$1.27 Adjusted EPS (up 8% from 2024); $8.3

billion Adjusted EBITDA; 3.8x leverage at year-end 2025; and $1.17

dividend per share

Kinder Morgan, Inc. (NYSE: KMI) today announced its preliminary

2025 financial projections. “We expect 4% growth from 2024 in

Adjusted EBITDA and 8% growth in Adjusted EPS due to growth

projects in all our business segments, but most prominently in

Natural Gas Pipelines and Energy Transition Ventures,” said Kim

Dang, KMI Chief Executive Officer.

“We are projecting an annualized dividend of $1.17 in 2025,

constituting the 8th year in a row in which we have increased our

dividend. Our end-of-year 2025 Net Debt-to-Adjusted EBITDA ratio is

forecast to be 3.8 times, which is in the lower part of our

3.5x-4.5x leverage target range and provides good capacity for

additional opportunistic investment,” Dang concluded.

“We anticipate generating Adjusted EPS of $1.27, up 8% compared

to our year-end 2024 forecast of $1.17 per share, and Adjusted

EBITDA of $8.3 billion, up 4% compared to the 2024 forecast of $8

billion,” said KMI President Tom Martin.

“We expect to continue benefiting from strong natural gas market

fundamentals driving growth on our existing natural gas

transportation and storage assets, as well as creating expansion

opportunities. Overall, our base business is relatively flat with

expansion projects in our Natural Gas Pipelines segment and Energy

Transition Ventures group as the primary growth drivers,” Martin

concluded.

Below is a summary of KMI’s expectations for 2025:

- Generate $1.27 of Adjusted EPS, up 8% versus our current 2024

forecast of $1.17.

- Generate $8.3 billion of Adjusted EBITDA, up 4% from the 2024

forecast of $8 billion.

- Invest $2.3 billion in discretionary capital expenditures,

including expansion projects and contributions to joint ventures,

funded out of internally generated cash flow.

- Return additional value to shareholders for 2025 through an

anticipated declared $1.17 per share dividend (annualized).

- End 2025 with a Net Debt-to-Adjusted EBITDA ratio of 3.8

times.

This press release includes budgeted Adjusted EPS, Adjusted

EBITDA and Net Debt, all of which are non-GAAP financial measures.

For descriptions of these non-GAAP financial measures and

reconciliations to the most comparable measures prepared in

accordance with generally accepted accounting principles, please

see “Non-GAAP Financial Measures” below. Historically, KMI has

disclosed budgeted distributable cash flow, or DCF, in the

aggregate and per share. KMI has excluded budgeted DCF from this

press release due to declining investor interest in DCF as a

primary performance measure. KMI expects to continue to disclose

DCF in 2025 as supplemental information in some investor materials

for comparability purposes.

KMI’s expectations assume average annual prices for West Texas

Intermediate (WTI) crude oil and Henry Hub natural gas of $68 per

barrel and $3.00 per MMBtu, respectively, consistent with forward

pricing during the budget process. The vast majority of cash

generated by KMI is fee-based and therefore is not directly exposed

to commodity prices. For 2025, the company estimates that every $1

per barrel change in the average WTI crude oil price impacts

Adjusted EBITDA by approximately $7 million, and each $0.10 per

MMBtu change in the price of natural gas impacts Adjusted EBITDA by

approximately $6 million.

The KMI board of directors has preliminarily reviewed the 2025

budget and will take formal action on it at the January board

meeting, expected to coincide with the issuance of fourth quarter

2024 earnings on January 22, 2025. The 2025 budget will be the

standard by which KMI measures its performance next year and will

be a factor in determining employee compensation. Kinder Morgan has

posted a presentation that includes a brief overview of the 2025

budget to the Investor Relations website and expects to publish a

detailed 2025 budget and outlook presentation on the company’s

website in early February.

About Kinder Morgan, Inc.

Kinder Morgan, Inc. (NYSE: KMI) is one of the largest energy

infrastructure companies in North America. Access to reliable,

affordable energy is a critical component for improving lives

around the world. We are committed to providing energy

transportation and storage services in a safe, efficient, and

environmentally responsible manner for the benefit of the people,

communities and businesses we serve. We own an interest in or

operate approximately 79,000 miles of pipelines, 139 terminals, 702

billion cubic feet of working natural gas storage capacity and have

renewable natural gas generation capacity of approximately 6.1 Bcf

per year with an additional 0.8 Bcf in development. Our pipelines

transport natural gas, refined petroleum products, crude oil,

condensate, CO2, renewable fuels and other products, and our

terminals store and handle various commodities including gasoline,

diesel fuel, jet fuel, chemicals, metals, petroleum coke, and

ethanol and other renewable fuels and feedstocks. Learn more about

our work advancing energy solutions on the lower carbon initiatives

page at www.kindermorgan.com.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities Exchange Act of 1934.

