false

0000095029

0000095029

2025-01-15

2025-01-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January

15, 2025

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation) |

001-10435

(Commission File Number) |

06-0633559

(IRS Employer Identification Number) |

| One Lacey Place, Southport, Connecticut |

06890 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(203) 259-7843

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

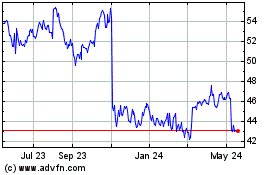

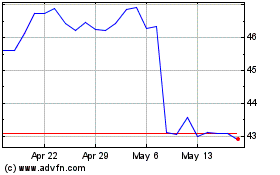

| Common Stock |

RGR |

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Employment Agreement with Todd W. Seyfert

On January 15, 2025, Sturm, Ruger & Company,

Inc. (“the Company”) entered into an Employment Agreement (the “Agreement”) with Todd W. Seyfert, who will become the

President and Chief Executive Officer of the Company on March 1, 2025.

The Agreement provides for: (i) Mr. Seyfert to serve

as President and Chief Executive Officer of the Company, (ii) the Company to pay Mr. Seyfert a base salary at a rate of not less than

$750,000 per annum, (iii) Mr. Seyfert to be eligible to receive, during the period he serves as Chief Executive Officer of the Company,

an annual target cash bonus equal to 100% of his Base Salary (as defined therein), and annual performance equity-based incentive compensation

and annual retention equity-based incentive compensation, each equal to 125% of his Base Salary, (iv) Mr. Seyfert to receive up to $345,000

in cash from the Company to compensate Mr. Seyfert for vested or earned incentive compensation with respect to the performance of Mr.

Seyfert or his former employer in 2024 that was forfeited by Mr. Seyfert with respect to his prior employment as a result of entering

into the Agreement and performing his obligations thereunder, (v) Mr. Seyfert to receive a one-time award of 40,000 RSUs (as defined therein),

which shall convert into shares of the Company’s Common Stock on a one-to-one basis when vested, a portion of which shall be subject

to time-based vesting and a portion of which shall be subject to performance-based vesting, (vi) if Mr. Seyfert is terminated by the Company

without Cause (as defined therein) or if Mr. Seyfert terminates his employment with Good Reason (as defined therein), in each case prior

to any Change in Control (as defined therein) of the Company, (a) Mr. Seyfert shall be entitled to receive a lump sum cash payment equal

to 18 months of Base Salary, (b) the prorated portion of Mr. Seyfert’s then-outstanding Retention Restricted Stock Unit Awards and

Performance Restricted Stock Unit Awards shall vest and be paid in accordance with their terms and (c) Mr. Seyfert shall be entitled to

continued medical insurance benefits for the period not to exceed 18 months from the date Mr. Seyfert’s employment with the Company

terminates, (vii) if a Change in Control occurs and, within 24 months thereafter, if Mr. Seyfert is terminated by the Company without

Cause or if Mr. Seyfert terminates his employment with Good Reason, (a) Mr. Seyfert shall be entitled to receive a lump sum cash payment

equal to 24 months of Annual Compensation (as defined therein), (b) Mr. Seyfert’s then-outstanding Retention Restricted Stock Unit

Awards and Performance Restricted Stock Unit Awards shall fully vest and be paid in a lump sum equal to the cash value of the subject

vested shares of Common Stock as of the effective date of such Change in Control and (c) Mr. Seyfert shall be entitled to continued medical

insurance benefits for the period not to exceed 24 months from the date Mr. Seyfert’s employment with the Company terminates and

(viii) a prohibition against Mr. Seyfert engaging in certain activities that compete or interfere with the Company during his employment

with the Company and for 2 years thereafter.

The foregoing description of the Agreement is qualified

in its entirety by reference to the complete terms and conditions of the Agreement, which are attached as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated herein by reference.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

The disclosure set forth in Item

1.01 (above) concerning the appointment of Mr. Seyfert as President and Chief Executive Officer of the Company, effective as of March

1, 2025, and concerning the terms and conditions of the Agreement is hereby incorporated by reference herein (qualified, with respect

to the description of the Agreement, in its entirety by reference to the complete terms and conditions of the Agreement, which are attached

as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference).

On January 17, 2025, the Company issued a press release

announcing the appointment of Todd W. Seyfert as the Company’s next President and Chief Executive Officer, effective March 1, 2025.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

STURM, RUGER & COMPANY, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ THOMAS A. DINEEN |

| |

|

Name: |

Thomas A. Dineen |

| |

|

Title: |

Principal Financial Officer, |

| |

|

|

Principal Accounting Officer, |

| |

|

|

Senior Vice President, Treasurer and |

| |

|

|

Chief Financial Officer |

Dated: January 17, 2025

EXHIBIT 10.1

EMPLOYMENT AGREEMENT

This EMPLOYMENT AGREEMENT (this “Agreement”)

is made and entered into as of January 15, 2025 by and between Sturm, Ruger & Company, Inc., a Delaware corporation with its principal

place of business at One Lacey Place, Southport, Connecticut 06890 (the “Company”), and Todd Seyfert, an individual

(“Employee”).

W I T N E S S E T H:

WHEREAS, the Company desires

to employ Employee and to enter into an agreement embodying the terms of such employment and Employee desires to enter into this Agreement

and to accept such employment, subject to the terms and provisions of this Agreement.

NOW, THEREFORE, in consideration

of the promises and mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which

are mutually acknowledged, and intending to be legally bound, the Company and Employee hereby agree as follows:

Section

1. Definitions.

(a) “Accrued

Obligations” shall mean (i) all accrued but unpaid Base Salary through the date of termination of Employee’s employment

and (ii) any unpaid or unreimbursed expenses incurred in accordance with Section 6 below.

(b) “Annual Compensation” shall mean, at any time, an amount equal to Employee’s Base Salary, plus

100% of the target cash bonus or other cash incentive that Employee is eligible to earn in the then-current year pursuant to each plan

or program (whether or not such plan or program has been formalized or is in written form) of the Company in effect for such year that

provides for cash bonuses or other cash incentives, or if no such plan or program has been adopted with respect to such year, 100% of

the target cash bonus or other cash incentive that Employee was eligible to earn in the most recent year in which such a plan or program

was in effect.

(c) “Base

Salary” shall mean the salary provided for in Section 3(a) below or any increased salary granted to Employee pursuant to Section

3(a).

(d) “Board” shall mean the Board of Directors of the Company.

(e)

“Cause” shall mean (i) a breach of Employee’s fiduciary duties or obligations to the Company including,

but not limited to, his failure to obey any lawful directive of the Board or Employee’s breach of his obligations hereunder or under

the Company’s policies, (ii) gross negligence in the performance of Employee’s duties, (iii) Employee’s personal dishonesty

or willful misconduct, or (iv) Employee’s willful violation of any law, rule or regulation (other than minor traffic violations

or similar offenses) or final cease-and-desist order, in each case as determined by the Board in good faith.

