Amended Statement of Beneficial Ownership (sc 13d/a)

13 May 2022 - 7:28AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

Canadian

National Railway Company

(Name of Issuer)

Common Shares,

No Par Value

(Title of Class of

Securities)

136375102

(CUSIP Number)

Jacki Badal, Esq.

2365 Carillon Point

Kirkland, WA 98033

(425) 889-7900

(Name, Address

and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 11,

2022

(Date of Event which Requires

Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to

be sent.

* The remainder of this cover

page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act")

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP

No. 136375102 |

| |

1. |

Names

of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Cascade Investment, L.L.C. |

| |

2. |

Check the

Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

3. |

SEC

Use Only |

| |

4. |

Source

of Funds (See Instructions)

WC |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| |

6. |

Citizenship

or Place of Organization

State of Washington |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

60,667,489 (1) (2) |

| 8. |

Shared

Voting Power

-0- |

| 9. |

Sole

Dispositive Power

60,667,489 (1) |

| 10. |

Shared

Dispositive Power

-0- |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

60,667,489 (1) (2) |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

8.7% (3) |

| |

14. |

Type

of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

|

| (1) | All common shares (“Common

Shares”) of Canadian National Railway Company (the “Issuer”) held by Cascade

Investment, L.L.C. (“Cascade”) may be deemed to be beneficially owned by its

sole member, William H. Gates III. |

| (2) | On April 5, 2022, the record date

for the Issuer’s next annual shareholder meeting, Cascade held and had the right to

vote 68,725,821 Common Shares. As a result, absent a change in the Issuer's record date for

its next annual shareholder meeting, Cascade may be deemed to continue to share beneficial

ownership through such meeting date of the Common Shares reported as sold herein. |

| (3) | Based on 694,032,805

Common Shares outstanding as of April 5, 2022, as reported by the Issuer on its Form 6-K

filed on April 19, 2022. |

| CUSIP

No. 136375102 |

| |

1. |

Names

of Reporting Persons

Bill & Melinda Gates Foundation Trust |

| |

2.

|

Check the

Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

¨ |

| |

|

(b) |

x |

| |

3. |

SEC

Use Only |

| |

4. |

Source

of Funds (See Instructions)

WC |

| |

5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or (e) ¨ |

| |

6. |

Citizenship

or Place of Organization

State of Washington |

| |

|

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

-0- |

| |

|

| 8. |

Shared

Voting Power

11,553,675 (1) (2) |

| |

|

| 9. |

Sole

Dispositive Power

-0- |

| |

|

| 10. |

Shared

Dispositive Power

11,553,675 (1) |

| |

11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

11,553,675 (1) (2) |

| |

12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| |

13. |

Percent

of Class Represented by Amount in Row (11)

1.7% (3) |

| |

14. |

Type

of Reporting Person (See Instructions)

OO |

| |

|

|

|

|

|

| (1) | For purposes

of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (“Rule 13d-3”),

William H. Gates III, as a Co-Trustee of Bill & Melinda Gates Foundation Trust (the “Trust”),

may be deemed to have shared beneficial ownership of all Common Shares held by the Trust. |

| (2) | On

April 5, 2022, the record date for the Issuer’s next annual shareholder meeting, the

Trust held and had the right to vote 13,066,169 Common Shares. As a result, absent a change

in the Issuer's record date for its next annual shareholder meeting, the Trust may be deemed

to continue to share beneficial ownership through such meeting date of the Common Shares

reported as sold herein. |

| (3) | Based on 694,032,805

Common Shares outstanding as of April 5, 2022, as reported by the Issuer on its Form 6-K

filed on April 19, 2022. |

| CUSIP

No. 136375102 |

| 1. |

Names

of Reporting Persons

William H. Gates III |

| 2.

|

Check the

Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

¨ |

| |

(b) |

x |

| 3. |

SEC

Use Only |

| 4. |

Source

of Funds (See Instructions)