Generally, the words “expects,” “believes,” anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are generally not historical in

nature. Forward-looking statements in this news release include

express or implied statements pertaining to KMI’s expectations for

2024 and 2025, including expected Adjusted EPS, Adjusted EBITDA,

Net Debt-to-Adjusted EBITDA, anticipated dividends, discretionary

capital expenditures, KMI’s financing and capital allocation

strategy, and the financial performance of growth projects.

Forward-looking statements are subject to risks and uncertainties

and are based on the beliefs and assumptions of management, based

on information currently available to them. Although KMI believes

that these forward-looking statements are based on reasonable

assumptions, it can give no assurance as to when or if any such

forward-looking statements will materialize nor their ultimate

impact on our operations or financial condition. Important factors

that could cause actual results to differ materially from those

expressed in or implied by these forward-looking statements

include: the timing and extent of changes in the supply of and

demand for the products we transport and handle; commodity prices;

regulatory and policy changes; delays or cost overruns affecting

expansion projects; and the other risks and uncertainties described

in KMI’s reports filed with the Securities and Exchange Commission

(SEC), including its Annual Report on Form 10-K for the year-ended

December 31, 2023 (under the headings “Risk Factors” and

“Information Regarding Forward-Looking Statements” and elsewhere)

and its subsequent reports, which are available through the SEC’s

EDGAR system at www.sec.gov and on our website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

KMI undertakes no obligation to update any forward-looking

statement because of new information, future events or other

factors. Because of these risks and uncertainties, readers should

not place undue reliance on these forward-looking statements.

Non-GAAP Financial

Measures

Our non-GAAP financial measures described further below should

not be considered alternatives to GAAP net income attributable to

Kinder Morgan, Inc. or other GAAP measures and have important

limitations as analytical tools. Our computations of these non-GAAP

financial measures may differ from similarly titled measures used

by others. You should not consider these non-GAAP financial

measures in isolation or as substitutes for an analysis of our

results as reported under GAAP. Management compensates for the

limitations of our consolidated non-GAAP financial measures by

reviewing our comparable GAAP measures identified in the

descriptions of consolidated non-GAAP measures below, understanding

the differences between the measures and taking this information

into account in its analysis and its decision-making processes.

Certain Items, as adjustments used

to calculate our non-GAAP financial measures, are items that are

required by GAAP to be reflected in net income attributable to

Kinder Morgan, Inc., but typically either (1) do not have a cash

impact (for example, unsettled commodity hedges and asset

impairments), or (2) by their nature are separately identifiable

from our normal business operations and in most cases are likely to

occur only sporadically (for example, certain legal settlements,

enactment of new tax legislation and casualty losses) We also

include adjustments related to joint ventures (see “Amounts from Joint Ventures” below).

Adjusted EPS is calculated as

Adjusted Net Income Attributable to Common Stock divided by our

weighted average shares outstanding. Adjusted

Net Income Attributable to Common Stock is calculated by

adjusting Net income attributable to Kinder Morgan, Inc., the most

comparable GAAP measure, for Certain Items, and further for net

income allocated to participating securities and adjusted net

income in excess of distributions for participating securities. We

believe Adjusted Net Income Attributable to Common Stock allows for

calculation of adjusted earnings per share (Adjusted EPS) on the

most comparable basis with earnings per share, the most comparable

GAAP measure to Adjusted EPS. Adjusted EPS applies the same

two-class method used in arriving at basic earnings per share.

Adjusted EPS is used by us, investors and other external users of

our financial statements as a per-share supplemental measure that

provides decision-useful information regarding our

period-over-period performance and ability to generate earnings

that are core to our ongoing operations.

Adjusted EBITDA is calculated by

adjusting net income attributable to Kinder Morgan, Inc. for

Certain Items and further for DD&A, income tax expense and

interest. We also include amounts from joint ventures for income

taxes and DD&A (see “Amounts associated

with Joint Ventures” below). Adjusted EBITDA (on a rolling

12-months basis) is used by management, investors and other

external users, in conjunction with our Net Debt (as described

further below), to evaluate our leverage. Management and external

users also use Adjusted EBITDA as an important metric to compare

the valuations of companies across our industry. Our ratio of Net

Debt-to-Adjusted EBITDA is used as a supplemental performance

target for purposes of our annual incentive compensation program.

