BNY Mellon Municipal Bond Closed-End Funds Declare Distributions

02 March 2023 - 8:29AM

Business Wire

BNY Mellon Investment Adviser, Inc. announced today that BNY

Mellon Municipal Income, Inc., BNY Mellon Strategic Municipal Bond

Fund, Inc. and BNY Mellon Strategic Municipals, Inc. (each, a

"Fund") have declared a monthly distribution for each Fund's common

shares as summarized below. The distributions are payable on March

31, 2023 to shareholders of record on March 16, 2023, with an

ex-dividend date of March 15, 2023.

Fund

Ticker

Monthly

Distribution Per Share

Change from Prior Monthly

Distribution Per Share

BNY Mellon Municipal Income,

Inc.

DMF

$0.015

($0.006)

BNY Mellon Strategic Municipal

Bond Fund, Inc.

DSM

$0.022

--

BNY Mellon Strategic Municipals,

Inc.

LEO

$0.023

--

The distribution reduction for BNY Mellon Municipal Income, Inc.

primarily reflects the lower interest rate environment that has

existed in the market for the reinvestment of the proceeds from

coupon payments and from called, sold and/or matured securities

that are held, or may be held, by the Fund and from the higher cost

of borrowings currently being borne by the Fund. The $0.015 per

share investment income dividend represents a decrease of $0.006

from the previously declared monthly net investment income dividend

of $0.021 per share.

Important Information

BNY Mellon Investment Adviser, Inc., the investment adviser for

the Fund, is part of BNY Mellon Investment Management. BNY Mellon

Investment Management is one of the world’s largest asset managers,

with $1.8 trillion in assets under management as of December 31,

2022. Through an investor-first approach, BNY Mellon Investment

Management brings to clients the best of both worlds: specialist

expertise from seven investment firms offering solutions across

every major asset class, backed by the strength, stability, and

global presence of BNY Mellon. Additional information on BNY Mellon

Investment Management is available on www.bnymellonim.com.

BNY Mellon Investment Management is a division of BNY Mellon,

which has $44.3 trillion in assets under custody and/or

administration as of December 31, 2022. BNY Mellon can act as a

single point of contact for clients looking to create, trade, hold,

manage, service, distribute or restructure investments. BNY Mellon

is the corporate brand of The Bank of New York Mellon Corporation

(NYSE: BK). Additional information is available on

www.bnymellon.com. Follow us on Twitter @BNYMellon or visit our

newsroom at www.bnymellon.com/newsroom for the latest company

news.

Closed-end funds are traded on the secondary market through one

of the stock exchanges. The Fund investment returns and principal

values will fluctuate so that an investor’s shares may be worth

more or less than the original cost. Shares of closed-end funds may

trade above (a premium) or below (a discount) the net asset value

(NAV) of the fund’s portfolio. There is no assurance that the Fund

will achieve its investment objective.

This release is for informational purposes only and should not

be considered as investment advice or a recommendation of any

particular security.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230301005915/en/

For Press Inquiries: BNY Mellon Investment Adviser, Inc.

Courtney Woolston (212) 635-6027 For Other Inquiries: BNY Mellon

Securities Corporation The National Marketing Desk 240 Greenwich

Street New York, New York 10286 1-800-334-6899

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Dec 2024 to Jan 2025

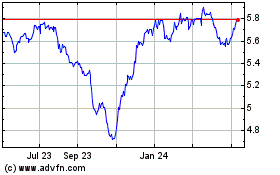

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Jan 2024 to Jan 2025