(f)

“CEO” shall mean the Chief Executive Officer of the Company.

(g)

“Change in Control” shall be deemed to have the same meaning as defined in the Plan.

(h)

“Code” shall mean the Internal Revenue Code of 1986, as amended.

(i)

“Common Stock” shall mean the Company’s common stock, par value $1.00 per share.

(j)

“Common Stock Holdings” shall have the meaning set forth in Section 2(e).

(k)

“Company” shall have the meaning set forth in the preamble hereto.

(l)

“Competitive Activities” shall mean any business activities involving, or related to, (i) the design,

manufacture or sale of firearms or firearms accessories or (ii) any other products or services which the Company or its subsidiaries manufacture,

sell, distribute or provide (or have committed plans to manufacture, sell, distribute or provide) during the term of Employee’s

employment with the Company.

(m) “Confidential

Information” shall mean confidential or proprietary trade secrets, customer lists, customer identities and information, information

regarding service providers, manufacturing processes, product designs or other intellectual property, marketing data or plans, sales

data or plans, management organization information, operating policies or manuals, personnel information, business plans, operations

or techniques, financial records or data, other financial, commercial, business or technical information, or any other information treated

as confidential (i) of or relating to the Company or any of its subsidiaries, or (ii) that the Company or any of its subsidiaries may

receive belonging to suppliers, customers or other Persons who do business with the Company or its subsidiaries, but shall exclude any

information that is in the public domain or hereafter enters the public domain, in each case, without the breach by Employee of his obligations

under this Agreement.

(n)

“Developments” shall have the meaning set forth in Section 8.

(o)

“Disabled” shall mean Employee becoming physically or mentally disabled or incapacitated to the extent

that he has been unable to perform his essential duties hereunder, with or without an accommodation, for a continuous period of four (4)

months on account of such disability or incapacitation in the reasonable judgment of a physician selected by the Board.

(p)

“Effective Date” shall mean March 1, 2025.

(q)

“Employee” shall have the meaning set forth in the preamble hereto.

(r) “Good

Reason” shall mean the Company, without Employee’s consent: (i) reduces in any manner Employee’s duties, responsibilities,

authority, Annual Compensation or material employee benefits or (ii) materially breaches this Agreement, and, in each case, the Company

does not cure the event constituting Good Reason within thirty (30) days following the date of the Company’s receipt of a written

notice from Employee describing such breach, which written notice must be received by the Company within ninety (90) days following the

occurrence of such breach.

(s) “Interfering

Activities” shall mean directly or indirectly (i) encouraging, soliciting, or inducing, or in any manner attempting to encourage,

solicit, or induce, any Person employed by, or Person providing consulting services to, the Company or any of its subsidiaries to terminate

such employment or consulting services; provided, that the foregoing shall not be violated by a general advertising not targeted at employees

or consultants of the Company or its subsidiaries; (ii) hiring any Person who was employed by the Company or any of its subsidiaries

at any time during the twelve (12) month period preceding the date of such hiring; or (iii) encouraging, soliciting or inducing, or in

any manner attempting to encourage, solicit or induce any customer, distributor, insurer, supplier, licensee or other business relation

of the Company or any of its subsidiaries to cease doing business with or reduce the amount of business conducted with the Company or

its subsidiaries, or interfering in any way with the relationship between any such customer, distributor, insurer, supplier, licensee

or business relation and the Company or its subsidiaries.

(t)

“OSHA” shall have the meaning set forth in Section 9(a).

(u)

“Ownership Threshold” shall have the meaning set forth in Section 2(e).

(v)

“Parachute Payment” shall have the meaning set forth in Section 12(b).

(w) “Person”

shall mean any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust

(charitable or non-charitable), unincorporated organization or other form of business entity.

(x) “Plan”

shall mean the Sturm, Ruger & Company, Inc. 2023 Stock Incentive Plan, as amended, modified, supplemented or superseded after the

date of this Agreement (for the avoidance of doubt, such term shall include any successor plan of the Company that replaces the Plan).

(y) “Release” shall mean a release made by Employee in favor of the Company and its affiliates, in form and

content acceptable to the Company, which shall include, but not be limited to, appropriate non-disparagement provisions.

(z) “Release Delivery Date” shall mean the date on which a Release is delivered by Employee to the Company.

(aa) “Release

Expiration Date” shall mean the date which is twenty-one (21) days following Employee’s receipt of the Release, or, in

the event that such termination of employment is “in connection with an exit incentive or other employment termination program”

(as such phrase is defined in the Age Discrimination in Employment Act of 1967), the date which is forty-five (45) days following Employee’s

receipt of the Release.

(bb) “Restricted Area” shall have the meaning set forth in Section 9(b).

(cc) “Restricted Period” shall have the meaning set forth in Section 9(b).

(dd) “SEC” shall have the meaning set forth in Section 9(a).

(ee) “Term of Employment” shall have the meaning set forth in Section 2(a).

Section

2. Acceptance

of Employment; Position, Duties and Responsibilities; Place of Performance.

(a)

Term of Employment; Employment Status. Effective as of the Effective Date, the Company agrees to employ Employee

and Employee agrees to serve the Company on the terms and conditions set forth herein. The term of Employee’s employment hereunder

shall commence on the Effective Date and shall continue until the termination of Employee’s employment for any reason (such period,

the “Term of Employment”). Notwithstanding the foregoing, or anything to the contrary herein, nothing in this Agreement

(i) confers upon the Employee the right to continue in the employment of the Company or to the right to hold any particular office or

position with the Company, (ii) except as set forth herein, entitles Employee to receive any specified annual salary or bonus or other

compensation or (iii) interferes with or restricts in any way the right of the Company to terminate Employee’s employment at any

time, with or without Cause.

(b)

Position. During the Term of Employment Employee shall be employed as the President and CEO of the Company (together

with such other position or positions consistent with Employee’s title as the Board shall specify from time to time) and shall have

such duties typically associated with such title and such additional duties as may be specified by the Board from time to time. Employee

also agrees to serve as an officer and/or director of the Company and/or any parent or subsidiary of the Company if requested by the Board,

in each case, without additional compensation. The Company anticipates that Employee will be nominated for election to the Company’s

Board at the 2025 annual meeting and, subject to the approval of the Company’s stockholders at such annual meeting, that Employee

will join the Company’s Board as a director thereafter.

