false000180373700018037372024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 7, 2024

Enhabit, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-41406 | 47-2409192 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

6688 N. Central Expressway, Suite 1300, Dallas, Texas 75206

(Address of principal executive offices, including zip code)

(214) 239-6500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | EHAB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Chief Financial Officer Appointment

On November 7, 2024, Enhabit, Inc. (the “Company” or “Enhabit”) announced the appointment of Ryan Solomon to serve as Chief Financial Officer (“CFO”), effective December 9, 2024. Mr. Solomon, age 45, brings over 20 years of corporate strategy and finance experience, including eight years as CFO in the home health and hospice space and other industries. Mr. Solomon previously served as CFO of AccentCare, a national leader in home health services, personal care services and hospice care, from February 2020 to October 2023. At AccentCare, Mr. Solomon was responsible for financial planning, accounting, tax, treasury, revenue cycle, corporate development, and internal audit—functions he will also oversee at Enhabit. Mr. Solomon will also leverage his experience in building successful finance teams, systems integration, mergers and acquisitions, and operational business planning. Mr. Solomon joins Enhabit after serving most recently as CFO of Aspirion, a leading technology-enabled healthcare revenue cycle management provider for revenue integrity and complex claims, since October 2023. Prior to his roles at AccentCare and Aspirion, Mr. Solomon held roles with increasing responsibility in finance and strategic planning at Apple Leisure Group, an international multi-billion-dollar hospitality conglomerate that he ultimately served as CFO from January 2018 to February 2020; Alcon Laboratories and American Airlines.

There are no arrangements or understandings between Mr. Solomon and any other persons pursuant to which he was selected as CFO. There are also no family relationships between Mr. Solomon and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction with the Company required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with his employment, Mr. Solomon:

•will be paid an annual base salary of $500,000;

•will participate in the Company’s Senior Management Bonus Plan with a target cash bonus of 70% of annual base salary, prorated in the first year;

•will participate in the Company’s Long-Term Incentive Plan and receive annual long-term incentive awards with a target annual equity grant of 125% of annual base salary;

•will be awarded restricted stock units (the “RSU Award”) with a value equal to $1,000,000, which will vest 50% on the first anniversary of the date of grant, 25% on the second anniversary of the date of grant, and 25% on the third anniversary of the date of grant;

•will receive a one-time lump sum cash payment upon hire in the amount of $300,000, subject to a two-year clawback for voluntary departure without good reason or termination for cause;

•will participate in the Executive Change in Control Benefits Plan, which describes the duties and obligations of the Company and Mr. Solomon upon a change in control event;

•will participate in the Executive Severance Plan, which describes the duties and obligations of the Company and Mr. Solomon if employment is terminated by Mr. Solomon for Good Reason or by the Company other than for Cause (each as defined in the Executive Severance Plan); and

•will enter into a Restrictive Covenants Agreement, which describes the confidentiality, non-competition and non-solicitation obligations of Mr. Solomon during his employment with the Company and for 12 months following termination, whether voluntary or involuntary.

With respect to the Executive Change in Control Benefits Plan and Executive Severance Plan, in the event of Mr. Solomon’s termination without Cause, or his resignation for Good Reason (each as defined in the respective plans), Mr. Solomon is entitled to receive a cash severance payment in the amount of 1.75 times his annual base salary, benefit plan continuation for 12 months, and vesting of a prorated portion of any then-unvested equity awards, subject to Mr. Solomon’s execution of a restrictive covenant and release agreement.

The foregoing descriptions of the Executive Change in Control Benefits Plan, Executive Severance Plan, and Restrictive Covenants Agreement are qualified in their entirety by reference to the full text of such agreements which are filed as Exhibits 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The RSU Award and long-term incentive awards will be subject to the terms and conditions set forth in the Enhabit, Inc. 2022 Omnibus Performance Incentive Plan (the “Incentive Plan”). Time-based restricted stock units and performance-based restricted stock units will be further subject to the terms and conditions set forth on the Form of Restricted Stock Unit Agreement (the “RSU Agreement”) and the Form of Performance-Based Restricted Stock Unit Agreement (the “PRSU Agreement”), each adopted pursuant to the Incentive Plan. The Incentive Plan, the RSU Agreement, and the PRSU Agreement are filed as Exhibits 10.4, 10.5, and 10.6, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.*

A copy of the press release issued by the Company on November 7, 2024, announcing Mr. Solomon’s appointment is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

* The information in Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified as being incorporated therein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ENHABIT, INC. |

| By: | /s/ Dylan C. Black |

| Name: | Dylan C. Black |

| Title: | General Counsel |

Dated: November 7, 2024

Exhibit 10.3

ENHABIT, INC.

