Teledyne Technologies Incorporated (NYSE:TDY)

- Record quarterly sales of $1,502.3 million, an increase of

5.4% compared with last year

- Fourth quarter GAAP diluted earnings per share of $4.20 and

record non-GAAP diluted earnings per share of $5.52

- Fourth quarter GAAP operating margin of 15.8% and fourth

quarter non-GAAP operating margin of 22.7%

- Full year GAAP diluted earnings per share of $17.21 and

record non-GAAP diluted earnings per share of $19.73

- Full year GAAP operating margin of 17.4% and full year

non-GAAP operating margin of 22.0%

- Record full year cash from operations of $1,191.9 million

and record free cash flow of $1,108.2 million

- Full year capital deployment of $1.1 billion for debt

repayments, stock repurchases and acquisitions. Expect to deploy

approximately $770 million on acquisitions in the first quarter of

2025

- Quarter-end Consolidated Leverage Ratio of 1.5x

- Recently completed acquisition of Micropac Industries, Inc.

on December 30, 2024

- Announced pending acquisition of select aerospace and

defense electronics businesses from Excelitas Technologies

Corp.

- Issuing full year 2025 GAAP diluted earnings per share

outlook of $17.70 to $18.20 and full year 2025 non-GAAP earnings

per share outlook of $21.10 to $21.50, which includes Micropac but

excludes Excelitas

Teledyne today reported fourth quarter 2024 net sales of

$1,502.3 million, compared with net sales of $1,425.0 million for

the fourth quarter of 2023, an increase of 5.4%. The fourth quarter

of 2024 net sales included $17.3 million in incremental net sales

from acquisitions. Net income attributable to Teledyne was $198.5

million ($4.20 diluted earnings per share) for the fourth quarter

of 2024, compared with $323.1 million ($6.75 diluted earnings per

share) for the fourth quarter of 2023, a decrease of 38.6%. The

fourth quarter of 2024 included $49.7 million of pretax acquired

intangible asset amortization expense, $52.5 million of pretax,

non-cash trademark impairments, $1.5 million of pretax transaction

and integration costs and $16.6 million of income tax benefits from

FLIR acquisition-related tax matters. Excluding these items,

non-GAAP net income attributable to Teledyne for the fourth quarter

of 2024 was $260.9 million ($5.52 diluted earnings per share). The

fourth quarter of 2023 included $48.6 million of pretax acquired

intangible asset amortization expense, $3.0 million of pretax

transaction and integration costs and $102.2 million of income tax

benefits from FLIR acquisition-related tax matters. Excluding these

items, non-GAAP net income attributable to Teledyne for the fourth

quarter of 2023 was $260.5 million ($5.44 diluted earnings per

share). Operating margin was 15.8% for the fourth quarter of 2024

compared with 19.1% for the fourth quarter of 2023. Excluding the

items discussed above, non-GAAP operating margin was 22.7% for both

the fourth quarter of 2024 and 2023.

“In the fourth quarter, we achieved all-time record sales and

non-GAAP earnings per share,” said Robert Mehrabian, Executive

Chairman. “Year-over-year growth accelerated, as our shorter-cycle

businesses improved throughout 2024 coupled with strong demand in

our longer cycle defense, space, and energy businesses. Given our

record free cash flow in 2024, we ended the year with very low

leverage despite $1.1 billion of capital deployment. We

successfully closed the Micropac acquisition at the beginning of

fiscal 2025, and we expect the completion of the Excelitas

carve-out transaction in the first quarter. We begin 2025

optimistic about our performance and business portfolio;

nevertheless, we remain vigilant given the strong U.S. dollar and

unpredictable geopolitical environment.”

Full Year

Full year net sales for 2024 were $5,670.0 million, compared

with $5,635.5 million for 2023, an increase of 0.6%. Net income

attributable to Teledyne was $819.2 million ($17.21 diluted

earnings per share) for fiscal year 2024, compared with $885.7

million ($18.49 diluted earnings per share) for fiscal year 2023, a

decrease of 7.5%.