(c)

Employment Duties; Conflicting Activities. During the Term of Employment, Employee shall devote his full business

time, attention, skill and best efforts to the performance of his duties under this Agreement and shall not engage in any other business

or occupation during the Term of Employment, including, without limitation, any activity that (x) conflicts with the interests of the

Company or its subsidiaries, (y) interferes with the proper and efficient performance of his duties for the Company or (z) interferes

with the exercise of his judgment in the Company’s best interests. Notwithstanding the foregoing, per Company policy, Employee is

permitted to serve on not more than one for profit board of Directors (public or private) and, with the prior written consent of the Board,

as a member of the board of directors or advisory boards (or their equivalents in the case of a non-corporate entity) of other non-competing

businesses and charitable organizations, (ii) engaging in charitable activities and community affairs and (iii) managing his personal

investments and affairs; provided, however, that the activities set out in clauses (i), (ii) and (iii) shall be limited by Employee so

as not to materially interfere, individually or in the aggregate, with the performance of his duties and responsibilities hereunder. The

Board hereby consents to Employee’s service on the Board of Directors of Hodgdon Powder Company as Employee’s single for profit

board commitment.

(d)

Place of Employment. During the first year of the Term of Employment, Employee shall maintain his primary residence

in Minnesota, with such regular business travel to meet with Company employees, supervise Company operations, and visit the facilities

of the Company, including those located in Arizona, Missouri, New Hampshire, and North Carolina, and the Company’s corporate headquarters

in Connecticut (or such other location as may be designated as the Company’s corporate headquarters by the Board from time to time),

as is necessary or advisable in connection with the performance of Employee’s duties hereunder; Employee shall be reimbursed by

the Company for usual and customary expenses associated with such business travel. With respect to the Term of Employment after the one

year anniversary of the Effective Date, Employee and the Company shall discuss in good faith and mutually agree upon Employee’s

principal place of employment. In the event that Employee and the Company agree upon Employee’s relocation, the Company will pay

reasonable relocation and/or temporary housing expenses. Employee understands and agrees that he will be required to travel from time

to time for business reasons in addition to those circumstances specifically described in this Section 2(d).

(e) Minimum

Stock Ownership. Employee shall comply with all policies of the Company, including those concerning minimum ownership of the Company’s

Common Stock or other securities by the Company’s senior executives. In furtherance thereof, Employee shall, from and after the

Effective Date, accumulate Common Stock Holdings (which may be solely in the form of the receipt of compensatory grants of Common Stock

Holdings from the Company) and refrain from selling Common Stock of the Company until such time as Employee owns or otherwise holds Common

Stock Holdings worth at least five (5) times Employee’s then-effective Base Salary (the “Ownership Threshold”).

Thereafter, Employee shall maintain sufficient ownership of Common Stock Holdings to meet the Ownership Threshold at all times during

the Term of Employment. “Common Stock Holdings” means shares of issued and outstanding Common Stock and shares of

Common Stock underlying performance-based incentive equity compensation, time-based equity incentive compensation, or restricted stock

award units awarded to and held by Employee (whether vested or unvested) from time to time.

Section

3. Compensation.

During the Term of Employment Employee shall be entitled to the following compensation:

(a) Base

Salary. Employee shall be paid an annualized Base Salary, payable in accordance with the regular payroll practices of the Company,

of not less than $750,000, with increases, if any, as may be approved by the Board.

(b) Annual

Bonus and Equity Compensation. During the Term of Employment, Employee shall be eligible to receive an annual target cash bonus and

awards of restricted stock units or other equity-based incentive compensation consistent with his position(s) with the Company, in each

case, as determined by the Board and the Compensation Committee of the Board; provided that Employee’s (i) annual target cash bonus

shall be based on 100% of Base Salary (it being understood that Employee’s target cash bonus for 2025 will be based on Employee’s

full per annum Base Salary for such year, and not subject to proration), (ii) annual performance-based equity incentive compensation,

with each such equity award equal to 125% of his Base Salary for the applicable period, and (iii) annual time-based equity incentive

compensation, with each such equity award equal to 125% of his Base Salary for the applicable period (all subject, in each case (including

the immediately foregoing clauses (i), (ii), and (iii)), to adjustment by the Board and the Compensation Committee of the Board from

time to time during the Term of Employment in connection with changes to the compensation structure of Company executives adopted thereby).

(c)

One-Time Reimbursement. Employee shall be entitled to a one-time reimbursement of up to $10,000 in fees and expenses

related to the installation of a home security system at Employee’s primary residence and/or financial planning services, upon submission

of documentation reasonably satisfactory the Company evidencing the nature and payment of such fees and expenses.

(d) One-Time

Make Whole Reimbursement. To the extent that Employee accepting the offer of employment hereunder and commencing employment with

the Company on the Effective Date causes Employee to forfeit vested or earned incentive compensation from Employee’s current employer

with respect to the performance of Employee or Employee’s current employer in 2024, the Company shall, on or before April 30, 2025,

reimburse Employee, on a dollar-for-dollar basis, up to $345,000 to compensate Employee for not receiving such incentive compensation

(such reimbursement, the “Make Whole Reimbursement”). The Make Whole Reimbursement described in this Section 3(d)

is subject to the submission, at least thirty (30) days prior to April 30, 2025, by Employee of documentation reasonably acceptable

to the Company evidencing such incentive compensation, with any proprietary, confidential, or competitive information redacted. By submission

of such documentation to the Company for reimbursement hereunder, Employee represents and warrants to the Company that such incentive

compensation has actually been earned and that payment in respect thereof would be made to Employee by Employee’s current employer,

but for Employee accepting the offer of employment hereunder and commencing employment on the Effective Date. If Employee terminates

Employee’s employment with the Company before March 1, 2027, Employee agrees and shall be obligated to re-pay to the Company, at

the time of his termination, the entire amount of the Make Whole Reimbursement paid to Employee by the Company hereunder.

(e)

One-Time Award of Restricted Stock Units. On or about the Effective Date, Employee shall receive a one-time award

of 40,000 restricted stock units (RSUs) under the Plan (the date of such award, the “Award Date”), which shall convert

into shares of the Company’s Common Stock on a one-to-one basis when vested and shall be subject to the vesting described below,

provided, that such award of RSUs shall be subject, in all events, to the Plan, and the more specific terms and conditions set

forth in the applicable award documentation to be entered into between the Company and Employee concerning this award of RSUs on the Award

Date.

