- Targeting $1.08 billion to $1.12 billion of Adjusted EBITDA(1)

in 2025

Six Flags Entertainment Corporation (NYSE: FUN), the largest

regional amusement park operator in North America, today announced

its results for the 2024 fourth-quarter and full year ended Dec.

31, 2024, and provided Adjusted EBITDA guidance for 2025.

On July 1, 2024, legacy Cedar Fair and legacy Six Flags closed

the merger transactions (the “Merger”) to form the new Six Flags

Entertainment Corporation (the “Company” or the “Combined

Company”). Legacy Cedar Fair has been determined to be the

accounting acquirer for financial statement purposes. Accordingly,

the reported results presented in this earnings release reflect the

financial results for the Combined Company from Sept. 30, 2024,

through Dec. 31, 2024. The reported results for the year ended Dec.

31, 2024, reflect combined operations for only July 1, 2024,

through Dec. 31, 2024, and include only legacy Cedar Fair’s results

(before giving effect to the Merger) for the first six months of

2024. Financial results and disclosures referring to periods prior

to July 1, 2024, include legacy Cedar Fair's results before giving

effect to the Merger, including the financial statements as of Dec.

31, 2023, and for the three and 12 months ended Dec. 31, 2023.

Fourth Quarter 2024

Highlights

- Total operating days were 878, of which 538 days were

contributed by the legacy Six Flags operations added in the

Merger.

- Net revenues totaled $687 million, $324 million of which

relates to the legacy Six Flags operations added in the

Merger.

- The net loss attributable to the Combined Company totaled $264

million, which included $3 million of net income from legacy Six

Flags operations added in the Merger, and net income margin was

negative 38.4%.

- Adjusted EBITDA(1) totaled $209 million, $113 million of which

relates to the legacy Six Flags operations added in the

Merger.

- Modified EBITDA margin(1) was 30.4%.

- Attendance totaled 10.7 million guests, 5.0 million of whom

attended legacy Six Flags parks added in the Merger.

- In-park per capita spending(2) was $61.60.

- Out-of-park revenues(2) totaled $48 million, $14 million of

which relates to legacy Six Flags operations added in the

Merger.

CEO Commentary

“Our strong fourth-quarter results reflect an outstanding

October performance and the incredible popularity of our fall and

Halloween themed events,” said Six Flags President and CEO Richard

A. Zimmerman. “We ended the year as the new Six Flags on a high

note, delivering on our goal of improving demand and increasing

in-park guest spending levels, while operating our parks more

efficiently. We successfully achieved more than $50 million in

gross cost synergies and drove meaningful improvement in guest

satisfaction scores and higher guest demand.”

Commenting on the outlook for the 2025 season, Zimmerman noted,

“In 2025, we are building on the momentum we established over the

second half of 2024 on both the revenue and cost fronts. We are

making progress toward realizing the remaining $70 million in

anticipated cost synergies from the merger, representing a targeted

4% reduction in operating costs and expenses, while advancing

strategic initiatives to drive attendance and guest spending levels

higher. We are seeing solid early demand trends, as evidenced by a

2% increase in attendance over the first two fiscal months of 2025

compared to combined attendance of the two legacy companies in the

prior year period, as well as a 3% increase in combined season pass

unit sales over that same period. We are focused on continuing to

drive guest demand as we reopen the remainder of our parks and are

thrilled to be introducing an exciting lineup of new rides and

attractions, including compelling new marketable products at 11 of

our 14 largest locations. Our investments in new thrills and

experience-enhancing initiatives demonstrate our commitment to

delivering world-class entertainment for guests and meaningful

growth and value creation for shareholders.”

Fourth Quarter 2024

Results

Operating days in the fourth quarter of 2024 totaled 878

days compared with 377 operating days for the fourth quarter of

2023. The increase in operating days reflects the addition of 538

operating days during the fourth quarter of 2024 at the legacy Six

Flags parks. That increase was partially offset by 37 fewer

operating days at the legacy Cedar Fair parks in the fourth quarter

of 2024 compared to the fourth quarter of 2023 primarily due to a

fiscal quarter calendar shift. The 2024 fourth quarter began on

Sept. 30, 2024, and ended on Dec. 31, 2024, while the prior 2023

fourth quarter began on Sept. 25, 2023, and ended on Dec. 31,

2023.

