Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

15 August 2024 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella

17

35017 Piombino Dese – Padua

Italy

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F.

Form 20-F

☒ Form 40-F ☐

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Stevanato Group S.p.A. |

|

|

|

|

| Date: August 14, 2024 |

|

|

|

By: |

|

/s/ Marco Dal Lago |

|

|

|

|

Name: |

|

Marco Dal Lago |

|

|

|

|

Title: |

|

Chief Financial Officer |

Exhibit 99.1

Stevanato Group S.p.A.

“Second Quarter 2024 Earnings Call”

Tuesday, August 06, 2024, 14:30 CET

| MODERATORS: |

FRANCO STEVANATO, EXECUTIVE CHAIRMAN & CHIEF

EXECUTIVE OFFICER |

MARCO DAL

LAGO, CHIEF FINANCIAL OFFICER

LISA

MILES, SENIOR VICE PRESIDENT OF INVESTOR RELATIONS

| OPERATOR: |

Good afternoon. This is the Chorus Call conference operator. Welcome and thank you for joining the Stevanato Group Second Quarter 2024

Earnings Call. As a reminder, all participants are in listen-only mode. After the presentation, there will be an opportunity to ask questions. Should anyone need assistance during the conference call, they may signal an operator by pressing

“*” and “0” on their telephone. |

| |

At this time, I would like to turn the conference over to Ms. Lisa Miles, Senior Vice President of

Investor Relations. Please go ahead, madam. |

| LISA MILES: |

Good morning, and thank you for joining us. With me today is Franco Stevanato, Executive Chairman and Chief Executive Officer, and Marco

Dal Lago, Chief Financial Officer. This morning, you can find a presentation to accompany today’s results on the Investor Relations page of our website, which can be found under the financial results tab. |

| |

As a reminder, some statements being made today will be forward-looking in nature and are only predictions.

Actual events and results may differ materially as a result of the risks we face, including those discussed in Item 3D entitled Risk Factors in the company’s most recent Annual Report on Form 20-F filed

with the SEC on March 07th, 2024. Please read our ‘safe harbor’ statement included in the front of the presentation and in today’s press release. The company does not assume any

obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances, except as required by law. |

| |

Today’s presentation may contain non-GAAP financial information.

Management uses this information in its internal analyses of results and believes this information may be informative to investors, engaging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. For a reconciliation of the non-GAAP measures, please see the company’s most recent earnings press

release. |

| |

And with that, I will now hand the call over to Franco Stevanato. |

| FRANCO STEVANATO: |

Thank you, Lisa, and thanks for joining us. Today, we will review our second quarter performance, provide an update on market dynamics

and share some insights on the challenges and the ongoing initiatives to meet our objectives. |

| |

For the second quarter, revenue was a little bit better than our expectation, driven by 9% growth in the BDS

Segment, but margins fell short of our forecast in the Engineering Segment, where delays led to higher costs on certain projects. We also incurred increased expenses related to the actions taken in the second quarter to address these delays. These

factors combined are the main reason for the revision of our 2024 guidance. |

| |

As you know, the Engineering Segment has experienced significant growth, more than doubling its revenue over

the last 4 years. We scaled our operations to support this large volume of work, but persistent delays in the supply of electronic components and the complexity of certain projects prevented us from delivery as planned. |

| |

The challenges are mostly limited to our Denmark operation and are related to certain highly customized

projects. Our #1 priority today is to advance this large volume of work in progress and bring these projects to completion. But this will take some time. |

| |

Moving to Slide 6. We are undergoing extensive efforts to optimize our Engineering footprint, harmonize

industrial processes and enhance our supply chain and logistics strategies. |

| |

Let me give you a concrete example of these efforts. In Denmark, we consolidated activities of 2 different

production sites into a single location so that the Danish team can focus on the advancement of our assembly and packaging technologies. At the same time, we’re implementing a cross-site plan to better support our visual inspection teams in

Denmark with our technical specialists in Italy. |

| |

This will also increase the standardization of our technologies and processes across the Engineering Segment.

While these initiatives include expenses that will impact our 2024 financial performance, they will help us optimize our operational structure, maximize efficiencies and secure the success of ongoing projects. |

| |

This is one of the primary areas of responsibility of Ugo Gay, our Chief Operating Officer, who joined

Stevanato Group in March. Ugo brings over 20 years of experience in the industry, having held both commercial and operations leadership positions at organizations such as Diasorin. |

| |

Long-term, we believe the demand landscape for Engineering remains favorable. Not only is the industry moving

to secure supply chains and manufacturing capacity for fast-growing biologics, but we also see an increasing shift to upgrade infrastructure to better align with the requirements under Annex One. |

| |

In addition to improving our execution in the Engineering Segment, we are still navigating through the effects

of vial destocking. We see positive signals in the market with orders starting to materialize in certain smaller markets such as Latin America. |

| |

In larger markets, we still expect a more gradual recovery. Our customers are sharing forecasts that point to

improving demand and they are beginning production planning. Accordingly, we are optimistic that vial orders will begin to pick up at the tail-end of 2024, starting with bulk vials. |