(i) 10,000

RSUs will vest upon the four-year anniversary of the Award Date, subject to Employee’s continued employment with the Company as

of such date;

(ii) 10,000

RSUs will vest upon the four-year anniversary of the Award Date if the average closing price for the Company’s Common Stock on

the New York Stock Exchange (or any successor exchange that is the primary exchange on which the Company’s Common Stock is traded)

exceeds $45 per share (as adjusted for any applicable stock split, stock dividend, combination, or other recapitalization, or reclassification)

over any thirty (30) consecutive trading day period prior to such date, subject to Employee’s continued employment with the Company

as of such date;

(iii) 10,000

RSUs will vest upon the four-year anniversary of the Award Date if the average closing price for the Company’s Common Stock on

the New York Stock Exchange (or any successor exchange that is the primary exchange on which the Company’s Common Stock is traded)

exceeds $55 per share (as adjusted for any applicable stock split, stock dividend, combination, or other recapitalization, or reclassification)

over any thirty (30) consecutive trading day period prior to such date, subject to Employee’s continued employment with the Company

as of such date; and

(iv) 10,000

RSUs will vest upon the four-year anniversary of the Award Date if the average closing price for the Company’s Common Stock on

the New York Stock Exchange (or any successor exchange that is the primary exchange on which the Company’s Common Stock is traded)

exceeds $65 per share (as adjusted for any applicable stock split, stock dividend, combination, or other recapitalization, or reclassification)

over any thirty (30) consecutive trading day period prior to such date, subject to Employee’s continued employment with the Company

as of such date.

Section

4. Employee

Benefits.

During the Term of Employment,

Employee shall be entitled to participate in health, insurance, retirement (including 401(k) plan participation) and other benefits provided

to other senior executives of the Company (including reimbursement of all out-of-pocket expenses incurred in connection with obtaining

annual executive physicals at the Cleveland Clinic). During the Term of Employment, Employee shall also be entitled to the same number

of holidays, vacation days, sick days and other benefits as are generally allowed to senior executives of the Company in accordance with

the Company’s policies in effect from time to time; provided that Employee shall in no event receive less than five weeks’

paid vacation. Notwithstanding the foregoing, the Company reserves the right to modify or eliminate any benefit that it offers to its

senior executives and employees generally.

Section

5. Key-Employee

Insurance.

At any time during the Term

of Employment, the Company shall have the right to insure the life of Employee for the sole benefit of the Company, in such amounts, and

with such terms, as it may determine. All premiums payable thereon shall be the obligation of the Company. Employee shall have no interest

in any such policy, but agrees to cooperate with the Company in taking out such insurance by submitting to physical examinations, supplying

all information required by each insurance company, and executing all necessary documents, provided that no financial obligation is imposed

on Employee by any such documents.

Section

6. Reimbursement

of Business Expenses.

During the Term of Employment,

Employee is authorized to incur reasonable business expenses that are ordinary and necessary in carrying out his duties and responsibilities

under this Agreement and the Company shall promptly reimburse him for all such reasonable business expenses incurred in connection with

carrying out the business of the Company, subject to documentation in accordance with the Company’s policies, as in effect from

time to time.

Section

7. Termination

of Employment.

(a)

General. Notwithstanding Section 2, or anything to the contrary herein, the Term of Employment shall terminate

upon the earliest to occur of (i) Employee’s death or Disability, (ii) a termination of Employee’s employment by the Company

with or without Cause and (iii) a termination by Employee for Good Reason or without Good Reason. Upon any termination of Employee’s

employment for any reason, except as may otherwise be requested by the Company in writing, Employee shall resign from any and all directorships,

committee memberships or any other positions Employee holds with the Company or any of its subsidiaries or affiliates.

(b)

Termination due to Death or Disability. Employee’s employment shall terminate automatically upon his death

or Disability. In the event Employee’s employment is terminated due to his death or Disability, Employee or Employee’s estate

or beneficiaries, as the case may be, shall be entitled to the Accrued Obligations. Following such termination of Employee’s employment

by the reason of death or Disability, except as set forth in this Section 7(b), Employee shall have no further rights to any compensation

or any other benefits under this Agreement.

(c)

Termination by the Company for Cause. The Company may terminate Employee’s employment at any time for Cause.

In the event the Company terminates Employee’s employment for Cause, he shall be entitled only to the Accrued Obligations. Following

such termination of Employee’s employment for Cause, except as set forth in this Section 7(c), Employee shall have no further

rights to any compensation or any other benefits under this Agreement.

(d)

Termination by the Company without Cause. The Company may terminate Employee’s employment at any time without

Cause. In the event Employee’s employment is terminated by the Company without Cause (other than due to death or Disability) during

the Term of Employment, Employee shall be entitled to receive:

(i)

The Accrued Obligations; and

(ii)

Subject to the limitations set forth in Section 12(b):

(A)

if, during the Term of Employment, and prior to the occurrence of a Change in Control, the Company terminates Employee’s

employment without Cause, provided that Employee executes and delivers an effective Release to the Company within the timeframe specified

in the Release (the “Release Requirement”), then the Company shall pay Employee, within sixty (60) days after such

termination date, or, to the extent required by Section 409A of the Code, on the first day of the seventh month following the Release

Delivery Date, as a severance payment for services previously rendered to the Company, a lump sum equal to eighteen (18) months of Employee’s

Base Salary. In addition, upon such termination, a pro-rated portion of Employee’s then-outstanding Retention Restricted Stock Unit

Awards and Performance Restricted Stock Unit Awards shall vest and be paid (in cash and/or shares of Common Stock, as applicable), in

accordance with their terms; or

(B)

if a Change in Control occurs during the Term of Employment and, within twenty-four (24) months

after the effective date of such Change in Control, the Company terminates Employee’s employment without Cause, provided that Employee

satisfies the Release Requirement, then the Company shall pay Employee, within sixty (60) days after such termination date or, to the

extent required by Section 409A of the Code, on the first day of the seventh month following the Release Delivery Date, a lump sum equal

to twenty-four (24) months of Employee’s Annual Compensation (without regard to any decrease in the rate of Employee’s Annual

Compensation made after the Change in Control). In addition, upon such termination, Employee’s then-outstanding Retention Restricted

Stock Unit Awards and Performance Restricted Stock Unit Awards shall fully vest and be paid in a lump sum (to the extent permitted by

Section 409A of the Code, at the same time as the Annual Compensation lump sum pursuant to the preceding sentence) equal to the cash value

of the subject vested shares of Common Stock as of the effective date of such Change in Control.

Following

such termination by Employee, except as set forth in this Section 7(d) and Section 7(g), Employee shall have no further

rights to any compensation or any other benefits under this Agreement.

(e)

Termination by Employee With Good Reason. Employee may terminate his employment with the Company for Good Reason.

