Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

13 April 2022 - 8:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2022

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

Ciudad de Buenos Aires, Abril 12th,

2022

Messrs.

COMISIÓN NACIONAL DE VALORES

Argentine Securities and Exchange Commission

Issuers´ Sub-Management Office

25 de Mayo 175

City of Buenos Aires

BOLSAS Y MERCADOS ARGENTINOS SA

Sarmiento 299

City of Buenos Aires

Ref:

EDENOR S.A. – Material Fact. Offer to exchange outstanding 9.75% Senior Notes due 2022

and newly issued 9.75% Senior Notes due 2025

Dear Sirs,

I hereby address you on

behalf of Empresa Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.) (the "Company") in compliance with current

regulations, in order to inform that on this day the Company has launched an offer to exchange any and all of our outstanding 9.75% Senior

Notes due on October 22nd, 2022 (the “Existing Notes”) for the applicable amount of newly issued 9.75% Senior Notes

due 2025 (the “New Notes”) and cash within our U.S.$750,000,000 Global Medium Term Note Program for the issuance of obligaciones

negociables simples no convertibles en acciones (simple, non-convertible negotiable obligations) authorized by the CNV by Resolution No.

20,503 dated October 23, 2019 and by Resolution No. DI-2022-4APN-GE#CNV dated April 8, 2022 (the “Program”).

The details of the applicable

terms and conditions of the New Notes are described in the Aviso de Suscripción y Canje (Press Release) and in the Suplemento de

Prospecto y Canje (Exchange Offering Memorandum) filed in the CNV website (Autopista de Información Financiera) under ID numbers

2879038 and 2879011 (https://www.cnv.gov.ar/sitioweb/empresas?seccion=buscador).

Yours faithfully,

Silvana E Coria

Investor Relations Officer

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima

(EDENOR S.A.)

Avda. del Libertador 6363 – Buenos Aires, C1428ARG – Argentina.

Tel.: 4346-5400 Fax: 4346-5327

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

April 13, 2022

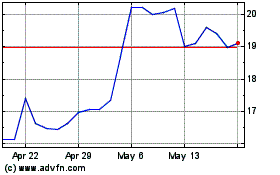

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

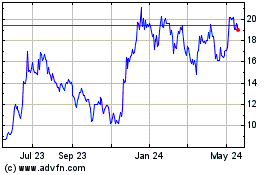

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024