Form 8-K - Current report

21 December 2024 - 1:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report: December 20, 2024 |

PERMIAN BASIN ROYALTY TRUST

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

1-8033 |

75-6280532 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Argent Trust Company 3838 Oak Lawn Ave. Suite 1720 |

|

Dallas, Texas |

|

75219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 855 588-7839 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Units of Beneficial Interest |

|

PBT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 20, 2024, the Registrant issued a press release announcing its monthly cash distribution to unitholders of record on December 31, 2024. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

This Report on Form 8-K is being furnished pursuant to Item 2.02, Results of Operations and Financial Condition. The information furnished is not deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PERMIAN BASIN ROYALTY TRUST |

|

|

|

|

|

|

By: |

ARGENT TRUST COMPANY, TRUSTEE |

|

|

|

|

|

|

By: |

/s/ Jana Egeler |

Date: December 20, 2024 |

|

|

Jana Egeler

Vice President and Trust Administrator |

Exhibit 99.1

Permian Basin Royalty Trust

PERMIAN BASIN ROYALTY TRUST NNOUNCES DECEMBER CASH DISTRIBUTION AND EXCESS COST POSITION ON WADDELL RANCH PROPERTIES

DALLAS, Texas, December 20, 2024 – Argent Trust Company, as Trustee of the Permian Basin Royalty Trust (NYSE: PBT) (“Permian” or the “Trust”) today declared a cash distribution to the holders of its units of beneficial interest of $0.021939 per unit, payable on January 15, 2025, to unit holders of record on December 31, 2024. The distribution does not include proceeds from the Waddell Ranch properties, as total production costs (“Production Costs”) exceeded gross proceeds (“Gross Proceeds”) for the month of November, resulting in an excess cost position for the Waddell Ranch properties. More information regarding the Waddell Ranch properties is described below.

This month’s distribution slightly increased from the previous month due primarily to the Texas Royalty Properties having higher oil and gas volumes, partially offset by lower gas and oil prices for the month reported.

WADDELL RANCH

Notwithstanding requests from the Trustee to Blackbeard, the operator of the Waddell Ranch properties, and the fact that prior to May 2024, Blackbeard has provided this information on a monthly basis since Argent Trust Company has become Trustee of the Trust, Blackbeard has refused to provide the Trustee information necessary to calculate the net profits interest (“NPI”) proceeds for December 2024 as of the announcement date for this month’s distribution. As a result of Blackbeard’s failure to provide this information by the NYSE notification date for the distribution, in accordance with the Trust indenture, if NPI proceeds are received from the Waddell Ranch properties on or prior to the record date, they will be included in the January distribution.

As noted above, no proceeds were received by the Trustee in November 2024 to be included in the December distribution. The excess costs (Gross Proceeds minus Production Costs) totaled $4,987,682 on the Underlying Properties ($3,740,762 net to the Trust) for the month of October, the latest information from Blackbeard received by the Trustee. The excess costs included accrued interest of $33,031 on the Underlying Properties ($24,773 net to the Trust). All excess costs, including any accrued interest, will need to be recovered by future proceeds from the Waddell Ranch properties before any proceeds are distributed to the Trust.

TEXAS ROYALTY PROPERTIES

Production for the underlying Texas Royalty Properties was 18,407 barrels of oil and 7,073 Mcf of gas. The production for the Trust’s allocated portion of the Texas Royalty Properties was 16,432 barrels of oil and 6,315 Mcf of gas. The average price for oil was $70.83 per bbl and for gas was $11.05, which includes significant NGL pricing, per Mcf. This would mainly reflect production and pricing in September for oil and August for gas. These allocated volumes were impacted by the pricing of both oil and gas. This production and pricing for the underlying properties resulted in revenues for the Texas Royalty Properties of $1,381,893. Deducted from these revenues were taxes and expenses of $144,874, resulting in a Net Profit of $1,237,019 for December. With the Trust’s NPI of 95% of the Underlying Properties, this would result in a net contribution by the Texas Royalty Properties of $1,175,168 to this month’s distribution.

|

|

|

|

|

|

|

|

Underlying Properties |

Net to Trust Sales |

|

|

Volumes |

Volumes |

Average Price |

|

Oil (bbls) |

Gas (Mcf) |

Oil (bbls) |

Gas (Mcf) (1) |

Oil (per bbl) |

Gas (per Mcf) (2) |

Current Month |

|

|

|

|

|

|

|

|

|

|

|

|

|

Waddell Ranch |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

Texas Royalties |

17,969 |

7,932 |

16,103 |

7,106 |

$77.19 |

$10.02 |

|

|

|

|

|

|

|

Prior Month |

|

|

|

|

|

|

Waddell Ranch |

(3) |

(3) |

(3) |

(3) |

(3) |

(3) |

Texas Royalties |

20,846 |

7,012 |

18,843 |

6,337 |

$79.03 |

$10.00 |

(1) These volumes are net to the Trust, after allocation of expenses to Trust’s net profit interest, including any prior period adjustments.

