Details Serious Concern with the Board’s

Decision to Effect a Debt-Financed Share Repurchase and Institute a

Poison Pill

Believes that the Board’s Recent Decisions

Expose Shareholders to Unnecessary Financial and Strategic

Risks

Contends the Board’s Decisions do not Benefit

All Shareholders

Danaos Corporation (“Danaos,” “we,” or “us”) (NYSE:DAC), one of

the world’s largest independent owners of containerships and the

largest shareholder of Eagle Bulk Shipping, Inc. (the “Company” or

“Eagle Bulk”) (NYSE:EGLE) with ownership of approximately 16.7% of

the outstanding shares, has issued a letter to the Board of

Directors of Eagle Bulk (the “Board”) in response to the Company’s

repurchase of Oaktree Capital’s (“Oaktree”) 28% stake in the

Company and unilateral adoption of a poison pill.

The full text of the letter issued to the Board follows:

A LETTER TO THE BOARD OF DIRECTORS OF

EAGLE BULK SHIPPING, INC. (EGLE)

June 26, 2023

Dear Members of the Board,

Danaos Corporation (“Danaos” or “we”) is the largest shareholder

of Eagle Bulk Shipping, Inc. (“Eagle Bulk”, “EGLE”, or the

“Company”), maintaining a 16.7% equity stake in the Company. As you

are likely aware, we are one of the largest independent owners of

modern, large-size containerships, chartering our fleet to many of

the world’s largest liner companies, and have been operating in the

maritime sector for over 50 years. Before making our initial

investment in the Company, we approached its management and

conveyed that our intention was to invest in the Company in the

open market and that a key consideration in our investment in the

Company was its sound track record in corporate governance. We

indicated our desire to work collaboratively and constructively

with the Board and believed that our intention was

reciprocated.

We were therefore surprised to see the announcement of the

Company’s recent repurchase of Oaktree Capital’s (“Oaktree”) entire

28% stake in the Company at nearly a 35% premium to the Company’s

45-day average share price and its decision to adopt a poison pill

without seeking prior shareholder approval. It goes without saying,

these transactions fundamentally alter the makeup of the Company.

As a result of the repurchase of Oaktree’s shares, there are

9,283,499 common shares outstanding and we now own 16.7% of the

Company’s shares, an increase from the approximately 11.3% we

purchased in open market transactions. Additionally, we are now

prohibited from purchasing any additional shares without triggering

the Company’s recently adopted poison pill. Since these actions

were taken by the Board, Eagle Bulk shares have declined by nearly

6%, which appears to provide a preliminary assessment of the

market’s reaction. We are concerned with these recent developments

and are seeking clarification to the following questions from the

Board:

1. How Does Repurchasing $219 million repurchase of Oaktree’s

stake protect all shareholders from disruption?

In the Company’s June 22, 2023 press release, Chairman Paul

Leand stated that the repurchase of Oaktree’s stake “ensures that

[Eagle Bulk] shareholders maintain the opportunity to realize the

value of their investment . . . and eliminates any potential

disruption resulting from the sale of [Oaktree’s 28% stake] in the

Company.” Implicit in the Company’s rationale for engaging in the

share purchase at the $58 per share price is the possibility that

Oaktree might indiscriminately sell its stake in Company in the

open market, negatively impacting the Company’s share price.

Accordingly, the Company is seemingly providing justification for

using all means at its discretion to repurchase Oaktree’s large

holdings, including increasing its debt burden and repurchasing

shares at a significant premium to the prevailing market price. It

is not clear, however, that a credible threat warranting such a

drastic response existed. In particular, if Oaktree truly wanted to

sell out of its position at the Company, it would have likely had

to do so at a materially lower price than the 45-day moving average

price of approximately $43.04. This would clearly not be in the

best interests of Oaktree.

Oaktree materially benefited by selling its significant stake at

a nearly 35% premium to Eagle’s 45-day average share price. We

struggle to understand how the Company’s decision to repurchase

Oaktree’s shares benefits all Eagle Bulk shareholders and question

whether the decisions taken by the Company were the most effective,

considered, or beneficial route for all shareholders. Rather, we

are concerned that the share repurchase and preferential treatment

afforded to Oaktree exposed Eagle Bulk’s remaining shareholders to

unnecessary strategic and financial risk. Indeed, the risk to

finance the repurchase with debt is shared by the Company’s

remaining shareholders.

2. How did the Board determine the fairness of the $58 per

share price offered to Oaktree and why weren’t other shareholders

afforded the same opportunity to tender their shares at that

price?

We struggle to understand why the Board engaged in this private

transaction when it could have pursued more egalitarian methods,

such as a tender offer directed towards all shareholders. Since the

start of 2017, the Company’s shares have traded above $58 for a

total of 90 days, or just 5.5% of total trading days. It seems

inherently unfair to us that the Company’s remaining shareholders

were not given the same opportunity to tender their shares at the

elevated price while simultaneously bearing the burdens of

financing the share repurchase.

