HCA Healthcare, Inc. (NYSE: HCA) today announced financial and

operating results for the fourth quarter ended December 31,

2024.

Key fourth quarter metrics (all percentage changes

compare 4Q 2024 to 4Q 2023 unless otherwise noted):

- Revenues totaled $18.285 billion

- Net income attributable to HCA Healthcare, Inc. totaled $1.438

billion, or $5.63 per diluted share (which includes an estimated

$0.60 per diluted share unfavorable impact from Hurricanes Helene

and Milton)

- Adjusted EBITDA totaled $3.712 billion

- Cash flows from operating activities totaled $2.559

billion

- Same facility admissions increased 3.0 percent and same

facility equivalent admissions increased 3.1 percent

"We finished 2024 with strong business fundamentals that were

consistent with previous quarters," said Sam Hazen, Chief Executive

Officer of HCA Healthcare. "The first half of the current decade,

which ended in 2024, proved to be another period of long-term

growth for the company and resulted in operational improvements

across key performance indicators and greater value for our

patients, employees and shareholders. These accomplishments are a

testament to the incredible work of our teams, and position us well

for the future."

Revenues in the fourth quarter of 2024 totaled $18.285 billion,

compared to $17.303 billion in the fourth quarter of 2023. Net

income attributable to HCA Healthcare, Inc. totaled $1.438 billion,

or $5.63 per diluted share, compared to $1.607 billion, or $5.93

per diluted share, in the fourth quarter of 2023. Results for the

fourth quarter of 2024 include losses on sales of facilities of

$195 million, or $0.59 per diluted share, primarily related to the

pending sale of a hospital facility in California. Results for the

fourth quarter of 2023 include gains on sales of facilities of $7

million, or $0.03 per diluted share.

For the fourth quarter of 2024, Adjusted EBITDA totaled $3.712

billion, compared to $3.618 billion in the fourth quarter of 2023.

Adjusted EBITDA is a non-GAAP financial measure. A table providing

supplemental information on Adjusted EBITDA and reconciling net

income attributable to HCA Healthcare, Inc. to Adjusted EBITDA is

included in this release.

Same facility admissions increased 3.0 percent and same facility

equivalent admissions increased 3.1 percent in the fourth quarter

of 2024, compared to the prior year period. Same facility emergency

room visits increased 2.4 percent in the fourth quarter of 2024,

compared to the prior year period. Same facility inpatient

surgeries increased 2.8 percent, and same facility outpatient

surgeries declined 1.3 percent in the fourth quarter of 2024,

compared to the same period of 2023. Same facility revenue per

equivalent admission increased 2.9 percent in the fourth quarter of

2024, compared to the fourth quarter of 2023.

Year Ended December 31, 2024

Revenues for the year ended December 31, 2024 totaled $70.603

billion, compared to $64.968 billion for the year ended December

31, 2023. Net income attributable to HCA Healthcare, Inc. was

$5.760 billion, or $22.00 per diluted share, compared to $5.242

billion, or $18.97 per diluted share, for the year ended December

31, 2023. Results for the year ended December 31, 2024 include

gains on sales of facilities of $14 million, or $0.04 per diluted

share. Results for the year ended December 31, 2023 included losses

on sales of facilities of $5 million, or $0.04 per diluted

share.

For 2024, Adjusted EBITDA totaled $13.882 billion, compared to

$12.726 billion in 2023. Adjusted EBITDA is a non-GAAP financial

measure. A table providing supplemental information on Adjusted

EBITDA and reconciling net income attributable to HCA Healthcare,

Inc. to Adjusted EBITDA is included in this release.

Balance Sheet and Cash Flows from Operations

As of December 31, 2024, HCA Healthcare, Inc.’s balance sheet

reflected cash and cash equivalents of $1.933 billion, total debt

of $43.031 billion, and total assets of $59.513 billion. During the

fourth quarter of 2024, capital expenditures totaled $1.285

billion, excluding acquisitions. Cash flows provided by operating

activities in the fourth quarter of 2024 totaled $2.559 billion,

compared to $2.674 billion in the fourth quarter of 2023.