| |

Moving to our capacity expansion projects on Slide 7, it is important to note that we are working through

these challenges in the midst of a large demand-driven CAPEX cycle. Last year, we successfully completed our Piombino Dese plant expansion, and we are continuing our multi-year ramp-up of our expansion

projects in Fishers, Indiana and Latina, Italy. |

| |

In Fishers, our validation activities are going as planned, and we are progressing through the first set of

customer audits. During the quarter, we took delivery of our second and third syringe lines and installation and qualification activities are underway. Most importantly, we are on track to launch commercial production and generate our first

commercial revenue from Fishers in the third quarter of 2024. |

| |

During the second quarter, we hosted 40 customers for the opening of the new plant in Latina to give them a

first look at our new high value solutions manufacturing facility. We expect to continue to expand our syringe production as part of our multi-year ramp up in Latina. We have 2 manufacturing plants at our Latina campus. |

| |

As previously disclosed, the next phase in Latina is concentrated on the expansion of EZ-fill cartridge capacity to support the transition from bulk to ready-to-use products for an anchor customer. Activities tied to this

project will launch next year. The expansion is designed to harmonize operations between the 2 sites. This includes the installation of new bulk and EZ-fill cartridge lines in the new plant, and the upgrade of

already-operational lines in the original Latina plant. |

| |

This approach is part of our wider strategy to enhance efficiency and production capacity, reduce lead times,

and expand our offer of premium solutions. As expected, the ramp-up activities for our 2 new facilities are resulting in temporary inefficiencies on which Marco will elaborate further. |

| |

With our teams focused on the execution in Latina and Fishers, we decided to further postpone any additional

expansion in China for the coming 12 months. As a consequence, we are shifting some of this CAPEX to Latina to accommodate a change in regional manufacturing preference for a large customer. Accordingly, we believe we have sufficient capacity to

support the demand in the region. |

| |

On Slide 8, in summary, we are confident that we can successfully navigate through the challenges in front of

us, and we are squarely focused on improving our execution. The core fundamentals of our business have not changed. The end-markets we serve are healthy and growing. Demand for our products remains strong. Our

integrated solutions resonate with our customers, and we are operating in an environment with favorable secular tailwinds. |

| |

We continue to see a durable, profitable growth path in front of us, driven mainly by biologics. In fact, in

the first half of 2024, biologics hit a record-high of 35% of BDS revenue, which is creating strong demand, especially in high value solutions. |

| |

I will now hand the call over to Marco. |

| MARCO DAL LAGO: |

Thanks Franco. Before I begin, I want to clarify that all comparisons refer to the second quarter of 2023, unless otherwise specified.

And, in the second quarter foreign currency was immaterial, so all revenue comparisons exclude currency translation. |

| |

Starting on Page 10. For the second quarter of 2024, revenue increased 2% to €260 million. This was

driven by a 9% growth in the Biopharmaceutical and Diagnostic Solutions Segment, which offset the expected decline in the Engineering Segment. Our product diversity helped expand our mix of high-value solutions, which grew 23% in the second quarter,

and represented approximately 40% of total revenue in the quarter. The increase in high-value solutions was favorable to gross profit margin. This offset lower revenue from EZ-fill vials which adversely

affected the mix within high-value solutions. |

| |

Gross profit margin was also tempered by 3 headwinds. First, the higher than anticipated costs in the

Engineering Segment had the biggest effect on gross profit margin in the second quarter. Second, the impact from vial destocking, causing the underutilization of our vial lines. And lastly, inefficiencies tied to the

ramp-up phase of our new facilities. As a result of these temporary headwinds, gross profit margin decreased to 26%. It is important to point out that we believe that these headwinds are temporary and will

gradually subside. In turn, we expect a step-up in margins. |

| |

As we outlined during our Capital Markets Day, margin expansion is expected to be driven by the mix shift to

high-value solutions, the benefit of scale and better leverage of our fixed assets, and operational efficiencies. |

| |

For the second quarter, lower gross profit led to a decline in operating profit margin to 10.8%, and on an

adjusted basis, operating profit margin |

| |

was 12.8%. For the second quarter of 2024, net profit totaled €20.6 million, and diluted earnings per share were €0.08. On an adjusted basis, net profit was

€24.5 million, and adjusted diluted earnings per share were €0.09. Adjusted EBITDA was €54 million, and adjusted EBITDA margin was 20.8%. |

| |

Moving to segment results on Page 11. For the second quarter of 2024, revenue from the BDS Segment increased

9% to €222.4 million, mostly driven by growth in high-performance syringes. The diversity in our product portfolio helped drive 9% growth, despite a 40% decrease in revenue related to vials. |

| |

Revenue from high-value solutions grew 23% to €103.4 million in the second quarter, while revenue

from other containment and delivery solutions decreased 1% to €119 million. As expected, the increase in high-value solutions benefitted gross profit margin, but segment margins continue to be unfavorably impacted by (i) the ongoing

effects of destocking, as customer inventories continue to normalize, and (ii)0020start-up inefficiencies in Latina and Fishers. |

| |

As a reminder, these are natural inefficiencies that occur during the early phases of operations. These

inefficiencies reflect the under absorption of expenses as volumes, productivity and revenue progressively grow to reach the target levels. As these facilities mature, we believe that this impact will decrease and that margins will improve

accordingly. |

| |

As a result, in the second quarter of 2024, BDS Segment gross profit margin was 27.7%. This represents a 390

basis point decrease compared to the prior year. For the second quarter, operating profit margin for the BDS segment decreased to 14.5% from 19.8% in the same period last year. |

| |

For the second quarter of 2024, revenue from the Engineering Segment decreased 26% to €37.2 million.

