Form 8-K - Current report

21 September 2024 - 1:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report: September 20, 2024 |

PERMROCK ROYALTY TRUST

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38472 |

82-6725102 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Argent Trust Company, Trustee 3838 Oak Lawn Ave. Suite 1720 |

|

Dallas, Texas |

|

75219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 855 588-7839 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Units of Beneficial Interest |

|

PRT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 20, 2024, PermRock Royalty Trust (the “Trust”) issued a press release, a copy of which is attached hereto as Exhibit 99.1, announcing, among other things, a cash distribution to record holders of its trust units representing beneficial interests in the Trust (“Trust Units”) as of September 30, 2024, and payable on October 15, 2024, in the amount of $365,300.26 ($0.030026 per Trust Unit), based principally upon production during the month of July 2024.

In accordance with general instruction B.2 to Form 8-K, the information in this Form 8-K shall be deemed “furnished” and not “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

PERMROCK ROYALTY TRUST |

|

|

By: |

Argent Trust Company, as Trustee |

|

|

|

|

Date: |

September 20, 2024 |

By: |

/s/ Jana Egeler |

|

|

|

Jana Egeler Vice President, Trust Administrator |

(The Trust has no directors or executive officers.)

Exhibit 99.1

PermRock Royalty Trust

News Release

PermRock Royalty Trust

Declares Monthly Cash Distribution

DALLAS, Texas, September 20, 2024 – PermRock Royalty Trust (NYSE:PRT) (the “Trust”) today declared a monthly cash distribution to record holders of its trust units representing beneficial interests in the Trust (“Trust Units”) as of September 30, 2024, and payable on October 15, 2024, in the amount of $365,300.26 ($0.030026 per Trust Unit), based principally upon production during the month of July 2024.

The following table displays underlying oil and natural gas sales volumes and average received wellhead prices attributable to the current and prior month net profits interest calculations:

|

|

|

|

|

|

|

|

Underlying Sales Volumes |

Average Price |

|

Oil |

Natural Gas |

Oil |

Natural Gas |

|

Bbls |

Bbls/D |

Mcf |

Mcf/D |

(per Bbl) |

(per Mcf) |

Current Month |

23,434 |

756 |

29,276 |

944 |

$78.98 |

$2.25 |

Prior Month |

22,761 |

759 |

30,104 |

1,003 |

$76.91 |

$2.09 |

Oil cash receipts for the properties underlying the Trust totaled $1.85 million for the current month, an increase of $0.10 million from the prior month’s distribution period. This increase was primarily due to an increase in oil sales volumes and prices.

Natural gas cash receipts for the properties underlying the Trust totaled $0.07 million for the current month, a slight increase from the prior month’s distribution period. This increase was primarily due to an increase in natural gas sales prices.

Total direct operating expenses, including marketing, lease operating expenses, and workover expenses, were $0.72 million, an increase of $0.04 million from the prior month’s distribution period. Severance and ad valorem taxes were $0.15 million, a slight increase from the prior month’s distribution period. Capital expenses were $0.62 million, an increase of $0.38 million from the prior month’s distribution period. Boaz Energy reports the increase was primarily related to upgrading a well in the Permian Platform.

Boaz Energy informed the Trust that this month’s net profits calculation included the application of $172,000 net to the Trust of funds previously reserved by Boaz Energy to cover future capital obligations and expenses.

DOCPROPERTY "CUS_DocIDChunk0" ACTIVE 702128685v2

About PermRock Royalty Trust

PermRock Royalty Trust is a Delaware statutory trust formed by Boaz Energy II, LLC (“Boaz Energy”) to own a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas production from certain properties owned by Boaz Energy in the Permian Basin of West Texas. For more information on PermRock Royalty Trust, please visit our website at www.permrock.com.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements.” These forward-looking statements represent the Trust’s and Boaz Energy’s expectations or beliefs concerning future events, and it is possible that the results described in this press release will not be achieved. These forward-looking statements include the amount and date of any anticipated distribution to unitholders, future cash retentions, advancements or recoupments from distributions, and statements regarding Boaz Energy’s operations and the resulting impact on the computation of the Trust’s net profits. The amount of cash received or expected to be received by the Trust (and its ability to pay distributions) has been and will continue to be directly affected by volatility in commodity prices and oversupply. Other important factors that could cause actual results to differ materially from those projected in the forward-looking statements include expenses of the Trust and reserves for anticipated future expenses, uncertainties in estimating the cost of drilling activities and risks associated with drilling and operating oil and natural gas wells.

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, the Trust does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Trust to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the Trust’s Annual Report on Form 10-K filed with the SEC on April 1, 2024, and other public filings filed with the SEC. The risk factors and other factors noted in the Trust's public filings with the SEC could cause its actual results to differ materially from those contained in any forward-looking statement. The Trust’s filed reports are or will be available over the Internet at the SEC’s website at http://www.sec.gov.

Contact: PermRock Royalty Trust

Argent Trust Company, Trustee

Jana Egeler, Vice President, Trust Administrator

Toll-free: (855) 588-7839

Fax: (214) 559-7010

Website: www.permrock.com

e-mail: trustee@permrock.com

DOCPROPERTY "CUS_DocIDChunk0" ACTIVE 702128685v2

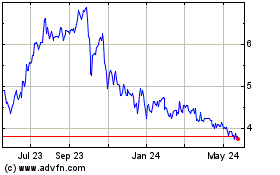

PermRock Royalty (NYSE:PRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

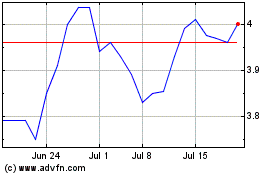

PermRock Royalty (NYSE:PRT)

Historical Stock Chart

From Jan 2024 to Jan 2025