During the fourth quarter of 2024, the Company repurchased 4.739

million shares of its common stock at a cost of $1.700 billion. The

Company had $764 million remaining under its repurchase

authorization as of December 31, 2024. As of December 31, 2024, the

Company had $7.986 billion of availability under its credit

facilities.

Share Repurchase Program

The HCA Healthcare, Inc. Board of Directors has authorized an

additional share repurchase program for up to $10 billion of the

Company’s outstanding common stock. Repurchases will be made in

accordance with applicable securities laws and may be made at

management’s discretion from time to time in the open market,

through privately negotiated transactions, or otherwise. The

repurchase program has no time limit and may be suspended for

periods or discontinued at any time.

Dividend

HCA today announced that its Board of Directors declared a

quarterly cash dividend of $0.72 per share on the Company’s common

stock. The dividend will be paid on March 31, 2025 to stockholders

of record at the close of business on March 17, 2025.

The declaration and payment of any future dividend will be

subject to the discretion of the Board of Directors and will depend

on a variety of factors, including the Company’s financial

condition, results of operations, and contractual restrictions.

Future dividends are expected to be funded by cash balances and

future cash flows from operations.

Impact of Hurricanes

During the fourth quarter of 2024, the Company incurred

additional expenses and experienced loss of revenues estimated at

$200 million, or $0.60 per diluted share, associated with Hurricane

Helene's impact on its North Carolina facilities, as well as from

Hurricane Milton, which impacted certain facilities in Florida.

For the year ended December 31, 2024, the Company incurred

additional expenses and experienced loss of revenues estimated at

$250 million, or $0.73 per diluted share, associated with the

impact of Hurricanes Helene and Milton on the Company's North

Carolina facilities and certain facilities in Florida.

These estimates do not include any insurance recoveries the

Company may receive. All facilities impacted by Hurricanes Helene

and Milton have resumed normal operations.

2025 Guidance

Today, the Company issued the following estimated guidance for

2025:

2025 Guidance Range

Revenues

$72.80 to $75.80 billion

Net Income Attributable to HCA Healthcare,

Inc.

$5.85 to $6.29 billion

Adjusted EBITDA

$14.30 to $15.10 billion

EPS (diluted)

$24.05 to $25.85 per diluted share

Capital expenditures for 2025, excluding acquisitions, are

estimated to be approximately $5.0 to $5.2 billion.

The Company’s guidance contains a number of assumptions,

including, among others, the Company’s current expectations

regarding volume growth coupled with an anticipated mostly stable

operating environment, payer mix, and the ongoing impacts of the

two major hurricanes, the impact of current and future health care

public policy developments, as well as general economic conditions,

including inflation, and excludes the impact of items such as, but

not limited to, gains or losses on sales of facilities, losses on

retirement of debt, legal claims costs and impairment of long-lived

assets.

Adjusted EBITDA is a non-GAAP financial measure. A table

reconciling forecasted net income attributable to HCA Healthcare,

Inc. to forecasted Adjusted EBITDA is included in this release.

The Company’s guidance is based on current plans and

expectations and are subject to a number of known and unknown

uncertainties and risks, including those set forth below in the

Company’s “Forward-Looking Statements.”

Annual Stockholders' Meeting

The Company's 2025 annual stockholders' meeting will be held

virtually on April 24, 2025 at 2:00 p.m. Central Time for

stockholders of record as of February 24, 2025.

Earnings Conference Call

HCA Healthcare will host a conference call for investors at 9:00

a.m. Central Time today. All interested investors are invited to

access a live audio broadcast of the call via webcast. The

broadcast also will be available on a replay basis beginning this

afternoon. The webcast can be accessed through the Company’s

Investor Relations web page at

https://investor.hcahealthcare.com/events-and-presentations/default.aspx.