Full year 2024 net sales included $49.4 million in incremental

net sales from acquisitions. The full year of 2024 included $198.0

million of pretax acquired intangible asset amortization expense,

$8.4 million of pretax transaction and integration costs, $52.5

million of pretax, non-cash trademark impairments and $77.8 million

of income tax benefits from FLIR acquisition-related tax matters.

Excluding these items, non-GAAP net income attributable to Teledyne

for the full year of 2024 was $939.2 million ($19.73 diluted

earnings per share). The full year of 2023 included $196.7 million

of pretax acquired intangible asset amortization expense, $8.8

million of pretax transaction and integration costs and $100.5

million of income tax benefits from FLIR acquisition-related tax

matters. Excluding these items, non-GAAP net income attributable to

Teledyne for the full year of 2023 was $943.3 million ($19.69

diluted earnings per share). Operating margin was 17.4% for 2024,

compared with 18.4% for 2023. Excluding the items discussed above,

non-GAAP operating margin was 22.0% for both 2024 and 2023.

Full year 2024 income tax expense included $77.8 million of

income tax benefits from FLIR acquisition-related tax matters as

well as $12.7 million of income tax benefits related to share-based

accounting. Full year 2023 income tax expense included $100.5

million of income tax benefits from FLIR acquisition-related tax

matters as well as $20.1 million of income tax benefits related to

share-based accounting.

In the fourth quarter of 2024, Teledyne completed its annual

impairment testing of goodwill and indefinite-lived intangibles

assets. As a result of the testing, the company recorded pretax,

non-cash impairment charges of $52.5 million related to

indefinite-lived trademarks.

Review of Operations

Comparisons are with the fourth quarter of 2023, unless noted

otherwise.

Digital Imaging

The Digital Imaging segment’s fourth quarter 2024 net sales were

$822.2 million, compared with $802.5 million, an increase of 2.5%.

Operating income was $90.8 million for the fourth quarter of 2024,

compared with $134.3 million, a decrease of 32.4%. The fourth

quarter of 2024 included $1.5 million of pretax transaction and

integration costs compared with $3.0 million. Acquired intangible

amortization expense for the fourth quarter of 2024 was $46.1

million compared with $44.9 million. In the fourth quarter of 2024,

Teledyne recorded a $49.5 million pretax, non-cash trademark

impairment. Excluding these items, non-GAAP operating income for

the fourth quarter of 2024 was $187.9 million, compared with $182.2

million, an increase of 3.1%.

The fourth quarter of 2024 net sales increased primarily due to

higher sales of unmanned air systems, surveillance systems, and

commercial infrared imaging systems partially offset by lower sales

of X-ray products, industrial automation imaging systems, and

unmanned ground systems. The fourth quarter of 2024 also included

$12.2 million of incremental sales from a recent acquisition. The

decrease in operating income was primarily due to a $49.5 million

pretax, non-cash trademark impairment recorded in the fourth

quarter of 2024.

Instrumentation

The Instrumentation segment’s fourth quarter 2024 net sales were

$368.9 million, compared with $335.2 million, an increase of 10.1%.

Operating income was $100.8 million for the fourth quarter of 2024,

compared with $90.7 million, an increase of 11.1%. In the fourth

quarter of 2024, Teledyne recorded a $3.0 million pretax, non-cash

trademark impairment.

The fourth quarter of 2024 net sales increase resulted from a

$29.9 million increase in sales of marine instrumentation primarily

due to stronger offshore energy and defense markets, a $1.9 million

increase in sales of electronic test and measurement

instrumentation as well as a $1.9 million increase in sales of

environmental instrumentation. The fourth quarter of 2024 also

included $5.1 million of incremental sales from recent

acquisitions. The increase in operating income primarily reflected

the impact of higher marine instrumentation sales as well as

favorable marine instrumentation product mix and improved marine

instrumentation margins.

