Packaging Corporation of America (NYSE: PKG) today reported

fourth quarter 2024 net income of $221 million, or $2.45 per share,

and net income of $222 million, or $2.47 per share, excluding

special items. Fourth quarter net sales were $2.1 billion in 2024

and $1.9 billion in 2023. Full year 2024 net income was $805

million, or $8.93 per share, and net income of $814 million, or

$9.04 per share, excluding special items. Full year net sales were

$8.4 billion in 2024 and $7.8 billion in 2023.

Diluted

earnings per share attributable to Packaging Corporation of America

shareholders

Three Months Ended

Full Year Ended

December 31

December 31

2024

2023

Change

2024

2023

Change

Reported Diluted EPS

$

2.45

$

2.10

$

0.35

$

8.93

$

8.48

$

0.45

Special Items Expense (1)

0.02

0.03

(0.01

)

0.11

0.21

(0.10

)

Diluted EPS excluding Special Items (2)

(3)

$

2.47

$

2.13

$

0.34

$

9.04

$

8.70

$

0.34

(1) For descriptions and amounts of our

special items, see the schedules with this release.

(2) Amounts may not foot or crossfoot due

to rounding.

(3) Diluted EPS excluding Special Items is

a non-GAAP financial measure. For information regarding our use of

non-GAAP financial measures and descriptions and amounts of our

special items, see the schedules with this release.

Reported earnings in the fourth quarter include special items

for closure and other costs related to corrugated products

facilities. Reported earnings for the full year 2024 include

special items primarily for closure and other costs related to

corrugated products facilities and design centers and certain costs

at the Jackson, AL mill for paper-to-containerboard conversion

related activities.

Excluding special items, the $.34 per share increase in fourth

quarter 2024 earnings compared to the fourth quarter of 2023 was

driven primarily by higher prices and mix $.52 and volume $.40 in

the Packaging segment, higher prices and mix $.02 and volume $.02

in the Paper segment, and lower freight and logistics expenses

$.06. These items were partially offset by higher operating costs

($.48), higher scheduled maintenance outage expenses ($.08), higher

depreciation expense ($.06), and higher other expenses ($.06).

Results for the quarter were equal to fourth quarter guidance.

Financial information by segment is summarized below and in the

schedules with this release.

(dollars in millions)

Three Months Ended

Full Year Ended

December 31

December 31

2024

2023

2024

2023

Segment operating income (loss)

Packaging

$

297.2

$

263.8

$

1,101.5

$

1,074.3

Paper

34.8

28.1

129.7

118.9

Corporate and Other

(29.8

)

(30.4

)

(129.9

)

(118.1

)

$

302.2

$

261.5

$

1,101.3

$

1,075.1

Segment operating income (loss)

excluding special items

Packaging

$

298.9

$

265.0

$

1,108.1

$

1,088.7

Paper

34.8

30.7

135.5

130.0

Corporate and Other

(29.8

)

(30.4

)

(129.9

)

(118.1

)

$

303.9

$

265.3

$

1,113.7

$

1,100.6

EBITDA excluding special items

(1)

Packaging

$

425.7

$

384.7

$

1,597.5

$

1,555.7

Paper

39.3

35.2

153.5

150.6

Corporate and Other

(25.7

)

(26.4

)

(113.9

)

(102.5

)

$

439.3

$

393.5

$

1,637.1

$

1,603.8

(1) Segment operating income (loss)

excluding special items and EBITDA excluding special items are

non-GAAP financial measures. We provide information regarding our

use of non-GAAP financial measures and reconciliations of

historical non-GAAP financial measures presented in this press

release to the most comparable measure reported in accordance with

GAAP in the schedules to this press release

In the Packaging segment, total corrugated product shipments and

shipments per day were up 9.1% versus last year’s fourth quarter.

Shipments per day were up 3.2% versus the third quarter of 2024.

