- Establishes H&P as a global leader in onshore drilling

- Immediately accretive to cash flow and free cash flow per

share

- Enhances scale and diversification, now with leading positions

in the U.S. and Middle East, the two most prominent oil and gas

producing regions in the world

- Increases H&P’s Middle East rig count(1) from 12 rigs to 88

rigs; positioning the Company as one of the largest rig providers

in the Middle East market

- Expects to maintain its high-quality investment grade credit

rating

- Adds complementary, asset-light global offshore management

contract business and manufacturing and engineering operations in

Europe and Middle East

- H&P to host a conference call to discuss its fiscal third

quarter results and transaction today at 7:30 a.m. CT

Helmerich & Payne, Inc. (NYSE: HP) (“H&P” or the

“Company”) and KCA Deutag International Limited (“KCA Deutag”)

today announced a definitive agreement under which H&P will

acquire KCA Deutag for $1.9725 billion in cash.

KCA Deutag is a diverse global drilling company. The company has

a significant land drilling presence in the Middle East, which

represents approximately two-thirds of the company’s calendar year

2023 Operating EBITDA, with additional operations in South America,

Europe and Africa. In addition to its land operations, KCA Deutag

has asset-light offshore management contract operations in the

North Sea, Angola, Azerbaijan and Canada, with super major

customers and long-term earnings visibility through a robust

backlog. KCA Deutag’s Kenera segment comprises manufacturing and

engineering businesses, including Bentec, with three facilities

serving the energy industry, representing a longer-term growth

opportunity.

President and CEO of H&P, John Lindsay, commented, “This is

a historic and transformative transaction for the Company, and we

are excited about what this means for H&P’s future, as it

accelerates our international expansion particularly in the Middle

East and enhances the Company’s global leadership in onshore

drilling solutions. KCA Deutag’s assets and operations will add

resilient revenues, providing greater earnings visibility and cash

flow generation. As a result, we expect to generate sizeable

incremental cash flows and are confident this transaction will

deliver near- and long-term growth and value creation for H&P

shareholders.

“H&P has a history of having a thoughtful and managed

approach to running and investing in the business and is well

versed in the challenges brought about by crude oil and natural gas

volatility. Our experience in the industry combined with a Middle

East market poised for continued growth should be indicative of the

importance and the compelling reasons for executing on this

acquisition at this time. Acquiring KCA Deutag gives H&P

immediate scale in core Middle East markets in a way that would be

challenging to replicate organically. Furthermore, as there is very

little geographic overlap, we view this transaction more than just

acquiring assets, but rather acquiring operations with quality

people.”

CEO of KCA Deutag, Joseph Elkhoury, also commented, “This

announcement represents a significant milestone in the strategic

transformation journey of KCA Deutag and delivers benefits to all

stakeholders: our employees, customers, shareholders and the

communities where we live and work. We look forward to joining

H&P, combining the strengths of our people together with our

geographical footprint, to create an organization with an

unrivalled global network, service capability and technology

offering. The size, scale and financial strength of the combined

organization will provide a stable foundation for long-term growth

and diversification to safeguard a sustainable and prosperous

future for our people. With similar customer-centric cultures,

focused on safety and delivering incident-free, quality services

and innovative technology, we will leverage H&Ps operational

processes and practices to accelerate efficiencies and optimize

operational excellence for our customers. Once completed, this

transaction is expected to deliver multiple growth opportunities

for our people and customers while facilitating value realization

for our investors.”

John Lindsay concluded, “As a combined company, we will maintain

our shared customer-centric approach and safety focus. We look

forward to welcoming KCA Deutag’s talented employees to the H&P

family and working together to provide exceptional performance and

value to customers across our global markets, now on a much larger

scale.”

Compelling Strategic and Financial

Benefits:

- Accelerates international growth

strategy, significantly increasing Middle East presence:

This acquisition provides immediate and significant exposure to

land operations in key markets in the Middle East, which generated

a large majority (~70%) of KCA Deutag’s calendar year 2023

Operating EBITDA. Through the transaction, H&P will increase

its Middle East rig count from 12(1) to 88 rigs, 71 of which are in

Saudi Arabia, Oman and Kuwait. Based on award activity to date, the

pro forma company would be one of the larger rig providers in the

Middle East.

- Enhances scale and

diversification: With KCA Deutag, H&P will have a

robust geographic and operational mix across the U.S. and

international crude oil and natural gas markets and diversified

geographical exposure in earnings and cash flow streams. The

transaction adds a complementary asset-light offshore management

contract business, primarily comprising 29 offshore platform rigs

under management, and a manufacturing and engineering business with

three facilities serving the energy industry. H&P expects this

transaction to grow its international land operations from ~1%(2)

on a standalone basis to ~19%(2) on a pro forma basis based on

calendar year 2023 Operating EBITDA. Offshore operations are

expected to grow from ~3%(2) on a standalone basis to ~7%(2) on a

pro forma basis based on calendar year 2023 Operating EBITDA.