Net revenues for the fourth quarter ended Dec. 31, 2024,

increased $316 million to $687 million, compared to net revenues of

$371 million for the fourth quarter ended Dec. 31, 2023. The

increase in net revenues reflects $324 million in net revenues

contributed by the legacy Six Flags operations in the three months

ended Dec. 31, 2024, offset by $8 million in lower net revenues at

legacy Cedar Fair operations during the fourth quarter of 2024

compared to the prior year period. The decline in legacy Cedar Fair

net revenues was the direct result of fewer operating days due to

the fourth quarter fiscal calendar shift, which negatively impacted

net revenues by $36 million.

The $316 million increase in net revenues reflects the impact of

a 4.9-million-visit increase in attendance, an $11 million increase

in out-of-park revenues, and a $2.01, or 3%, increase in in-park

per capita spending. The 4.9 million-visit increase in attendance

included a 5.0-million-visit increase resulting from attendance at

the legacy Six Flags parks during the fourth quarter of 2024,

offset slightly by 115,000 fewer visits at the legacy Cedar Fair

parks. The decrease in fourth quarter attendance at the legacy

Cedar Fair parks was entirely due to the fiscal calendar shift and

fewer operating days in the quarter, which resulted in 576,000

fewer visits in the 2024 fourth quarter.

Of the $2.01 increase in in-park per capita spending, $1.60 was

related to the impact of in-park per capita spending at the legacy

Six Flags parks, with the remaining $0.41 increase attributable to

higher in-park guest spending on food, merchandise, games and

extra-charge attractions at the legacy Cedar Fair parks. The

increase in out-of-park spending was the result of the $14 million

contributed by legacy Six Flags operations, offset by a $3 million

decline in fourth quarter out-of-park revenues from legacy Cedar

Fair operations due entirely to the fiscal calendar shift.

Operating costs and expenses in the fourth quarter of

2024 totaled $523 million, an increase of $217 million compared to

the fourth quarter of 2023. The increase in operating costs and

expenses reflects increases in operating expenses (up $167

million), SG&A expenses (up $23 million), and cost of goods

sold (up $27 million), which were primarily the result of legacy

Six Flags operations during the period. The increase in operating

expenses included $180 million of operating expenses related to

legacy Six Flags operations, offset by a $13 million net decrease

in legacy Cedar Fair operating expenses primarily due to the fiscal

quarter calendar shift. Excluding these factors, fourth-quarter

operating expenses at legacy Cedar Fair increased $3 million,

primarily the result of planned increases in seasonal labor costs.

The increase in SG&A expenses included $27 million of expenses

related to legacy Six Flags operations, offset by a $4 million

decrease of SG&A expenses at legacy Cedar Fair. The increase in

cost of goods sold included $26 million of cost of goods sold

related to legacy Six Flags operations. Cost of goods sold as a

percentage of food, merchandise and games revenue increased 170

basis points (bps), with the majority of the increase driven by the

inclusion of the legacy Six Flags operations during the

quarter.

Depreciation and amortization expense in the fourth quarter of

2024 totaled $106 million, an increase of $76 million compared with

the three months ended Dec. 31, 2023. The increase reflected $57

million of depreciation expense that was attributable to legacy Six

Flags, as well as the impact of a change in interim depreciation

methodology for legacy Cedar Fair. During the fourth quarter of

2024, the Combined Company also recognized a $7 million loss on

retirement of fixed assets in the normal course of business,

including $2 million of retirements at the legacy Six Flags

parks.

After the items above, operating income for the three

months ended Dec. 31, 2024, totaled $51 million, including $32

million of operating income from the legacy Six Flags operations.

This compares with $29 million of operating income for the three

months ended Dec. 31, 2023.

Net interest expense for the quarter totaled $79 million, an

increase of $44 million compared to the prior-year fourth quarter.