In the event Employee’s employment is terminated by Employee for Good Reason, then Employee shall be entitled to receive:

(i)

The Accrued Obligations; and

(ii)

Subject to the limitations set forth in Section 12(b):

(A)

if, during the Term of Employment, and prior to the occurrence of a Change in Control, Employee

terminates Employee’s employment for Good Reason, provided that Employee satisfies the Release Requirement, then the Company shall

pay Employee, within sixty (60) days after such termination date, or, to the extent required by Section 409A of the Code, on the first

day of the seventh month following the Release Delivery Date, as a severance payment for services previously rendered to the Company,

a lump sum equal to eighteen (18) months of Employee’s Base Salary (without regard to any decrease in the rate of Employee’s

Base Salary following the event(s) giving rise to Good Reason). In addition, upon such termination, a pro-rated portion of Employee’s

then-outstanding Retention Restricted Stock Unit Awards and Performance Restricted Stock Unit Awards shall vest and be paid (in cash and/or

shares of Common Stock, as applicable), in accordance with their terms; or

(B) if

a Change in Control occurs during the Term of Employment and, within twenty-four (24) months after the effective date of such Change

in Control, Employee terminates Employee’s employment for Good Reason, provided that Employee satisfies the Release Requirement,

then the Company shall pay Employee, within sixty (60) days after such termination date or, to the extent required by Section 409A of

the Code, on the first day of the seventh month following the Release Delivery Date, a lump sum equal to twenty-four (24) months of Employee’s

Annual Compensation (without regard to any decrease in the rate of Employee’s Annual Compensation made after the Change in Control).

In addition, upon such termination, Employee’s then-outstanding Retention Restricted Stock Unit Awards and Performance Restricted

Stock Unit Awards shall fully vest and be paid in a lump sum (to the extent permitted by Section 409A of the Code, at the same time as

the Annual Compensation lump sum pursuant to the preceding sentence) equal to the cash value of the subject vested shares of Common Stock

as of the effective date of such Change in Control.

Following such termination by Employee,

except as set forth in this Section 7(e) and Section 7(g), Employee shall have no further rights to any compensation or

any other benefits under this Agreement.

(f)

Termination by Employee Without Good Reason. Employee may terminate his employment with the Company at any time,

but must provide at least (sixty) 60 days’ notice prior to termination without Good Reason. In the event of a termination of employment

by Employee, other than a termination of employment by Employee that qualifies as a termination with Good Reason pursuant to Section

7(e), Employee shall be entitled only to the Accrued Obligations. Following such termination by Employee, except as set forth in this

Section 7(f), Employee shall have no further rights to any compensation or any other benefits under this Agreement.

(g)

Benefits. Upon the occurrence of a termination of Employee’s employment pursuant to Section 7(d) or

Section 7(e) the Company shall also cause to be continued, for a period of time equal to the number of months of severance pay

due to Employee, such life, medical and dental insurance coverage as is otherwise maintained by the Company for full-time employees—and

in the case of tiered programs, at the same level of coverage previously elected by Employee and in place at the time of termination—(based

on the Base Salary in effect immediately prior to the date Employee’s employment terminates), subject to the limitations set forth

in such plans, programs or policies, provided that Employee shall continue to pay all amounts in respect of such coverage that an employee

receiving the same level of coverage is or would be required to pay (the employee contribution). The foregoing payments and benefits will

not be made or may be treated as taxable income to the Employee where necessary to avoid violating applicable laws, rules, or regulations,

including under the Code. This Section 7(g) does not affect the Company’s right to modify or eliminate any benefits provided

to its senior executives or employees generally.

(h)

Release. Notwithstanding any provision herein to the contrary, the Company may require that, prior to payment of

any amount or provision of any benefit pursuant to Section 7(d), Section 7(e), or Section 7(g) (other than the Accrued

Obligations), Employee shall have executed, on or prior to the Release Expiration Date, a Release, and any revocation period contained

in such Release shall have expired. In the event that Employee fails to execute a Release in favor of the Company and its subsidiaries

and affiliates and their respective related parties on or prior to the Release Expiration Date, Employee shall not be entitled to any

payments or benefits pursuant to Section 7(d), Section 7(e), or Section 7(g) (other than the Accrued Obligations).

(i) Exclusive

Rights. The severance benefits specified in this Section 7 (i) shall be in lieu of any severance pay or other severance benefit

that the Company may provide to terminated employees pursuant to policies of the Company that may at that time be in effect and (ii)

shall not in any way affect Employee’s entitlement to the receipt of a pro-rated cash bonus or other cash incentive that Employee

is otherwise eligible to earn in the ordinary course, during the partial year prior to date of termination, pursuant to each plan or

program (whether or not such plan or program has been formalized or is in written form) of the Company in effect for such year that provides

for cash bonuses or other cash incentives (provided that the Company goals that trigger the obligation of the Company to pay any such

cash bonus or other cash incentives are satisfied). Except in connection with any termination of Employee’s employment by the Company

with Cause or by Employee without Good Reason, in such event, provided that Employee satisfies the Release Requirement, such partial

year cash bonus or other cash incentive shall be paid to Employee when cash bonuses are paid to the Company’s other senior executive

with respect to such year, but no event later than seventy-five (75) days after the end of such year.

Section

8. Works for Hire. Employee agrees that the Company shall own all right, title and interest throughout

the world in and to any and all inventions, original works of authorship, developments, concepts, know-how, improvements or trade secrets,

whether or not patentable or registerable under copyright or similar laws, which Employee may solely or jointly conceive or develop or

reduce to practice, or cause to be conceived or developed or reduced to practice during the Term of Employment, whether or not during

regular working hours, provided such inventions, original works of authorship, developments, concepts, know-how, improvements or trade

secrets (i) relate at the time of conception or development to the actual or demonstrably proposed business or research and development

activities of the Company or its subsidiaries; (ii) result from or relate to any work performed for the Company or its subsidiaries; or

(iii) are developed through the use of Confidential Information and/or Company resources or in consultation with Company personnel (such

inventions, original works of authorship, developments, concepts, know-how, improvements or trade secrets are collectively referred to

herein as “Developments”). Employee hereby assigns all right, title and interest in and to any and all of these Developments

to the Company. Employee agrees to assist the Company, at the Company’s expense, to further evidence, record and perfect such assignments,

and to perfect, obtain, maintain, enforce, and defend any rights specified to be so owned or assigned. Employee hereby irrevocably designates

and appoints the Company and its agents as attorneys-in-fact to act for and on Employee’s behalf to execute and file any document

and to do all other lawfully permitted acts to further the purposes of the foregoing with the same legal force and effect as if executed

by Employee. In addition, and not in contravention of any of the foregoing, Employee acknowledges that all original works of authorship

which are made by him (solely or jointly with others) within the scope of employment and which are protectable by copyright are “works

made for hire,” as that term is defined in the United States Copyright Act (17 USC Sec. 101). To the extent allowed by law, this

includes all rights of paternity, integrity, disclosure and withdrawal and any other rights that may be known as or referred to as “moral

rights.” To the extent Employee retains any such moral rights under applicable law, Employee hereby waives such moral rights and

consents to any action consistent with the terms of this Agreement with respect to such moral rights, in each case, to the full extent

of such applicable law. Employee will confirm any such waivers and consents from time to time as requested by the Company.

