- Statement of Changes in Beneficial Ownership (4)

07 March 2012 - 5:56AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Expires:

November 30, 2011

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934, Section 17(a) of the Public

Utility Holding Company Act of 1935 or Section 30(f) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Ibrahim Sanford A

|

2. Issuer Name

and

Ticker or Trading Symbol

RADIAN GROUP INC

[

RDN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__

X

__ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

Chief Executive Officer

|

|

(Last)

(First)

(Middle)

RADIAN GROUP INC., 1601 MARKET ST

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/5/2012

|

|

(Street)

PHILADELPHIA, PA 19103

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

3/5/2012

|

|

P

|

|

15000

|

A

|

$3.6322

(1)

|

551298

(2)

|

D

|

|

|

Common Stock

|

|

|

|

|

|

|

|

12095

|

I

|

401K stock fund

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Option

|

$3.58

|

|

|

|

|

|

|

6/9/2014

(3)

|

6/9/2018

|

Common Stock

|

269700

(3)

|

|

269700

(3)

|

D

|

|

|

Restricted Stock Units -Performance Award

|

$

0

|

|

|

|

|

|

|

(4)

|

6/9/2018

|

Common Stock

|

658080

(5)

(8)

|

|

658080

(5)

(8)

|

D

|

|

|

Stock Option

|

$10.42

|

|

|

|

|

|

|

5/12/2013

(6)

|

5/12/2017

|

Common Stock

|

87900

(6)

|

|

87900

(6)

|

D

|

|

|

Restricted Stock Units -Performance Award

|

$

0

|

|

|

|

|

|

|

(4)

|

5/12/2017

|

Common Stock

|

72800

(7)

(9)

|

|

72800

(7)

(9)

|

D

|

|

|

Stock Appreciation Right

|

$2.68

|

|

|

|

|

|

|

5/13/2012

|

5/13/2014

|

Common Stock

|

269000

|

|

269000

|

D

|

|

|

Stock Option

|

$2.48

|

|

|

|

|

|

|

8/7/2011

|

8/7/2015

|

Common Stock

|

253000

|

|

253000

|

D

|

|

|

Stock Option

|

$56.03

|

|

|

|

|

|

|

2/7/2007

|

5/5/2013

|

Common Stock

|

35800

|

|

35800

|

D

|

|

|

Stock Option

|

$46.39

|

|

|

|

|

|

|

5/5/2006

|

5/5/2012

|

Common Stock

|

60000

|

|

60000

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

Purchase price ranges from $3.615 to $3.66 per share with the average purchase price being $3.6322 per share.

|

|

(

2)

|

Total includes 385,802 shares owned outright.

|

|

(

3)

|

Non-Qualified Stock Option: Vesting is 50% on the third anniversary of the grant and 50% on the fourth anniversary of the grant, provided that Radian's common stock has closed at 25% above the exercise price of the option for 10 consecutive trading days ending at any point on or after the third anniversary of the grant.

|

|

(

4)

|

Not Applicable.

|

|

(

5)

|

Performance Based Restricted Stock Units ("RSUs"): Vesting is 100% at the end of the three year performance period, with a potential payout ranging from 0% to 200% (**subject to limitations discussed in Footnote 8 below) of the target award based on Radian's total stockholder return ("TSR") over the three year performance period relative to the median TSR of Radian's primary competitors and the companies listed on the NASDAQ Financial Index. TSR is measured generally as (i) the change in market value of common stock during the period, plus dividends, (ii) divided by the 20 day trading average preceding and including the RSU grant date. The RSUs have no voting or dividend rights and will be settled in cash.

|

|

(

6)

|

Non-Qualified Stock Option: Vesting is 50% on the third anniversary of the grant and 50% on the fourth anniversary of the grant.

|

|

(

7)

|

Performance Based RSUs: Vesting is 100% at the end of year three, with settlement in common shares based on the achievement of total shareholder return ("TSR") performance goals as follows: 50% of the award is eligible for a payment (between 0% and 100%, up to 36,400 shares) based on the Company's relative TSR compared to its peers; and 50% of the award is eligible for a payment (between 0% and 150%, up to 54,600 shares) based on the Company's relative TSR compared to the TSR's of companies included in the S&P 400 index. Upon the occurrence of certain corporate events involving one or more companies included in the Company's peer group, the performance goals for the entire award (between 0% and 150%, up to 109,200 shares) would then be based on the Company's relative TSR compared to the TSR's of companies included in the S&P 400 index.

|

|

(

8)

|

The number of RSUs reported (658,080) represents the target award. **As discussed in Footnote 5 above, at the end of the performance period, the participant may earn up to 200% of the target award, subject to a maximum award limitation of one million (1,000,000) shares that may be issued to any individual in a calendar year under the Radian Group Inc. Amended and Restated 2008 Equity Compensation Plan.

|

|

(

9)

|

The number of RSUs reported (72,800) represents the target award. As discussed in Footnote 7 above, the number of shares that may be issued upon vesting ranges from 0 shares to 91,000 shares (109,200 shares in the event TSR performance is measured solely against the companies included in the S&P 400 index).

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Ibrahim Sanford A

RADIAN GROUP INC.

1601 MARKET ST

PHILADELPHIA, PA 19103

|

X

|

|

Chief Executive Officer

|

|

Signatures

|

|

Edward J. Hoffman /s/, Edward J. Hoffman as Power of Attorney

|

|

3/6/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

Radian (NYSE:RDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

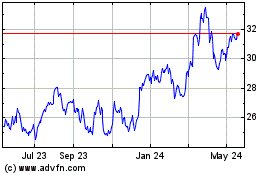

Radian (NYSE:RDN)

Historical Stock Chart

From Jul 2023 to Jul 2024