The increase reflected $39 million of interest incurred on debt

acquired in the Merger and incremental revolver borrowings in the

fourth quarter. Meanwhile, net other expense totaled $27 million

compared with $4 million of net other income during the fourth

quarter of 2023. Both amounts primarily represented the

remeasurement of U.S. dollar denominated notes to the functional

currency of the Company’s Canadian entity.

During the three months ended Dec. 31, 2024, the Combined

Company recorded a provision for taxes of $210 million, compared to

a provision of $8 million for the fourth quarter of 2023. The

higher provision for income taxes relates primarily to the non-cash

tax effects of the change in tax status of a lower-tier partnership

as part of an internal restructuring completed on Dec. 31,

2024.

After the items noted above, net loss attributable to the

Combined Company for 2024 totaled $264 million, or $2.76 per

diluted common share, which included $3 million of net income

related to legacy Six Flags operations during the fourth quarter.

This compares with a net loss of $10 million, or $0.20 per diluted

limited partner unit, attributable to the Company, for the three

months ended Dec. 31, 2023.

Adjusted EBITDA and Modified EBITDA margin, which

management believes are meaningful measures of park-level operating

results, increased $120 million to $209 million and 650 bps to

30.4%, respectively, compared to the fourth quarter of 2023. The

increase in Adjusted EBITDA included $113 million from legacy Six

Flags operations and a $7 million increase from legacy Cedar Fair

operations, including the impact of the fiscal quarter calendar

shift. The 650 bps increase in Modified EBITDA margin included a

410 bps increase related to legacy Six Flags operations and 240 bps

increase due to legacy Cedar Fair operations. The $7 million

increase in Adjusted EBITDA and 240 bps increase in Modified EBITDA

margin from legacy Cedar Fair operations reflects a decrease in

operating costs and expenses during the fourth quarter of 2024,

offset by lower attendance and revenues, due to the fiscal quarter

calendar shift. See the attached table for a reconciliation of net

loss to Modified EBITDA and Adjusted EBITDA.

Balance Sheet and Liquidity

Highlights

Deferred revenues on Dec. 31, 2024, totaled $308 million,

compared with $192 million of deferred revenues on Dec. 31, 2023.

The $117 million increase reflects the inclusion of $123 million of

deferred revenues at the legacy Six Flags parks as of Dec. 31,

2024, offset somewhat by a decrease of $6 million, or 3%, at the

legacy Cedar Fair parks. The decrease in deferred revenues at the

legacy Cedar Fair parks reflects the normal amortization of prepaid

lease payments related to California’s Great America, the

elimination of transaction fees in California, and a slight

decrease in sales of advance purchase products, including sales of

season passes and related products, for the 2025 season.

Liquidity as of Dec. 31, 2024, totaled $578 million,

including cash on hand and available borrowings under the Combined

Company’s revolving credit facility.

Net debt(3) on Dec. 31, 2024, calculated as total debt of

$4.96 billion (before debt issuance costs and acquisition fair

value layers) less cash and cash equivalents of $83 million,

totaled $4.88 billion.

Six Flags Announces Investor Day and

2025 Financial Guidance

Six Flags announced today that it will host an Investor Day at

its Cedar Point park on May 20, 2025, beginning at 9:00 AM ET.

Additional details regarding event registration will be provided by

the Investor Relations Department in the coming weeks.

For 2025, Six Flags is targeting Adjusted EBITDA of $1.08

billion to $1.12 billion, exclusive of any portfolio optimization

efforts.

“Since finalizing the Merger nearly eight months ago, our team

has been diligently executing against the initiatives within

Project Accelerate, our long-term strategic plan to drive

sustainable, long-term growth and maximize the full potential of

the Merger,” said Zimmerman. “Our 2025 guidance reflects the strong

progress we’ve made to date and our belief in the opportunities

ahead as we execute our initiatives to drive higher levels of

attendance and guest spending, while realizing cost synergies and

maximizing operating efficiencies. At our Investor Day in May, we

will share our vision for the future of Six Flags, outlining our

comprehensive strategy to build on our momentum and providing

long-term performance objectives. I am so proud of everything our

team has accomplished to date, and excited about the tremendous

opportunities ahead for Six Flags.”