Section

9. Confidentiality; Restricted

Activities. Employee agrees that some restrictions on his activities are necessary to protect the goodwill,

Confidential Information and other legitimate interests of the Company and its affiliates:

(a)

From and after the date of this Agreement, Employee shall not disclose Confidential Information to, or use Confidential

Information for the benefit of, any Person, except (i) as required in the performance of Employee’s obligations under this Agreement,

(ii) to the extent required by an order of a court having jurisdiction over Employee or under subpoena from an appropriate government

agency, in which event, Employee shall use his good faith efforts to consult with the General Counsel of the Company prior to responding

to any such order or subpoena, (iii) in initiating communications directly with, responding to any inquiry from, providing information

to or testimony before, or filing a complaint with, any law enforcement agency, including but not limited to the Occupational Safety and

Health Administration (“OSHA”), the Securities and Exchange Commission (“SEC”), the United States

Congress, the Department of Justice, or any agency Inspector General, about actual or potential violations of laws or regulations, or

making other disclosures that are protected under the whistleblower provisions of federal law or regulation, or (iv) in providing information

pursuant to, or receiving and fully retaining a monetary award from, a government-administered whistleblower award program (such as, but

not limited to, the SEC or Internal Revenue Service whistleblower award programs) for providing information directly to a government agency.

Further, Employee is advised that pursuant to the Defend Trade Secrets Act an individual will not

be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (i) is made

(A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and (B) solely

for the purpose of reporting or investigating a suspected violation of law, or (ii) is made in a complaint or other document filed in

a lawsuit or other proceeding if such filing is made under seal. Further, an individual who files a lawsuit alleging retaliation by an

employer for reporting a suspected violation of law may disclose the trade secret to the individual's attorney and use the trade secret

information in the court proceeding if the individual (A) files any document containing the trade secret under seal and (B) does not otherwise

disclose the trade secret, except pursuant to court order. Employee understands that any disclosure by Employee of the Company’s

trade secrets not done in good faith consistent with the above may subject Employee to substantial damages, including punitive damages

and attorney’s fees.

(b)

Employee agrees that, during the period commencing on the date of this Agreement and ending on the two (2) year anniversary

of the termination of Employee’s employment with the Company for any reason (such period, the “Restricted Period”),

Employee shall not, directly or indirectly, individually or jointly, own any interest in, operate, join, control or participate as a partner,

director, principal, officer, or agent of, enter into the employment of, act as a consultant to, or perform any services for any Person

(other than the Company or its subsidiaries), that engages in any Competitive Activities within the United States of America or any other

jurisdiction in which the Company or its subsidiaries are engaged (or have committed plans to engage) in business during the Consulting

Period (the “Restricted Area”). Notwithstanding anything herein to the contrary, this Section 9 shall not prevent

Employee from acquiring or holding as an investment securities (x) of the Company or (y) representing not more than three percent (3%)

of the outstanding voting securities of any other publicly-held corporation.

(c)

During the Restricted Period, Employee shall not, for his own account or for the account of any other Person (other than

the Company or its subsidiaries), engage in Interfering Activities.

(d)

Without limiting the remedies available to the Company, Employee acknowledges that a breach of any of the covenants contained

in this Section 9 may result in material irreparable injury to the Company or its subsidiaries for which there is no adequate remedy

at law, that it will not be possible to measure damages for such injuries precisely and that, in the event of such a breach or threat

thereof, the Company shall be entitled to seek a temporary restraining order and/or a preliminary or permanent injunction, without the

necessity of proving irreparable harm or injury as a result of such breach or threatened breach of this Section 9, restraining

Employee from engaging in activities prohibited by this Section 9 or such other relief as may be required specifically to enforce

any of the covenants in this Section 9. Notwithstanding any other provision herein to the contrary, the Restricted Period shall

be tolled during any period of violation of Section 9(b) or Section 9(c) and during any other period required for litigation

during which the Company seeks to enforce such covenants against Employee if it is ultimately determined that Employee was in breach of

such covenants.

(e)

If any court of competent jurisdiction shall at any time determine that any covenant or agreement contained in this Section

9 exceeds the temporal, geographic or other limitations permitted by applicable law in any jurisdiction and renders such covenant

or agreement unenforceable, the other provisions of this Section 9 shall nevertheless remain in effect and such covenant or agreement

shall be deemed to be reformed and modified to the maximum temporal, geographic or other limitation permitted by law under the circumstances,

and the Company and Employee each agree that any such court shall be expressly empowered to so reform and modify such covenant or agreement.

(f) Employee

acknowledges and agrees that (A) the agreements and covenants contained in this Section 9 (i) are reasonable and valid in geographical

and temporal scope and in all other respects, (ii) are essential to protect the value of the business, assets and confidential information

of the Company and its subsidiaries and (iii) will not impose any undue hardship on Employee, (B) Employee has and will obtain valuable

knowledge (including knowledge of the Company’s trade secrets, customer relationships and other confidential information), contacts,

know-how, training and experience and such knowledge, know-how, contacts, training and experience could be used to the substantial detriment

of the Company and its subsidiaries, and (C) the markets served by the Company and its subsidiaries include each state within the Restricted

Area and are not dependent on the geographical location of the Company’s offices or its employees. Employee further acknowledges

that the Company’s agreement to enter into the Agreement and to make the payments and take the actions contemplated herein is conditioned

upon Employee’s agreement to the terms set forth in this Section 9 and the Company’s agreement to enter into the Agreement

constitutes good and valuable consideration for Employee’s agreement to the restrictions set forth in this Section 9.

(g)

In the event of the termination of Employee’s employment for any reason, Employee shall deliver to the Company all

of (i) the property of the Company and (ii) the documents and data of any nature and in whatever medium of the Company, and he shall not

take with him any such property, documents or data or any reproduction thereof, or any documents containing or pertaining to any Confidential

Information.

Section

10. Injunctive Relief.

Without limiting the remedies

available to the Company, Employee acknowledges that a breach of any of the covenants contained in Section 9 hereof may result

in material irreparable injury to the Company or its subsidiaries or affiliates for which there is no adequate remedy at law, that it

will not be possible to measure damages for such injuries precisely and that, in the event of such a breach or threat thereof, the Company

shall be entitled to obtain a temporary restraining order and/or a preliminary or permanent injunction, without the necessity of proving

irreparable harm or injury as a result of such breach or threatened breach of Section 9 hereof, restraining Employee from engaging

in activities prohibited by Section 9 hereof or such other relief as may be required specifically to enforce any of the covenants

in Section 9 hereof. Notwithstanding any other provision to the contrary, the Restricted Period shall be tolled during any period

of violation of any of the covenants in Section 9(b) or Section 9(c) hereof and during any other period required for litigation

during which the Company seeks to enforce such covenants against Employee if it is ultimately determined that Employee was in breach of

such covenants.

Section

11. Representations and

Warranties of Employee.