WC |

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or (e) ¨ |

| 6. |

Citizenship

or Place of Organization

United States of America |

| |

|

|

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole

Voting Power

60,667,489 (1) (2) |

| |

|

| 8. |

Shared

Voting Power

11,553,675 (2) (3) |

| |

|

| 9. |

Sole

Dispositive Power

60,667,489 (1) |

| |

|

| 10. |

Shared

Dispositive Power

11,553,675 (3) |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

72,201,164 (1) (2) (3) |

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

10.4% (4) |

| 14. |

Type

of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

| (1) | Includes Common

Shares held by Cascade. All Common Shares of the Issuer held by Cascade may be deemed to

be beneficially owned by William H. Gates III as the sole member of Cascade. |

| (2) | On April 5,

2022, the record date for the Issuer’s next annual shareholder meeting, William H.

Gates III had sole and shared voting power over a total of 81,791,990 Common Shares (68,725,821

held by Cascade and 13,066,169 held by the Trust). As a result, absent a change in the Issuer's

record date for its next annual shareholder meeting, he may be deemed to continue to share

beneficial ownership through such meeting date of the Common Shares reported as sold herein. |

| (3) | Includes Common

Shares held by the Trust. For purposes of Rule 13d-3, William H. Gates III, as a Co-Trustee

of the Trust, may be deemed to have shared beneficial ownership of all Common Shares held

by the Trust. |

| (4) | Based o n

694,032,805 Common Shares outstanding as of April 5, 2022, as reported by the Issuer on its

Form 6-K filed on April 19, 2022. |

This Amendment No. 5 to Schedule 13D (this

“Amendment”) relates to the common shares, no par value, of Canadian National Railway Company. Cascade Investment, L.L.C.,

Bill & Melinda Gates Foundation Trust, and William H. Gates III (collectively, the “Reporting Persons”) jointly

file this Amendment to amend and restate the Schedule 13D previously filed by the Reporting Persons and Melinda French Gates (“MFG”)

with the Securities and Exchange Commission on March 24, 2021, as amended on May 4, 2021; August 6, 2021; September 8,

2021; and December 20, 2021. As disclosed in the previous amendment, MFG is no longer a reporting person hereunder.

| Item 1. |

Security

and Issuer |

| |

|

| |

This

statement relates to the common shares, no par value (the “Common Shares”), of Canadian National Railway Company (the “Issuer”).

The principal executive offices of the Issuer are located at 935 de La Gauchetière Street West, Montréal, Québec,

H3B 2M9, Canada. |

| |

|

| Item 2. |

Identity

and Background |

| |

|

| |

(a) |

This statement is being filed jointly by Cascade Investment, L.L.C. (“Cascade”),

Bill & Melinda Gates Foundation Trust (the “Trust”), and William H. Gates III (“WHG”). Neither the present

filing nor anything contained herein shall be construed as an admission that the Reporting Persons constitute a “group” for

any purpose, and the Reporting Persons expressly disclaim membership in a group. |

| |

|

| |

(b) |

The business addresses of the Reporting Persons are as follows: |

| |

|

· |

Cascade: 2365 Carillon Point,

Kirkland, Washington 98033 |

| |

|

· |

The Trust: 2365 Carillon Point,

Kirkland, Washington 98033 |

| |

|

· |

WHG: 500 Fifth Avenue North,

Seattle, Washington 98109 |

| |

|

| |

(c) |

Cascade is a limited liability company organized under the laws of the

State of Washington. Cascade is a private investment entity that seeks appreciation of its assets for the benefit of its member. Mr. Gates

controls Cascade as its sole member. The address of Cascade’s principal office is set forth in paragraph (b) of this item. |

| |

|

| |

|

The Trust is a charitable trust established under the laws of the State

of Washington. The Trust was established to manage investment assets and transfer proceeds to the Bill & Melinda Gates Foundation

(the “Foundation”) as necessary to achieve the Foundation's charitable goals. The Trust’s co-trustees are WHG and MFG.