Footnotes:

(1)

Adjusted EBITDA, Modified EBITDA

and Modified EBITDA margin are not measurements computed in

accordance with GAAP. Management believes Adjusted EBITDA and

Modified EBITDA are meaningful measures of park-level operating

profitability and uses them for measuring returns on capital

investments, evaluating potential acquisitions, determining awards

under incentive compensation plans, and calculating compliance with

certain loan covenants. For additional information regarding

Adjusted EBITDA, Modified EBITDA and Modified EBITDA margin,

including how the Company defines and uses these measures, see the

attached reconciliation table and related footnotes. The Combined

Company is not providing a quantitative reconciliation of

forward-looking Adjusted EBITDA targets or guidance to net income

in reliance on the unreasonable-efforts exception provided under

Item 10(e)(1)(i)(B) of Regulation S-K. The Combined Company is

unable, without unreasonable effort, to forecast the exact amount

or timing of certain individual items required to reconcile

Adjusted EBITDA targets or guidance with the most directly

comparable GAAP financial measure (net income). These items include

provision for taxes, non-cash foreign currency (gain) loss, and

costs related to the Merger, as well as other non-cash and unusual

items and other adjustments as defined under the Combined Company’s

credit agreement, which are difficult to predict in advance in

order to include in a GAAP estimate and the variability of which

could have a significant impact on the Combined Company's future

GAAP results.

(2)

In-park per capita spending and

out-of-park revenues are non-GAAP financial measures. See the

attached reconciliation table and related footnote for the

calculations of in-park per capita spending and out-of-park

revenues. These metrics are used by management as major factors in

significant operational decisions as they are primary drivers of

financial and operational performance, measuring demand, pricing,

and consumer behavior.

(3)

Net debt is a non-GAAP financial

measure. See the attached reconciliation table and related footnote

for the calculation of net debt. Net debt is a meaningful measure

used by the Company and investors to monitor leverage, and

management believes it is meaningful for this purpose.

Conference Call

As previously announced, Six Flags Entertainment Corporation

will host a conference call with analysts starting at 10 a.m. ET

today, Feb. 27, 2025, to discuss its recent financial results.

Participants on the call will include Six Flags President and CEO

Richard Zimmerman and Executive Vice President and CFO Brian

Witherow.

Investors and all other interested parties can access a live,

listen-only audio webcast of the call on the Six Flags Investors

website at https://investors.sixflags.com under the tabs Investor

Information / Events & Presentations. Those unable to listen to

the live webcast can access a recorded version of the call on the

Six Flags Investors website at https://investors.sixflags.com under

Investor Information / Events and Presentations, shortly after the

live call’s conclusion.

A digital recording of the conference call will be available for

replay by phone starting at approximately 1 p.m. ET on Thursday

Feb. 27, 2025, until 11:59 p.m. ET on Wednesday Mar. 13, 2025. To

access the phone replay in North America please dial (800)

770-2030; from international locations please dial +1 (609)

800-9909, followed by Conference ID 3720518.

About Six Flags Entertainment

Corporation

Six Flags Entertainment Corporation (NYSE: FUN) is North

America’s largest regional amusement-resort operator with 27

amusement parks, 15 water parks and nine resort properties across

17 states in the U.S., Canada and Mexico. Focused on its purpose of

making people happy, Six Flags provides fun, immersive and

memorable experiences to millions of guests every year with

world-class coasters, themed rides, thrilling water parks, resorts

and a portfolio of beloved intellectual property such as Looney

Tunes®, DC Comics® and PEANUTS®.

