UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

Under the Securities Exchange Act of 1934

LSB

Industries, Inc.

(Name of Issuer)

Common Stock,

par value $0.10 per share

(Title of Class of Securities)

502160104

(CUSIP Number)

Todd L. Boehly

SBT Investors LLC

600

Steamboat Road

Greenwich, CT 06830

1-800-224-6469

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 15, 2022

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

(Continued on following pages)

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed

to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes). |

|

|

|

|

|

| CUSIP No. 502160104 |

|

SCHEDULE 13D |

|

|

|

|

|

|

|

|

|

| 1 |

|

Name of Reporting Person

SBT Investors LLC |

| 2 |

|

Check the Appropriate Box

if a Member of a Group (a) ☐ (b) ☐

|

| 3 |

|

SEC Use Only

|

| 4 |

|

Source of Funds

OO |

| 5 |

|

Check Box if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of

Organization Delaware |

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7 |

|

Sole Voting Power

18,272,476 (1) |

| |

8 |

|

Shared Voting Power

0 |

| |

9 |

|

Sole Dispositive Power

18,272,476 (1) |

| |

10 |

|

Shared Dispositive Power

0 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

18,272,476 (1) |

| 12 |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13 |

|

Percent of

Class Represented by Amount in Row (11) 22.0%(1)(2) |

| 14 |

|

Type of Reporting

Person OO |

| (1) |

Represents 17,453,398 shares of common stock, par value $0.10 per share (the “Common Stock”) directly

held by the Reporting Person and 819,078 shares of Common Stock directly held by EEH 2017, LLC (“EEH”). The Reporting Person is the indirect controlling member of EEH and in such capacity may be deemed to have sole voting power and sole

dispositive power over the shares of Common Stock held by EEH. |

| (2) |

Calculated based on 88,726,177 shares of Common Stock outstanding as of August 9, 2022, as reported in LSB

Industries, Inc.’s Registration Statement filed on August 10, 2022 and the repurchase by the Issuer of 5,500,000 shares of its Common Stock from the Underwriters (as defined below) in connection with the Public Equity Offering (as defined

below). |

2

|

|

|

|

|

| CUSIP No. 502160104 |

|

SCHEDULE 13D |

|

|

Item 1. Security and Issuer

This statement on Schedule 13D (this “Statement”) relates to the common stock, par value $0.10 per share (the “Common Stock”) of LSB

Industries, Inc., a Delaware corporation (the “Issuer”). The address of the principal executive offices of the Issuer is 3503 NW 63rd Street, Suite 500, Oklahoma City, Oklahoma 73116.

Item 2. Identity and Background

(a), (f) This

statement is being filed by SBT Investors LLC, a Delaware limited liability company (the “Reporting Person”). The Member Manager of the Reporting Person is NZC Capital LLC, a Delaware limited liability company (the “Member

Manager”). Todd Boehly is the controlling member of the Member Manager and is a U.S. citizen.

(b) The address of the principal business and principal

office of the Reporting Person and the Member Manager is 600 Steamboat Road, Greenwich, Connecticut 06830.

(c) The principal business of the Reporting

Person is making equity investments.

(d), (e) During the last five years, neither the Reporting Person nor the Member Manager (i) has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a

judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration

Effective August 10, 2022, LSB Funding LLC, a Delaware limited liability company (“LSB Funding”), made a pro rata distribution in kind, without

consideration, of shares of Common Stock to its indirect equityholders, certain of whom then made a pro rata distribution in kind, without consideration, of a total of 24,803,398 shares of Common Stock (the “Distributed Shares”) to the

Reporting Person, in each case, as such indirect equityholder’s member (collectively, the “Distribution”).

Item 4. Purpose of

Transaction

The Distributed Shares are being held for investment purposes.

In connection with the Distribution, on August 10, 2022, the Reporting Person entered into a letter agreement with the Issuer, LSB Funding and the other

parties thereto (the “Board Representation Letter Agreement”), a letter agreement with the Issuer and LSB Funding (the “Rights Letter Agreement”) and an additional letter agreement with the Issuer and LSB Funding (the “Rule

144 Letter Agreement” and, together with the Board Representation Letter Agreement and the Rights Letter Agreement, the “Letter Agreements”).