As Franco noted, delays have led to higher costs on certain complex and highly customized projects in process. As a result, gross profit margin decreased to 10.3% and operating profit margin declined to 2.6% for the second quarter.

|

| |

It is important to mention that we currently see strong continued interest in our innovative, market-leading

technologies. With the actions we have ongoing, we believe that we can drive the necessary improvements to bring these projects to completion, improve the segment’s financial performance, and return to a profitable growth trajectory.

|

| |

Please turn to the next slide for a review of balance sheet and cash flow items. We continue to carefully

manage trade working capital to support the growth of our business. As expected, our inventory levels increased in the quarter mainly due to the establishment of baseline inventories in our new plants in the US and Italy, including products that are

expected to be delivered to customers in the future quarters. This was partially offset by collections of trade receivables. |

| |

We ended the second quarter with cash and cash equivalents of €78.1 million and net debt of

€238.2 million. Through a combination of our cash on hand, available credit lines, cash generated from operations, and our ability to access additional financing, we believe that we have adequate liquidity to fund our strategic and

operational priorities over the next 12 months. As expected, capital expenditures for the second quarter of 2024 totaled €75.9 million, as our demand-driven investments continue to ramp. |

| |

In the second quarter of 2024, net cash from operating activities totaled €22.3 million. During the

second quarter, we received proceeds of €3 million for the sale of a building in Denmark, as part of our initiatives to optimize our footprint, and gain operational efficiencies. Cash used in the purchase of property, plant, and equipment

and intangible assets was €72.1 million. This resulted in negative free cash flow of €46.1 million in the second quarter. |

| |

Lastly, on Slide 13, we are updating guidance for fiscal 2024. Let me walk you through the changes. Starting

with the Engineering Segment, which is the main reason for the revision. We now estimate a revenue decrease of approximately 15% to 20% for fiscal 2024 compared with last year. |

| |

Turning to the BDS Segment. For fiscal 2024, we continue to anticipate

mid-single-digit revenue growth compared with last year, and we remain comfortable with the current consensus revenue estimate of €930 million for the segment. |

| |

So, when you add this all up, for fiscal 2024, we now expect, revenue in the range of €1.090 billion

to €1.110 billion, adjusted EBITDA in the range of €264 million to €272 million, and adjusted diluted EPS in the range of €0.48 to €0.50. |

| |

As we consider the future trajectory, our long-term growth construct remains unchanged. We believe we have the

right ingredients in place to return to double-digit growth and expand margins, as outlined at our Capital Markets Day. |

| |

Looking to next year, in the BDS Segment we have positive momentum in high value solutions, particularly in

syringes, which is a favorable |

| |

tailwind. On the other side, we currently anticipate that our growth may be tempered by the current headwinds. This includes the pace of recovery in bulk and

EZ-fill vials, which is the largest factor, and the timing of the effect of the corrective actions we are taking for the Engineering Segment. |

| |

We will continue to update you on our progress, but we will provide formal guidance in March. We remain

confident in our strategy and in our long-term growth prospects going forward. |

| |

Thank you, I will hand the call back to Franco. |

| FRANCO STEVANATO: |

Thank you, Marco. In closing, on Slide 15, we are maintaining focus on our long-term objectives and we are confident in our strategic

direction. Despite the headwinds, we are still delivering organic growth, primarily in high-value solutions. We are investing in the right areas and meeting customer demand. In the near-term, we must deliver on our commitments and sharpen our focus

on solid execution across our main priorities. This includes the ongoing expansion in Latina, our ramp-up activities in Fishers and improving our project delivery in the Engineering Segment.

|

| |

The fundamentals of our business remain strong. We operate in a dynamic and growing market with favorable

secular tailwinds. Demand is robust and we have a portfolio of products that are ideally suited to meet customers’ needs. We believe the business is well positioned to capitalize on these trends, and we are determined to return to durable

double-digit organic growth, expand margins and drive long-term shareholder value. |

| |

Over the past few months, I had the opportunity to meet with many of our key stakeholders, including

customers, employees, and investors. As a CEO, I am confident that we will achieve our long-term objectives. |

| |

Operator, let’s open it up for questions |

Q&A

| OPERATOR: |

Thank you. This is the Chorus Call conference operator. We will now begin the question and answer session. Anyone who wishes to ask a

question may press “*” and “1” on their touchtone telephone. To remove yourself from the question queue, please press “*” and “2.” Please pick-up the receiver when

asking questions. Anyone who has a question may press “*” and “1” at this time. We kindly ask you to limit to one question and a follow-up only and join the queue again for any further