Forward-Looking

Statements

Some of the statements contained in this news release that are

not historical in nature are forward-looking statements within the

meaning of the federal securities laws, including Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including statements

as to our expectations, beliefs, goals and strategies regarding the

future. Words such as “anticipate,” “believe,” “create,” “expect,”

“future,” “guidance,” “intend,” “plan,” “potential,” “seek,”

“synergies,” “target,” “will,” “would,” similar expressions, and

variations or negatives of these words identify forward-looking

statements. However, the absence of these words does not mean that

the statements are not forward-looking. Forward-looking statements

by their nature address matters that are, to different degrees,

uncertain. These forward-looking statements may involve current

plans, estimates, expectations and ambitions that are subject to

risks, uncertainties and assumptions that are difficult to predict,

may be beyond our control and could cause actual results to differ

materially from those described in such statements. Although we

believe that the expectations reflected in such forward-looking

statements are reasonable, we can give no assurance that such

expectations will prove to be correct, that our growth and

operational strategies will achieve the target results. Important

risks and uncertainties that may cause such a difference and could

adversely affect attendance at our parks, our future financial

performance, and/or our growth strategies, and could cause actual

results to differ materially from our expectations or otherwise to

fluctuate or decrease, include, but are not limited to: failure to

realize the anticipated benefits of the Merger, including

difficulty in integrating the businesses of legacy Six Flags and

legacy Cedar Fair; failure to realize the expected amount and

timing of cost savings and operating synergies related to the

Merger; general economic, political and market conditions; the

impacts of pandemics or other public health crises, including the

effects of government responses on people and economies; adverse

weather conditions; competition for consumer leisure time and

spending; unanticipated construction delays; changes in our capital

investment plans and projects; anticipated tax treatment,

unforeseen liabilities, future capital expenditures, revenues,

expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and

management strategies for the management, expansion and growth of

the Combined Company’s operations; legislative, regulatory and

economic developments and changes in laws, regulations, and

policies affecting the Combined Company; acts of terrorism or

outbreak of war, hostilities, civil unrest, and other political or

security disturbances; and other risks and uncertainties we discuss

under the heading “Risk Factors” within our Annual Report on Form

10-K and in the other filings we make from time to time with the

Security and Exchange Commission. Readers are urged not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document and are based on information

currently and reasonably known to us. We do not undertake any

obligation to publicly update or revise any forward-looking

statements to reflect future events, information or circumstances

that arise after publication of this new release.

This news release and prior releases are

available under the News tab at https://investors.sixflags.com

(financial tables follow)

SIX FLAGS ENTERTAINMENT

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands)

Quarters ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net revenues:

Admissions

$

360,557

$

200,367

$

1,403,932

$

925,734

Food, merchandise and games

212,512

120,695

898,175

613,969

Accommodations, extra-charge products and

other

114,241

50,061

406,819

258,965

687,310

371,123

2,708,926

1,798,668

Costs and expenses:

Cost of food, merchandise and games

revenues

57,797

30,745

232,556

159,830

Operating expenses

376,902

210,312

1,376,061

949,527

Selling, general and administrative

88,646

65,679

411,164

207,085

Depreciation and amortization

106,226

30,284

318,113

157,995

Loss on retirement of fixed assets,

net

6,658

5,288

18,064

18,067

Loss on impairment of goodwill

—

—

42,462

—

636,229

342,308

2,398,420

1,492,504

Operating income

51,081

28,815

310,506

306,164

Interest expense, net

78,867

34,853

234,770

138,952

Loss on early debt extinguishment

—

—

7,974

—

Other expense (income), net

26,722

(3,882

)

33,584

(5,390

)

(Loss) income before taxes

(54,508

)

(2,156

)

34,178

172,602

Provision for taxes

209,708

7,797

240,843

48,043

Net (loss) income

(264,216

)

(9,953

)

(206,665

)

124,559

Net income attributable to non-controlling

interests

—

—

24,499

—

Net (loss) income attributable to Six

Flags Entertainment Corporation

$

(264,216

)

$

(9,953

)

$

(231,164

)

$

124,559

Net (loss) income margin (1)

-38.4

%

-2.7

%

-7.6

%

6.9

%

(1) Net (loss) income margin is calculated

as net income divided by net revenues.