About the Company

As of December 31, 2024, HCA operated 190 hospitals and

approximately 2,400 ambulatory sites of care, including surgery

centers, freestanding emergency rooms, urgent care centers and

physician clinics, in 20 states and the United Kingdom.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, which involve risks and

uncertainties. Forward-looking statements include the Company’s

financial guidance for the year ending December 31, 2025, as well

as other statements that do not relate solely to historical or

current facts. Forward-looking statements can be identified by the

use of words like “may,” “believe,” “will,” “expect,” “project,”

“estimate,” “anticipate,” “plan,” “initiative” or “continue.” These

forward-looking statements are based on our current plans and

expectations and are subject to a number of known and unknown

uncertainties and risks, many of which are beyond our control,

which could significantly affect current plans and expectations and

our future financial position and results of operations. These

factors include, but are not limited to, (1) changes in or related

to general economic conditions nationally and regionally in our

markets, including inflation and economic and business conditions

(and the impact thereof on the economy, financial markets and

banking industry); changes in revenues due to declining patient

volumes; changes in payer mix (including increases in uninsured and

underinsured patients); potential increased expenses related to

labor, supply chain or other expenditures; workforce disruptions;

supply shortages and disruptions (including as a result of

geopolitical disruptions); and the impact of potential federal

government shutdowns, (2) the impact of our significant

indebtedness and the ability to refinance such indebtedness on

acceptable terms, (3) the impact of current and future health care

public policy developments and possible changes to other federal,

state or local laws and regulations affecting the health care

industry, including, but not limited to, the expiration of enhanced

premium tax credits for individuals eligible to purchase insurance

coverage through federal and state-based health insurance

marketplaces, (4) the effects related to the implementation of

sequestration spending reductions required under the Budget Control

Act of 2011, related legislation extending these reductions, and

the potential for future deficit reduction legislation that may

alter these spending reductions, which include cuts to Medicare

payments, or create additional spending reductions, (5) increases

in the amount and risk of collectability of uninsured accounts and

deductibles and copayment amounts for insured accounts, (6) the

ability to achieve operating and financial targets, attain expected

levels of patient volumes and revenues, and control the costs of

providing services, (7) possible changes in Medicare, Medicaid and

other state programs, including Medicaid supplemental payment

programs, Medicaid waiver programs or state directed payments, that

may impact reimbursements to health care providers and insurers and

the size of the uninsured or underinsured population, (8)

personnel-related capacity constraints, increases in wages and the

ability to attract, utilize and retain qualified management and

other personnel, including affiliated physicians, nurses and

medical and technical support personnel, (9) the highly competitive

nature of the health care business, (10) changes in service mix,

revenue mix and surgical volumes, including potential declines in

the population covered under third-party payer agreements, the

ability to enter into and renew third-party payer provider

agreements on acceptable terms and the impact of consumer-driven

health plans and physician utilization trends and practices, (11)

the efforts of health insurers, health care providers, large

employer groups and others to contain health care costs, (12) the

outcome of our continuing efforts to monitor, maintain and comply

with appropriate laws, regulations, policies and procedures, (13)

the availability and terms of capital to fund the expansion of our

business and improvements to our existing facilities, (14) changes

in accounting practices, (15) the emergence of and effects related

to pandemics, epidemics and outbreaks of infectious diseases or

other public health crises, (16) future divestitures which may

result in charges and possible impairments of long-lived assets,

(17) changes in business strategy or development plans, (18) delays

in receiving payments for services provided, (19) the outcome of

pending and any future tax audits, disputes and litigation

associated with our tax positions, (20) the impact of known and

unknown government investigations, litigation and other claims that

may be made against us, (21) the impact of actual and potential

cybersecurity incidents or security breaches involving us or our

vendors and other third parties, (22) our ongoing ability to

demonstrate meaningful use of certified electronic health record

technology and the impact of interoperability requirements, (23)

the impact of natural disasters, such as hurricanes and floods,

including Hurricanes Milton and Helene, physical risks from climate

change or similar events beyond our control on our assets and

activities and the communities we serve, (24) changes in U.S.

federal, state, or foreign tax laws including interpretive guidance

that may be issued by taxing authorities or other standard setting

bodies, (25) the results of our efforts to use technology and

resilience initiatives, including artificial intelligence and

machine learning, to drive efficiencies, better outcomes and an

enhanced patient experience, (26) the impact of recent decisions of

the U.S. Supreme Court regarding the actions of federal agencies,

and (27) other risk factors described in our annual report on Form

10-K for the year ended December 31, 2023 and our other filings

with the Securities and Exchange Commission. Many of the factors

that will determine our future results are beyond our ability to

control or predict. In light of the significant uncertainties

inherent in the forward-looking statements contained herein,

readers should not place undue reliance on forward-looking

statements, which reflect management’s views only as of the date

hereof. We undertake no obligation to revise or update any

forward-looking statements, or to make any other forward-looking

statements, whether as a result of new information, future events

or otherwise. All references to “Company,” “HCA” and “HCA

Healthcare” as used throughout this release refer to HCA

Healthcare, Inc. and its affiliates.

