Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

10 February 2024 - 6:57AM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on February 9, 2024

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

First Trust Specialty Finance

and Financial Opportunities Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a-6(i)(1) and 0-11. |

First Trust Specialty Finance

and Financial Opportunities Fund

February 9, 2024

Dear Shareholder:

I am contacting you to remind you to

vote FOR the proposed reorganization of First Trust Specialty Finance and Financial Opportunities Fund (FGB) (the “Fund”)

with and into abrdn Total Dynamic Dividend Fund (“AOD”) (the “Reorganization”) which will be considered

at the Fund’s special meeting of shareholders, scheduled for February 20, 2024.

INSTITUTIONAL SHAREHOLDER SERVICES

(“ISS”), THE LEADING INDEPENDENT PROXY ADVISORY FIRM, HAS RECOMMENDED THAT SHAREHOLDERS VOTE FOR THE APPROVAL OF THE

REORGANIZATION ON THE FUND’S WHITE PROXY CARD.

The Fund believes there are many

potential benefits of the Fund’s tax-free Reorganization into AOD, including:

| • | Lower Expense Ratio: AOD has a lower net total annual operating expense than your Fund. |

| • | Improved Trading: Shares of AOD have historically traded at meaningfully higher volumes at tighter

bid-ask spread percentages than those of your Fund. |

| • | Better Performance: AOD has outperformed your Fund on both a market value and net asset value basis

for the 5-year period ending December 31, 2023. Please refer to the Joint Proxy Statement/Prospectus for the full presentation of performance

of AOD and the Fund. |

The

Board of Trustees of the Fund (the “Board”) has unanimously recommended that shareholders vote FOR the approval of

the Reorganization.

To vote FOR the Reorganization, use the WHITE proxy card enclosed.

|

Vote the WHITE

proxy card.

Voting the WHITE proxy card will help your Fund obtain the needed approval

to consummate the Reorganization. |

|

|

Discard the GOLD

proxy card.

Saba Capital Management L.P. (“Saba”) is conducting

a self-interested counter-solicitation and is trying to derail the Reorganization. |

Saba is an activist hedge fund investor

using the Reorganization solely for its own economic interests. Saba was not a shareholder of record prior to the announcement of

the Reorganization, and cannot vote any of its after-the-fact acquired shares. Saba is trying to derail the Reorganization to

advance its own agenda at the expense of shareholders at-large. The Board urges you NOT to sign any proxy cards sent

to you by Saba. If you already signed a gold proxy card, you have the right as a shareholder of the Fund to change your vote before

the meeting takes place. You can do this by completing the WHITE proxy card sent to you by your Fund, which will replace

the gold proxy card you previously completed.

Do not let Saba hijack the

Reorganization to advance its own self-interested agenda. Vote FOR the Reorganization on the WHITE proxy card by following

the instructions contained therein. Regardless of the number of shares you own, it is important that your shares be represented

at the meeting by voting your proxy. The Board believes the Reorganization is in the overall best interests of the Fund’s

shareholders and unanimously recommends that you vote your shares “FOR” the approval of the Reorganization by

voting your WHITE proxy card.

If you have any questions, please contact the

Fund’s proxy solicitor, EQ Fund Solutions LLC, at (866) 796-7172 weekdays from 9:00 a.m. to 10:00 p.m. Eastern Time.

Thank you for your continued support.

Sincerely,

First

Trust Specialty Finance and Financial Opportunities Fund

_/s/ James A. Bowen

James A. Bowen

Chairman of the Board

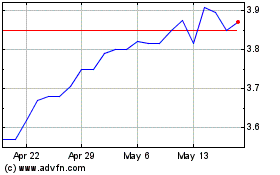

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Dec 2023 to Dec 2024