Aerospace and Defense Electronics

The Aerospace and Defense Electronics segment’s fourth quarter

2024 net sales were $196.5 million, compared with $184.0 million,

an increase of 6.8%. Operating income was $56.4 million for the

fourth quarter of 2024, compared with $50.0 million, an increase of

12.8%.

The fourth quarter of 2024 net sales reflected higher sales of

$15.3 million for defense electronics, partially offset by lower

sales of $2.8 million for aerospace electronics. The increase in

operating income primarily reflected the impact of higher sales and

favorable product mix.

Engineered Systems

The Engineered Systems segment’s fourth quarter 2024 net sales

were $114.7 million, compared with $103.3 million, an increase of

11.0%. Operating income was $9.8 million for the fourth quarter of

2024, compared with $12.3 million, a decrease of 20.3%.

The fourth quarter of 2024 net sales reflected higher sales of

$11.3 million for engineered products and $0.1 million for energy

systems. The higher sales for engineered products primarily

reflected increased sales from electronic manufacturing services

products. The decrease in operating income included $2.9 million of

unfavorable contract estimate changes related to electronic

manufacturing services products.

Additional Financial Information

Cash Flow

Cash provided by operating activities was $332.4 million for the

fourth quarter of 2024 compared with $164.4 million, with the

increase driven primarily by lower income tax payments in the

fourth quarter of 2024. In the prior year, the Internal Revenue

Service (“IRS”) announcements related to the California floods

postponed approximately $139 million of Teledyne’s second and third

quarter 2023 U.S. federal income tax payments, which the Company

paid in the fourth quarter of 2023. Depreciation and amortization

expense for the fourth quarter of 2024 was $77.1 million compared

with $77.4 million. Stock-based compensation expense for the fourth

quarter of 2024 was $7.7 million compared with $8.0 million.

Capital expenditures for the fourth quarter of 2024 were $29.0

million compared with $40.2 million, with the decrease related to

timing of capital projects. Teledyne received $21.4 million from

the exercise of stock options in the fourth quarter of 2024

compared with $18.2 million.

During the fourth quarter and full year of 2024, the Company

repurchased approximately 47.9 thousand shares for $21.4 million,

and 885.3 thousand shares for $353.9 million, respectively.

As of December 29, 2024, net debt was $1,999.2 million which is

calculated as total debt of $2,649.0 million, net of cash and cash

equivalents of $649.8 million. As of December 31, 2023, net debt

was $2,596.6 million representing total debt of $3,244.9 million,

net of cash and cash equivalents of $648.3 million.

As of December 29, 2024, $1.17 billion was available under the

$1.20 billion credit facility, after reductions of $29.3 million in

outstanding letters of credit.

Fourth Quarter

Total Year

Free Cash Flow

2024

2023

2024

2023

Cash provided by operating activities

$

332.4

$

164.4

$

1,191.9

$

836.1

Capital expenditures for property, plant

and equipment

(29.0

)

(40.2

)

(83.7

)

(114.9

)

Free cash flow

$

303.4

$

124.2

$

1,108.2

$

721.2

Income Taxes

The effective tax rate for the fourth quarter of 2024 was 11.7%.

The fourth quarter of 2024 included certain income tax benefits of

$30.2 million compared with $123.4 million, with the benefits in

both years primarily due to FLIR acquisition-related tax

matters.

Other

Corporate expense was $20.7 million for the fourth quarter of

2024 compared with $15.8 million. Non-service retirement benefit

income was $2.6 million for the fourth quarter of 2024 compared

with $3.1 million. Interest expense, net of interest income, was

$13.7 million for the fourth quarter of 2024 compared with $15.6

million, with the decrease due to reduced outstanding borrowings

compared to the fourth quarter of 2023.

Outlook

Based on its current outlook, which includes Micropac but

excludes Excelitas, the company’s management believes that first

quarter 2025 GAAP diluted earnings per share will be in the range

of $3.90 to $4.04 and full year 2025 GAAP diluted earnings per

share will be in the range of $17.70 to $18.20. The company’s

management further believes that first quarter 2025 non-GAAP

diluted earnings per share will be in the range of $4.80 to $4.90

and full year 2025 non-GAAP diluted earnings per share will be in

the range of $21.10 to $21.50. The non-GAAP outlook excludes

acquired intangible asset amortization as well as acquisition and

integration costs.