The address of the Trust’s principal office is set forth in paragraph (b) of this item. |

| |

|

| |

|

WHG, a natural person, is a Co-Trustee of the Foundation and the Trust.

The Foundation is a nonprofit organization fighting poverty, disease, and inequity around the world; its business address is 500 Fifth

Avenue North, Seattle, Washington 98109. |

| |

|

| |

(d) |

None. |

| |

|

| |

(e) |

None. |

| |

|

| |

(f) |

WHG is a citizen of the United States of America. |

| |

|

| Item 3. |

Source

and Amount of Funds or Other Consideration |

| |

|

| |

Cascade purchased its Common Shares with working capital.

The Trust purchased its Common Shares with working capital. |

| |

|

| Item 4. |

Purpose

of Transaction |

| |

|

| |

The Reporting Persons acquired their respective Common Shares for investment

purposes. |

| |

The Reporting Persons intend to continuously review and evaluate all of their alternatives

with respect to their investment in the Issuer and intend to take any and all actions that they deem appropriate with respect to the

performance of their investment. This may include trading securities in the future, depending on market conditions and portfolio-management

concerns, including liquidity and exposure preferences. |

| |

|

| |

A senior investment manager for WHG, Justin Howell, serves on the Issuer’s board of

directors. Mr. Howell exercises no investment or voting power over the Common Shares beneficially owned by WHG. |

| |

|

| |

The Reporting Persons may formulate plans or proposals regarding the Issuer or its securities

to the extent deemed advisable by the Reporting Persons in light of their general investment policies, market conditions and valuations,

subsequent developments affecting the Issuer, the general business and prospects of the Issuer, or other factors. |

| |

|

| |

Except as set forth herein, the Reporting Persons have no current intention, plan or proposal

with respect to items (a) through (j) of Schedule 13D. |

| |

|

| Item 5. |

Interest in Securities of the Issuer |

| |

|

| |

(a) |

See items 11 and 13 of the cover pages to this Amendment for the aggregate number of Common Shares

and percentage of Common Shares beneficially owned by each of the Reporting Persons. |

| |

|

| |

(b) |

See items 7 through 10 of the cover pages to this Amendment for the number of Common Shares beneficially

owned by each of the Reporting Persons as to which there is sole power to vote or to direct the vote, shared power to vote or to direct

the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| |

(c) |

Cascade sold 8,058,332 Common Shares during the past 60 days for cash in market transactions at the

weighted-average sale price per share set forth in Exhibit 99.1, attached hereto and incorporated by reference herein. |

| |

|

| |

|

The Trust sold 1,532,494 Common Shares during the past 60 days for cash in market transactions at the weighted-average

sale price per share set forth in Exhibit 99.1, attached hereto and incorporated by reference herein. |

| |

|

| |

(d) |

None. |

| |

|

| |

(e) |

Not applicable. |

| |

|

| Item 6. |

Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer |

| |

|

| |

The information included in Item 4 is incorporated

herein by reference. |

| |

|

| Item 7. |

Material to be Filed as Exhibits |

| |

|

| |

Exhibit 99.1 – Sales by Cascade

and the Trust during the past 60 days. |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Date: May 12,

2022 |

CASCADE

INVESTMENT, L.L.C. |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan

Heuberger (1) |

| |

|

Title: |

Attorney-in-fact

for Michael Larson, |

| |

|

|

Business

Manager |

| |

|

| |

BILL &

MELINDA GATES FOUNDATION TRUST |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan Heuberger