SIX FLAGS ENTERTAINMENT

CORPORATION

CONSOLIDATED BALANCE SHEET

DATA

(In thousands)

December 31, 2024

December 31, 2023

Cash and cash equivalents

$

83,174

$

65,488

Total assets

$

9,130,516

$

2,240,533

Long-term debt, including current

maturities:

Revolving credit loans

$

296,953

$

—

Term debt

976,712

—

Notes

3,659,407

2,275,451

$

4,933,072

$

2,275,451

Equity (deficit)

$

2,041,863

$

(582,962

)

SIX FLAGS ENTERTAINMENT

CORPORATION

RECONCILIATION OF MODIFIED

EBITDA, ADJUSTED EBITDA AND MODIFIED EBITDA MARGIN

(In thousands)

Quarters Ended December

31,

Years Ended December

31,

(In thousands)

2024

2023

2024

2023

Net (loss) income

$

(264,216

)

$

(9,953

)

$

(206,665

)

$

124,559

Interest expense, net

78,867

34,853

234,770

138,952

Provision for taxes

209,708

7,797

240,843

48,043

Depreciation and amortization

106,226

30,284

318,113

157,995

EBITDA

130,585

62,981

587,061

469,549

Loss on early debt extinguishment

—

—

7,974

—

Non-cash foreign currency loss (gain)

24,677

(3,920

)

30,557

(5,594

)

Non-cash equity compensation expense

10,259

6,770

63,809

22,611

Loss on retirement of fixed assets,

net

6,658

5,288

18,064

18,067

Loss on impairment of goodwill

—

—

42,462

—

Costs related to the Mergers (1)

23,726

17,275

118,336

22,287

Self-insurance adjustment (2)

—

—

14,865

—

Other (3)

13,069

468

16,662

752

Modified EBITDA (4)

208,974

88,862

899,790

527,672

Net income attributable to non-controlling

interests

—

—

24,499

—

Adjusted EBITDA (4)

$

208,974

$

88,862

$

875,291

$

527,672

Modified EBITDA margin (5)

30.4

%

23.9

%

33.2

%

29.3

%

(1)

Consists of third-party legal and

consulting transaction costs, as well as integration costs related

to the Mergers. Integration costs include third-party consulting

costs, contract termination costs, retention bonuses, severance

related to the Mergers, integration team salaries and benefits,

maintenance costs to update Former Six Flags parks to Cedar Fair

standards, onboarding of new advertising firms, and travel costs.

These costs are added back to net (loss) income to calculate

Modified EBITDA and Adjusted EBITDA as defined in the Combined

Company's credit agreement.

(2)

During the third quarter of 2024,

an actuarial analysis of Former Cedar Fair's self-insurance

reserves resulted in a change in estimate that increased the

incurred but not reported ("IBNR") reserves related to these

self-insurance reserves by $14.9 million. The increase was driven

by an observed pattern of increasing litigation and settlement

costs.

(3)

Consists of certain costs as

defined in the Combined Company's credit agreement. These costs are

added back to net (loss) income to calculate Modified EBITDA and

Adjusted EBITDA and include: enacted cost savings initiatives

related to overhead and administrative costs incurred by Former Six

Flags, specifically for insurance premiums, legal costs and

information technology costs; repairs for unusual weather events;

certain legal and consulting expenses; Mexican VAT taxes on

intercompany activity; severance and related benefits; payments

related to the Partnership Parks; cost of goods sold recorded to

align inventory standards following the Mergers; and contract

termination costs. This balance also includes unrealized gains and

losses on pension assets and short-term investments.

(4)

Modified EBITDA represents

earnings before interest, taxes, depreciation, amortization, other

non-cash items, and adjustments as defined in the Combined

Company's credit agreement. Adjusted EBITDA represents Modified

EBITDA minus net income attributable to non-controlling interests.

Management included both measures to disclose the effect of

non-controlling interests. Prior to the Merger, legacy Cedar Fair

did not have net income attributable to non-controlling interests.