While the Board justifies the significant premium paid to

Oaktree by stating that the purchase price represented a discount

to NAV, there seems to a significant difference between the fair

market value of the Company’s fleet, as calculated by two

third-party brokers as of June 12, 2023, and the GAAP value

ascribed to the fleet by the Company as of March 31, 2023. This is

particularly notable as the Company’s benchmark Baltic Supramax

Index has declined significantly since March 31, 2023 and quoted

vessel values have declined as well.

3. What is the true rationale for adopting the poison pill

and how does it protect Eagle Bulk shareholders?

The Company described the implementation of the poison pill as

reducing “…the likelihood that any person or group gains control of

the Company through open market accumulation, or other abusive

tactics potentially disadvantaging the interests of all

shareholders, without paying all shareholders an appropriate

control premium or providing the Company’s Board of Directors

sufficient time to make informed decisions in the best interest of

all shareholders.”

To our knowledge, we are the only shareholder that is now

effectively prohibited from purchasing any additional shares.

Again, our intention has only been to work collaboratively and

constructively with the Board and Eagle Bulk management. We

informed management of our intentions before purchasing our shares

in the open market. Perhaps the Board could elaborate on how an

open market purchase followed by a prompt 13G filing constitutes an

abusive tactic especially in light of the Board’s preferential deal

with Oaktree?

We struggle to see how the poison pill truly accomplishes the

Company’s stated goal of avoiding “abusive tactics” and are

concerned with where the share repurchase and poison pill leave us

as well as the Company’s other remaining shareholders. To this

point, we note that it is also peculiar that the Board is only now

adopting this poison pill (which is triggered at 15%) given the

fact that Oaktree was long permitted to maintain its significant

28% stake without a similarly threatening response from the Board.

Oaktree is a $164 billion enterprise with control positions in

multiple public shipping companies. They have the knowledge and

means to acquire the Company, but no poison pill was in place to

prevent them from doing so.

Finally, a less obvious but equally harmful consequence of the

poison pill is the limitation it places on the rights of the

remaining Eagle Bulk shareholders by limiting their ability to

communicate openly about their investments in the Company. For

example, the poison pill precludes us from having productive

discussions with other Eagle Bulk shareholders regarding the

significant value that could be unlocked over the fear that our

conversations with potentially like-minded Eagle Bulk shareholders

will trigger the poison pill’s dilution provisions. Given our

extensive knowledge of the shipping industry, we feel that we must

be able to communicate our views with the Company’s shareholders at

large to facilitate growth in shareholder value. The Board’s

defensive measure to adopt the poison pill without seeking the

prior approval of shareholders raises the question of whether the

Board is truly acting in the best interests of stockholders. We

can’t buy more stock, and the Company seeks to curtail our ability

to share our opinions absent a public forum.

Conclusion

As Eagle Bulk’s current largest shareholder, we have a strong

vested interest in seeing the Company enhance long-term shareholder

value and believe that we have a duty to speak up when we think the

Board and/or management may be acting outside the best interests of

all shareholders. Accordingly, we are committed to working

constructively with the Board to identify balanced,

well-considered, and effective methods to enhance shareholder value

on behalf of all shareholders. We look forward to constructive

engagement with the Board on moving the Company forward in a

positive direction.

Sincerely,

Danaos Corporation

About Danaos Corporation

Danaos Corporation is one of the largest independent owners of

modern, large-size containerships. Our current fleet of 68

containerships aggregating 421,293 TEU and 10 under construction

containerships aggregating 74,914 TEU ranks Danaos among the

largest containership charter owners in the world based on total

TEU capacity. Our fleet is chartered to many of the world's largest

liner companies on fixed-rate charters. Our long track record of

success is predicated on our efficient and rigorous operational

standards and environmental controls. Danaos Corporation's shares

trade on the New York Stock Exchange under the symbol "DAC".

Cautionary Statements

Statements contained in this press release that are not

historical facts are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include words or phrases such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

“project,” “could,” “may,” “might,” “should,” “will” and similar

words and specifically include statements relating to future

financial performance and shareholder value. Forward-looking

statements are aspirational and are not guarantees or promises that

such expectations, plans, or goals will be met. They are also

subject to numerous risks, uncertainties and assumptions that may

cause actual results to vary materially from those indicated. Each

forward-looking statement speaks only as of the date of the

particular statement and we undertake no obligation to update or

revise any forward-looking or other statements, except as required

by law and notwithstanding any historical practice of doing so.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230626926926/en/

Evangelos Chatzis Chief Financial Officer Danaos Corporation

Athens, Greece +30 210 419 6480 cfo@danaos.com

Iraklis Prokopakis Senior Vice President and Chief Operating

Officer Danaos Corporation Athens, Greece +30 210 419 6400

coo@danaos.com

Investor Relations and Financial Media Rose & Company

New York 212-359-2228 danaos@rosecoglobal.com

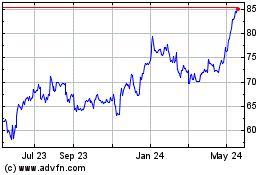

Danaos (NYSE:DAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

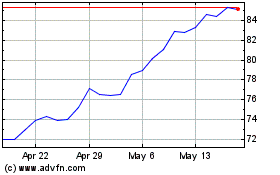

Danaos (NYSE:DAC)

Historical Stock Chart

From Dec 2023 to Dec 2024