Containerboard production was 1,310,000 tons, and containerboard

inventory was up 54,000 tons from the fourth quarter of 2023 and up

61,000 tons compared to the third quarter of 2024. In the Paper

segment, sales volume was up 5% compared to the fourth quarter of

2023 and down 5% from the seasonally stronger third quarter of

2024.

Commenting on reported results, Mark W. Kowlzan, Chairman and

CEO, said, “As we have seen throughout the year, demand in our

Packaging segment during the quarter remained very strong. Our

corrugated products plants delivered record fourth quarter total

shipments and an all-time record shipments per day. The plants also

set new annual records for total shipments and shipments per day.

Excellent operations throughout our mill containerboard system set

new quarterly and annual production records as well. This allowed

us to meet our customer’s demand needs in a timely manner as well

as achieve year-end inventory targets ahead of the mill outages

scheduled for the first half of 2025. Although seasonally slower,

volume and price/mix in the Paper segment were above last year’s

levels. Throughout the Company, our employees together with the

benefits of our capital spending program continued to do a great

job to lessen the inflationary impact across most of our cost

structure.”

“Looking ahead as we move from the fourth and into the first

quarter,” Mr. Kowlzan continued, “in our Packaging segment,

although seasonally slower, we expect volume in our corrugated

products plants to set new first quarter records for total

shipments and shipments-per-day. Containerboard volume will be

lower with two less operating days and scheduled maintenance

outages at our Counce, TN and Valdosta, GA mills. Domestic prices

will be higher with an improved product mix together with our

previously announced price increases. Export prices are assumed to

be stable. In our Paper segment, we forecast slightly lower volume

with two less mill operating days and prices and mix to be fairly

flat. With the exception of recycled fiber prices, we expect price

inflation across most of our direct, indirect and fixed operating

and converting costs along with a higher cost mix of mill

operations. In addition, wood, energy, and chemical costs will also

increase due to the unusually cold seasonal weather negatively

impacting usages and yields for these items. Labor and benefits

costs will be higher due to timing-related items that occur at the

beginning of a new year for annual increases, the restart of

payroll taxes, and share-based compensation expenses. First quarter

rail rate increases at three of our mills will impact freight and

logistics expenses and we expect higher depreciation expense.

Lastly, scheduled outage expenses should be slightly lower and we

assume a lower corporate tax rate. Considering these items, we

expect first quarter earnings of $2.21 per share.”

We present our earnings expectation for the upcoming quarter

excluding special items as special items are difficult to predict

and quantify and may reflect the effect of future events. We do not

currently expect any significant special items during the first

quarter; however, additional special items may arise due to first

quarter events.

PCA is the third largest producer of containerboard products and

a leading producer of uncoated freesheet paper in North America.

PCA operates eight mills and 86 corrugated products plants and

related facilities.

Some of the statements in this press release are forward-looking

statements. Forward-looking statements include statements about our

future earnings and financial condition, expected benefits from

acquisitions and restructuring activities, our industry and our

business strategy. Statements that contain words such as “will”,

“should”, “anticipate”, “believe”, “expect”, “intend”, “estimate”,

“hope” or similar expressions, are forward-looking statements.

These forward-looking statements are based on the current

expectations of PCA. Because forward-looking statements involve

inherent risks and uncertainties, the plans, actions and actual

results of PCA could differ materially. Among the factors that

could cause plans, actions and results to differ materially from

PCA’s current expectations include the following: the impact of

general economic conditions; conditions in the paper and packaging

industries, including competition, product demand and product

pricing; fluctuations in wood fiber and recycled fiber costs;

fluctuations in purchased energy costs; the possibility of

unplanned outages or interruptions at our principal facilities; and

legislative or regulatory requirements, particularly concerning

environmental matters, as well as those identified under Item 1A.

Risk Factors in PCA’s Annual Report on Form 10-K for the year ended

December 31, 2023, and in subsequent quarterly reports on Form

10-Q, filed with the Securities and Exchange Commission and

available at the SEC’s website at “www.sec.gov”.

