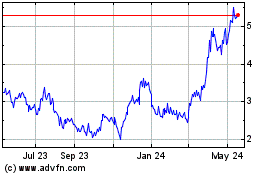

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2024 to May 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From May 2023 to May 2024