Current Report Filing (8-k)

10 December 2021 - 8:34AM

Edgar (US Regulatory)

false

0000315131

0000315131

2021-12-06

2021-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Date of Report: (Date of Earliest Event Reported): December 6, 2021

PHX MINERALS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Oklahoma

|

001-31759

|

73-1055775

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(I.R.S. Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

1601 NW Expressway,

|

|

|

|

Suite 1100

|

|

|

|

Oklahoma City, OK

|

|

73118

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(405) 948-1560

(Registrant’s telephone number including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant in Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.01666 par value

|

|

PHX

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Entry into Purchase and Sale Agreements

On December 6, 2021, PHX Minerals Inc. (the “Company”) entered into two separate Purchase and Sale Agreements (collectively, the “Purchase Agreements”) with affiliated sellers (the “Sellers”) to acquire certain mineral interests, royalty interests and overriding royalty interests underlying certain lands located in Caddo Parish, Louisiana (the “Assets”). The Company entered into one Purchase Agreement with Merrimac Properties Partners, LLC and Quarter Horse Energy Partners, LLC (the “Merrimac Purchase Agreement”) to acquire a portion of the Assets for consideration equal to $5,185,475 in cash, and a separate Purchase Agreement with Palmetto Investment Partners II, LLC (the “Palmetto Purchase Agreement”) to acquire the remainder of the Assets for consideration equal to $601,797 in cash. The Assets include mineral and royalty interests totaling approximately 426 net royalty acres in the Haynesville play. The transactions contemplated in the Purchase Agreements are conditioned upon both Purchase Agreements closing concurrently and are expected to close by December 15, 2021. As of December 6, 2021, the Sellers and their affiliates collectively own 3,549,207 shares of common stock of the Company, or approximately 10.8% of the issued and outstanding shares of common stock of the Company.

The terms and conditions of both Purchase Agreements are substantially similar, and the purchase price under each Purchase Agreement is subject to customary adjustments, including adjustments based on due diligence performed by the Company prior to closing. Both Purchase Agreements contain customary representations, warranties, covenants and indemnities by each of the applicable parties thereto. The obligations of the Company and the Sellers to close each acquisition is subject to certain customary closing conditions as set forth in the Purchase Agreements. There can be no assurance that the conditions to closing the acquisitions of the Assets will be satisfied.

The above description of the material terms and conditions of the Purchase Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Merrimac Purchase Agreement, which is filed as Exhibit 10.1 hereto, and the Palmetto Purchase Agreement, which is filed as Exhibit 10.2 hereto.

First Amendment to Credit Agreement

On December 6, 2021 (the “Amendment Closing Date”), the Company entered into the First Amendment to Credit Agreement (the “Amendment”), which amends and modifies the Credit Agreement dated as of September 1, 2021 among the Company, Independent Bank, as Administrative Agent and L/C Issuer, and certain other lenders (the “Credit Agreement”).

The Amendment provides for an increase to the Company’s Borrowing Base from $27.5 million to $32.0 million effective on the Amendment Closing Date. The Borrowing Base will remain at $32.0 million until the next scheduled semi-annual redetermination, which is scheduled to occur on or about June 1, 2022, unless otherwise redetermined pursuant to an Unscheduled Redetermination. In addition, the Amendment amends the commitment schedule to reallocate the Committed Sum and Commitment Percentage of each Lender under the Credit Agreement. All capitalized terms in this description of the Amendment that are not otherwise defined in this Current Report on Form 8-K have the meaning assigned to them in the Credit Agreement.

The above description of the material terms and conditions of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed as Exhibit 10.3 hereto.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 of this Current Report with respect to the Amendment is incorporated herein by reference.

|

|

Item 7.01

|

Regulation FD Disclosure.

|

On December 9, 2021, the Company issued a press release announcing the Company’s entry into the Purchase Agreements and the Amendment. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including the attached Exhibit 99.1, is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

|

Description

|

|

|

10.1*

|

|

|

Purchase and Sale Agreement, dated December 6, 2021, by and among Merrimac Properties Partners, LLC and Quarter Horse Energy Partners, LLC, as Sellers, and PHX Minerals Inc., as Buyer.

|

|

|

10.2*

|

|

|

Purchase and Sale Agreement, dated December 6, 2021, by and between Palmetto Investment Partners II, LLC, as Seller, and PHX Minerals Inc., as Buyer.

|

|

|

10.3

|

|

|

First Amendment to Credit Agreement dated as of December 6, 2021, by and among PHX Minerals Inc., each lender party thereto, and Independent Bank, as Administrative Agent and L/C Issuer.

|

|

|

99.1

|

|

|

Press Release of PHX Minerals Inc. dated December 9, 2021.

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

|

|

|

|

|

|

* The Purchase and Sale Agreement contains schedules and exhibits that have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish a supplemental copy of any such omitted exhibit or schedule to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PHX MINERALS INC.

|

|

|

By:

|

/s/ Chad L. Stephens

|

|

|

|

|

Chad L. Stephens

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

DATE:

|

December 9, 2021

|

|

|

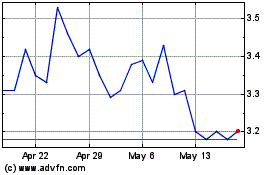

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Jun 2024 to Jul 2024

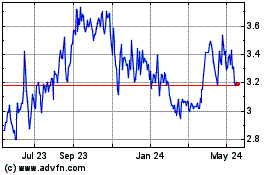

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Jul 2023 to Jul 2024