Conference Call

Information:

WHAT:

Packaging Corporation of America’s 4th

Quarter 2024 Earnings Conference Call

Conference ID: Packaging Corporation of

America

WHEN:

Wednesday, January 29, 2025 at 9:00am

Eastern Time

PRE-REGISTRATION:

https://dpregister.com/sreg/10195036/fe19693604

CALL-IN NUMBER:

(833) 816-1102 (U.S.); (866) 605-3852

(Canada) or (412) 317-0684 (International)

Dial in by 8:45am Eastern Time

WEBCAST INFO:

www.packagingcorp.com;

REBROADCAST DATES:

January 29, 2025 through February 12,

2025

REBROADCAST NUMBERS:

(877) 344-7529 (U.S.); (855) 669-9658

(Canada) or (412) 317-0088 (International)

Passcode: 9444032

Packaging Corporation of America Consolidated Earnings

Results Unaudited (dollars in millions, except per-share

data)

Three Months Ended

Full Year Ended

December 31,

December 31,

2024

2023

2024

2023

Net sales

$

2,146.1

$

1,937.9

$

8,383.3

$

7,802.4

Cost of sales

(1,676.4

)

(1)

(1,527.8

)

(3)

(6,600.2

)

(1)(2)

(6,103.5

)

(3)

Gross profit

469.7

410.1

1,783.1

1,698.9

Selling, general, and administrative expenses

(147.0

)

(142.8

)

(610.3

)

(1)

(580.9

)

(3)

Other expense, net

(20.5

)

(1)

(5.8

)

(3)

(71.5

)

(1)(2)

(42.9

)

(3)

Income from operations

302.2

261.5

1,101.3

1,075.1

Non-operating pension income (expense)

1.1

(1.9

)

4.5

(7.7

)

Interest expense, net

(11.7

)

(11.1

)

(41.4

)

(53.3

)

Income before taxes

291.6

248.5

1,064.4

1,014.1

Provision for income taxes

(70.5

)

(59.3

)

(259.3

)

(248.9

)

Net income

$

221.1

$

189.2

$

805.1

$

765.2

Earnings per share: Basic

$

2.46

$

2.11

$

8.97

$

8.52

Diluted

$

2.45

$

2.10

$

8.93

$

8.48

Computation of diluted earnings per share under the two

class method: Net income

$

221.1

$

189.2

$

805.1

$

765.2

Less: Distributed and undistributed income available to

participating securities

(1.5

)

(1.4

)

(5.6

)

(6.2

)

Net income attributable to PCA shareholders

$

219.6

$

187.8

$

799.5

$

759.0

Diluted weighted average shares outstanding

89.5

89.3

89.5

89.5

Diluted earnings per share

$

2.45

$

2.10

$

8.93

$

8.48

Supplemental financial information: Capital spending

$

201.3

$

141.1

$

669.7

$

469.7

Cash, cash equivalents, and marketable debt securities

$

852.2

$

1,205.6

$

852.2

$

1,205.6

(1)

The three and twelve months ended December 31, 2024 include $1.7

million and $2.7 million of charges, respectively, consisting of

closure costs related to corrugated products facilities. For the

twelve months ended December 31, 2024, these charges were partially

offset by income primarily related to a favorable lease buyout for

a closed corrugated products facility during the first quarter of

2024. These items were recorded in "Cost of sales", "Selling,

general, and administrative expenses", and "Other expense, net", as

appropriate.

(2)

The twelve months ended December 31, 2024 include $9.7 million of

charges related to the announced discontinuation of production of

uncoated freesheet paper grades on the No. 3 machine at the

Jackson, Alabama mill associated with the permanent conversion of

the machine to produce linerboard and other paper-to-containerboard

conversion related activities. The costs were recorded in “Cost of

sales” and “Other expense, net”, as appropriate.