HCA Healthcare, Inc.

Condensed Consolidated

Comprehensive Income Statements

Fourth Quarter

Unaudited

(Dollars in millions, except

per share amounts)

2024

2023

Amount

Ratio

Amount

Ratio

Revenues

$

18,285

100.0

%

$

17,303

100.0

%

Salaries and benefits

7,917

43.3

7,570

43.7

Supplies

2,793

15.3

2,584

14.9

Other operating expenses

3,873

21.2

3,559

20.7

Equity in earnings of affiliates

(10

)

(0.1

)

(28

)

(0.2

)

Depreciation and amortization

856

4.6

789

4.5

Interest expense

528

2.9

491

2.8

Losses (gains) on sales of facilities

195

1.1

(7

)

—

16,152

88.3

14,958

86.4

Income before income taxes

2,133

11.7

2,345

13.6

Provision for income taxes

447

2.5

484

2.8

Net income

1,686

9.2

1,861

10.8

Net income attributable to noncontrolling

interests

248

1.3

254

1.5

Net income attributable to HCA Healthcare,

Inc.

$

1,438

7.9

$

1,607

9.3

Diluted earnings per share

$

5.63

$

5.93

Shares used in computing diluted earnings

per share (millions)

255.310

271.186

Comprehensive income attributable to HCA

Healthcare, Inc.

$

1,429

$

1,673

HCA Healthcare, Inc.

Condensed Consolidated

Comprehensive Income Statements

For the Years Ended December

31, 2024 and 2023

Unaudited

(Dollars in millions, except

per share amounts)

2024

2023

Amount

Ratio

Amount

Ratio

Revenues

$

70,603

100.0

%

$

64,968

100.0

%

Salaries and benefits

31,170

44.1

29,487

45.4

Supplies

10,755

15.2

9,902

15.2

Other operating expenses

14,819

21.0

12,875

19.8

Equity in earnings of affiliates

(23

)

—

(22

)

—

Depreciation and amortization

3,312

4.7

3,077

4.7

Interest expense

2,061

2.9

1,938

3.0

Losses (gains) on sales of facilities

(14

)

—

5

—

62,080

87.9

57,262

88.1

Income before income taxes

8,523

12.1

7,706

11.9

Provision for income taxes

1,866

2.7

1,615

2.5

Net income

6,657

9.4

6,091

9.4

Net income attributable to noncontrolling

interests

897

1.2

849

1.3

Net income attributable to HCA Healthcare,

Inc.

$

5,760

8.2

$

5,242

8.1

Diluted earnings per share

$

22.00

$

18.97

Shares used in computing diluted earnings

per share (millions)

261.806

276.412

Comprehensive income attributable to HCA

Healthcare, Inc.

$

5,798

$

5,307

HCA Healthcare, Inc.

Condensed Consolidated Balance

Sheets

Unaudited

(Dollars in millions)

December 31,

September 30,

December 31,

2024

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,933

$

2,888

$

935

Accounts receivable

10,751

9,915

9,958

Inventories

1,738

1,776

2,021

Other

1,992

2,083

2,013

16,414

16,662

14,927

Property and equipment, at cost

62,514

61,750

58,548

Accumulated depreciation

(33,100

)

(32,703

)

(30,833

)

29,414

29,047

27,715

Investments of insurance subsidiaries

569

553

477

Investments in and advances to

affiliates

662

705

756

Goodwill and other intangible assets

10,093

9,982

9,945

Right-of-use operating lease assets

2,131

2,201

2,207

Other

230

309

184

$

59,513

$

59,459

$

56,211

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

4,276

$

4,235

$

4,233

Accrued salaries

2,304

2,164

2,127

Other accrued expenses

3,899

3,819

3,871

Long-term debt due within one year

4,698

4,682

2,424

15,177

14,900

12,655

Long-term debt, less debt issuance costs

and discounts of $369, $378 and $333

38,333

38,283

37,169

Professional liability risks

1,544

1,584

1,557

Right-of-use operating lease

obligations

1,863

1,924

1,903

Income taxes and other liabilities

2,041

1,982

1,867

Stockholders' equity:

Stockholders' deficit attributable to HCA

Healthcare, Inc.

(2,499

)

(2,182

)

(1,774

)

Noncontrolling interests

3,054

2,968

2,834

555

786

1,060

$

59,513

$

59,459

$

56,211

HCA Healthcare, Inc.

Condensed Consolidated

Statements of Cash Flows

For the Years Ended December

31, 2024 and 2023

Unaudited

(Dollars in millions)

2024

2023

Cash flows from operating activities:

Net income

$

6,657

$

6,091

Adjustments to reconcile net income to net

cash provided by operating activities:

Increase (decrease) in cash from operating

assets and liabilities:

Accounts receivable

(799

)

(935

)

Inventories and other assets

334

(126

)

Accounts payable and accrued expenses

359

604

Depreciation and amortization

3,312

3,077

Income taxes

22

229

Losses (gains) on sales of facilities

(14

)

5

Amortization of debt issuance costs and

discounts

35

35

Share-based compensation

360

262

Other

248

189

Net cash provided by operating

activities

10,514

9,431

Cash flows from investing activities:

Purchase of property and equipment

(4,875

)

(4,744

)

Acquisition of hospitals and health care

entities

(266

)

(635

)

Sales of hospitals and health care

entities

328

193

Change in investments

(115

)

(112

)

Other

(5

)

(19

)

Net cash used in investing activities

(4,933

)

(5,317

)

Cash flows from financing activities:

Issuances of long-term debt

7,495

3,224

Net change in revolving credit

facilities

(1,880

)

(1,020

)

Repayment of long-term debt

(2,410

)

(909

)

Distributions to noncontrolling

interests

(711

)

(640

)

Payment of debt issuance costs

(67

)

(31

)

Payment of dividends

(690

)

(661

)

Repurchase of common stock

(6,042

)

(3,811

)

Other

(277

)

(246

)

Net cash used in financing activities

(4,582

)

(4,094

)

Effect of exchange rate changes on cash

and cash equivalents

(1

)

7

Change in cash and cash equivalents

998

27

Cash and cash equivalents at beginning of

period

935

908

Cash and cash equivalents at end of

period

$

1,933

$

935

Interest payments

$

1,938

$

1,892

Income tax payments, net

$

1,844

$

1,386

HCA Healthcare, Inc.

Operating Statistics

Fourth Quarter

For the Years Ended December

31,

2024

2023

2024

2023

Operations:

Number of Hospitals

190

186

190

186

Number of Freestanding Outpatient Surgery

Centers*

124

124

124

124

Licensed Beds at End of Period

49,985

49,588

49,985

49,588

Weighted Average Beds in Service

42,705

42,072

42,633

41,873

Reported:

Admissions

559,170

544,554

2,236,595

2,130,728

% Change

2.7

%

5.0

%

Equivalent Admissions

1,007,623

974,561

3,990,085

3,788,434

% Change

3.4

%

5.3

%

Revenue per Equivalent Admission

$

18,146

$

17,755

$

17,695

$

17,149

% Change

2.2

%

3.2

%

Inpatient Revenue per Admission

$

19,737

$

18,992

$

19,050

$

18,201

% Change

3.9

%

4.7

%

Patient Days

2,691,710

2,674,331

10,826,574

10,483,236

% Change

0.6

%

3.3

%

Equivalent Patient Days

4,850,820

4,786,197

19,314,608

18,639,194

% Change

1.4

%

3.6

%

Inpatient Surgery Cases

135,643

132,417

540,704

528,845

% Change

2.4

%

2.2

%

Outpatient Surgery Cases

263,832

270,286

1,024,998

1,044,415

% Change

-2.4

%

-1.9

%

Emergency Room Visits

2,498,429

2,452,395

9,789,265

9,342,783

% Change

1.9

%

4.8

%

Outpatient Revenues as a Percentage of

Patient Revenues

37.9

%

38.4

%

37.8

%

38.3

%

Average Length of Stay (days)