- Strengthens cash flow and

durability: The Middle East rig market is expected to

continue to grow in the coming years. With an additional ~$5.5(3)

billion contract backlog from KCA Deutag, supported by a blue-chip

customer base, the Company will have highly resilient revenues and

cash flow and increased earnings visibility. On a combined company

basis, the last-twelve months (LTM) Operating EBITDA is ~ $1.2

billion.

- Generates attractive

returns: The transaction is expected to be immediately

accretive to cash flow and free cash flow per share, and

increasingly accretive thereafter, with double-digit free cash flow

accretion expected as soon as 2025. Transaction returns are

expected to exceed cost of capital by 2026.

- Committed to balanced and sustainable

financial practices and investor returns: H&P

expects to maintain its high-quality investment grade credit rating

with debt reduction a capital allocation priority for one to two

years post-close. The focus will be on reducing the

net-debt-to-Operating EBITDA ratio from 1.7x at close to at or

below 1.0x. The Company intends to maintain its current base

dividend and intends to pay the fourth and final installment of the

fiscal 2024 supplemental dividend as declared on June 5, 2024.

Thereafter, the Company does not anticipate providing a

supplemental dividend during the near-term deleveraging period. As

the Company reduces debt, it will continue to target select

investment opportunities with strong return profiles and will

consider additional opportunistic returns to shareholders beyond

the base dividend through the several years following close.

- Opportunity to realize

synergies: Despite little geographic overlap, H&P

expects to realize ~$25 million in run-rate synergies by 2026,

driven primarily by reduction in overhead and procurement savings.

H&P also expects to refinance KCA Deutag’s existing debt, which

will enable the Company to reinvest in the acquired business at a

lower cost of debt.

Transaction

Details:

Under the terms of the agreement, which has been unanimously

approved by the H&P Board of Directors, H&P will acquire

KCA Deutag International Limited for $1.9725 billion in cash. The

transaction is expected to close prior to calendar 2024 year end,

subject to customary closing conditions and regulatory

approvals.

The transaction will be funded with cash on hand and new

borrowings. Given the Company’s projected cash flow generation and

increased visibility with long-term contracts, H&P will be well

positioned to quickly reduce debt utilizing pre-payable term loans,

newly issued bonds with staggered maturities and strong cash flows.

H&P expects to refinance KCA Deutag’s existing debt at a lower

cost of capital.

Post-Close

Operations:

Following the completion of the transaction, H&P will remain

headquartered in Tulsa, Oklahoma, and John Lindsay will continue to

serve as President and Chief Executive Officer and as a member of

the H&P Board of Directors. There will be no changes to the

existing H&P Board of Directors.

Upon closing the transaction, H&P expects to have three

primary operating segments: North America Solutions, International

Solutions, and Offshore Solutions. H&P’s North America

Solutions segment will remain unchanged.

Conference Call and

Webcast:

A conference call will be held on Thursday, July 25, 2024 at

7:30 a.m. (CT) with John Lindsay, President and CEO, Mark Smith,

Senior Vice President and CFO, and Dave Wilson, Vice President of

Investor Relations, to discuss the transaction and the Company’s

third quarter fiscal year 2024 results. Dial-in information for the

conference call is (800) 343-4849 for domestic callers or (203)

518-9848 for international callers. The call access code is

“Helmerich1”. You may also listen to the conference call by logging

on to the Company’s website at http://www.helmerichpayne.com and

accessing the corresponding link through the investor relations

section by clicking on “Investors” and then clicking on “News and

Events - Events & Presentations” to find the event and the link

to the webcast and the accompanying presentation materials.

This conference call will replace the previously scheduled

conference call scheduled for 10 a.m. CT today.

Advisors:

Morgan Stanley & Co. LLC acted as financial advisor to

H&P, and Morgan Stanley Senior Funding, Inc. is providing

committed financing to H&P for the transaction. Kirkland &

Ellis LLP acted as legal advisor to H&P. Veriten has served as

independent strategic advisor, and Joele Frank, Wilkinson Brimmer

Katcher served as investor relations advisor to H&P. Moelis

& Co and PJT Partners acted as financial advisors to KCA

Deutag, and A&O Shearman acted as legal advisor.

About Helmerich & Payne,

Inc.

Founded in 1920, Helmerich & Payne, Inc. is committed to

delivering industry leading drilling productivity and reliability.

