Form 8-K - Current report

29 October 2024 - 12:50AM

Edgar (US Regulatory)

0000791963false00007919632024-07-302024-07-30

As filed with the Securities and Exchange Commission on October 28, 2024

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 28, 2024

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

| | | | | | | | |

| Delaware | | 98-0080034 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A non-voting common stock | OPY | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 – REGULATION FD

ITEM 7.01 Regulation FD Disclosure.

On October 28, 2024, Oppenheimer Holdings Inc. (the “Company”) posted to the Investor Relations page of its website, www.oppenheimer.com, a presentation to investors regarding the Company in the form of the slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.1 (the “Slides”). The Company may use the Slides, in whole or in part, and possibly with minor modifications, in connection with presentations to investors after such date.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The information contained in the Slides is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

In accordance with General Instruction B.2 of this Current Report on Form 8-K, the information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)Exhibits:

The following Exhibit is submitted herewith:

99.1 Investor Presentation (Third Quarter 2024 Investor Update) posted on October 28, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Oppenheimer Holdings Inc.

| | |

Date: October 28, 2024

By: /s/ Brad M. Watkins

---------------------------------

Brad M. Watkins

Chief Financial Officer

(Duly Authorized Officer and Principal Financial and Accounting Officer) |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

Oppenheimer Holdings Inc. Third Quarter 2024 Investor Update

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. ("Oppenheimer” or the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forward-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2024 (the “2023 10-K”) and Quarterly Report on Form 10-Q for the quarter-ended September 30, 2024 filed with the SEC on October 25, 2024 (the “2024 10-Q3”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part I, “Item 2. Management’s Discussion & Analysis of Financial Condition and Results of Operations” of the 2024 10-Q3. Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2023 10-K, the 2024 10-Q3 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward-looking statements. Any forward-looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. 3 • Hong Kong, China• London, UK • Geneva, Switzerland • St. Helier, Isle of Jersey • Tel Aviv, Israel (1) Represents book value less goodwill and intangible assets divided by number of shares outstanding. (2) Attributable to Oppenheimer Holdings Inc. $24.5 million Net Income in 3Q-24 $373.4 million Revenue in 3Q-24 Business Overview Oppenheimer Snapshot (as of 9/30/2024) Listed NYSE Ticker: OPY Stockholders' Equity ($M): $837.8 Market Cap ($M): $528.6 Book Value per Share: $81.10 Tangible Book Value per Share:(1) $64.03 Share Price: $51.16 3Q-24 Earnings per Share (Basic)(2): $2.38 3Q-24 Earnings per Share (Diluted)(2): $2.16 YTD Earnings per Share (Basic)(2): $5.87 YTD Earnings per Share (Diluted)(2): $5.45 P/E Ratio (TTM): 7.38 Dividend Yield (TTM): 1.23% Employees: 2,993 # of Financial Advisors: 928 Retail Branches in the US: 89 Client Assets under Administration ($B): $129.8 Assets Under Management ($B): $49.1 .

Earnings (loss) per share (Basic)1 $ 2.38 $ 1.32 80.3% Earnings (loss) per share (Diluted)1 $ 2.16 $ 1.21 78.5% Summary Operating Results: 3Q-24 vs. 3Q-23 (Unaudited) 4 Highlights ($000’s) For the 3-Months Ended REVENUE 9/30/2024 9/30/2023 % Change Commissions 103,079 83,933 22.8 % Advisory fees 121,631 107,969 12.7 % Investment banking 52,185 37,411 39.5 % Bank deposit sweep income 34,875 42,304 -17.6 % Interest 38,034 26,430 43.9 % Principal transactions, net 14,364 16,892 -15.0 % Other 9,184 (2,272) * Total Revenue 373,352 312,667 19.4 % EXPENSES Compensation and related expenses 237,935 195,684 21.6 % Non-compensation related expenses 100,047 95,396 4.9 % Total Expenses 337,982 291,080 16.1 % Pre-tax income 35,370 21,587 63.8 % Net income attributable to Oppenheimer Holdings Inc. $ 24,508 $ 13,861 76.8 % Increased revenue for the third quarter of 2024 was primarily driven by significantly higher advisory fees attributable to a rise in bil lable assets under management (“AUM”), an increase in transaction-based commissions as well as improved investment banking and interest revenues Assets under administration and under management were both at record levels at September 30, 2024, benefiting from market appreciation Compensation expenses increased from the prior year quarter largely as a result of higher incentive compensation, deferred compensation and production-related expenses Non-compensation expenses increased from the prior year quarter primarily due to higher interest and technology related expenses partially offset by lower legal costs Total stockholders' equity, book value and tangible book value per share reached new record highs as a result of positive earnings Announced plans to further strengthen balance sheet through the redemption of all outstanding Senior Secured Notes which occurred on October 10, 2024 *Percentage not meaningful. 1 Attributable to Oppenheimer Holdings Inc.

