Gift Boxes: Profits in the Packaging Industry - Zacks Industry Rank Analysis

20 December 2013 - 4:38AM

Zacks

‘Tis the season of shipping, shopping and sharing (and using the

term "‘tis"). Of course, each of these activities usually

requires an item be carefully wrapped, perhaps with some additional

festive flair, which is a fitting introduction to an industry which

has been "present"-ing quite a few surprises recently.

Nine companies make up the Containers – Paper/Plastic sector of the

Zacks Industry Rank, gaining 8 positions in the last week.

The industry now holds a rank of #28 out of 260 ranked

industries.

With 9 positive earnings revisions and only 2 negative, every

company in this sector, save one, has had their Zacks Rank revised

upward. Averaging positive Earnings per Share (EPS) surprises

of +33%, it’s apparent that things are looking merry, even if the

Christmas tree is destined to be a corrugated box.

With online shopping/shipping taking over retail sales, demand has

been strong. Add to this viral images like

Amazon’s (AMZN) package-delivering helicopter

drones, and the future of the packaging industry seems “air

apparent.”

Below are two companies which have moved into the prime position of

a Zacks Rank #1 (Strong Buy) from a “Buy” rating. With

projected prices still sitting comfortably above current market

value, there may still be time to ride an exceptional year a bit

longer. EPS surprises are expected to continue, and factoring

in individual performance while analyzing and industry’s strength

is beneficial in determining your investment strategy.

It’s well understood that young children and pets often prefer the

packaging to the actual present. Maybe they’re onto

something.

Packaging Corp. of America (PKG)

PKG was upgraded to a Zacks Rank #1 (Strong Buy) last week from #2

(Buy).

Packaging Corp. of America is one of the largest producers of

containerboard in the United States and also one of the largest

manufacturers of corrugated packaging products. The company

produces corrugated containers as well as the containerboard used

to manufacture corrugated containers.

PKG pays a dividend of 2.57% and its last earnings surprise was

2.25% with expected EPS growth of 15.24%. It reports its next

earnings on January 28, 2014.

Sealed Air Corp. (SEE)

SEE is a Zacks Rank #1 (Strong Buy). It moved up from a Zacks

Rank #2 (Buy) last week. This company reports quarterly

earnings on February 18, 2014.

Sealed Air Corporation is a global leader in performance solutions

for food, protective and specialty packaging. They offer a broad

range of differentiated products to a diverse set of markets.

Their portfolio consists of widely recognized brands, including

Cryovac® brand food packaging solutions, Bubble Wrap® brand

cushioning and Diversey™ cleaning and hygiene solutions

SEE pays a dividend of 1.63% and its last earnings surprise was

14.71%.

AMAZON.COM INC (AMZN): Free Stock Analysis Report

PACKAGING CORP (PKG): Free Stock Analysis Report

SEALED AIR CORP (SEE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

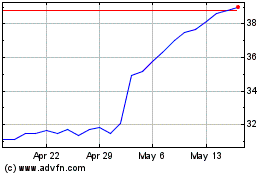

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Jun 2024 to Jul 2024

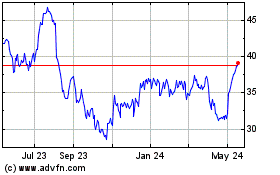

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Jul 2023 to Jul 2024