questions. We will pause for a moment as callers join the queue. |

| |

The first question is from Jacob Johnson of Stephens. Please go ahead. |

| JACOB JOHNSON: |

Hey, good morning. Thanks for taking the questions. Maybe just on the Engineering business, you know, this business grew rapidly the

past few years. We’ve heard you know, about some weakness around capital equipment demand in the current environment. Do you think this is largely supply chain issues and within your control or is there any softening in demand that you’re

seeing for Engineering equipment? |

| FRANCO STEVANATO: |

Thank you, Jacob, Franco speaking. So today, in order to put in a context the Engineering Division, we more than doubled our revenue in

the last years, in particular in the middle of the context of the pandemic and supply chain shortages. Today, we are behind schedule in some complex new projects, more than what we previously expected. And this is putting pressure on our performance

on the business. Those temporary challenges are predominantly isolated to our Denmark operation on certain highly customized projects at the late stage of development. And we are taking strong action to improve and recover the situation. We are

confident that |

| |

we can successfully navigate through these temporary challenges in front of us in the new next few quarters. And by the way, the portfolio of orders in the Engineering Division is solid, is

strong with our big customers, in particular in biologics. |

| JACOB JOHNSON: |

Got it. Thanks for that, Franco. And then, I guess, I’ll ask one on Fishers. You guys talked about seeing commercial revenues in

3Q. Was this always what was kind of assumed in guidance or is this a slight benefit versus prior expectations? And I guess as we think about Fishers coming online in 3Q, should we think about that initial contribution? It’s being kind of

modest. Thanks. |

| FRANCO STEVANATO: |

Correct, Jacob. Validation activity are progressing as planned. So practically, we are on track to launch commercial production in the

third quarter of 2024. And we expect to generate commercial revenue also in the Q3 of this year. Today, the big attention, the big focus on all our organization is to perform validation audits with all our US based customers. |

| MARCO DAL LAGO: |

On the guidance, the revenue is embedded in our guidance we provided. |

| JACOB JOHNSON: |

Got it. Thanks for taking the questions. |

| FRANCO STEVANATO: |

Thank you. |

| OPERATOR: |

The next question is from Paul Knight of KeyBanc. Please go ahead. |

| PAUL KNIGHT: |

Hi, Franco. Do you expect Engineering systems to grow in 2025, I mean, obviously, this is a reorg year? |

| MARCO DAL LAGO: |

We provided some color. Marco is speaking, Paul. We provided some color about 2025, about our preliminary focus on next year. It’s

a little bit early to provide guidance. We will provide guidance as usual after Q4 earnings call. What we can tell you today, again, is that we see strong demand in syringes in high value - Nexa and Alba - suitable for biologics. And this is a good

tailwind. On the other side, we see some uncertainty about the timing of a recovery of the vials and the timing of the effect of the actions we are taking for Engineering. |

| |

As Franco mentioned before, we see strong demand for our technology in Engineering. Unfortunately, we are

struggling to complete the testing on some highly customized projects, and this is impairing a little bit our ability to bring on new contracts and advance on the projects. So, this is a little bit early to talk about specifically Engineering for

2025. |

| FRANCO STEVANATO: |

Paul, if I can further give you some more elements. These complex lines that Marco is referring to, are new technologies that our big

customers in particular on assembling technology and inspection, where the average lead time is up to 20-24 months. So, we have faced now some challenges at the latest stage of a certain test at the end of May

and June. It also is important to specify that these projects are the first of a kind of machinery for our customers that are part of a long-term multiple line equipment. |

| |

So, what do you see? On one side, you see a big increase in demand on syringes, Nexa and cartridges ready-to-fill. Automatically, our same customers are asking to also deliver new high-sophisticated lines for assembling and for inspection. These are the first lines, and our

organization, Denmark, is facing some temporary challenges, but under the new leadership of Ugo Gay, they already put in place all the actions in order to recover and to be back on track in the next few quarters. |

| PAUL KNIGHT: |

And then, the second question is Latina, which seems to, I know you had a lot of...another opening down there recently. What was...the

transfer of expansion was from what? Piombino? or what...could you just give us an update on Latina, it seems to be a lot bigger expansion than that has been planned 2 years ago. |

| FRANCO STEVANATO: |

Yes, Paul. Practically, Latina was...we have decided that it became the second big hub in Europe in order to serve our customers for our

Nexa syringes. And this is the reason why, by the way, if you compare Latina with Fisher, we are 2, 3 quarters ahead. Today, we already...so many customers, we are generating commercial revenue. Today, one of our major anchor customers have decided

to increase capacity in Latina for this new technology, for these cartridges ready-to-fill. We know that we are market leader on cartridges, both on cartridges, bulk

also in technology. Today, we see there is more and more demand from these cartridges ready-to-fill from all the bio-customers.