5 Select Financial Measures Earnings per Share ($)1 Net Income ($M)1Revenue ($M) Shareholders’ Equity ($M)1 1 Attributable to Oppenheimer Holdings Inc. BV/Share 54.93 65.66 72.41 76.72 75.01 81.10

6 Segment Revenue Breakdown 3Q-24 vs. 3Q-23 Pre-Tax Income Breakdown by Segment ($M)Revenue Breakdown by Segment ($M) Private Client Asset Management Capital Markets 3Q-24 Revenue $373.4 MM 3Q-23 Revenue $312.7 MM 150.8 57% $54.5 71.3 30% 71.3 30% $3.3 Corp/Other $4.0 Corp/Other 59% 7% 33% 30% 62%7%

Wealth Management Well-recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities Retail Services • Full-Service Brokerage • Financial Planning, Retirement Services, Insurance Solutions, Corporate & Executive Services & Trust Services • Margin & Securities Lending Advisory Services • Investment Policy Design & Implementation • Asset Allocation & Portfolio Construction • Research, Diligence & Manager Selection • Portfolio Monitoring & Reporting Retail Investments • Hedge Funds & Fund-of-Funds • Private Equity • Private Market Opportunity (Qualified Investors only) to source investments across the private markets continuum Wealth Management Revenue ($M) Pre-Tax Income ($M) and Pre-Tax Margin (%) 928 Financial Advisors At 9/30/2024 $129.8B Assets under Administration At 9/30/2024 $49.1B Assets under Management At 9/30/2024 12.7% Advisory Fees 3Q-24 vs 3Q-23 * Wealth Management includes both Private Client and Asset Management business segments. 7 25% 18% 25% 23%

25.2% Sales & Trading Revenues 3Q-24 vs 3Q-23 Capital Markets A leading capital markets business providing sophisticated investment banking, research and trading solutions Healthcare Technology Transportation & Logistics Finance & Real Estate Consumer & Retail Energy Capital Markets Revenue Breakdown 3Q-24 ($M) Capital Markets Revenue ($M) Investment Banking Focus Industries 8 Institutional Equities • Sales and Trading • Equity Research − 35+ senior research analysts covering 600+ companies • Corporate Access (Conferences & NDRs) Investment Banking • Mergers & Acquisitions • Equity Capital Markets • Debt Capital Markets • Restructuring & Special Situations Fixed Income • Taxable Fixed Income • Non-Taxable Fixed Income • Public Finance Retail Services 39.5% Investment Banking Revenues 3Q-24 vs 3Q-23 3Q-24 $124.0M $39.2 31%

9 Capital Structure Book & Tangible Book Value per Share ($) Liquidity & Capital 1 Total Assets divided by Total Stockholders' Equity. • Stockholders’ equityof $837.8 million as of September 30, 2024 • Book value ($81.10) and tangible book value ($64.03) per share increased from the prior year period largely as a result of positive earnings • The Board of Directors announced a quarterly dividend in the amount of $0.18 per share payable on November 22, 2024 to holders of Class A non-voting and Class B voting common stock of record on November 8, 2024 • Level 3 assets, comprised of auction rate securities, were $2.7 millionas of September 30, 2024 As of September 30, 2024 ($ in thousands) Total Assets: $3,367,285 Stockholders’ Equity: $ 837,838 Long-Term Debt (redeemed in full on 10/10/24): $ 113,050 Total Capitalization: $ 950,888 Debt to Equity Ratio: 13.5 % Gross Leverage Ratio(1): 4.0 Broker-Dealer Regulatory Capital ($ in millions) Regulatory Net Capital: $ 487.5 Regulatory Excess Net Capital: $ 464.6 81.10 54.93 65.66 72.41 76.72 75.01

For more information contact Investor Relations at info@opco.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

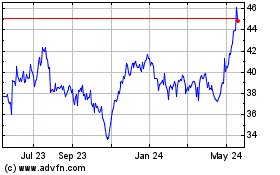

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Dec 2024 to Jan 2025

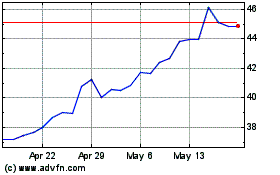

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jan 2024 to Jan 2025