Use of Non-GAAP Financial Measures

We report our financial results in accordance with generally

accepted accounting principles in the United States (“GAAP”). We

supplement the reporting of our financial results determined under

GAAP with certain non-GAAP financial measures. The non-GAAP

financial measures presented provides management, financial

analysts, and investors with additional useful information in

evaluating the performance of the company. The non-GAAP financial

measures should be considered in addition to, and not as a

substitute for, financial measures prepared in accordance with

GAAP. Further details on reasons that we use non-GAAP financial

measures, a reconciliation of these measures to the most directly

comparable GAAP measures, and other information relating to these

measures are included following our GAAP financial statements.

Forward-Looking Statements Cautionary Notice

This earnings release contains forward-looking statements, as

defined in the Private Securities Litigation Reform Act of 1995,

with respect to management’s beliefs about the financial condition,

results of operations, acquisitions and product synergies,

integration costs, tax matters and businesses of Teledyne in the

future. Forward-looking statements involve risks and uncertainties,

are based on the current expectations of the management of Teledyne

and are subject to uncertainty and changes in circumstances.

The forward-looking statements contained herein may include

statements relating to sales, sales growth, stock-based

compensation expense, tax rates, anticipated capital expenditures,

stock repurchases, product developments, completion of acquisitions

and other strategic options. Forward-looking statements generally

are accompanied by words such as “projects”, “intends”, “expects”,

“anticipates”, “targets”, “estimates”, “will” and words of similar

import that convey the uncertainty of future events or outcomes.

All statements made in this communication that are not historical

in nature should be considered forward-looking. By its nature,

forward-looking information is not a guarantee of future

performance or results and involves risks and uncertainties because

it relates to events and depends on circumstances that will occur

in the future.

Actual results could differ materially from these

forward-looking statements. Many factors could change anticipated

results, including: changes in relevant tax and other laws; foreign

currency exchange risks; rising interest rates; risks associated

with indebtedness, as well as our ability to reduce indebtedness

and the timing thereof; the impact of policies of the new

Presidential Administration, especially with respect to new and

higher tariffs, cutbacks in the funding of government agencies and

programs, and the scaling back of environmental and green energy

policies; the impact of semiconductor and other supply chain

shortages; higher inflation, including wage competition and higher

shipping costs; labor shortages and competition for skilled

personnel; the inability to develop and market new competitive

products; inherent uncertainties involved in the estimates and

judgments used in the preparation of financial statements and the

providing of estimates of financial measures, in accordance with

GAAP and related standards; disruptions in the global economy; the

ongoing conflict in Israel and neighboring regions, including

related protests, attacks on defense contractors and suppliers and

the disruption to global shipping routes; the ongoing conflict

between Russia and Ukraine, including the impact to energy prices

and availability, especially in Europe; customer and supplier

bankruptcies; changes in demand for products sold to the defense

electronics, instrumentation, digital imaging, energy exploration

and production, commercial aviation, semiconductor and

communications markets; funding, continuation and award of

government programs; cuts to defense spending resulting from

existing and future deficit reduction measures or changes to U.S.

and foreign government spending and budget priorities triggered by

inflation, rising interest costs, and economic conditions; the

imposition and expansion of, and responses to, trade sanctions and

tariffs; the continuing review and resolution of FLIR’s trade

compliance and tax matters; escalating economic and diplomatic

tension between China and the United States; threats to the

security of our confidential and proprietary information, including

cybersecurity threats; risks related to artificial intelligence;

natural and man-made disasters, including those related to or

intensified by climate change; and our ability to achieve emission

reduction targets and decrease our carbon footprint. Lower oil and

natural gas prices, as well as instability in the Middle East or

other oil producing regions, and new regulations or restrictions

relating to energy production, including those implemented in

response to climate change, could further negatively affect our

businesses that supply the oil and gas industry. Weakness in the

commercial aerospace industry negatively affects the markets of our

commercial aviation businesses. Lower aircraft production rates at

Boeing or Airbus could result in reduced sales of our commercial

aerospace products. In addition, financial market fluctuations

affect the value of the company’s pension assets. Changes in the

policies of U.S. and foreign governments, including economic

sanctions or in regard to support for Ukraine, could result, over

time, in reductions or realignment in defense or other government

spending and further changes in programs in which the company

participates.