(3)

The three and twelve months ended December 31, 2023 include the

following: a. $2.9 million and $11.1 million, respectively, of

charges related to the announced discontinuation of production of

uncoated freesheet paper grades on the No. 3 machine at the

Jackson, Alabama mill associated with the permanent conversion of

the machine to produce linerboard and other paper-to-containerboard

conversion related activities. The costs were recorded in “Cost of

sales” and “Other expense, net”, as appropriate. b. $0.9 million

and $14.4 million, respectively, of charges related to the closure

of corrugated products facilities and design centers. For the

twelve months ended December 31, 2023, these costs were partially

offset by a gain on sale of a corrugated products facility. These

items were recorded in "Cost of sales", "Selling, general, and

administrative expenses", and "Other expense, net", as appropriate.

Packaging Corporation of America Segment Information

Unaudited (dollars in millions)

Three Months Ended

Full Year Ended

December 31,

December 31,

2024

2023

2024

2023

Segment sales Packaging

$

1,975.6

$

1,776.9

$

7,690.9

$

7,135.6

Paper

151.5

143.8

624.7

595.4

Corporate and Other

19.0

17.2

67.7

71.4

$

2,146.1

$

1,937.9

$

8,383.3

$

7,802.4

Segment operating income (loss) Packaging

$

297.2

$

263.8

$

1,101.5

$

1,074.3

Paper

34.8

28.1

129.7

118.9

Corporate and Other

(29.8

)

(30.4

)

(129.9

)

(118.1

)

Income from operations

302.2

261.5

1,101.3

1,075.1

Non-operating pension income (expense)

1.1

(1.9

)

4.5

(7.7

)

Interest expense, net

(11.7

)

(11.1

)

(41.4

)

(53.3

)

Income before taxes

$

291.6

$

248.5

$

1,064.4

$

1,014.1

Segment operating income (loss) excluding special items

(1) Packaging

$

298.9

$

265.0

$

1,108.1

$

1,088.7

Paper

34.8

30.7

135.5

130.0

Corporate and Other

(29.8

)

(30.4

)

(129.9

)

(118.1

)

$

303.9

$

265.3

$

1,113.7

$

1,100.6

EBITDA excluding special items (1) Packaging

$

425.7

$

384.7

$

1,597.5

$

1,555.7

Paper

39.3

35.2

153.5

150.6

Corporate and Other

(25.7

)

(26.4

)

(113.9

)

(102.5

)

$

439.3

$

393.5

$

1,637.1

$

1,603.8

(1)

Income (loss) from operations excluding special items, segment

operating income (loss) excluding special items, earnings before

non-operating pension income (expense), interest, income taxes, and

depreciation, amortization, and depletion (EBITDA), segment EBITDA,

EBITDA excluding special items, and segment EBITDA excluding

special items are non-GAAP financial measures. Management excludes

special items as it believes these items are not necessarily

reflective of the ongoing results of operations of our business. We

present these measures because they provide a means to evaluate the

performance of our segments and our company on an ongoing basis

using the same measures that are used by our management, because

these measures assist in providing a meaningful comparison between

periods presented and because these measures are frequently used by

investors and other interested parties in the evaluation of

companies and the performance of their segments. The tables

included in "Reconciliation of Non-GAAP Financial Measures" on the

following pages reconcile the non-GAAP measures with the most

directly comparable GAAP measures. Any analysis of non-GAAP

financial measures should be done only in conjunction with results

presented in accordance with GAAP. The non-GAAP measures are not

intended to be substitutes for GAAP financial measures and should

not be used as such.