We believe the GAAP measure most directly comparable to Adjusted

EBITDA is net income attributable to Kinder Morgan, Inc.

Net Debt is calculated by

subtracting from debt (1) cash and cash equivalents, (2) debt fair

value adjustments, and (3) the foreign exchange impact on

Euro-denominated bonds for which we have entered into currency

swaps. Net Debt, on its own and in conjunction with our Adjusted

EBITDA (on a rolling 12-months basis) as part of a ratio of Net

Debt-to-Adjusted EBITDA, is a non-GAAP financial measure that is

used by management, investors, and other external users of our

financial information to evaluate our leverage. Our ratio of Net

Debt-to-Adjusted EBITDA is also used as a supplemental performance

target for purposes of our annual incentive compensation program.

We believe the most comparable measure to Net Debt is total debt.

2025 budgeted Net Debt is calculated as budgeted total debt of

$31.4 billion, less budgeted cash and cash equivalents of less than

$0.1 billion; 2025 budgeted Net Debt does not include budgeted debt

fair value adjustments or the budgeted foreign exchange impact on

our Euro denominated debt, as these amounts are impractical to

predict and are expected to be immaterial.

Amounts associated with Joint

Ventures - Certain Items and Adjusted EBITDA reflect amounts

from unconsolidated joint ventures (JVs) and consolidated JVs

utilizing the same recognition and measurement methods used to

record “Earnings from equity investments” and “Noncontrolling

interests,” respectively. The calculation of Adjusted EBITDA

related to our unconsolidated and consolidated JVs include the same

items (DD&A, including amortization of basis differences

related to our JVs, and income tax expense) with respect to the JVs

as those included in the calculation of Adjusted EBITDA for our

wholly owned consolidated subsidiaries; further, we remove the

portion of these adjustments attributable to non-controlling

interests. Although these amounts related to our unconsolidated JVs

are included in the calculation of Adjusted EBITDA, such inclusion

should not be understood to imply that we have control over the

operations and resulting revenues, expenses, or cash flows of such

unconsolidated JVs.

Table 1

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

Adjusted EBITDA

(In billions,

unaudited)

2024 Forecast

2025 Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.7

$

2.8

Total Certain Items (1)

(0.1

)

—

DD&A

2.4

2.4

Income tax expense (2)

0.8

0.8

Interest, net (2)

1.8

1.8

Amounts associated with joint ventures

Unconsolidated JV DD&A (3)

0.4

0.5

Remove consolidated JV partners'

DD&A

(0.1

)

(0.1

)

Unconsolidated JV income tax expense

(4)

0.1

0.1

Adjusted EBITDA

$

8.0

$

8.3

Table 2

Kinder Morgan, Inc. and

Subsidiaries

Reconciliation of Projected

Net Income Attributable to Kinder Morgan, Inc. to Projected

Adjusted Net Income Attributable to Common Stock

(In billions,

unaudited)

2024 Forecast

2025 Budget

Net income attributable to Kinder

Morgan, Inc. (GAAP)

$

2.7

$

2.8

Total Certain Items (1)

(0.1

)

—

Net income allocated to participating

securities (1)(5)

—

—

Other (1)(6)

—

—

Adjusted Net Income Attributable to

Common Stock (7)

$

2.6

$

2.8

Notes

(1)

Aggregate adjustments are currently

estimated to be less than $100 million.

(2)

Amounts are adjusted for Certain

Items.

(3)

Includes amortization of basis differences

related to our JVs.

(4)

Includes the tax provision on Certain

Items recognized by the investees that are taxable entities

associated with our Citrus, NGPL and Products (SE) Pipe Line equity

investments.

(5)

Net income allocated to common stock and

participating securities is based on the amount of dividends paid

in the current period plus an allocation of the undistributed

earnings or excess distributions over earnings to the extent that

each security participates in earnings or excess distributions over

earnings, as applicable.

(6)

Adjusted net income in excess of

distributions for participating securities.

(7)

Adjusted Net Income Attributable to Common

Stock is used to calculate Adjusted EPS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209656170/en/

Dave Conover Media Relations newsroom@kindermorgan.com

Investor Relations (800) 348-7320 km_ir@kindermorgan.com

www.kindermorgan.com

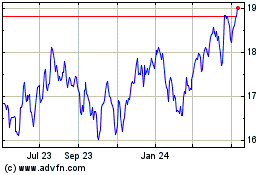

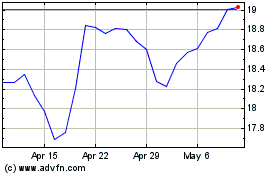

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Dec 2023 to Dec 2024