H&P operates with the highest level of integrity, safety and

innovation to deliver superior results for our customers and

returns for shareholders. Through its subsidiaries, the Company

designs, fabricates and operates high-performance drilling rigs in

conventional and unconventional plays around the world. H&P

also develops and implements advanced automation, directional

drilling and survey management technologies. For more information,

visit www.helmerichpayne.com.

About KCA Deutag

KCA Deutag is a leading drilling, engineering and technology

partner in current and future global energy markets, delivering

innovative solutions to ensure a secure, affordable and sustainable

energy future. With over 135 years of experience our global network

of operations spans 26 countries, where we employ approximately

11,000 people in our Land, Offshore and Kenera business units. We

currently operate or own 167 drilling rigs across the Middle East,

Europe, Africa, Caspian Sea, Latin America and Canada. For more

information, visit www.kcadeutag.com.

(1)

H&P’s Middle East rig count is pro

forma and includes 7 rigs that recently received tender awards to

work in Saudi Arabia and are in the process of being prepared for

operations and exported from the U.S.

(2)

Percentages of 2023 calendar year-end

Operating EBITDA based upon operating segment contributions only

and exclude corporate level amounts.

(3)

KCA Deutag’s backlog at May 1, 2024

included ~$3.8 billion in firm backlog and ~$1.7 billion in option

backlog.

Disclaimer:

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical facts

included in this news release are forward-looking statements.

Forward-looking statements may be identified by the use of

forward-looking terminology such as “may,” “will,” “expect,”

“intend,” “estimate,” “anticipate,” “believe,” “predict,”

“project,” “target,” “continue,” or the negative thereof or similar

terminology, and such include, but are not limited to, statements

regarding the proposed acquisition (the “Acquisition”) by Helmerich

& Payne, Inc. (“H&P” or the “Company”) of KCA Deutag

International Limited (“KCAD”), the anticipated benefits (including

synergies and cash flow and free cash flow accretion) of the

Acquisition, the anticipated impact of the Acquisition on the

Company’s business and future financial and operating results, the

anticipated impact of the Acquisition and the related transactions

on the Company’s credit ratings, the expected timing of the

Acquisition, including the expected closing date of the Acquisition

and the timing of expected synergies and returns from the

Acquisition, statements regarding our ability to continue to pay

dividends following the Acquisition, and statements regarding our

future financial position, estimated revenues and losses, business

strategy, projected costs, prospects and plans and objectives of

management. Forward-looking statements are based upon current

plans, estimates, and expectations that are subject to risks,

uncertainties, and assumptions, many of which are beyond our

control and any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. Although we believe that the

expectations reflected in such forward-looking statements are

reasonable, we can give no assurance that such expectations will

prove to be correct. The inclusion of such statements should not be

regarded as a representation that such plans, estimates, or

expectations will be achieved. Factors that could cause actual

results to differ materially from those expressed in or implied by

such forward-looking statements include, but are not limited to:

our ability and the time required to consummate the Acquisition;

our ability to achieve the strategic and other objectives relating

to the proposed Acquisition; the risk that regulatory approvals for

the Acquisition are not obtained or are obtained subject to

conditions that are not anticipated; the risk that we are unable to

integrate KCAD’s operations in a successful manner and in the

expected time period; the volatility of future oil and natural gas

prices; contracting of our rigs and actions by current or potential

customers; the effects of actions by, or disputes among or between,

members of the Organization of Petroleum Exporting Countries and

other oil producing nations with respect to production levels or

other matters related to the prices of oil and natural gas; changes

in future levels of drilling activity and capital expenditures by

our customers, whether as a result of global capital markets and

liquidity, changes in prices of oil and natural gas or otherwise,

which may cause us to idle or stack additional rigs, or increase

our capital expenditures and the construction, upgrade or

acquisition of rigs; the impact and effects of public health

crises, pandemics and epidemics, such as the COVID-19 pandemic;

changes in worldwide rig supply and demand, competition, or

technology; possible cancellation, suspension, renegotiation or

termination (with or without cause) of our contracts as a result of

general or industry-specific economic conditions, mechanical

difficulties, performance or other reasons; expansion and growth of

our business and operations; our belief that the final outcome of

our legal proceedings will not materially affect our financial

results; the impact of federal and state legislative and regulatory

actions and policies affecting our costs and increasing operating

restrictions or delay and other adverse impacts on our business;

environmental or other liabilities, risks, damages or losses,

whether related to storms or hurricanes (including wreckage or

debris removal), collisions, grounding, blowouts, fires,

explosions, other accidents, terrorism or otherwise, for which

insurance coverage and contractual indemnities may be insufficient,

unenforceable or otherwise unavailable; the impact of geopolitical

developments and tensions, war and uncertainty involving or in the

geographic region of oil-producing countries (including the ongoing

armed conflicts between Russia and Ukraine and Israel and Hamas,

and any related political or economic responses and

counter-responses or otherwise by various global actors or the

general effect on the global economy); global economic conditions,

such as a general slowdown in the global economy, supply chain

disruptions, inflationary pressures, currency fluctuations, and

instability of financial institutions, and their impact on the

Company; our financial condition and liquidity; tax matters,

including our effective tax rates, tax positions, results of

audits, changes in tax laws, treaties and regulations, tax

assessments and liabilities for taxes; the occurrence of security

incidents, including breaches of security, or other attack,

destruction, alteration, corruption, or unauthorized access to our

information technology systems or destruction, loss, alteration,

corruption or misuse or unauthorized disclosure of or access to

data; potential impacts on our business resulting from climate

change, greenhouse gas regulations, and the impact of climate

change related changes in the frequency and severity of weather

patterns; potential long-lived asset impairments; and our

sustainability strategy, including expectations, plans, or goals

related to corporate responsibility, sustainability and

environmental matters, and any related reputational risks as a

result of execution of this strategy.

Additional factors that could cause actual results to differ

materially from our expectations or results discussed in the

forward‑looking statements are disclosed in H&P’s 2023 Annual

Report on Form 10-K, including under Part I, Item 1A— “Risk

Factors” and Part II, Item 7— “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” thereof, as

updated by subsequent reports (including the Company’s Quarterly

Reports on Form 10-Q) we file with the Securities and Exchange

Commission. All forward-looking statements included in this

presentation and all subsequent written and oral forward-looking

statements, express or implied, are expressly qualified in their

entirety by these cautionary statements. All forward-looking

statements speak only as of the date they are made and are based on

information available at that time. Because of the underlying risks

and uncertainties, we caution you against placing undue reliance on

these forward-looking statements. We assume no duty to update or

revise these forward-looking statements based on changes in

internal estimates, expectations or otherwise, except as required

by law.

Market & Industry

Data:

The data included in this news release regarding the oil field

services industry, including trends in the market and the Company's

position and the position of its competitors within this industry,

are based on the Company's estimates, which have been derived from

management's knowledge and experience in the industry, and

information obtained from customers, trade and business

organizations, internal research, publicly-available information,

industry publications and surveys and other contacts in the

industry. The Company has also cited information compiled by

industry publications, governmental agencies and publicly-available

sources. Although the Company believes these third-party sources to

be reliable, it has not independently verified the data obtained

from these sources and it cannot assure you of the accuracy or

completeness of the data. Estimates of market size and relative

positions in a market are difficult to develop and inherently

uncertain and the Company cannot assure you that it is accurate.

Accordingly, you should not place undue weight on the industry and

market share data presented in this news release.

We use our Investor Relations website at

https://www.helmerichpayne.com/ as a channel of distribution for

material company information. Such information is routinely posted

and accessible at such site.

Use of Non-GAAP Financial

Measures:

This news release contains certain financial measures that are

not prepared in accordance with GAAP, including Operating EBITDA,

net-debt-to-Operating EBITDA and Free Cash Flow.

- Operating EBITDA is defined as Operating Income plus

depreciation and amortization and excluding the impacts of select

items. Select items are non-GAAP metrics and are excluded as they

are deemed to be outside the Company’s core business

operations.

- Net-debt-to-Operating EBITDA is defined as total debt less cash

and cash equivalents and short-term investments divided by

Operating EBITDA.

- Free Cash Flow is defined as net cash provided by/used in

operating activities less capital expenditures.

We believe that Operating EBITDA, net-debt-to-Operating EBITDA

and Free Cash Flow are useful measures to assess and understand the

financial performance of the Company. These financial measures are

not substitutes for financial measures prepared in accordance with

GAAP and should therefore be considered only as supplemental to

such GAAP financial measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725290265/en/

HP Contacts: Dave Wilson,

Vice President of Investor Relations investor.relations@hpinc.com

(918) 588‑5190

Media Stephanie Higgins Director of Communications

Stephanie.Higgins@hpinc.com (918) 588-2670

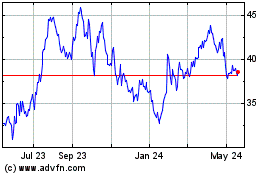

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Oct 2024 to Nov 2024

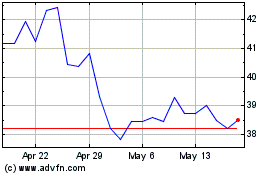

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Nov 2023 to Nov 2024