Pursuant to the Board Representation Letter, the Reporting Person has the right to designate nominees to serve on the Issuer’s board of directors (the

“Board”). Pursuant to the Rule 144 Letter Agreement, the Reporting Person has agreed that, for a period of six months following the date of the Distribution, the Reporting Person will only sell shares of Common Stock subject to certain

limitations on the volume of shares sold as would be applicable to the unrestricted resale of shares by affiliates of the Issuer under Rule 144 of the Securities Act of 1933, as amended.

The Issuer and the Reporting Person and LSB Funding have also entered into certain modifications to the Registration Rights Agreement between LSB Funding and

the Issuer and the Securities Exchange Agreement between LSB Funding and the Issuer, each as described in the Rights Letter Agreement.

The descriptions

of the Letter Agreements are summaries only and are qualified in their entirety by reference to the text of the Letter Agreements, which are referenced as Exhibit 1, Exhibit 2 and Exhibit 3 to this Statement. The Board Representation Letter

Agreement and the Rights Letter Agreement are incorporated by reference to Exhibits 99.1 and 99.2 to the Form 13D/A filed by LSB Funding with the Securities and Exchange Commission (the “SEC”) on August 10, 2022.

The text of the originally filed Board Representation and Standstill Agreement that the Board Representation Letter Agreement amends and other corresponding

amendments thereto are qualified in their entirety by reference to their text and are referenced as Exhibit 4, Exhibit 5 and Exhibit 6 to this Statement. The Board Representation and Standstill Agreement and corresponding amendments are incorporated

by reference to Exhibit 10.3 to the Issuer’s Current Report on Form 8-K filed with the SEC on December 8, 2015, Exhibit 10.1 to the Issuer’s Current Report on Form

8-K filed with the SEC on October 26, 2017 and Exhibit 10.2 to the Issuer’s Current Report on Form 8-K filed with the SEC on October 19, 2018.

3

The text of the originally filed Registration Rights Agreement that the Rights Letter Agreement amends is

qualified in its entirety by reference to its text and is referenced as Exhibit 7 to this Statement and is incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form 8-K filed with

the SEC on December 8, 2015. The text of the originally filed Securities Exchange Agreement that the Rights Letter Agreement amends is qualified in its entirety by reference to its text and is referenced as Exhibit 8 to this Statement and is

incorporated by reference to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on July 19, 2021.

Underwriting Agreement

On August 10, 2022, the

Reporting Person and LSB Funding LLC (collectively the “Selling Stockholders”), entered into an underwriting agreement (the “Underwriting Agreement”) with the Issuer and Goldman Sachs & Co. LLC and UBS Securities LLC, as

the representatives of the several underwriters (the “Underwriters”), pursuant to which the Underwriters agreed to purchase an aggregate of 13,500,000 shares of Common Stock from the Selling Stockholders (the “Public Equity

Offering”) with an option to purchase up to 1,200,000 additional shares of Common Stock from the Selling Stockholders (the “Option”) each at a price of $12.3175 per share. The Underwriters gave notice on August 12, 2022 to the

Selling Stockholders of their intention to exercise the Option in full. The Public Equity Offering closed on August 15, 2022, and the Option closed on August 16, 2022. The Selling Stockholders sold the following number of shares of Common

Stock in the aggregate pursuant to the Underwriting Agreement:

|

|

|

|

|

| Selling Stockholder |

|

Number of shares of Common Stock Sold |

|

| LSB Funding LLC |

|

|

7,350,000 |

|

| SBT Investors LLC |

|

|

7,350,000 |

|

Simultaneously upon the closing of the Public Equity Offering, the Issuer repurchased 5,500,000 shares of its Common Stock

from the Underwriters at a price per share equal to the price per share paid by the Underwriters to the Selling Stockholders in the Public Equity Offering and the Option.

Lock-up Agreement

In connection with the Underwriting Agreement, each of the Selling Stockholders entered into a 120-day lock-up agreement (the “Lock-up Agreement”) with the Underwriters.

The descriptions of the Underwriting Agreement and Lock-up Agreement are summaries only and are qualified in their

entirety by reference to the texts of the Underwriting Agreement and Lock-up Agreement, which are referenced as Exhibit 9 and Exhibit 10 to this Statement. The Underwriting Agreement is incorporated by

reference to Exhibit 1.1 to the Current Report on Form 8-K filed by the Issuer with the SEC on August 15, 2022.

