UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For February 22, 2024

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

("Harmony" and/or "the Company")

Trading statement and operating update for the six months ended 31 December 2023

Johannesburg, Thursday, 22 February 2024. In terms of paragraph 3.4(b) of the Listings Requirements of the JSE Limited ("JSE"), a company listed on the JSE is required to publish a trading statement as soon as they are satisfied that a reasonable degree of certainty exists that the financial results for the next period to be reported upon - being its interim results for the six months ended 31 December 2023 ("H1FY24") - will differ by at least 20% from the financial results for the comparable six months ended 31 December 2022 ("the previous comparable period" or "H1FY23").

"The stellar H1FY24 results are a result of our ongoing investment in safety, higher quality ounces, a stable and predictable cost structure and operational excellence across the entire group. This has placed us in a very good position to take advantage of the strong gold price and generate excellent operating free cash flows. We will continue using our wealth of experience and specialised skills to convert our significant Mineral Resources to Mineral Reserves as we create long-term value for all," says Peter Steenkamp, CEO.

Expected basic and headline earnings for H1FY24

Shareholders of Harmony are advised that a reasonable degree of certainty exists that basic earnings for H1FY24 will be higher than for H1FY23 primarily due to an increased gross profit as a result of:

•higher recovered grades

•an increase in gold production

•a higher average gold price received

In addition, an increase in the production of silver and uranium at the Hidden Valley and Moab Khotsong operations respectively, coupled with a meaningful increase in the average prices received for both commodities also contributed to a better performance.

The increase in earnings was partially offset by the following:

•an increase in production costs due to inflationary increases in labour and electricity costs as planned, and higher royalty taxes driven by an increase in revenue and profitability

•an increase in amortisation and depreciation as a result of higher depreciation recognised for Hidden Valley's stripping activities

•additional exploration expenditure incurred for the execution of an updated feasibility study of the Eva Copper project

•an increase in the current taxation due to higher taxable income resulting from favourable gold prices and an increase in gold sold

Consequently, earnings per share (“EPS”) are expected to be between 937 and 976 South African cents per share, which is an increase of more than 100% on the EPS of 298 South African cents per share for the previous comparable period. In United States ("US") dollar terms, the EPS are expected to be between 50 and 52 US cents per share, which is an increase of more than 100% on the EPS of 17 US cents per share reported for the previous comparable period.

Headline earnings per share (“HEPS”) are expected to be between 937 and 976 South African cents, which represents an increase of more than 100% from the HEPS of 293 South African cents reported in the previous comparable period. In US dollar terms, the HEPS are expected to be between 50 and 52 US cents per share, which is an increase of more than 100% on the headline earnings of 17 US cents per share reported for the previous comparable period.

Harmony will publish its financial results for the six months ended

31 December 2023 on Wednesday, 28 February 2024. Please see Harmony's website for more details: www.harmony.co.za.

The financial information on which this trading statement is based has not been reviewed or reported on by Harmony’s external auditors.

For more details, contact:

Jared Coetzer

Head of Investor Relations

+27 (0) 82 746 4120

Johannesburg, South Africa

22 February 2024

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

FORWARD-LOOKING STATEMENTS

This market release contains forward-looking statements within the meaning of the safe harbour provided by Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters.

These forward-looking statements, including, among others, those relating to our future business prospects, revenues, and the potential benefit of acquisitions (including statements regarding growth and cost savings) wherever they may occur in this market release, are necessarily estimates reflecting the best judgement of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this market release.

By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances and should be considered in light of various important factors, including those set forth in this disclaimer. Readers are cautioned not to place undue reliance on such statements. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation: overall economic and business conditions in South Africa, Papua New Guinea, Australia and elsewhere; the impact from, and measures taken to address, Covid-19 and other contagious diseases, such as HIV and tuberculosis; high and rising inflation, supply chain issues, volatile commodity costs and other inflationary pressures exacerbated by the Russian invasion of Ukraine and subsequent sanctions; estimates of future earnings, and the sensitivity of earnings to gold and other metals prices; estimates of future gold and other metals production and sales; estimates of future cash costs; estimates of future cash flows, and the sensitivity of cash flows to gold and other metals prices; estimates of provision for silicosis settlement; increasing regulation of environmental and sustainability matters such as greenhouse gas emission and climate change, and the impact of climate change on our operations; estimates of future tax liabilities under the Carbon Tax Act (South Africa); statements regarding future debt repayments; estimates of future capital expenditures; the success of our business strategy, exploration and development activities and other initiatives; future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; estimates of reserves statements regarding future exploration results and the replacement of reserves; the ability to achieve anticipated efficiencies and other cost-savings in connection with past and future acquisitions, as well as at existing operations; fluctuations in the market price of gold and other metals; the occurrence of hazards associated with underground and surface gold mining; the occurrence of labour disruptions related to industrial action or health and safety incidents; power cost increases as well as power stoppages, fluctuations and usage constraints; ageing infrastructure, unplanned breakdowns and stoppages that may delay production, increase costs and industrial accidents; supply chain shortages and increases in the prices of production imports and the availability, terms and deployment of capital; our ability to hire and retain senior management, sufficiently technically-skilled employees, as well as our ability to achieve sufficient representation of historically disadvantaged persons in management positions or sufficient gender diversity in management positions or at Board level; our ability to comply with requirements that we operate in a sustainable manner and provide benefits to affected communities; potential liabilities related to occupational health diseases; changes in government regulation and the political environment, particularly tax and royalties, mining rights, health, safety, environmental regulation and business ownership including any interpretation thereof; court decisions affecting the mining industry, including, without limitation, regarding the interpretation of mining rights; our ability to protect our information technology and communication systems and the personal data we retain; risks related to the failure of internal controls; our ability to meet our environmental, social and corporate governance targets; the outcome of pending or future litigation or regulatory proceedings; fluctuations in exchange rates and currency devaluations and other macroeconomic monetary policies, as well as the

impact of South African exchange control regulations; the adequacy of the Group’s insurance coverage; any further downgrade of South Africa’s credit rating and socio-economic or political instability in South Africa, Papua New Guinea, Australia and other countries in which we operate; changes in technical and economic assumptions underlying our mineral reserves estimates; geotechnical challenges due to the ageing of certain mines and a trend toward mining deeper pits and more complex, often deeper underground, deposits; and actual or alleged breach or breaches in governance processes, fraud, bribery or corruption at our operations that leads to censure, penalties or negative reputational impacts.

The foregoing factors and others described under "Risk Factors" in our Integrated Annual Report (www.har.co.za) and our Form 20-F should not be construed as exhaustive. We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this market release or to reflect the occurrence of unanticipated events, except as required by law. All subsequent written or oral forward-looking statements attributable to Harmony or any person acting on its behalf, are qualified by the cautionary statements herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Harmony Gold Mining Company Limited |

| |

| Date: February 22, 2024 | By: /s/ Boipelo Lekubo |

| Name: Boipelo Lekubo |

| Title: Financial Director |

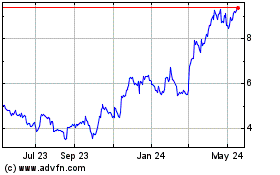

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Dec 2023 to Dec 2024