And in particular, these big customers want to... have big capacity in Europe, in particular, on the site of Latina. This is the reason for these further expansions. |

| PAUL KNIGHT: |

Okay, thanks. |

| OPERATOR: |

The next question is from Matt Larew of William Blair. Please go ahead. |

| MATT LAREW: |

Hi, good morning. Last quarter, when you took down guidance for destocking, you communicated that you were trying to be conservative

there. And you did beat, I think, our expectations for the second quarter on BDS. And it sounds like you’re maintaining that outlook largely for the year. Now that you’ve encountered issues in Engineering, are you trying to take a similar

approach now in terms of the way that you are communicating those challenges to investors? |

| MARCO DAL LAGO: |

Yes, you mentioned, there are 2 very different reasons for adjusting the guidance. We recognize we have to change the guidance twice in

a year, but again, for 2 very different reasons. Vials destocking is affecting all the industry and at the beginning of the year, we didn’t expect the dropdown for about 40% year-over-year in our vials demand and this is the specific reason why

we had to review the guidance in Q1. Engineering is different situation whereas, Franco explained, we more than doubled the size of the business. We are taking some highly customized projects. As a matter of fact, we are delaying some acceptance

from customers because they are really specific projects and customized ones. |

| |

As a matter of fact, we are spending more time to test the equipment. We had to add more resources in May and

June to complete the stuff. So, as a matter of fact, we are spending more time with more people on those projects and this is affecting our profitability in the second quarter. At the same time, we took a conservative approach also in bringing in

new customized projects, and this is the main reason why we are reviewing our guidance for fiscal 2024. |

| FRANCO STEVANATO: |

If Matt, if I can give some more color to the answer of Marco. So, from our perspective, if you’re going to isolate these temporary

challenges, we will expect that the effects from vial destocking will be behind us. Also, like Marco mentioned in his remarks, that we will gain leverage from the scale of our new operation in Latina and Fisher, and the Engineering Segment should

return to profitable growth in the next quarter. So, we are excited that this will give us confidence in the future. |

| LISA MILES: |

Matt, one clarification. We don’t expect the Engineering Segment to return to profitable growth next quarter. It will be in the

coming quarters. |

| MATT LAREW: |

Okay. Thank you. And then just on CAPEX, we took up the high end of the range there, I think to €335 billion. This obviously

was expected to be another big year of CAPEX following last year. But just given, I think, Fisher’s validation maybe a little bit ahead of at least street expectations. Could you just provide us with sort of an outlook on CAPEX over the next

several quarters here as, you know, starting to continue to fill out those facilities with lines? |

| MARCO DAL LAGO: |

Yes, we are online with our CAPEX plan for the year. So, we reiterated our guidance for the year between €300 million to

€335 million. So, everything is going according to the plan, and we reiterate our guidance. It means that second half of the year will be slightly below first half of the year with respect of cash out, but we are not talking about big

differences compared to the first half of the year. |

| MATT LAREW: |

Okay. Thanks. |

| OPERATOR: |

The next question is from Michael Ryskin of Bank of America. Please go ahead. |

| JOHN KIM: |

Hello. Good afternoon. This is John Kim on for Michael. Great to hear of the orders coming in in Latin America, and elsewhere you talked

about the customers, talking about the production planning coming in. Is that across the boards as in all regions? And then, what sort of products can we expect to come after bulk vials? And if there’s a timeline expectation for that destocking

to happen, I would appreciate those comments? |

| FRANCO STEVANATO: |

So, thank you for your question. We are still navigating through the effects of the market vial destocking. We see today positive signs

like I mentioned to you in the market with orders starting to materialize in certain smaller markets such as Latin America. In larger markets, we still |

| |

expect a more gradual recovery, but our customers are sharing forecasts that point to improving demand at their beginning production planning. This reinforces our confidence that vial orders will

begin to pick up at the tail end of 2024 starting from bulk vials. So, we are starting to see all overall positive sign from the market. |

| JOHN KIM: |

Great. Thank you for that. And in the guide update today, you laid out for the fiscal ‘24 that high value solutions, now, you

expect that to take over…take up 36% to 39% of the total sales. And that’s making progress towards your 2027 target. But 2Q is already 40%. So, I’m wondering if that fiscal ‘24 target could even be higher? |

| MARCO DAL LAGO: |

This is our guidance today about 2024. So, we reiterate in absolute value that the revenue from high value solutions, we can see strong

demand as mentioned in high value syringes. Compared to initial guidance as mentioned, we have seen pronounced reduction in sterile vials. But all overall, we confirm our guidance in total numbers. Obviously, going down in Engineering, we are

consequently increased the percentage on total revenue. |

| |

About the mid-term view, we feel confident to get to 40% to 45% by

2027 with the growth in the coming years also. As mentioned by Franco, we see temporary…the vials destocking. So, we expect to restart growing in vials both bulk and sterile. We expect also other product lines to ramp up and not only high value

products. |

| JOHN KIM: |

Alright. Thank you. |

| OPERATOR: |

The next question is from Patrick Donnelly of Citi. Please go ahead. |

| PATRICK DONNELLY: |

Hi, guys. Thanks for taking the questions. I’ll just ask you 2 up front. Franco, maybe just quickly on destocking piece, can you

just talk about visibility, what you’re hearing from customers, just expectations on that front as we work our way through the year? |

| |

And then second, just on the China facility, how to think about the timing and the commitment to that region

would be helpful. Thank you, guys. |

| LISA MILES: |

So, just to clarify your question, Patrick, it was a little hard to hear you. Your first question was on destocking and asking about

visibility into our customer forecasts? |

| |

And the second question related to China and the timing on China. Is that correct? |

| PATRICK DONNELLY: |

Yes, you got it. |

| FRANCO STEVANATO: |

So, regarding destocking, just to give some number, the vial market…bulk vial market is a market that have a size around

13 billion vials per year consumption. These are number approximately pre-pandemic. We started to face some issue with destocking in 2023, also this year. So, practically, we are entering the second year

where we are facing this destocking issue. Today, what we see that practically all our customers…international customers, regional customers; they build a huge inventory for COVID vials, also for all the other therapeutic drugs. Now, our

customers are moving this situation of destocking. We are starting, like I mentioned before, to see, in particular, in smaller customers where they have more lean supply chain, a reactivation of order. What is more related to international

customers, they are starting to…they are still soft in the demand on 2024, but they’re starting to discuss forecasts for 2025. So, this is the reason why we are starting to see an overall positive sign on the vial market.

|

| |

Regarding China, the fact, by the way, China, Asia-Pacific for Stevanato is still, we remain a strategic

market, because we see a very big opportunity, in particular, in Biosimilars in the next years to come. It’s also true that in Stevanato Group, we are very flexible in terms of follow the demand requested by our customers. It also, where our

customer is addressing the request, our model to make investments are modular. |

| |

So, in particular, one of our major anchor customers, they have just reallocated their needs from Asia.

They’ve asked us to further enforce our capacity into the plants of Latina. This is the reason why we have partially reallocated our investment. We are increasing capacity in Italy. Also, because what we…the capacity that we have in China

today is sufficient to serve and satisfy the market. |

| OPERATOR: |

The next question is from David Windley of Jefferies. Please go ahead. |

| DAVID WINDLEY: |

Hi, hopefully you can hear me. I wanted to ask…I’m trying to understand the guidance a little bit from some scratch math

I’ve done here. It looks like you need about 27% EBITDA margins in the second half from 21% in the first half, and then incremental margins of you know, something in the mid-50s percentage to kind of hit

this new midpoint of the range. And clearly with the costs that you’ve incurred, the delays in projects or the complexity of some of these projects, your margins have been negatively affected. I mean, effectively, your incremental margins have

been negative. Just wanted to understand how you see the progression from first half to second half. Are you taking costs out of the business? It sounds like you’re actually investing into, but again, wondering if you’re taking costs out

of the business that would help to support those high incremental margins to get to the much higher EBITDA targets in the second half. Thanks. |

| MARCO DAL LAGO: |

Yes, thanks for the question, David. We see a path similar to last year with respect of sequential growing between Q2, Q3, and Q4. So

basically, we need to repeat what we have done last year. All overall, we are, let’s say, we took the hit of the higher cost in Engineering in second quarter. We expect to grow particularly with the good mix in high-value products, especially

in syringes. And we can leverage the ramp-up of Latina. By the way, to give you more comfort on this, in the first half of the year, the ramp-up in Fishers and Latina

was painful from the P&L perspective because we have all the structure in place. We have quality in place, information technology, controlling, and logistic planning. And we are…we generated a small amount of revenue first half of the year.

Differently for the second part of the year, we plan to ramp-up significantly Latina and start generating some commercial revenue in Fishers. So, this is one of the drivers of the growth. And everything is

embedded in our guidance, basically, to repeat what we have been able to do last year. |

| FRANCO STEVANATO: |

David, if I can complement the answer of Marco. Also, we are making a lot of attention, also under the leadership of Ugo Gay, this year

the new Chief Operating Officer, to make a lot of attention in making a lot of improvement in efficiency internally in order to really to try to maximize and bring the full plants in Stevanato Group, the full function, it will become extremely

efficient. So, this is an exercise that we are starting to put a lot of attention. By the way, it will be an ongoing activity also for the next year. |

| DAVID WINDLEY: |

Got it. Maybe a slight twist on the question. Would you be willing to give us some sense of split? I don’t think you did that in

the updated guidance. I’m sorry if I missed it. But the sense of split of revenue contribution for the year between BDS and Engineering? |

| MARCO DAL LAGO: |

Yes, we, let’s say, are in line with current consensus with respect of BDS around €930 million. That means a mid-single-digit growth in BDS. In Engineering, we mentioned that we expect a decline between 15% to 20% compared to last year. |

| DAVID WINDLEY: |

Okay. And then if I could ask one last one that’s more long-term. In thinking about your longer-term margin targets and the change,

so we’ve kind of come to understand that high-value vials are quite profitable for you. Vials, I think you said, vials maybe overall were down 40%. Is the achievement of your longer-term targets dependent on vials recovering the same percentage

of your business that they were, say, a year or 2 years ago? |

| FRANCO STEVANATO: |

David, today, once we will scale up our 2 new Greenfield plants, in particular Latina and Fisher, we are confident that we’ll

continue really to match our adjusted EBITDA target that we share on ‘27, about 30%, and to stay in the high-value range of high-value solutions product between 40% to 45%. This is where we target. Today, we are growing a lot on Syringes Nexa.

