0001408198false00014081982025-01-272025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2025

MSCI Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

Delaware | | 001-33812 | | 13-4038723 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| | |

| | |

| |

| 7 World Trade Center, | 250 Greenwich Street, 49th Floor, | New York, | New York | 10007 |

(Address of Principal Executive Offices) (Zip Code) |

(212) 804-3900

(Registrant's telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | MSCI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

2025 CEO Special Incentive Award

On January 27, 2025, the Compensation, Talent, and Culture Committee (the “Committee”) of the Board of Directors of MSCI Inc. (the “Company”) approved the grant of a one-time premium-priced stock option award (the “Award”) to Henry A. Fernandez, the Company’s Chairman and Chief Executive Officer. The Award will be granted under the MSCI Inc. 2016 Omnibus Incentive Plan and will have a grant date on or around January 31, 2025 (the “Grant Date”).

The Award consists of non-qualified stock options with a total grant-date value of $15.0 million, allocated equally across three tranches with rigorous performance-based exercise prices of $1,000, $1,100, and $1,200. For reference, the Company’s stock price closed at $590.73 on January 30, 2025, with the exercise price hurdles representing premiums of approximately 69.3%, 86.2%, and 103.1%, respectively, over the Company’s stock price on that date. The options vest on the fifth anniversary of the Grant Date, subject to Mr. Fernandez’s continued service through the vesting date (except as described below), and have a ten-year term. The number of options to be granted in each tranche will be calculated by dividing the grant date value allocated to that tranche by the fair value of an option in that tranche, as determined as of the Grant Date. The Award does not include any interim vesting opportunities before the fifth anniversary of the Grant Date.

The Company’s compensation philosophy reflects its robust commitment to an “owner-operator” culture by using equity awards that directly link pay with performance and prioritize long-term shareholder value creation. The Award supports this philosophy by aligning Mr. Fernandez’s interests with those of shareholders through rigorous exercise price hurdles and an extended vesting schedule. The Committee considered Mr. Fernandez’s proven track record of value creation, including his over 25 years as the Company’s CEO and the more than 37-fold increase in the Company’s share price under his leadership from its initial public offering in 2007 through year-end 2024. This performance reflects a total shareholder return compound annual growth rate (“CAGR”) of 23.5%, significantly exceeding the S&P 500 index CAGR of 10.6% over the same period. The Committee, in consultation with its independent compensation consultant, reviewed an in-depth analysis of compensation practices among the Company’s peers and CEO pay opportunities and the performance-based weighting of CEO pay within the Company’s peer group. The Committee determined that this Award appropriately balanced the need to incentivize exceptional shareholder returns while maintaining alignment with market practices and the Company’s pay-for-performance philosophy.

Shareholder-Aligned Termination Provisions

In the event Mr. Fernandez’s employment terminates during the vesting period, the Award will be forfeited in full, except as otherwise set forth below. In the event of Mr. Fernandez’s termination of employment due to death or disability, all options will fully vest and remain exercisable for the remainder of their term. In the event of an involuntary termination without cause, a prorated portion of the options will vest if termination occurs before the third anniversary of the Grant Date, based on months of service, and all unvested options will fully vest if termination without cause occurs on or after the third anniversary. In both scenarios, vested options will remain exercisable for the remainder of their term.

In the event of a change in control, the Committee may provide for the continuation, assumption, substitution or replacement of the Award by the surviving company. If the Award is not continued or assumed or substituted or replaced, the options will fully vest and become exercisable immediately prior to the change in control. Similarly, the options will fully vest and remain exercisable upon a termination of employment without cause or a resignation for good reason within 24 months following a change in control.

Notably, and unlike the Company’s historical equity incentive compensation program, the Award does not include any retirement vesting provisions. To that end, the entirety of the Award will be “at-risk” and contingent upon Mr. Fernandez’s continued service to the Company.

Additional Terms and Requirements

The Award is subject to post-employment restrictions against competition, the solicitation of clients and employees of the Company, and the use or disclosure of confidential information. Furthermore, the Award is subject to the Company’s compensation recoupment policies and the Company’s stock ownership guidelines. Consistent with the Company’s stock retention requirements, Mr. Fernandez will be required to maintain 25% of the “net shares” realized following the exercise of any stock options associated with the Award through the end of his service on the Company’s Management Committee, supporting alignment with shareholder value over the long term. The retention requirements are in addition to the Company’s stock ownership requirements, which require Mr. Fernandez to hold shares equivalent to twelve times his annual base salary.

The foregoing description is qualified in its entirety by reference to the full text of the award agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

2025 CEO Target Compensation

The Committee also evaluated Mr. Fernandez’s annual long-term equity incentive compensation as part of its review of the Company’s 2025 executive compensation program. Based on this review the Committee approved an increase in Mr. Fernandez’s annual long-term equity incentive compensation from $11.6 million to $14.6 million, effective January 27, 2025.

The entirety of Mr. Fernandez’s 2025 long-term equity award is performance-based, delivering value only if pre-set performance metrics are achieved or if the Company’s stock price appreciates. The award structure reflects the Committee’s commitment to aligning executive compensation with shareholder interests with 70% of the value in three-year performance stock options that vest based on cumulative revenue and cumulative adjusted EPS goals and 30% of the value in three-year performance stock units that vest based on total-shareholder-return goals. The increase reflects the Committee’s recognition of Mr. Fernandez’s critical contributions to the Company’s growth, as well as a review of competitive CEO compensation practices among the Company’s peers, which found the revised award size to be consistent with market standards. No changes were made to Mr. Fernandez’s annual base salary or annual target cash incentive compensation.

Item 7.01 Regulation FD Disclosure

The compensation actions described in this Current Report on Form 8-K are reflected in the Company’s expense guidance referenced in the Company’s press release included as Exhibit 99.1 to its Current Report on Form 8-K (the “Earnings Press Release”) furnished to the Securities and Exchange Commission on January 29, 2025. For the avoidance of doubt, the contents of the Earnings Press Release are expressly not incorporated by reference into or intended to be filed as a part of this Current Report on Form 8-K.

The information furnished under Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MSCI Inc. |

| |

| |

Date: January 31, 2025 | By: | /s/ Robert J. Gutowski |

| Name: | Robert J. Gutowski |

| Title: | General Counsel and Head of Corporate Affairs |

Document and Entity Information Document

|

Jan. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 27, 2025

|

| Entity Registrant Name |

MSCI Inc.

|

| Entity Central Index Key |

0001408198

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

13-4038723

|

| Entity Address, Address Line One |

7 World Trade Center,

|

| Entity Address, Address Line Two |

250 Greenwich Street, 49th Floor,

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10007

|

| City Area Code |

212

|

| Local Phone Number |

804-3900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

MSCI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33812

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

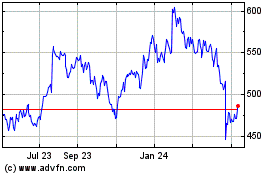

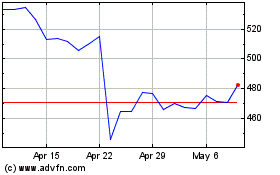

MSCI (NYSE:MSCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

MSCI (NYSE:MSCI)

Historical Stock Chart

From Feb 2024 to Feb 2025