Regulatory News:

Coty (NYSE: COTY) (Paris: COTY), one of the world’s largest

beauty companies with a portfolio of iconic brands across

fragrance, color cosmetics, and skin and body care, today announced

preliminary Q1 results while reiterating its full year profit

target.

The global beauty market has maintained solid but slightly lower

global growth. Within this backdrop, the prestige fragrance

category continues to outperform, supported by expansion in both

volumes and price/mix, while mass beauty continues to experience

slower growth trends fueled entirely by unit demand. While beauty

growth remains resilient in many parts of the world, the U.S.

market growth has slowed in the second half of Q1. For Coty, very

tight order and inventory management by retailers has resulted in

Coty’s sell-in tracking well below sell-out in a number of markets,

including in the U.S., as well as in Australia, China and Travel

Retail Asia, each of which account for only a low single digit

percentage of the Company’s business. Coty’s revenue growth across

other key markets has remained robust, growing by a mid single

digit to double digit percentage. In addition, due to its limited

exposure in China, Coty continues to be relatively less impacted by

the market there.

In total, Coty’s Q1 sales grew approximately 4-5% LFL, despite

the very elevated comparison of the prior year, though moderately

below its prior Q1 estimated growth of 6% LFL. Factoring in the

ongoing retailer caution and incrementally slower U.S. market, Coty

now anticipates Q2 LFL sales to grow moderately, with some growth

acceleration expected in the second half supported by easier prior

year comparisons, resumed alignment between sell-in and sell-out,

several strong launch initiatives in both divisions, and select

distribution expansion.

The combination of lower than anticipated order patterns in the

second half of Q1, the investments behind strong ROI sell-out

initiatives, the timing of certain fixed costs, and the profit

impact from the divestiture of the Lacoste license, are resulting

in Q1 adjusted EBITDA which is expected to be roughly flat to

moderately lower YoY despite strong gross margin expansion.

However, in anticipation of a more uncertain demand backdrop,

including cautious retailer behavior and a complex macroeconomic

environment, Coty is re-accelerating its cost reduction efforts

across all parts of the P&L to deliver savings well above the

initial FY25 target of approximately $75M. Through the combination

of continued sales growth, continuous gross margin expansion and

increased cost savings for FY25 and beyond, while maintaining

A&CP in the high 20s percentage, Coty continues to expect FY25

adjusted EBITDA to grow +9-11% YoY, consistent with prior guidance,

including resumed adjusted EBITDA growth in Q2. This adjusted

EBITDA growth target, in conjunction with continued though more

moderate revenue growth, reflects an even stronger adjusted EBITDA

margin expansion in FY25, following the 30 bps adjusted EBITDA

margin expansion in FY24. Coty continues to target leverage close

to 2.5x exiting CY24, though the tight inventory management by

retailers is adding some variability on cash inflow timing.

Coty will publish its full set of Q1 results and its prepared

remarks webcast on November 6, 2024, with a live Q&A call for

financial analysts and investors on November 7, 2024.

About Coty Inc.'s Preliminary First Quarter Results

The above information includes the Company’s preliminary

estimates of results for the three months ended September 30, 2024,

based on currently available information. Neither Deloitte &

Touche LLP, the Company’s independent auditors, nor any other

independent accountants, have compiled, examined, or performed any

procedures with respect to the preliminary estimates contained

herein, nor have they expressed any opinion or any other form of

assurance on such information or its achievability, and assume no

responsibility for, and disclaim any association with, the

preliminary estimates. The Company has not completed its internal

closing procedures and related controls with respect to the

financial information for the three months ended September 30, 2024

presented above. In connection with its quarterly closing and

review, the Company may identify items that would require it to

make adjustments to the preliminary estimates set forth above and

such adjustments may be significant. As a result, the Company’s

final results for the period may vary from the preliminary

estimates presented above. The Company’s actual results will not be

finalized until around November 6, 2024 and may differ materially

from the above estimates. Accordingly, you should not place undue

reliance upon these preliminary estimates. See “Forward-Looking

Statements.”

In addition, the Company’s expected LFL Sales growth adjusted

EBITDA are forward-looking non-GAAP financial measures. The Company

does not provide reconciliations of such forward-looking non-GAAP

measures to GAAP due to the inherent difficulty in forecasting and

quantifying certain amounts that are necessary for such

reconciliation, including adjustments that could be made for the

charges reflected in our reconciliation of historic numbers, the

amount of which, based on historical experience, could be

significant.

About Coty Inc.

Founded in Paris in 1904, Coty is one of the world’s largest

beauty companies with a portfolio of iconic brands across

fragrance, color cosmetics, and skin and body care. We serve

consumers around the world, selling prestige and mass market

products in more than 125 countries and territories. Coty and our

brands empower people to express themselves freely, creating their

own visions of beauty; and we are committed to protecting the

planet. Learn more at coty.com or on LinkedIn and Instagram.

Forward Looking Statements

This press release includes certain statements that may be

deemed to be “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and are intended

to be covered by the safe harbor provisions thereof. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and actual results or

developments may differ materially, and we caution you not to place

undue reliance on such statements. Forward-looking statements are

generally identifiable by words or phrases, such as “anticipate”,

“are going to”, “estimate”, “plan”, “project”, “expect”, “believe”,

“intend”, “foresee”, “forecast”, “will”, “may”, “should”,

“outlook”, “continue”, “temporary”, “target”, “aim”, “potential”,

“goal” and similar words or phrases.

Forward-looking statements contained in this press release are

based on certain assumptions and estimates that we consider

reasonable, but are subject to a number of risks and uncertainties,

many of which are beyond our control, which could cause actual

events or results (including our financial condition, results of

operations, cash flows and prospects) to differ materially from

such statements. Factors and risks to our business that could cause

actual results to differ from those contained in the

forward-looking statements include the risks and uncertainties

described in our filings with the Securities and Exchange

Commission. These forward-looking statements are made only as of

the date of this release, and Coty does not undertake any

obligation, other than as may be required by applicable law, to

update or revise any forward-looking or cautionary statements to

reflect changes in assumptions, the occurrence of events,

unanticipated or otherwise, or changes in future operating results

over time or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014939691/en/

For more information: Investor

Relations Olga Levinzon, +1 212 389-7733

olga_levinzon@cotyinc.com

Media Antonia

Werther, +31 621 394495 antonia_werther@cotyinc.com

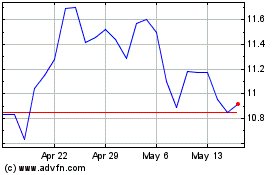

Coty (NYSE:COTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Coty (NYSE:COTY)

Historical Stock Chart

From Jan 2024 to Jan 2025