Employee represents and warrants to the

Company that:

(a) Employee

is entering into this Agreement voluntarily and that his employment hereunder and compliance with the terms and conditions hereof will

not conflict with or result in the breach by him of any agreement to which he is a party or by which he may be bound;

(b) He

has not, and in connection with his employment with the Company will not, violate any non-solicitation or other similar covenant or agreement

by which he is or may be bound; and

(c) In

connection with his employment with the Company he will not use any confidential or proprietary information he may have obtained in connection

with employment with any prior employer.

Section

12. Taxes.

(a)

The Company may withhold from any payments made under this Agreement, including payments made pursuant to Section 7,

all applicable taxes, including, but not limited to, income, employment and social insurance taxes, as shall be required by law. Employee

acknowledges and represents that the Company has not provided any tax advice to him in connection with this Agreement and that he has

been advised by the Company to seek tax advice from his own tax advisors regarding this Agreement and payments that may be made

to him pursuant to this Agreement, including, specifically, the application of the provisions of Sections 280G or 409A of the Code to

such payments.

(b) In

the event that any amount otherwise payable pursuant to Section 7 would be deemed to constitute a parachute payment (a “Parachute

Payment”) within the meaning of Section 280G of the Code, and if any such Parachute Payment, when added to any other payments

which are deemed to constitute Parachute Payments, would otherwise result in the imposition of an excise tax under Section 4999 of the

Code, the amounts payable hereunder shall be reduced by the smallest amount necessary to avoid the imposition of such excise tax. Any

such limitation shall be applied to such compensation and benefit amounts, and in such order, as the Company shall determine in its sole

discretion.

Section

13. Set Off.

The Company’s obligation

to pay Employee the amounts provided and to make the arrangements provided hereunder shall be subject to set-off, counterclaim or recoupment

of amounts owed by Employee to the Company or its subsidiaries or affiliates to the greatest extent permitted by applicable law.

Section

14. Delay in Payment.

Notwithstanding any provision

in this Agreement to the contrary, any payment otherwise required to be made hereunder to Employee at any date as a result of the termination

of Employee’s employment shall be delayed for such period of time as may be necessary to meet the requirements of section 409A(a)(2)(B)(i)

of the Code. On the earliest date on which such payments can be made without violating the requirements of section 409A(a)(2)(B)(i) of

the Code, there shall be paid to Employee, in a single cash lump sum, an amount equal to the aggregate amount of all payments delayed

pursuant to the preceding sentence. Notwithstanding anything herein to the contrary, this Agreement shall be interpreted, operated and

administered in a manner consistent with such intentions; provided, however, that in no event shall the Company or its agents,

subsidiaries, affiliates or successors be liable for any additional tax, interest or penalty that may be imposed on Employee pursuant

to Section 409A of the Code or for any damages incurred by Employee as a result of this Agreement (or the payment or benefits hereunder)

failing to comply with, or be exempt from, Section 409A of the Code.

Section

15. Successors and Assigns;

No Third-Party Beneficiaries.

(a)

The Company. This Agreement shall inure to the benefit of and be binding upon the Company and its successors and

assigns. Neither this Agreement nor any of the rights, obligations or interests arising hereunder may be assigned by the Company without

Employee’s prior written consent, to a Person other than a subsidiary, affiliate or parent entity of the Company, or their respective

successors or assigns; provided, however, that, in the event of the merger, consolidation, transfer or sale of all or substantially

all of the assets of the Company with or to any other Person, this Agreement shall, subject to the provisions hereof, be freely assignable

to, and be binding upon and inure to the benefit of, each such Person, without Employee’s consent, and, to the extent the Agreement

has been so assigned, such Person shall discharge and perform all the promises, covenants, duties and obligations of the Company hereunder.

(b) Employee.

Employee’s rights and obligations under this Agreement shall not be transferable by Employee, by assignment or otherwise, without

the prior written consent of the Company; provided, however, that if Employee shall die, all amounts then payable to Employee

hereunder shall be paid in accordance with the terms of this Agreement to Employee’s devisee, legatee or other designee or, if

there be no such designee, to Employee’s estate.

(c) No

Third-Party Beneficiaries. Except as otherwise set forth in Section 7(b) or this Section 15, nothing expressed or referred

to in this Agreement will be construed to give any person or entity other than the Company (and its subsidiaries and affiliates) and

Employee any legal or equitable right, remedy or claim under or with respect to this Agreement or any provision of this Agreement.

Section

16. Waiver and Amendments.

Any waiver, alteration, amendment

or modification of any of the terms of this Agreement shall be valid only if made in writing and signed by each of the parties hereto;

provided, however, that any such waiver, alteration, amendment or modification is approved by the Board. No waiver by either

of the parties hereto of their rights hereunder shall be deemed to constitute a waiver with respect to any subsequent occurrences or transactions

hereunder unless such waiver specifically states that it is to be construed as a continuing waiver.

Section

17. Severability.

If any covenants or such

other provisions of this Agreement are found to be invalid or unenforceable by a final determination of a court of competent jurisdiction:

(i) the remaining terms and provisions hereof shall be unimpaired, and (ii) the invalid or unenforceable term or provision hereof shall

be deemed replaced by a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid

or unenforceable term or provision hereof.

Section

18. Governing Law and Jurisdiction.

This Agreement is governed

by and is to be construed under the laws of the State of Connecticut without regard to conflict of laws rules. Any dispute or claim arising

out of or relating to this Agreement or claim of breach hereof (other than claims for injunctive relief, which shall be governed by Section

10 hereof) shall be brought exclusively in the State or Federal courts located in Hartford, Connecticut. By execution of the Agreement,

the parties hereto, and their respective affiliates, consent to the exclusive jurisdiction of such court, and waive any right to challenge

jurisdiction or venue in such court with regard to any suit, action, or proceeding under or in connection with the Agreement. Each party

to this Agreement also hereby waives any right to trial by jury in connection with any suit, action or proceeding under or in connection

with this Agreement.

Section

19. Notices.

(a) Every

notice or other communication relating to this Agreement shall be in writing, and shall be mailed to or delivered to the party for whom

it is intended at such address as may from time to time be designated by it in a notice mailed or delivered to the other party as herein

provided, provided that, unless and until some other address be so designated, all notices or communications by Employee to the Company

shall be mailed or delivered to the Company at its principal executive office, and all notices or communications by the Company to Employee

may be given to Employee personally or may be mailed to Employee at Employee’s last known address, as reflected in the Company’s

records.

(b)

Any notice so addressed shall be deemed to be given: (i) if delivered by hand, on the date of such delivery; (ii) if mailed

by courier or by overnight mail, on the first business day following the date of such mailing; and (iii) if mailed by registered or certified

mail, on the third (3rd) business day after the date of such mailing.

Section

20. Section Headings.

The headings of the sections

and subsections of this Agreement are inserted for convenience only and shall not be deemed to constitute a part thereof, affect the meaning

or interpretation of this Agreement or of any term or provision hereof.