While the company’s growth strategy includes possible

acquisitions, we cannot provide any assurance as to when, if or on

what terms any acquisitions will be made. Acquisitions involve

various inherent risks, such as, among others, our ability to

integrate acquired businesses, retain key management and customers

and achieve identified financial and operating synergies. There are

additional risks associated with acquiring, owning and operating

businesses internationally, including those arising from U.S. and

foreign government policy changes or actions and exchange rate

fluctuations.

Additional factors that could cause results to differ materially

from those described above can be found in Teledyne’s Annual Report

on Form 10-K for the year ended December 31, 2023, as well as

subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, all of which are on file with the U.S. Securities and

Exchange Commission (“SEC”) and available in the “Investors”

section of Teledyne’s website, teledyne.com, under the heading

“Investor Information” and in other documents Teledyne files with

the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Teledyne assumes no obligation to update forward-looking statements

to reflect circumstances or events that occur after the date the

forward-looking statements were made or to reflect the occurrence

of unanticipated events except as required by federal securities

laws. As forward-looking statements involve significant risks and

uncertainties, caution should be exercised against placing undue

reliance on such statements.

A live webcast of Teledyne’s fourth quarter earnings conference

call will be held at 11:00 a.m. (Eastern) on Wednesday, January 22,

2025. To access the call, go to

www.teledyne.com/investors/events-and-presentations approximately

ten minutes before the scheduled start time. A replay will also be

available for one month starting at 12:00 p.m. (Eastern) on

Wednesday, January 22, 2025.

TELEDYNE TECHNOLOGIES

INCORPORATED

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

FOR THE FOURTH QUARTER AND

YEAR ENDED

DECEMBER 29, 2024 AND DECEMBER

31, 2023

(Unaudited - in millions, except

per share amounts)

Fourth Quarter

Fourth Quarter

Total Year

Total Year

2024

2023

2024

2023

Net sales

$

1,502.3

$

1,425.0

$

5,670.0

$

5,635.5

Costs and expenses:

Costs of sales

859.6

801.9

3,235.2

3,196.1

Selling, general and administrative

(a)

355.9

303.0

1,247.7

1,208.3

Acquired intangible asset amortization

49.7

48.6

198.0

196.7

Total costs and expenses

1,265.2

1,153.5

4,680.9

4,601.1

Operating income (loss)

237.1

271.5

989.1

1,034.4

Interest and debt income (expense),

net

(13.7

)

(15.6

)

(57.9

)

(77.3

)

Gain (loss) on debt extinguishment

—

—

—

1.6

Non-service retirement benefit income

(expense), net

2.6

3.1

10.8

12.4

Other income (expense), net

(0.4

)

(4.8

)

(4.1

)

(12.2

)

Income (loss) before income taxes

225.6

254.2

937.9

958.9

Provision (benefit) for income taxes

(b)

26.5

(69.3

)

117.2

72.3

Net income (loss) including noncontrolling

interest

199.1

323.5

820.7

886.6

Less: Net income (loss) attributable to

noncontrolling interest

0.6

0.4

1.5

0.9

Net income (loss) attributable to

Teledyne

$

198.5

$

323.1

$

819.2

$

885.7

Diluted earnings per common share

$

4.20

$

6.75

$

17.21

$

18.49

Weighted average diluted common shares

outstanding

47.3

47.9

47.6

47.9

(a) The fourth quarter and full year of 2024 includes pretax,

non-cash impairment charges of $52.5 million related to

indefinite-lived trademarks.