The Reporting Person may engage in discussions with management, the board of directors, other stockholders of the Issuer and other relevant parties concerning

the business, assets, capitalization, financial condition, operations, management, strategy and future plans of the Issuer. The Reporting Person may also explore one or more other monetization transactions with respect to shares of Common Stock,

which may include additional public offerings or private placements. The potential transactions may involve one or more of the matters described in subsections (a) through (j) of Item 4 of Schedule 13D.

The Reporting Person may review its investments in the Issuer on a continuing basis. The determination to conduct any such additional monetization

transactions will be based on a variety of factors, including, among other things, the price level and liquidity of the Common Stock and general market and economic conditions. There can be no assurance that any such transactions will be

consummated. Depending on various factors, including, without limitation, the Issuer’s financial position and strategic direction, the market price of the Common Stock, other investment opportunities available to the Reporting Person, market

conditions and general economic and industry conditions, the Reporting Person may take such actions with respect to its investments in the Issuer as it deems appropriate. Notwithstanding anything to the contrary herein, the Reporting Person

specifically reserves the right to change its intentions with respect to any or all of such matters.

4

Item 5. Interest in Securities of the Issuer

(a), (b) Based upon the Issuer’s Registration Statement filed on August 10, 2022, there were 88,726,177 shares of Common Stock outstanding as of

August 9, 2022. On August 15, 2022, the Reporting Person sold 6,750,00 shares of Common Stock in the Public Equity Offering and the Issuer repurchased 5,500,000 shares of its Common Stock. On August 16, 2022, the Reporting Person sold

600,000 additional shares of Common Stock to the Underwriters pursuant to the exercise of the Option. Accordingly, the Reporting Person beneficially owns 18,272,476 shares of Common Stock, representing approximately 22.0% of the outstanding Common

Stock. The Reporting Person has sole voting and dispositive power over such shares.

(c) Except as reported herein, the Reporting

Person has not effected any transactions in the Common Stock during the past 60 days.

(d) No person other than the Reporting Person is known to have the

right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the Distributed Shares.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The Reporting Person is the borrower under a senior secured term loan facility with lenders party thereto from time to time (as the same may be amended,

refinanced or replaced from time to time, the “Secured Facility”) pursuant to which the Distributed Shares and certain other assets are pledged as collateral for the benefit of the lenders under the Secured Facility. Except for the matters

described herein, the Reporting Person does not have any contract, arrangement, understanding or relationship (legal or otherwise) with any person with respect to the securities of the Issuer.

5

Item 7. Material to be Filed as Exhibits

|

|

|

| Exhibit 1 |

|

The Board Representation Letter Agreement, dated as of August 10, 2022, by and among LSB Funding LLC, the Issuer, the Reporting Person and the other parties thereto (incorporated by reference to Exhibit 99.1 to the Form 13D/A

filed by LSB Funding with the SEC on August 10, 2022). |

|

|

| Exhibit 2 |

|

The Rights Letter Agreement, dated as of August 10, 2022, by and among LSB Funding LLC, the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.2 to the Form 13D/A filed by LSB Funding with the SEC on

August 10, 2022). |

|

|

| Exhibit 3 |

|

The Rule 144 Letter Agreement, dated as of August 9, 2022, by and among LSB Funding LLC, the Issuer and the Reporting Person. |

|

|

| Exhibit 4 |

|

Board Representation and Standstill Agreement, dated as of December 4, 2015, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.3 to the Issuer’s Current Report

on Form 8-K filed with the SEC on December 8, 2015). |

|

|

| Exhibit 5 |

|

Amendment, dated October 26, 2017, to the Board Representation and Standstill Agreement, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.1 to the Issuer’s

Current Report on Form 8-K filed with the SEC on October 26, 2017). |

|

|

| Exhibit 6 |

|

Amendment, dated October 18, 2018, to the Board Representation and Standstill Agreement, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.2 to the Issuer’s

Current Report on Form 8-K filed with the SEC on October 19, 2018). |

|

|

| Exhibit 7 |

|

Registration Rights Agreement, dated as of December 4, 2015, by and between LSB Funding LLC and the Issuer (incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form