(2) |

| |

|

Title: |

Attorney-in-fact

for the Co-Trustees, |

| |

|

|

William

H. Gates III and Melinda French Gates |

| |

|

|

|

| |

WILLIAM

H. GATES III |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan Heuberger

(3) |

| |

|

Title: |

Attorney-in-fact |

| |

|

|

|

| |

*By: |

/s/

Alan Heuberger |

| |

|

Alan

Heuberger |

| (1) | Duly

authorized under Special Limited Power of Attorney appointing Alan Heuberger attorney-in-fact,

dated October 11, 2013, by and on behalf of Michael Larson, filed as Exhibit 99.1 to Amendment

No. 9 to Cascade’s Schedule 13D with respect to Western Asset/Claymore Inflation-Linked

Opportunities & Income Fund on December 11, 2013, SEC File No. 005-81261, and incorporated

by reference herein. |

| (2) | Duly

authorized under Special Limited Power of Attorney appointing Alan Heuberger attorney-in-fact,

dated August 12, 2008, by and on behalf of WHG and MFG as Co-Trustees, filed as Exhibit 99.5

to Cascade’s Schedule 13D with respect to Grupo Televisa, S.A.B. on May 7, 2009,

SEC File No. 005-60431, and incorporated by reference herein. |

| (3) | Duly authorized under Special Limited

Power of Attorney appointing Alan Heuberger attorney-in-fact, dated August 12, 2008, by and

on behalf of WHG, filed as Exhibit 99.2 to Amendment No. 1 to Cascade’s Schedule 13D

with respect to Otter Tail Corporation on April 15, 2009, SEC File No. 005-06638, and incorporated

by reference herein. |

JOINT FILING AGREEMENT

We, the signatories of the statement to which

this Joint Filing Agreement is attached, hereby agree that such statement is filed, and any amendments thereto filed by any or all of

us will be filed, on behalf of each of us.

| Date: May 12, 2022 |

CASCADE INVESTMENT, L.L.C. |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan Heuberger (1) |

| |

|

Title: |

Attorney-in-fact for Michael Larson, |

| |

|

|

Business Manager |

| |

|

| |

BILL & MELINDA GATES FOUNDATION TRUST |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan Heuberger (2) |

| |

|

Title: |

Attorney-in-fact for each of the Co-Trustees, |

| |

|

|

William H. Gates III and Melinda French Gates |

| |

|

|

|

| |

WILLIAM H. GATES III |

| |

|

|

| |

By: |

* |

| |

|

Name: |

Alan Heuberger (3) |

| |

|

Title: |

Attorney-in-fact |

| |

|

|

|

| |

*By: |

/s/

Alan Heuberger |

| |

|

Alan Heuberger |

| (1) | Duly

authorized under Special Limited Power of Attorney appointing Alan Heuberger attorney-in-fact,

dated October 11, 2013, by and on behalf of Michael Larson, filed as Exhibit 99.1 to Amendment

No. 9 to Cascade’s Schedule 13D with respect to Western Asset/Claymore Inflation-Linked

Opportunities & Income Fund on December 11, 2013, SEC File No. 005-81261, and incorporated

by reference herein. |

| (2) | Duly

authorized under Special Limited Power of Attorney appointing Alan Heuberger attorney-in-fact,

dated August 12, 2008, by and on behalf of WHG and MFG as Co-Trustees, filed as Exhibit 99.5

to Cascade’s Schedule 13D with respect to Grupo Televisa, S.A.B. on May 7, 2009,

SEC File No. 005-60431, and incorporated by reference herein. |

| (3) | Duly

authorized under Special Limited Power of Attorney appointing Alan Heuberger attorney-in-fact,

dated August 12, 2008, by and on behalf of WHG, filed as Exhibit 99.2 to Amendment No. 1

to Cascade’s Schedule 13D with respect to Otter Tail Corporation on April 15, 2009,

SEC File No. 005-06638, and incorporated by reference herein. |

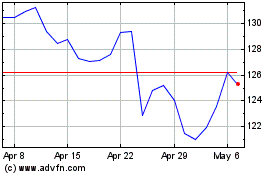

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Apr 2023 to Apr 2024