Section

21. Entire Agreement.

This Agreement, together with

any exhibits attached hereto, constitutes the entire understanding and agreement of the parties hereto regarding the subject matter hereof.

This Agreement supersedes all prior negotiations, discussions, correspondence, communications, understandings and agreements between the

parties hereto relating to the subject matter of this Agreement, including, without limitation, the Severance Agreement.

Section

22. Survival of Operative

Sections.

Upon any termination of Employee’s

employment with the Company, the provisions of Section 7 through Section 23 of this Agreement (together with any related

definitions set forth in Section 1 hereof) shall survive to the extent necessary to give effect to the provisions thereof.

Section

23. Counterparts.

This Agreement may be executed

in multiple counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same

instrument. The execution of this Agreement may be by actual or facsimile (including by way of PDF files) signature.

* * *

[Signatures to appear on the following page.]

IN WITNESS WHEREOF, the undersigned have executed

this Employment Agreement as of the date first above written.

| COMPANY: |

|

|

|

| STURM RUGER & COMPANY, INC. |

|

|

|

| |

|

|

|

|

| By: |

/S/ KEVIN B. REID, SR. |

|

|

|

| Name: Kevin B. Reid, Sr. |

|

|

|

| Title: VP, General Counsel and Corporate Secretary |

|

|

|

| |

|

|

|

|

| EMPLOYEE: |

|

|

|

| |

|

|

|

| /S/ TODD W. SEYFERT |

|

Date: |

January 15, 2025 |

| Todd W. Seyfert |

|

|

|

EXHIBIT 99.1

FOR RELEASE: January 17, 2025

For further information, contact:

Rob Werkmeister, Vice President of Marketing

rwerkmeister@ruger.com

Sturm, Ruger & Co., Inc. Announces Appointment of Todd

W. Seyfert as its Next President and Chief Executive Officer

Southport, CT – Sturm, Ruger & Company, Inc. (NYSE:

RGR) is pleased to announce the appointment of Todd W. Seyfert as its next President and Chief Executive Officer, effective March 1, 2025.

Mr. Seyfert brings to Ruger a distinguished track record of driving corporate growth, profitability, and operational excellence across

multiple manufacturing enterprises.

John A. Cosentino, Jr., Chairman of the Board of Directors, noted,

“Todd is an accomplished executive with extensive experience in the outdoor adventure and shooting sports industries, and well recognized

for his leadership, strategic vision, and operational expertise. He will be instrumental in further strengthening Ruger’s market

position and delivering long-term value to shareholders, employees, and customers alike. The Board of Directors is confident that Todd’s

appointment has positioned Ruger for sustained growth, profitability and innovation in the years to come.”

Recently serving as the Chief Executive Officer of

FeraDyne Outdoors, LLC, a leading manufacturer of premium archery and hunting products, Seyfert had been responsible for driving the company’s

growth and innovation. Under his leadership, FeraDyne solidified its position as a market leader through product development, operational

improvements, and strategic acquisitions. His ability to align business strategies with customer needs resulted in significant market

expansion and increased profitability during his tenure.

Before joining FeraDyne, Seyfert held key leadership

roles in several other manufacturing and consumer goods companies, where he honed his skills in operational excellence, team development,

and financial management. His extensive industry background includes well-known companies such as ATK/Vista Outdoors, Magnum Research,

Bushnell, Michaels of Oregon, and Birchwood Laboratories. He is known for his commitment to building high-performing teams and fostering

a culture of accountability and innovation.

Throughout his career, Seyfert has demonstrated a

strong ability to navigate complex challenges and deliver measurable results. His leadership style emphasizes collaboration, adaptability,

and a relentless focus on achieving organizational goals.

“I am honored to join Ruger and am eager to build upon the

strong foundation established by Chris Killoy, the executive team and the 1,800 Ruger employees,” said Seyfert. “I look forward

to leading Ruger into its next phase of growth while maintaining our commitment to the Company’s core values of integrity, respect,

innovation, and teamwork.”

Mr. Cosentino expressed the Company’s deepest gratitude to Chris

Killoy for his exceptional leadership and dedication over the past 20 years, “Chris successfully guided the Company through transformative

milestones, including the pivotal acquisition of Marlin Firearms that expanded our capabilities and market presence, as well as expertly

steering the organization through the unprecedented challenges of the COVID-19 pandemic. During his tenure, we introduced numerous innovative

and commercially successful new products, including the recently launched RXM pistol.”

Killoy joined Ruger in 2003, was named Vice President

of Sales and Marketing in 2006, became President and Chief Operating Officer in 2014, and assumed the role of Chief Executive Officer

in 2017. Under his leadership, Ruger has solidified its position as one of the leading firearms manufacturers in the United States, renowned

for its innovation, quality, and customer focus.

Prior to his tenure at Ruger, Killoy held key leadership

roles at Smith & Wesson Corp. and Savage Range Systems, where he honed his expertise in sales, product development, and operational

management. His deep product and industry knowledge, coupled with a commitment to excellence, has made him a highly respected figure in

the firearms sector.

Cosentino continued, “Throughout his career,

Chris has emphasized the importance of new product development, manufacturing excellence, and taking care of Ruger employees. His ability

to navigate complex challenges while delivering value to stakeholders has been a hallmark of his leadership.”

Killoy will serve as a Special Advisor to Seyfert

and the Board of Directors through his planned retirement from the Company in May 2025 and will remain on the Ruger Board.

Mr. Killoy commented on his tenure at Ruger, “It has been

an honor to lead Ruger and work alongside such an extraordinary team. I am confident in Todd’s ability to drive the Company’s

continued success and am excited to see what the future holds for Ruger. While transitioning is always bittersweet, I am thrilled to continue

contributing to the Company’s success as a member of the Board of Directors. This will allow me to remain closely connected to Ruger

and support Todd and the leadership team as they guide the Company into its next chapter of growth and innovation.”

About Ruger Firearms

Sturm, Ruger & Co., Inc. is one of the nation's leading manufacturers

of rugged, reliable firearms for the commercial sporting market. With products made in America, Ruger offers consumers almost 800 variations

of more than 40 product lines, across both the Ruger and Marlin brands. For over 75 years, Ruger has been a model of corporate and community

responsibility. Our motto, “Arms Makers for Responsible Citizens®,” echoes our commitment to these principles

as we work hard to deliver quality and innovative firearms.

Forward-Looking Statements

The Company may, from time to time, make forward-looking

statements and projections concerning future expectations. Such statements are based on current expectations and are subject to certain

qualifying risks and uncertainties, such as market demand, sales levels of firearms, anticipated castings sales and earnings, the need

for external financing for operations or capital expenditures, the results of pending litigation against the Company, the impact of future

firearms control and environmental legislation, and accounting estimates, any one or more of which could cause actual results to differ

materially from those projected. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events or circumstances

after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC