Statement of Changes in Beneficial Ownership (4)

01 November 2019 - 8:15AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Knight Travis A |

2. Issuer Name and Ticker or Trading Symbol

NIKE, Inc.

[

NKE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

ONE BOWERMAN DRIVE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/29/2019

|

|

(Street)

BEAVERTON, OR 97005

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Class B Common Stock

|

|

|

|

|

|

|

|

22269

|

D

|

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Class A Common Convertible

|

(1)

|

10/29/2019

|

|

J (2)(3)(4)

|

|

|

9000000

|

(1)

|

(1)

|

Class B Common Stock

|

9000000

|

$0 (2)

|

275856369

|

I

|

by Trust (2)(3)(4)(5)

|

|

Class A Common Convertible

|

(1)

|

10/29/2019

|

|

J (2)(3)(4)

|

|

900000

|

|

(1)

|

(1)

|

Class B Common Stock

|

900000

|

$0

|

276756369

|

I

|

by Trust (2)(3)(4)(5)

|

|

Explanation of Responses:

|

| (1)

|

Class A Common Stock is convertible at any time on a one-for-one basis into Class B Common Stock with no expiration date.

|

| (2)

|

On October 29, 2019, Swoosh, LLC, a Delaware limited liability company ("Swoosh"), made a private pro rata distribution of shares of the Issuer's Class A Common Stock. A wholly-owned subsidiary ("Subsidiary") of the Travis A. Knight 2009 Irrevocable Trust II (the "Trust") received 900,000 of the 9,000,000 shares so distributed, which 900,000 shares were simultaneously distributed to the Trust in a transaction representing only a change in the form of beneficial ownership of such shares. As described in footnote 5, the reporting person, through the Trust, acquired an interest in such shares.

|

| (3)

|

Pursuant to the Amended and Restated Limited Liability Company Agreement of Swoosh (the "Swoosh Agreement"), Swoosh is managed by a board of directors consisting of five board seats (the "Swoosh Board"). Two of the five seats on the Swoosh Board are classified as Class X Board Seats and are filled by vote of the Class X Units. The other three Swoosh board seats are held by directors who are self-electing (the "Independent Directors"). The reporting person currently holds both of the Class X Board Seats. At least two Independent Directors and a director holding a Class X Board Seat constitute a quorum at a meeting of the Swoosh Board, and board action requires the approval of a majority of votes cast at a meeting at which a quorum is present.

|

| (4)

|

The foregoing description of the Swoosh Agreement and the Swoosh Board is qualified in its entirety by reference to the Schedule 13D filed by Swoosh on June 30, 2015, as amended on December 31, 2015 and June 30, 2016. The reporting person disclaims beneficial ownership of all securities held by Swoosh, and this report shall not be deemed an admission that the reporting person is, or has been, the beneficial owner of such securities for purposes of Section 16 or for any other purpose.

|

| (5)

|

The number in column 9 represents 20,713,989 shares, in the case of row 1 of Table II, and 21,613,989 shares, in the case of row 2 of Table II, held directly by the Trust, 19,142,380 shares held directly by a Delaware limited liability company of which Subsidiary is the sole manager, and 236,000,000 shares held directly by Swoosh (all the Class X Units of which are held by Subsidiary). The reporting person disclaims beneficial ownership of all such shares held directly and indirectly by the Trust in excess of his pecuniary interest therein and disclaims beneficial ownership of all securities held by Swoosh.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Knight Travis A

ONE BOWERMAN DRIVE

BEAVERTON, OR 97005

|

X

|

|

|

|

Signatures

|

|

/s/ Adrian L. Bell, attorney-in-fact for Mr. Knight

|

|

10/31/2019

|

|

**Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person, see Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2024 to May 2024

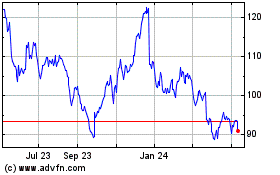

Nike (NYSE:NKE)

Historical Stock Chart

From May 2023 to May 2024

NIKE, Inc. Declares $0.370 Quarterly Dividend

Friday 3 May 2024 (19 hours ago) • Business Wire |

Li Auto Stock Drops 7.3% Amid Tesla Price Cuts, Salesforce Retreats from Informatica Deal, and Other Market Updates

Monday 22 April 2024 (2 weeks ago) • IH Market News |

Paramount’s Shares Surge Following Sony and Apollo’s Joint Bid; ISS Backs Berkshire Hathaway Director Re-election, and More

Friday 19 April 2024 (2 weeks ago) • IH Market News |

Paramount Global Board Shrinks, Morgan Stanley Faces Regulatory Probe, and More News

Friday 12 April 2024 (3 weeks ago) • IH Market News |

Nike Kicks Off Multi-Year Innovation Cycle

Friday 12 April 2024 (3 weeks ago) • Business Wire |

Costco Increases Dividend by 14%, Meta Introduces ‘Artemis’ AI Chip, and More News

Thursday 11 April 2024 (3 weeks ago) • IH Market News |

Tech Sector Weakness May Weigh On Wall Street

Tuesday 26 March 2024 (1 month ago) • IH Market News |

U.S. Stocks Close Mixed On The Day But Sharply Higher For The Week

Saturday 23 March 2024 (1 month ago) • IH Market News |

FedEx Soars 13% with Profits Above Forecasts, Nike Hit by China Slowdown, and Latest News

Saturday 23 March 2024 (1 month ago) • IH Market News |

NIKE, Inc. Reports Fiscal 2024 Third Quarter Results

Friday 22 March 2024 (1 month ago) • Business Wire |

U.S. Index Futures Rise as Fed’s Dovish Outlook Spurs Positive Investor Sentiment; Oil Prices See Minor Declines

Thursday 21 March 2024 (1 month ago) • IH Market News |

Apple Pre-Market Drop Due to Antitrust Threats, Surprising Profit Boosts Micron Shares, and Latest Market Updates

Thursday 21 March 2024 (1 month ago) • IH Market News |

More Nike, Inc. News Articles

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.