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited (dollars in millions)

Three Months Ended

Full Year Ended

December 31,

December 31,

2024

2023

2024

2023

Packaging Segment operating income

$

297.2

$

263.8

$

1,101.5

$

1,074.3

Facilities closure and other costs

1.7

0.9

2.7

14.4

Jackson mill conversion-related activities

-

0.3

3.9

-

Segment operating income excluding special items (1)

$

298.9

$

265.0

$

1,108.1

$

1,088.7

Paper Segment operating income

$

34.8

$

28.1

$

129.7

$

118.9

Jackson mill conversion-related activities

-

2.6

5.8

11.1

Segment operating income excluding special items (1)

$

34.8

$

30.7

$

135.5

$

130.0

Corporate and Other Segment operating loss

$

(29.8

)

$

(30.4

)

$

(129.9

)

$

(118.1

)

Segment operating loss excluding special items (1)

$

(29.8

)

$

(30.4

)

$

(129.9

)

$

(118.1

)

Income from operations

$

302.2

$

261.5

$

1,101.3

$

1,075.1

Income from operations, excluding special items (1)

$

303.9

$

265.3

$

1,113.7

$

1,100.6

(1) See footnote (1) on page 2, for a discussion of non-GAAP

financial measures.

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited (dollars in millions)

Net Income Excluding

Special Items and EPS Excluding Special Items (1)

Three Months Ended December

31,

2024

2023

Income before taxes

Income Taxes

Net Income

Diluted EPS

Income before taxes

Income Taxes

Net Income

Diluted EPS

As reported in accordance with GAAP

$

291.6

$

(70.5

)

$

221.1

$

2.45

$

248.5

$

(59.3

)

$

189.2

$

2.10

Special items (2): Facilities closure and other costs

1.7

(0.4

)

1.3

0.02

0.9

(0.2

)

0.7

0.01

Jackson mill conversion-related activities

-

-

-

-

2.9

(0.7

)

2.2

0.02

Total special items

1.7

(0.4

)

1.3

0.02

3.8

(0.9

)

2.9

0.03

Excluding special items

$

293.3

$

(70.9

)

$

222.4

$

2.47

$

252.3

$

(60.2

)

$

192.1

$

2.13

Full Year Ended December

31,

2024

2023

Income before taxes

Income Taxes

Net Income

Diluted EPS

Income before taxes

Income Taxes

Net Income

Diluted EPS

As reported in accordance with GAAP

$

1,064.4

$

(259.3

)

$

805.1

$

8.93

$

1,014.1

$

(248.9

)

$

765.2

$

8.48

Special items (2): Jackson mill conversion-related activities

9.7

(2.4

)

7.3

0.08

11.1

(2.7

)

8.4

0.09

Facilities closure and other costs

2.7

(0.6

)

2.1

0.03

14.4

(3.6

)

10.8

0.12

Total special items

12.4

(3.0

)

9.4

0.11

25.5

(6.3

)

19.2

0.21

Excluding special items

$

1,076.8

$

(262.3

)

$

814.5

$

9.04

$

1,039.6

$

(255.2

)

$

784.4

$

8.70 (3

)

(1)

Net income excluding special items and

earnings per share excluding special items are non-GAAP financial

measures. Management excludes special items as it believes these

items are not necessarily reflective of the ongoing results of

operations of our business. We present these measures because they

provide a means to evaluate the performance of our company on an

ongoing basis using the same measures that are used by our

management, because these measures assist in providing a meaningful

comparison between periods presented and because these measures are

frequently used by investors and other interested parties in the

evaluation of companies and their performance. Any analysis of

non-GAAP financial measures should be done only in conjunction with

results presented in accordance with GAAP. The non-GAAP measures

are not intended to be substitutes for GAAP financial measures and

should not be used as such.

(2) Pre-tax special items are tax-effected at a combined federal

and state income tax rate in effect for the period the special

items were recorded and this rate is adjusted for each subsequent

quarter to be consistent with the estimated annual effective tax

rate, in accordance with ASC 270, Interim Reporting, and ASC

740-270, Income Taxes – Intra Period Tax Allocation. For all

periods presented, income taxes on pre-tax special items represent

the current amount of tax. For more information related to these

items, see the footnotes to the Consolidated Earnings Results on

page 1. (3) Amount may not foot due to rounding.