4.814

4.911

4.841

4.920

Occupancy**

71.7

%

72.5

%

72.7

%

72.3

%

Same Facility:

Admissions

552,610

536,350

2,204,148

2,101,839

% Change

3.0

%

4.9

%

Equivalent Admissions

980,330

950,949

3,881,505

3,713,950

% Change

3.1

%

4.5

%

Revenue per Equivalent Admission

$

18,185

$

17,674

$

17,625

$

17,071

% Change

2.9

%

3.2

%

Inpatient Revenue per Admission

$

19,835

$

19,006

$

19,085

$

18,185

% Change

4.4

%

4.9

%

Inpatient Surgery Cases

134,482

130,779

534,330

523,074

% Change

2.8

%

2.2

%

Outpatient Surgery Cases

257,663

261,155

997,043

1,013,752

% Change

-1.3

%

-1.6

%

Emergency Room Visits

2,466,784

2,410,050

9,642,016

9,192,154

% Change

2.4

%

4.9

%

* Excludes freestanding endoscopy centers

(26 centers at December 31, 2024 and 24 centers at December 31,

2023).

** Reflects the rate of occupancy (patient

days and observations) based on weighted average beds in

service.

HCA Healthcare, Inc.

Supplemental Non-GAAP

Disclosures

Operating Results

Summary

(Dollars in millions, except

per share amounts)

Fourth Quarter

For the Years Ended December

31,

2024

2023

2024

2023

Revenues

$

18,285

$

17,303

$

70,603

$

64,968

Net income attributable to HCA Healthcare,

Inc.

$

1,438

$

1,607

$

5,760

$

5,242

Losses (gains) on sales of facilities (net

of tax)

149

(9

)

(11

)

12

Net income attributable to HCA Healthcare,

Inc., as adjusted (a)

1,587

1,598

5,749

5,254

Depreciation and amortization

856

789

3,312

3,077

Interest expense

528

491

2,061

1,938

Provision for income taxes

493

486

1,863

1,608

Net income attributable to noncontrolling

interests

248

254

897

849

Adjusted EBITDA (a)

3,712

$

3,618

$

13,882

$

12,726

Adjusted EBITDA margin (a)

20.3

%

20.9

%

19.7

%

19.6

%

Diluted earnings per share:

Net income attributable to HCA Healthcare,

Inc.

$

5.63

$

5.93

$

22.00

$

18.97

Losses (gains) on sales of facilities

0.59

(0.03

)

(0.04

)

0.04

Net income attributable to HCA Healthcare,

Inc., as adjusted (a)

$

6.22

$

5.90

$

21.96

$

19.01

Shares used in computing diluted earnings

per share (millions)

255.310

271.186

261.806

276.412

______________

(a)

Net income attributable to HCA Healthcare,

Inc., as adjusted, diluted earnings per share, as adjusted, and

Adjusted EBITDA should not be considered as measures of financial

performance under generally accepted accounting principles

("GAAP"). These non-GAAP financial measures are adjusted to exclude

losses (gains) on sales of facilities and losses on retirement of

debt. We believe net income attributable to HCA Healthcare, Inc.,

as adjusted, diluted earnings per share, as adjusted, and Adjusted

EBITDA are important measures that supplement discussions and

analysis of our results of operations. We believe it is useful to

investors to provide disclosures of our results of operations on

the same basis used by management. Management relies upon net

income attributable to HCA Healthcare, Inc., as adjusted, diluted

earnings per share, as adjusted, and Adjusted EBITDA as the primary

measures to review and assess operating performance of its health

care facilities and their management teams.