(2) This pricing includes sales of gas liquid products.

(3) Information is not being made available monthly, but may be provided within 30 days next following the close of each calendar quarter.

General and Administrative Expenses deducted for the month, net of interest earned were $152,583 resulting in a distribution of $1,022,585 to 46,608,796 units outstanding, or $0.021939 per unit.

The worldwide market conditions continue to affect the pricing for domestic production. It is difficult to predict what effect these conditions will have on future distributions.

TRUST LITIGATION

On May 8, 2024, the Trustee announced that it had initiated a lawsuit by filing a petition in the District Court of Tarrant County, Texas against Blackbeard Operating, LLC (“Blackbeard”), the operator of properties in the Waddell Ranch, in Crane County, Texas, in which the Trust holds a 75% net overriding royalty. On June 10, 2024, Blackbeard filed its original answer and counterclaim to the lawsuit. The case is in the early fact discovery phase, and the trial date in the District Court of Tarrant County has been moved to November 17, 2025, 8:30 a.m., Central Time.

Under the original petition, the Trustee sought to recover more than $15 million in damages to the Trust resulting from overhead costs and other expenses the Trustee alleges were impermissibly deducted from royalty payments to the Trust. The Trustee routinely engages in audits of the revenues and expenses with respect to the Trust’s royalty payments. In connection with its audit for the period from 2020-2022 the Trustee identified exceptions to certain expenses deducted from the Trust’s royalty payments, including among other things, incorrect overhead charges, application of overhead charges to non-producing wells, duplicate charges for services, materials and utilities as well as other expenses the Trustee alleges are ineligible charges. The Trustee’s petition was amended in September 2024 to add additional claims relating to the 2023 audit and production volumes, seeking damages of more than $25 million. Attempts to resolve the disputed charges outside of court have been unsuccessful to date. Included in Blackbeard’s original answer and counterclaim are requests for declaratory judgment by the court that it may deduct certain disputed overhead charges from Trust royalty payments and that it may limit information it provides to the Trust to quarterly statements of the net proceeds computation and inspection of books and record during normal business hours.

The 2023 Annual Report with Form 10-K, which includes the December 31, 2023, Reserve Summary, is posted on Permian’s website. Permian’s cash distribution history, current and prior year financial reports, tax information booklets, and a link to filings made with the Securities and Exchange Commission, all can be found on Permian’s website at http://www.pbt-permian.com/. Additionally, printed reports can be requested and are mailed free of charge.

FORWARD-LOOKING STATEMENTS

Any statements in this press release about future events or conditions, and other statements containing the words “estimates,” “believes,” “anticipates,” “plans,” “expects,” “will,” “may,” “intends,” and similar expressions, other than historical facts, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Factors or risks that could cause the Trust’s actual results to differ materially from the results the Trustee anticipates include, but are not limited to the factors described in Part I, Item 1A, “Risk Factors” of the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023, and Part II, Item 1A, “Risk Factors” of subsequently filed Quarterly Reports on Form 10-Q.

Actual results may differ materially from those indicated by such forward-looking statements. In addition, the forward-looking statements included in this press release represent the Trustee’s views as of the date hereof. The Trustee anticipates that subsequent events and developments may cause its views to change. However, while the Trustee may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Trustee’s views as of any date subsequent to the date hereof.

* * *

Contact: Jana Egeler, Vice President, Argent Trust Company, Trustee, Toll Free – 1.855.588.7839

Permian Basin Royalty (NYSE:PBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

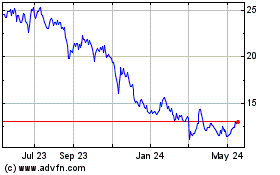

Permian Basin Royalty (NYSE:PBT)

Historical Stock Chart

From Jan 2024 to Jan 2025