We are going, we have a good pipeline on ALBA Technology. We have a lot of mid-small program on syringes with bypass. And also, we have a big program on cartridges ready-to-fill with some anchor customers. But we see more and more a trend on the industry that cartridges will turn into

ready-to-fill. So, overall, we are confident that on the number that we share with you. |

| DAVID WINDLEY: |

Okay. Thank you. |

| MARCO DAL LAGO: |

In the medium-term, we see this appear in the vials, destocking. We are taking action to be back on track for the Engineering. And

compared to the Capital Markets Day, we see very, very strong demand in syringes, as Franco was saying, the conversion, the acceleration of the conversion of cartridges to sterile. So, we are offsetting some risk also in EZ-fill vials, but we are confident to drive the growth in the same direction. |

| DAVID WINDLEY: |

Thank you. |

| OPERATOR: |

The next question is from Larry Solow of CJS Securities. Please go ahead. |

| LARRY SOLOW: |

Great. Thank you. One of my questions to ask. Just to follow up on David’s question on the vials. So, it does feel like you have

seen some positive signs, and maybe you were hopeful for some of those positive signs that we are starting to see. But it also feels like you are not maybe as confident or certain that we get a recovery in 2025, maybe some recovery. But is it fair

to say that maybe you are a little bit less confident, or you just don’t want to necessarily stick your neck out and make a guide for 2025 yet? But on the same respect, though, it does not feel like your confidence has diminished at all in the

overall potential of vials, and that we will get back to levels you thought you would get to, maybe just a little bit further out. Is that kind of fair to sum that up that way? |

| MARCO DAL LAGO: |

From that, we are confident the vial market is there. It’s a necessary format for the industry. For 2025, there’s uncertainty

about the timing of the inflection point, because we are monitoring it, but it’s a little bit early to say that January 02nd will be at the level of we expect. |

| FRANCO STEVANATO: |

Today, we have a constant dialogue with our customers, because we are involved with our customers, not only in vials, in many programs,

we can |

| |

move to syringes, on cartridges, DDS program. So, today, we have an intense discussion of their supply chain level, because also it’s one of their main concern to reduce, to normalize the

level of stock. So, all overall, the trend is positive. We see positive signs in small customer, like I mentioned before, that they’re going back to normalize. The bigger customers, more when they have complex supply chain. There are multiple

sites. This is something that we are more prudent. But there are a constant and intimate discussion that we have practically every week with our customers today. |

| LARRY SOLOW: |

And you mentioned some stuff a little up there on the cartridge market. Can you just give us any more color? I know manufacturing

capabilities capacity had been built out a little bit by some of your customers last year, but we’ve seen some destocking there, too. It’s a smaller market, so probably not. But could you give us anything there…any update there?

|

| LISA MILES: |

Larry, just to clarify the question, you’re asking if we’re also seeing destocking effects in cartridges?

|

| LARRY SOLOW: |

Or just any up…not destocking, just any update qualitatively, you know, in terms of, you know. |

| FRANCO STEVANATO: |

We don’t…we have no signs for changes in demand with our customers. Most we see a strong demand on Nexa syringes, and we see

an increase in demand of cartridges ready-to-fill. For sure, on cartridge ready-to-fill,

we are putting in place high-speed lines, but this is something that will generate more big revenue in the later stage, because now our Engineering Division is in a complex phase to build the technology for internal use. So, but all over all, the

demand is robust, and in biologics is really strong in this moment. |

| LARRY SOLOW: |

If I may, just a quick last question. Just on cash flow expectations, I think your cash balance was about €75 million

currently. Looks like, I think, so can you just give us any thoughts on that in light of your CAPEX plans, and will you need to raise any more, maybe, you know, any more financing this year? Any thoughts on that? Thank you. |

| MARCO DAL LAGO: |

As mentioned, we have €78 million of cash on hand. We have availability on credit lines, and we are, we have positive free

cash flow from…cash flow from operations. So, we believe we are in the position to finance the grow, at least for the next 12 months. And then, you know, looking ahead, we are still working on the plan for 2025. We are working on the budget to

see a detailed plan for CAPEX in 2025. We still have a balance sheet with a small leverage, so we can leverage the opportunity to further invest in high-value products, obviously, provided the internal rate of return is higher than our cost of

capital. |

| LARRY SOLOW: |

Okay, great. Thank you very much. |

| OPERATOR: |

The next question is from Dan Leonard of UBS. Please, go ahead. |

| DAN LEONARD: |

Thank you. You made a comment that you’re seeing an increasing shift to upgrade infrastructure to better align with Annex 1

requirements. Could you elaborate a bit more on that? |

| FRANCO STEVANATO: |

Yes. Practically, Annex 1 is a new regulation that practically that overall is asking all the pharmaceutical industry to try to put in

place some process that avoid any type of risk to put in danger the sterility of their product. So, practically, which is the answer of Stevanato Group on this? Our EZ-fill configuration, because it’s

going to be serving a no-glass-to-glass configuration to our customer, is helping really to avoid any type of generation of

particle can be particle from glass, delamination, or some |

| |

particle that came from during the washing, sterilization, and heating program. So, this is the reason why we think that in the medium term, the adoption of