RESTRICTIVE COVENANTS AGREEMENT

This RESTRICTIVE COVENANTS AGREEMENT (“Agreement”) is entered into as of ________ _____, 2024 (the “Effective Date”), by and between Advanced Homecare Management, LLC, on behalf of itself, and its current, past, and future parents, subsidiaries, and other corporate affiliates, and its or their successors or assigns (collectively referred to herein as “the Company”), and the undersigned employee (“Employee”). The Company and Employee shall be referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, in connection with Employee’s executive-level position, Employee will receive access to certain information concerning the Company which is non-public, confidential, or proprietary in nature and the Company wishes to protect and preserve the confidentiality of such information; and

WHEREAS, Employee acknowledges that a breach of this Agreement by Employee can materially damage the Company and could result, among other things, in the termination of Employee’s employment with the Company.

NOW, THEREFORE, in return for Employee’s employment or continued employment by the Company, Employee’s access to certain Confidential Information (defined below), the compensation received by Employee from the Company, and other good and valuable consideration, the receipt and sufficiency which Employee hereby acknowledges, Employee acknowledges and agrees as follows:

1.Confidential Information.

(a)Employee understands and acknowledges that based on Employee’s executive-level position with the Company, during Employee’s employment with the Company, Employee will have access to and learn about certain Confidential Information which is not known to the Company’s competitors or within the Company’s industry generally, which was developed by the Company over a period of time and/or at its substantial expense, and which is of great competitive value to the Company. For purposes of this Agreement, “Confidential Information” includes, but is not limited to, all information not generally known to the public, in spoken, printed, electronic, or any other form or medium, relating directly or indirectly to: business processes, practices, methods, policies, plans, documents, research, operations, services, strategies, techniques, agreements, contracts, terms of agreements, transactions, potential transactions, negotiations, including pending negotiations, business plans, know-how, trade secrets, applications, operating systems, work-in-process, technologies, databases, compilations, device configurations, metadata, manuals, records, systems, materials, financial information, results, accounting information, legal information, marketing information, advertising information, personnel information, employee lists, supplier lists, vendor lists, developments, reports, internal controls, security procedures, market studies, revenue, costs, notes, communications, ideas, inventions, unpublished patent applications, original works of authorship, discoveries, experimental processes and/or results, specifications, customer information, customer lists, client information, client lists, investor information, third-party information that has been entrusted to the Company in confidence, and other business information disclosed or made available to Employee by the Company, either directly or indirectly, in writing, orally, or by observation, that is not known to the public or to the Company’s competitors or within the Company’s industry generally, which was developed by the Company at its expense, and which is of value to the Company. Employee understands that the above list is not exhaustive, and that Confidential Information also includes other information that is marked or otherwise identified or treated as confidential or proprietary, or that would otherwise appear to a reasonable person to be confidential or proprietary in the context and circumstances in which the information is known or used. Employee further understands and agrees that Confidential Information includes information developed by Employee in the course of Employee’s employment by the Company as if the Company furnished the same Confidential Information to Employee in the first instance. Confidential Information shall not include information that is generally available to and known by the public at the time of disclosure to Employee, provided that the disclosure is through no direct or indirect fault of Employee or person(s) acting on Employee’s behalf.

(b)Creation and Use of Confidential Information. Employee understands and acknowledges that the Company has invested, and continues to invest, substantial time, money, and specialized knowledge into developing its resources, creating a customer base, generating customer and potential customer lists, training its employees, and improving its offerings in the field of home health, hospice, private duty and related business. Employee understands and acknowledges that as a result of these efforts, the Company has created and continues to use and create

Confidential Information. This Confidential Information provides the Company with a competitive advantage over others in the marketplace.

(c)Disclosure and Use Restrictions. Employee agrees and covenants: (1) to treat all Confidential Information as strictly confidential; (2) not to directly or indirectly disclose, publish, communicate, or make available Confidential Information, or allow it to be disclosed, published, communicated, or made available, in whole or part, to any entity or person whatsoever (including other employees of the Company) not having a need to know and authority to know and use the Confidential Information in connection with the business of the Company and, in any event, not to anyone outside of the direct employ of the Company except as required in the performance of Employee’s authorized employment duties to the Company acting on behalf of the Company in each instance (and then, such disclosure shall be made only within the limits and to the extent of such duties or consent); and (3) not to access or use any Confidential Information, and not to copy any documents, records, files, media, or other resources containing any Confidential Information, or remove any such documents, records, files, media, or other resources from the premises or control of the Company, except as required in the performance of Employee’s authorized employment duties to the Company acting on behalf of the Company in each instance (and then, such disclosure shall be made only within the limits and to the extent of such duties or consent). Employee understands and acknowledges that Employee’s obligations under this Agreement regarding any particular Confidential Information begins immediately when Employee first has access to the Confidential Information and shall continue during and after Employee’s employment by the Company until the time that the Confidential Information has become public knowledge other than as a result of Employee’s breach of this Agreement or breach by those acting in concert with Employee or on Employee’s behalf.

(d)Defend Trade Secrets Act of 2016. Employee is hereby notified in accordance with the Defend Trade Secrets Act of 2016, that Employee will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney solely for the purpose of reporting or investigating a suspected violation of law, or is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding.

(e)Permitted Activities. Notwithstanding any other provision of this Agreement, (i) Employee may disclose Confidential Information when required to do so by a court of competent jurisdiction, by any governmental agency having authority over Employee or the business of the Company or by any administrative body or legislative body (including a committee thereof) with jurisdiction to order Employee to divulge, disclose or make accessible such information; and (ii) nothing in this Agreement is intended to interfere with Employee’s right to (A) report possible violations of state or federal law or regulation to any governmental or law enforcement agency or entity; (B) make other disclosures that are protected under the whistleblower provisions of state or federal law or regulation; (C) file a claim or charge with any governmental agency or entity; or (D) testify, assist, or participate in an investigation, hearing, or proceeding conducted by any governmental or law enforcement agency or entity, or any court. For purposes of clarity, in making or initiating any such reports or disclosures or engaging in any of the conduct outlined in subsection (ii) above, Employee may disclose Confidential Information to the extent necessary to such governmental or law enforcement agency or entity or such court, need not seek prior authorization from the Company, and is not required to notify the Company of any such reports, disclosures or conduct.

2.Restrictive Covenants. In consideration for (i) the Company’s promise to provide Confidential Information to Employee, (ii) the substantial economic investment made by the Company in the Confidential Information and goodwill of the Company, and/or the business opportunities disclosed or entrusted to Employee, (iii) access to the Company’s customers and clients, and (iv) the Company’s employment of Employee and the compensation and other benefits provided by the Company to Employee, to protect the Company’s Confidential Information and the business goodwill of the Company, Employee agrees to the following restrictive covenants:

(a)Non-Competition. Employee agrees and covenants, other than in connection with Employee’s duties for the Company, during the Restricted Period (defined below), Employee shall not, and shall not use any Confidential Information to, directly or indirectly, either individually or as a principal, partner, stockholder, manager, agent, advisor, consultant, contractor, volunteer, distributor, employee, lender, investor, or as a director or officer of any corporation, entity or association, or in any other manner or capacity whatsoever, (1) own, control, manage, operate, establish, take steps to establish, lend money to, invest in, solicit investors for, or otherwise provide capital to, or (2) become employed by, own, operate, manage, join, perform services for, consult for, do business with or otherwise engage in, any Competing Business within the Restricted Territory. For purposes of this Agreement, the following definitions shall apply:

(i)“Restricted Period” means the period of Employee’s employment with the Company and 12 months immediately following the termination of Employee’s employment with the Company, regardless of the reason for the termination, whether voluntary or involuntary.

(ii)“Restricted Territory” means any geographical area or territory in the United States within a 75-mile radius of where the Company and/or any subsidiary of the Company operates and for or within which Employee performed any services for the Company or for which Employee had any responsibility or about which Employee received Confidential Information during the last twenty-four (24) months of Employee’s employment with the Company.

(iii)“Competing Business” means (i) any business in competition with the Company or engaged in the same or similar business as the Company, including, but not limited to, the home health, hospice, private duty, personal care, home care, personal assistance business as well as any business or services associated with or related to the foregoing; (ii) any other business in which the Company engages during Employee’s employment and for which Employee performed any services or had any responsibility; and (iii) any business the Company seriously contemplated conducting during the last 12 months of Employee’s employment with the Company.

Nothing in this Agreement shall prohibit Employee from purchasing or owning less than five percent (5%) of the publicly traded securities of any corporation, provided that such ownership represents a passive investment, and that Employee is not a controlling person of, or a member of a group that controls, such corporation.

(b)Non-Solicitation of Employees. Employee understands and acknowledges that the Company has expended and continues to expend significant time and expense in recruiting and training its employees and that the loss of its employees would cause significant and irreparable harm to the Company. Accordingly, Employee agrees and covenants that during the Restricted Period, Employee shall not, directly or indirectly, solicit, hire, recruit, or attempt to solicit, hire, or recruit, any employee of the Company who is currently employed by the Company or has been employed by the Company in the 12 months preceding the last day of Employee’s employment (each a “Covered Employee”), or induce the termination of employment of any Covered Employee. This non-solicitation provision explicitly covers all forms of oral, written, or electronic communication, including, but not limited to, communications by email, regular mail, express mail, telephone, fax, instant message, and social media. This Section does not restrict or impede, in any way, and shall not be interpreted or understood as restricting or impeding, Employee from engaging in the conduct described in Section 1(e) of this Agreement.

(c)Non-Solicitation of Customers. Employee agrees that during the Restricted Period, other than in connection with Employee’s duties for the Company, Employee shall not, and shall not use any Confidential Information to, directly or indirectly, either as a principal, manager, agent, employee, consultant, officer, director, stockholder, partner, investor or lender or in any other capacity, and whether personally or through other persons, (1) solicit business, or attempt to solicit business, from any Customer or Prospective Customer, (2) interfere with, or attempt to interfere with, the Company’s relationship, contracts or business with any Customer or Prospective Customer, or (3) induce or persuade in any manner, or attempt to induce or persuade, any Customer or Prospective Customer to curtail or cancel any business or contracts with the Company. For purposes of this Section, “Customer or Prospective Customer” means any customer or prospective customer with whom the Company did business during Employee’s employment or whom the Company solicited within the 12 month period preceding Employee’s termination from employment, and whom or which: (1) Employee contacted, called on, serviced or did business with during Employee’s employment with the Company; (2) Employee learned of as a result of Employee’s employment with the Company; or (3) about whom Employee received Confidential Information. This restriction applies only to business which is in the scope of services or products provided by the Company or an affiliate thereof.

(d)Non-Disparagement. Employee agrees and covenants that Employee will not at any time make, publish, or communicate to any person or entity or in any public forum any defamatory or disparaging remarks, comments, or statements concerning the Company or its businesses, or any of its employees, officers, Customer or Prospective Customers, suppliers, investors, and other associated third parties. This Section does not restrict or impede, in any way, and shall not be interpreted or understood as restricting or impeding, Employee from engaging in the conduct described in Section 1(e) of this Agreement.

3.Acknowledgments. Employee acknowledges and agrees that: (i) Employee’s services to be rendered to the Company are of a special and unique character; (ii) that Employee will obtain knowledge and skill relevant to the Company’s industry, methods of doing business, and marketing strategies by virtue of Employee's employment; (iii) that the restrictive covenants and other terms and conditions of this Agreement are reasonable and reasonably necessary to protect the legitimate business

interests of the Company; and (iv) that Employee will be reasonably able to earn a living without violating the terms of this Agreement; and (v) that Employee has the right to consult with counsel before signing this Agreement. Employee further acknowledges that: (1) the amount of Employee’s compensation reflects, in part, Employee’s obligations and the Company’s rights under this Agreement; (2) Employee has no expectation of any additional compensation, royalties, or other payment of any kind not otherwise referenced herein in connection herewith; and (3) Employee will not be subject to undue hardship by reason of Employee’s full compliance with the terms and conditions of this Agreement or the Company’s enforcement of it; and (4) this Agreement is not a contract of employment and shall not be construed as a commitment by either Party to continue an employment relationship for any certain time period.

The Parties acknowledge and agree that nothing in this Agreement shall be construed to in any way terminate, supersede, undermine, or otherwise modify the “at-will” status of the employment relationship between the Company and Employee, pursuant to which either the Company or Employee may terminate the employment relationship at any time, with or without cause, and with or without notice.

4.Remedies. Employee acknowledges that the restrictions contained in Section 1 and Section 2, in view of the nature of the Company’s businesses, are reasonable and necessary to protect the Company’s legitimate business interests, business goodwill and reputation, and that any violation of these restrictions would result in irreparable injury and continuing damage to the Company. Therefore, Employee agrees that the Company shall be entitled to a temporary restraining order and injunctive relief restraining Employee from the commission of any breach or threatened breach of Section 1 or Section 2, without the necessity of establishing irreparable harm or the posting of a bond, and to recover from Employee damages incurred by the Company as a result of the breach, as well as the Company’s attorneys’ fees, costs and expenses related to any breach or threatened breach of this Agreement and enforcement of this Agreement. Nothing contained in this Agreement shall be construed as prohibiting the Company from pursuing any other remedies available to it for any breach or threatened breach, including, without limitation, the recovery of money damages, attorneys’ fees, and costs. The existence of any claim or cause of action by Employee against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of the restrictive covenants contained in Section 1 or Section 2, or preclude injunctive relief.

5.Tolling. If Employee violates any of the restrictions contained in Section 2, the Restricted Period shall be suspended and shall not run in favor of Employee until such time that Employee cures the violation to the satisfaction of the Company and the period of time in which Employee is in breach shall be added to the Restricted Period applicable to such covenant(s).

6.Reasonableness. Employee hereby represents to the Company that Employee has read and understands and agrees to be bound by the terms of this Agreement, including the terms of Section 1 and Section 2. Employee understands that the covenants in Section 2 may limit Employee’s ability to engage in certain businesses anywhere in or involving the Restricted Territory during the Restricted Period, but Employee acknowledges that Employee shall receive Confidential Information, as well as sufficiently high remuneration and other benefits as an employee of the Company to justify such restrictions. Employee acknowledges that the geographic scope and duration of the restrictions and covenants contained in Section 2 are fair and reasonable in light of (i) the nature and wide geographic scope of the operations of the Company’s business; (ii) Employee’s level of control over and contact with the business in the Restricted Territory; and (iii) the amount of compensation and Confidential Information that Employee is receiving in connection with Employee’s employment with the Company in an executive-level position. It is the desire and intent of the Parties that the provisions of Section 1 and Section 2 be enforced to the fullest extent permitted under applicable law, whether now or hereafter in effect and therefore, to the extent permitted by applicable law, Employee and the Company hereby waive any provision of applicable law that would render any provision of Section 1 and/or Section 2 invalid or unenforceable.

7.IP Assignment.

(a)Ownership and Assignment of Developments. Employee hereby agrees to (i) assign to the Company any Developments and all rights therein, including all patents, copyrights, and other intellectual property rights, and waive all moral rights therein (to the extent legally permissible), and (ii) execute all documents and take all other actions reasonably requested by the Company to evidence, perfect, or maintain the Company’s ownership of the Developments. As used in this Agreement, “Developments” means all inventions, works of authorship, work product and improvements, whether or not patentable or copyrightable, created, conceived, acquired, developed or made by Employee before, on or after the date hereof, either solely or jointly, while in the employ of the Company (including any of its predecessors), and that: (i) relate, at the time of conception or reduction to practice, to the business or actual or anticipated research or development of the Company; (ii) result from any work performed by Employee for the Company; or (iii) were created or otherwise developed on the Company’s time or with the use of any equipment, supplies, facilities, or Confidential Information of the Company. All Developments shall be the property and

intellectual property of the Company and are “works made for hire” for purposes of the Company’s rights under copyright laws.

(b)Personal Materials. Employee will not use any information or materials that Employee owns (“Personal Materials”) when performing work for the Company, but to the extent that Employee does provide Personal Materials to the Company or uses Personal Materials in connection with his or her work for the Company, Employee hereby grants the Company a non-exclusive, perpetual, irrevocable, royalty free, fully paid, worldwide, sublicensable, transferable license to use, practice, make, have made, reproduce, modify, create derivative works from, display, and sell any such Personal Materials.

8.No Previous Restrictive Agreements. Employee represents that Employee is not bound by the terms of any agreement with any previous employer or other third party to refrain from using or disclosing any confidential, proprietary or trade secret information in the course of Employee’s employment with the Company or that contains any non-competition, non-solicitation and/or non-recruitment obligations. Employee further represents that the performance of Employee’s job duties for the Company does not and will not violate or breach any agreement with any previous employer or other party, or any legal obligation that Employee may owe to any previous employer or other party, including, without limitation, any non-disclosure, non-competition, non-solicitation and/or non-recruitment obligations. Employee shall not disclose to the Company or induce the Company to use any confidential, proprietary or trade secret information belonging to any previous employer or others.

9.Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective heirs, successors, legal representatives and permitted assigns. Employee may not assign this Agreement to a third party. The Company may assign its rights, together with its obligations hereunder, to any affiliate and/or subsidiary of the Company or any successor thereto or any purchaser of substantially all of the assets of the Company, without Employee’s consent and without advance notice.

10.Controlling Law and Venue. Any dispute in the meaning, effect, or validity of this Agreement and/or any dispute arising out of Employee’s relationship with the Company shall be resolved in accordance with the laws of the State of Texas without regard to the conflict of laws provisions thereof. Venue of any dispute arising out of, in connection with or in any way related to this Agreement shall be in a state district court of competent jurisdiction in Dallas County, Texas, or the United States District Court for the Northern District of Texas. Employee consents to personal jurisdiction of the state district courts of Dallas County, Texas and to the United States District Court for the Northern District of Texas for any dispute arising out of, in connection with or in any way related to this Agreement and agrees that Employee shall not challenge personal jurisdiction in such courts. Employee waives any objection that Employee may now or hereafter have to the venue or jurisdiction of any proceeding in such courts or that any such proceeding was brought in an inconvenient forum (and agrees not to plead or claim the same).

11.Waiver of Jury Trial. WITH RESPECT TO ANY DISPUTE BETWEEN EMPLOYEE AND THE COMPANY ARISING OUT OF, IN CONNECTION WITH OR IN ANY WAY RELATED TO THIS AGREEMENT, EMPLOYEE AGREES TO RESOLVE SUCH DISPUTE(S) BEFORE A JUDGE OF COMPETENT JURISDICTION SITTING WITHOUT A JURY. EMPLOYEE HAS KNOWLEDGE OF THIS PROVISION, AND WILL PROVIDE SERVICES TO THE COMPANY THEREAFTER, HEREBY WAIVING EMPLOYEE’S RIGHT TO TRIAL BY JURY.

12.Modification and Waiver. No provision of this Agreement may be amended or modified unless the amendment or modification is agreed to in writing and signed by Employee and a duly authorized representative of the Company. No oral statements or other prior written material not specifically incorporated into this Agreement shall be of any force or effect, and no changes in or additions to this Agreement shall be recognized, unless incorporated into this Agreement by written amendment, such amendment to become effective on the date stipulated in it. No waiver by either Party of any breach of any condition or provision of this Agreement to be performed by the other Party shall be deemed a waiver of any other provision or condition at the same or any prior or subsequent time, nor shall the failure of or delay by either Party in exercising any right, power, or privilege under this Agreement operate as a waiver to preclude any other or further exercise of any right, power, or privilege.

13.Severability. Should any provision of this Agreement be held by a court of competent jurisdiction to be enforceable only if modified, or if any portion of this Agreement shall be held as unenforceable and thus stricken, that holding shall not affect the validity of the remainder of this Agreement, the balance of which shall continue to be binding on the Parties with any modification to become a part of and treated as though originally set forth in this Agreement. The Parties further agree that any such court is expressly authorized to modify any unenforceable provision of this Agreement instead of severing the unenforceable provision from this Agreement in its entirety, whether by rewriting the offending provision, deleting any or all of the offending provision, adding additional language to this Agreement, or by making any other modifications it deems warranted to carry out the intent and agreement of the Parties as embodied in this Agreement to the maximum extent permitted

by law. The Parties expressly agree that this Agreement as so modified by the court shall be binding upon and enforceable against each of them. Should one or more of the provisions of this Agreement be held to be invalid, illegal, or unenforceable in any respect, that invalidity, illegality, or unenforceability shall not affect any other provisions of this Agreement, and if such provision or provisions are not modified as provided above, this Agreement shall be construed as if such invalid, illegal, or unenforceable provisions had not been set forth in this Agreement.

14.Captions. Captions and headings of the sections and paragraphs of this Agreement are intended solely for convenience and no provision of this Agreement is to be construed by reference to the caption or heading of any section or paragraph.

15.Counterparts. This Agreement may be executed in multiple counterparts, whether or not all signatories appear on these counterparts, and each counterpart shall be deemed an original for all purposes.

16.Notice. If and when Employee’s employment with the Company terminates for any reason, whether voluntarily or involuntarily, Employee agrees to provide to any subsequent employer a copy of this Agreement. In addition, Employee authorizes the Company to provide a copy of this Agreement to third parties, including but not limited to, Employee’s subsequent, anticipated, or possible future employer.