Packaging

Corporation of America Reconciliation of Non-GAAP Financial

Measures Unaudited (dollars in millions)

EBITDA and

EBITDA Excluding Special Items (1) EBITDA represents

income before non-operating pension (income) expense, interest,

income taxes, and depreciation, amortization, and depletion. The

following table reconciles net income to EBITDA and EBITDA

excluding special items:

Three Months Ended

Full Year Ended

December 31,

December 31,

2024

2023

2024

2023

Net income

$

221.1

$

189.2

$

805.1

$

765.2

Non-operating pension (income) expense

(1.1

)

1.9

(4.5

)

7.7

Interest expense, net

11.7

11.1

41.4

53.3

Provision for income taxes

70.5

59.3

259.3

248.9

Depreciation, amortization, and depletion

136.0

130.8

525.6

517.7

EBITDA (1)

$

438.2

$

392.3

$

1,626.9

$

1,592.8

Special items: Facilities closure and other costs

1.1

0.9

1.9

8.9

Jackson mill conversion-related activities

-

0.3

8.3

2.1

EBITDA excluding special items (1)

$

439.3

$

393.5

$

1,637.1

$

1,603.8

(1) See footnote (1) on page 2, for a discussion of non-GAAP

financial measures.

Packaging Corporation of America

Reconciliation of Non-GAAP Financial Measures

Unaudited (dollars in millions) The following table

reconciles segment operating income (loss) to segment EBITDA and

segment EBITDA excluding special items:

Three Months Ended

Full Year Ended

December 31,

December 31,

2024

2023

2024

2023

Packaging Segment operating income

$

297.2

$

263.8

$

1,101.5

$

1,074.3

Depreciation, amortization, and depletion

127.4

119.7

490.1

472.5

EBITDA (1)

424.6

383.5

1,591.6

1,546.8

Facilities closure and other costs

1.1

0.9

1.9

8.9

Jackson mill conversion-related activities

-

0.3

4.0

-

EBITDA excluding special items (1)

$

425.7

$

384.7

$

1,597.5

$

1,555.7

Paper Segment operating income

$

34.8

$

28.1

$

129.7

$

118.9

Depreciation, amortization, and depletion

4.5

7.1

19.5

29.6

EBITDA (1)

39.3

35.2

149.2

148.5

Jackson mill conversion-related activities

-

-

4.3

2.1

EBITDA excluding special items (1)

$

39.3

$

35.2

$

153.5

$

150.6

Corporate and Other Segment operating loss

$

(29.8

)

$

(30.4

)

$

(129.9

)

$

(118.1

)

Depreciation, amortization, and depletion

4.1

4.0

16.0

15.6

EBITDA (1)

(25.7

)

(26.4

)

(113.9

)

(102.5

)

EBITDA excluding special items (1)

$

(25.7

)

$

(26.4

)

$

(113.9

)

$

(102.5

)

EBITDA excluding special items (1)

$

439.3

$

393.5

$

1,637.1

$

1,603.8

(1) See footnote (1) on page 2, for a discussion of non-GAAP

financial measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128391014/en/

Barbara Sessions Packaging Corporation of America INVESTOR

RELATIONS: (877) 454-2509 PCA’s Website: www.packagingcorp.com

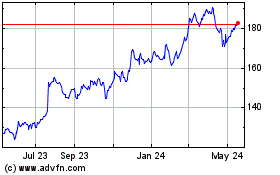

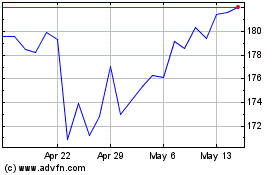

Packaging (NYSE:PKG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Packaging (NYSE:PKG)

Historical Stock Chart

From Feb 2024 to Feb 2025