Management believes Modified EBITDA and Adjusted EBITDA are

meaningful measures of park-level operating profitability and use

them for measuring returns on capital investments, evaluating

potential acquisitions, determining awards under incentive

compensation plans, and calculating compliance with certain loan

covenants. Adjusted EBITDA is widely used by analysts, investors

and comparable companies in the industry to evaluate operating

performance on a consistent basis, as well as more easily compare

results with those of other companies in the industry. Modified

EBITDA and Adjusted EBITDA are provided as a supplemental measure

of the Combined Company's operating results and are not intended to

be a substitute for operating income, net income or cash flows from

operating activities as defined under generally accepted accounting

principles. In addition, Modified EBITDA and Adjusted EBITDA may

not be comparable to similarly titled measures of other

companies.

(5)

Modified EBITDA margin (Modified

EBITDA divided by net revenues) is not a measurement computed in

accordance with GAAP and may not be comparable to similarly titled

measures of other companies. Modified EBITDA margin is provided

because management believes the measure provides a meaningful

metric of operating profitability. Modified EBITDA margin has been

disclosed as opposed to Adjusted EBITDA margin because management

believes Modified EBITDA margin more accurately reflects the

park-level operations of the Combined Company as it does not give

effect to distributions to non-controlling interests.

SIX FLAGS ENTERTAINMENT

CORPORATION

CALCULATION OF NET

DEBT

(In thousands)

December 31, 2024

Long-term debt, including current

maturities

$

4,933,072

Plus: Debt issuance costs and original

issue discount

49,562

Less: Acquisition fair value layers

(22,634

)

Less: Cash and cash equivalents

(83,174

)

Net Debt (1)

$

4,876,826

(1) Net Debt is a non-GAAP financial

measure used by investors to monitor leverage. The measure may not

be comparable to similarly titled measures of other companies.

SIX FLAGS ENTERTAINMENT

CORPORATION

KEY OPERATIONAL

MEASURES

(In thousands, except per capita

and operating day amounts)

Quarters Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Attendance

10,694

5,776

41,649

26,665

In-park per capita spending (1)

$

61.60

$

59.59

$

61.31

$

62.21

Out-of-park revenues (1)

$

47,792

$

36,892

$

232,415

$

192,257

Operating days

878

377

4,369

2,365

(1)

In-park per capita spending is calculated

as revenues generated within the Combined Company's amusement parks

and separately gated outdoor water parks along with related parking

revenues and online transaction fees charged to customers (in-park

revenues), divided by total attendance. Out-of-park revenues are

defined as revenues from resorts, out-of-park food and retail

locations, sponsorships, international agreements and all other

out-of-park operations. In-park revenues, in-park per capita

spending and out-of-park revenues are non-GAAP measures. These

metrics are used by management as major factors in significant

operational decisions as they are primary drivers of financial and

operational performance, measuring demand, pricing, and consumer

behavior. A reconciliation of in-park revenues and out-of-park

revenues to net revenues for the periods presented in the table

below. Certain prior period amounts totaling $5.6 million for the

three months ended December 31, 2023 and $31.0 million for the year

ended December 31, 2023 were reclassified from out-of-park revenues

to in-park revenues following completion of the Merger. The

Combined Company made certain reclassification adjustments to prior

period amounts where it adopted the legacy Six Flags

classification.

Quarters Ended December

31,

Years Ended December

31,

(In thousands)

2024

2023

2024

2023

In-park revenues

$

658,720

$

344,188

$

2,553,486

$

1,658,912

Out-of-park revenues

47,792

36,892

232,415

192,257

Concessionaire remittance

(19,202

)

(9,957

)

(76,975

)

(52,501

)

Net revenues

$

687,310

$

371,123

$

2,708,926

$

1,798,668

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227928301/en/

Investor Contact: Michael Russell, 419.627.2233 Media

Contact: Gary Rhodes, 704.249.6119

https://investors.sixflags.com

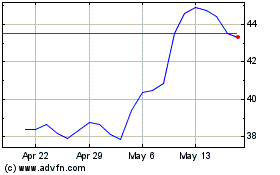

Six Flags Entertainment (NYSE:FUN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Six Flags Entertainment (NYSE:FUN)

Historical Stock Chart

From Mar 2024 to Mar 2025