17.Entire Agreement. This Agreement constitutes the entire agreement and understanding between the Parties, and fully supersede all prior and contemporaneous negotiations, understandings, representations, writings, discussions and/or agreements between the Parties, whether written or oral, pertaining to or concerning the subject matter of this Agreement.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date above.

| | | | | |

| ADVANCED HOMECARE MANAGEMENT, LLC |

| By: | |

| Name: | |

| Title: | |

| | | | | |

| EMPLOYEE |

| Signature | |

| Print Name: | Ryan Solomon |

Enhabit Home Health & Hospice Appoints Ryan Solomon as Chief Financial Officer

Seasoned Industry Executive Brings Significant Financial Operations Expertise and Track Record of Driving Growth and Value Creation

DALLAS, TX – November 7, 2024 – Enhabit, Inc. (NYSE: EHAB), (“Enhabit”), leading home health and hospice provider, today announced the appointment of Ryan Solomon as its next chief financial officer (CFO), effective Dec. 9, 2024. Mr. Solomon’s appointment follows the previously announced transition of Crissy Carlisle, CFO.

Mr. Solomon brings to Enhabit over 20 years of corporate strategy and finance experience, including eight years as CFO in the home health and hospice space and other industries. Mr. Solomon previously served as CFO of AccentCare, where he was responsible for financial planning, accounting, tax, treasury, revenue cycle, corporate development and internal audit—functions he will oversee at Enhabit. Mr. Solomon will also leverage his experience in building successful finance teams, systems integration, mergers and acquisitions and operational business planning. Mr. Solomon joins Enhabit after serving most recently as CFO of Aspirion, a leading technology-enabled health care revenue cycle management provider for revenue integrity and complex claims. Before his roles at AccentCare and Aspirion, Mr. Solomon held roles with increasing responsibility in finance and strategic planning at Apple Leisure Group, an international multi-billion-dollar hospitality conglomerate, where he ultimately served as CFO; Alcon Laboratories and American Airlines.

“Ryan’s experience in the home health and hospice space, along with his proven track record as a chief financial officer and his accomplishments in financial, operational and strategic leadership, make him ideally suited to serve as Enhabit’s next CFO,” said Barb Jacobsmeyer, president and CEO of Enhabit. “Ryan’s deep understanding of how to link financials with performance drivers aligns well with our objectives. The Enhabit team has worked hard to stabilize the business, and we look forward to benefiting from Ryan’s fresh perspectives to build on our momentum as we advance our position as a leading national home health and hospice provider.”

Mr. Solomon commented, “I have long admired the Enhabit team and the high-quality care they provide to their patients, and I am excited to join the company. Enhabit is at a pivotal point in its growth journey and is well-positioned to capitalize on the market opportunities ahead. I look forward to working with Barb and the rest of the leadership team to accelerate Enhabit’s mission of delivering high-quality and compassionate care to patients.”

Ms. Jacobsmeyer continued, “I am grateful for Crissy’s partnership, her contributions throughout her tenure, and her work to ensure a smooth transition of the CFO position. We wish her all the best in her next chapter.”

About Enhabit Home Health & Hospice

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what’s possible for patient care in the home. Enhabit's team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 256 home health locations and 112 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

Media contact

Erin Volbeda

media@ehab.com

972-338-5141

Investor relations contact

investorrelations@ehab.com

469-860-6061

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

Enhabit, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41406

|

| Entity Tax Identification Number |

47-2409192

|

| Entity Address, Address Line One |

6688 N. Central Expressway

|

| Entity Address, Address Line Two |

Suite 1300

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75206

|

| City Area Code |

214

|

| Local Phone Number |

239-6500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

EHAB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001803737

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

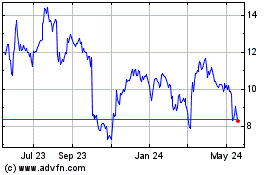

Enhabit (NYSE:EHAB)

Historical Stock Chart

From Jan 2025 to Feb 2025

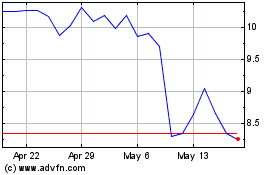

Enhabit (NYSE:EHAB)

Historical Stock Chart

From Feb 2024 to Feb 2025