Longtime Servicing Client PNC Expands Use of ICE Data and Analytics to Further Benefit From End-to-End, Integrated Technology Ecosystem

17 September 2024 - 11:00PM

Business Wire

Proprietary mortgage and real estate data helps

manage portfolio risk and uncover opportunity in a complex

market

Intercontinental Exchange, Inc. (NYSE: ICE), a

leading global provider of technology and data, today announced

that PNC has expanded its use of ICE’s data and analytics solutions

as part of their renewal of the MSP® loan servicing system.

ICE’s proprietary mortgage data sets and advanced analytic models

help companies adapt to changing market conditions and evaluate and

mitigate portfolio risk.

“Today’s mortgage market is more challenging and nuanced than

we’ve seen in decades,” said Tim Bowler, President of ICE Mortgage

Technology. “As PNC works to maximize its technology investment,

they are also realizing the value of ICE’s trusted valuation

solutions, mortgage performance data, and prepayment and default

models to help manage risk and uncover opportunities.”

ICE Automated Valuation Models (AVMs) help reduce

regulatory compliance risk, decrease costs and turn times, and

identify opportunities for growth. ICE AVMs combine mortgage

performance and public records data sets with advanced modeling

techniques, rigorous testing and technology that spans the entire

real estate and mortgage continuum.

The ICE AFT Prepayment and Credit Model provides a

single, comprehensive, holistic view of servicing portfolios,

including an enhanced modeling tool for CECL and stress

testing.

McDash®, ICE’s loan-level performance database, gives an

unparalleled, granular view of the majority of the active mortgage

market across the United States. McDash offers the deepest and

broadest loan-level data repository in the industry to support

research, modeling, risk-management, compliance and benchmarking

needs. ICE’s servicer-contributed loan-level database of mortgage

assets uses proprietary information to provide users with

higher-quality model inputs to produce more reliable results.

“At ICE, our goal is to make the path to homeownership or

refinancing an existing mortgage faster, simpler, and more

transparent,” said Bowler. “PNC’s renewal with ICE will help them

achieve just that.”

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds, and operates digital networks

that connect people to opportunity. We provide financial technology

and data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines, and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: Mortgage Technology

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917379314/en/

ICE Media Contact Mitch Cohen mitch.cohen@ice.com +1

(704) 890-8158

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com +1 (678) 981-3882

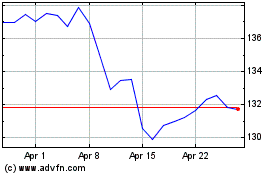

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Dec 2023 to Dec 2024