EZ-fill vials can help Stevanato in order to boost our revenue. And on the top of this, if you’re moving to our Engineering Segment, it’s going to require more sophisticated inspection lines with a

particular artificial intelligence that can further detect and improve the process of the pharma company. So, overall, our next one in the medium term, we think that would be favorable for Stevanato Group. |

| DAN LEONARD: |

Sure. Thank you. And then, as a follow-up, you mentioned that some of the CAPEX shifts from

China to Latina was the result of a regional capacity preference change from an anchor customer. Could you discuss that a bit more? Is that due to concerns from that customer about bio-secure or anything

specific you could point to? Thank you. |

| FRANCO STEVANATO: |

I’m sorry, we don’t have the internal detail from the customer. We know that usually our global customer, they want to secure

a global footprint. And this is why most probably I decided to make some modification from one region to another one. But we don’t have more elements that are in our hand. |

| DAN LEONARD: |

Okay. Thanks, Franco. |

| FRANCO STEVANATO: |

You’re welcome. |

| OPERATOR: |

The next question is from Curtis Moiles of BNP Paribas Exane. Please go ahead. |

| CURTIS MOILES: |

Thank you for taking my questions. First one, I just wanted to come back on the gross margin for the Engineering Segment. I think I

heard you say that you took kind of the biggest impact of the higher cost in 2Q. Does |

| |

that mean that in the second half of the year, we should see that gross margin bounce back to a more normalized level? Or what are you expecting there? |

| MARCO DAL LAGO: |

WE expect a sequential improvement for the projects in Engineering. We took costs in the second quarter on those big

projects. Nevertheless, we expect still some quarters before going back to the normal profitability in Engineering. We still have to navigate and complete the project and satisfy our customers. And to do that, we need to put more effort and more

people on the field in order to satisfy the customers. |

| FRANCO STEVANATO: |

Today, if I can also give some operational clarification, under the leadership of Ugo Gay, the new Chief Operating Officer, and not only

Ugo, also Raffaele Pace that most of you, you met in the past, we are really…we are back, and we are building a clear program in order really to review all our footprint, to optimize all our factories, even more to prepare the Engineering

Division for the next future growth with our customer. So, these are all the actions that we are putting in place. There is a clear governance, in particular starting from Denmark, and we count to have the first result in the next few quarters in

front of us. |

| CURTIS MOILES: |

Okay, that’s helpful. Thank you. And then, the second question, again, you were talking about earlier how you were postponing the

expansion in China and shifting it over to Latina, I think. Does that kind of indicate to us that you’re going to come in at the lower end of the full year CAPEX range of €300 million to €335 million, or is nothing really

changing there? |

| MARCO DAL LAGO: |

It’s not changing. The guidance for CAPEX we expect between €300 million to €335 million. So, it’s not

making a big difference in 2024. It’s more an impact we will be considered for 2025 guidance. |

| CURTIS MOILES: |

Okay, I appreciate it. Thank you. |

| FRANCO STEVANATO: |

If I can say, maybe if there is no more questions, some final words. Today, all the organization is squarely focused to face these

temporary challenges. But also, in the meantime, also, we are excited in the company because we are also working for the future. So, there is a high concentration and the motivation in the company to deliver, in particular with these new Greenfield

plants, this amazing program that we have around cartridges ready-to-fill. And today, all the organization, no matter if it’s in Europe, United States, this is the

big goal, to deliver the long-term agreements and Business Plan that we have and the commitments with our customer. This is the only thing that we have tried to do every day. |

| OPERATOR: |

As a reminder, if you wish to register for a question, please press “*” and “1” on your telephone. For any further

questions, please press “*” and “1” on your telephone. The next question is a follow-up from Paul Knight of KeyBanc. Please go ahead. |

| PAUL KNIGHT: |

Hi, Marco or Franco. On the third-party intercompany line item, what’s in that? It seems to have obviously been huge as well. Is

that internal supply of inspection systems for yourself? What is that exactly? |

| MARCO DAL LAGO: |

Mainly, Paul, we have there the glass forming machines that our Engineering Segment is providing to Fisher’s and Latina to expand

our capacity. |

| PAUL KNIGHT: |

Okay. Completely makes sense. Thank you. |

| FRANCO STEVANATO: |

Welcome. |

| OPERATOR: |

That was the last question. Ladies and gentlemen, thank you for joining. The conference is now over. You may disconnect your telephones.

Thank you. |

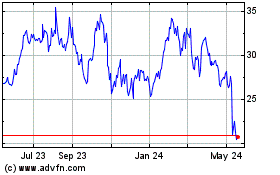

Stevanato (NYSE:STVN)

Historical Stock Chart

From Oct 2024 to Nov 2024

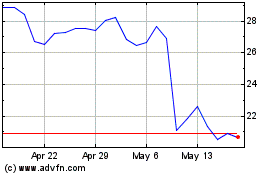

Stevanato (NYSE:STVN)

Historical Stock Chart

From Nov 2023 to Nov 2024