8-K filed with the SEC on December 8, 2015). |

|

|

| Exhibit 8 |

|

Securities Exchange Agreement, dated as of July 19, 2021, by and between LSB Funding LLC and the Issuer (incorporated by reference to Exhibit 10.1 to the Issuer’s Current Report on Form

8-K filed with the SEC on July 19, 2021). |

|

|

| Exhibit 9 |

|

The Underwriting Agreement, dated as of August 10, 2022, by and among the Issuer, the Selling Stockholders and the Underwriters (incorporated by reference to Exhibit 1.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on August 15, 2022). |

|

|

| Exhibit 10 |

|

The Lock-up Agreement, dated as of August 10, 2022, by and among the Issuer, the Reporting Person and the Underwriters. |

6

SIGNATURES

After reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth in

this statement is true, complete and correct.

Date: August 16, 2022

|

|

|

| NZC CAPITAL LLC, in its capacity as Member Manager of SBT Investors LLC |

|

|

| By: |

|

/s/ Todd L. Boehly |

| Name: |

|

Todd L. Boehly |

| Title: |

|

Manager |

7

EXHIBIT INDEX

|

|

|

| Exhibit 1 |

|

The Letter Agreement, dated as of August 10, 2022, by and among LSB Funding LLC, the Issuer, the Reporting Person and the other parties thereto (incorporated by reference to Exhibit 99.1 to the Form 13D/A filed by LSB Funding

with the SEC on August 10, 2022). |

|

|

| Exhibit 2 |

|

The Letter Agreement, dated as of August 10, 2022, by and among LSB Funding LLC, the Issuer and the Reporting Person (incorporated by reference to Exhibit 99.2 to the Form 13D/A filed by LSB Funding with the SEC on

August 10, 2022). |

|

|

| Exhibit 3 |

|

The Rule 144 Letter Agreement, dated as of August 9, 2022, by and among LSB Funding LLC, the Issuer and the Reporting Person. |

|

|

| Exhibit 4 |

|

Board Representation and Standstill Agreement, dated as of December 4, 2015, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.3 to the Issuer ‘s Current Report

on Form 8-K filed with the SEC on December 8, 2015). |

|

|

| Exhibit 5 |

|

Amendment, dated October 26, 2017, to the Board Representation and Standstill Agreement, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.1 to the Issuer ‘s

Current Report on Form 8-K filed with the SEC on October 26, 2017). |

|

|

| Exhibit 6 |

|

Amendment, dated October 18, 2018, to the Board Representation and Standstill Agreement, by and among LSB Funding LLC, the Issuer and the other parties thereto (incorporated by reference to Exhibit 10.2 to the Issuer ‘s

Current Report on Form 8-K filed with the SEC on October 19, 2018). |

|

|

| Exhibit 7 |

|

Registration Rights Agreement, dated as of December 4, 2015, by and between LSB Funding LLC and the Issuer (incorporated by reference to Exhibit 10.4 to the Issuer ‘s Current Report on Form

8-K filed with the SEC on December 8, 2015). |

|

|

| Exhibit 8 |

|

Securities Exchange Agreement, dated as of July 19, 2021, by and between LSB Funding LLC and the Issuer (incorporated by reference to Exhibit 10.1 to the Issuer ‘s Current Report on Form

8-K filed with the SEC on July 19, 2021). |

|

|

| Exhibit 9 |

|

The Underwriting Agreement, dated as of August 10, 2022, by and among the Issuer, the Selling Stockholders and the Underwriters (incorporated by reference to Exhibit 1.1 to the Issuer’s Current Report on Form 8-K filed with the SEC on August 15, 2022). |

|

|

| Exhibit 10 |

|

The Lock-up Agreement, dated as of August 10, 2022, by and among the Issuer, the Reporting Person and the Underwriters. |

8

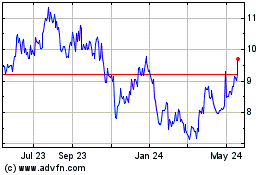

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Mar 2024 to Apr 2024

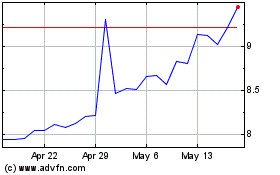

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Apr 2023 to Apr 2024