Management and investors review both the

overall performance (including net income attributable to HCA

Healthcare, Inc., as adjusted, diluted earnings per share, as

adjusted, and GAAP net income attributable to HCA Healthcare, Inc.)

and operating performance (Adjusted EBITDA) of our health care

facilities. Adjusted EBITDA and the Adjusted EBITDA margin

(Adjusted EBITDA divided by revenues) are utilized by management

and investors to compare our current operating results with the

corresponding periods during the previous year and to compare our

operating results with other companies in the health care industry.

It is reasonable to expect that adjustments, including losses

(gains) on sales of facilities and losses on retirement of debt

will occur in future periods, but the amounts recognized can vary

significantly from period to period, do not directly relate to the

ongoing operations of our health care facilities and complicate

period comparisons of our results of operations and operations

comparisons with other health care companies.

Net income attributable to HCA Healthcare,

Inc., as adjusted, diluted earnings per share, as adjusted, and

Adjusted EBITDA are not measures of financial performance under

GAAP, and should not be considered as alternatives to net income

attributable to HCA Healthcare, Inc. as a measure of operating

performance or cash flows from operating, investing and financing

activities as a measure of liquidity. Because net income

attributable to HCA Healthcare, Inc., as adjusted, diluted earnings

per share, as adjusted, and Adjusted EBITDA are not measurements

determined in accordance with GAAP and are susceptible to varying

calculations, net income attributable to HCA Healthcare, Inc., as

adjusted, diluted earnings per share, as adjusted, and Adjusted

EBITDA, as presented, may not be comparable to other similarly

titled measures presented by other companies.

HCA Healthcare, Inc.

Supplemental Non-GAAP

Disclosures

2025 Operating Results

Forecast

(Dollars in millions, except

per share amounts)

For the Year Ending

December 31, 2025

Low

High

Revenues

$

72,800

$

75,800

Net income attributable to HCA Healthcare,

Inc. (a)

$

5,850

$

6,290

Depreciation and amortization

3,495

3,565

Interest expense

2,230

2,320

Provision for income taxes

1,800

1,950

Net income attributable to noncontrolling

interests

925

975

Adjusted EBITDA (a) (b)

$

14,300

$

15,100

Diluted earnings per share:

Net income attributable to HCA Healthcare,

Inc.

$

24.05

$

25.85

Shares used in computing diluted earnings

per share (millions)

243.000

243.000

The Company's forecasted guidance is based

on current plans and expectations and is subject to a number of

known and unknown uncertainties and risks.

______________

(a)

The Company does not forecast the impact

of items such as, but not limited to, losses (gains) on sales of

facilities, losses on retirement of debt, legal claim costs

(benefits) and impairments of long-lived assets because the Company

does not believe that it can forecast these items with sufficient

accuracy.

(b)

Adjusted EBITDA should not be considered a

measure of financial performance under generally accepted

accounting principles ("GAAP"). We believe Adjusted EBITDA is an

important measure that supplements discussions and analysis of our

results of operations. We believe it is useful to investors to

provide disclosures of our results of operations on the same basis

used by management. Management relies upon Adjusted EBITDA as a

primary measure to review and assess operating performance of its

health care facilities and their management teams.

Management and investors review both the

overall performance (including net income attributable to HCA

Healthcare, Inc.) and operating performance (Adjusted EBITDA) of

our healthcare facilities. Adjusted EBITDA is utilized by

management and investors to compare our current operating results

with the corresponding periods during the previous year and to

compare our operating results with other companies in the health

care industry.

Adjusted EBITDA is not a measure of

financial performance under GAAP and should not be considered as an

alternative to net income attributable to HCA Healthcare, Inc. as a

measure of operating performance or cash flows from operating,

investing and financing activities as a measure of liquidity.

Because Adjusted EBITDA is not a measurement determined in

accordance with GAAP and is susceptible to varying calculations,

Adjusted EBITDA, as presented, may not be comparable to other

similarly titled measures presented by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124034956/en/

INVESTOR CONTACT: Frank Morgan 615-344-2688

MEDIA CONTACT: Harlow Sumerford 615-344-1851

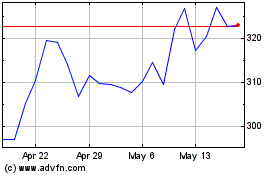

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

From Jan 2025 to Feb 2025

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

From Feb 2024 to Feb 2025