(b) The fourth quarter and full year of 2024 includes income tax

benefits from FLIR acquisition-related tax matters of $16.6 million

and $77.8 million, respectively. The fourth quarter and full year

of 2023 includes income tax benefits from FLIR acquisition-related

tax matters of $102.2 million and $100.5 million, respectively.

This condensed consolidated financial statements were prepared

in accordance with GAAP.

TELEDYNE TECHNOLOGIES

INCORPORATED

SUMMARY OF SEGMENT NET SALES

AND OPERATING INCOME

FOR THE FOURTH QUARTER AND

YEAR ENDED

DECEMBER 29, 2024 AND DECEMBER

31, 2023

(Unaudited - $ in millions)

Fourth

Quarter

Fourth

Quarter

%

Change

Total

Year

Total

Year

%

Change

2024

2023

2024

2023

Net sales:

Digital Imaging

$

822.2

$

802.5

2.5

%

$

3,070.8

$

3,144.1

(2.3

)%

Instrumentation

368.9

335.2

10.1

%

1,382.6

1,326.2

4.3

%

Aerospace and Defense Electronics

196.5

184.0

6.8

%

776.8

726.5

6.9

%

Engineered Systems

114.7

103.3

11.0

%

439.8

438.7

0.3

%

Total net sales

$

1,502.3

$

1,425.0

5.4

%

$

5,670.0

$

5,635.5

0.6

%

Operating income (loss):

Digital Imaging (a)

$

90.8

$

134.3

(32.4

)%

$

442.0

$

517.4

(14.6

)%

Instrumentation (a)

100.8

90.7

11.1

%

370.3

338.3

9.5

%

Aerospace and Defense Electronics

56.4

50.0

12.8

%

221.7

199.6

11.1

%

Engineered Systems

9.8

12.3

(20.3

)%

32.9

44.7

(26.4

)%

Corporate expense

(20.7

)

(15.8

)

31.0

%

(77.8

)

(65.6

)

18.6

%

Operating income (loss)

237.1

271.5

(12.7

)%

989.1

1,034.4

(4.4

)%

Interest and debt income (expense),

net

(13.7

)

(15.6

)

(12.2

)%

(57.9

)

(77.3

)

(25.1

)%

Gain (loss) on debt extinguishment

—

—

—

%

—

1.6

(100.0

)%

Non-service retirement benefit income

(expense), net

2.6

3.1

(16.1

)%

10.8

12.4

(12.9

)%

Other income (expense), net

(0.4

)

(4.8

)

(91.7

)%

(4.1

)

(12.2

)

(66.4

)%

Income (loss) before income taxes

225.6

254.2

(11.3

)%

937.9

958.9

(2.2

)%

Provision (benefit) for income taxes

(b)

26.5

(69.3

)

(138.2

)%

117.2

72.3

62.1

%

Net income (loss) including noncontrolling

interest

199.1

323.5

(38.5

)%

820.7

886.6

(7.4

)%

Less: Net income (loss) attributable to

noncontrolling interest

0.6

0.4

50.0

%

1.5

0.9

66.7

%

Net income (loss) attributable to

Teledyne

$

198.5

$

323.1

(38.6

)%

$

819.2

$

885.7

(7.5

)%

(a) The fourth quarter and full year of 2024 includes pretax,

non-cash impairment charges of $52.5 million related to

indefinite-lived trademarks, with $49.5 million recorded within

Digital Imaging and $3.0 million recorded within Marine

Instrumentation.

(b) The fourth quarter and full year of 2024 includes income tax

benefits from FLIR acquisition-related tax matters of $16.6 million

and $77.8 million, respectively. The fourth quarter and full year

of 2023 includes income tax benefits from FLIR acquisition-related

tax matters of $102.2 million and $100.5 million, respectively.

This condensed consolidated financial statements were prepared

in accordance with GAAP.

TELEDYNE TECHNOLOGIES

INCORPORATED

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions)

December 29, 2024

December 31, 2023

(Unaudited)

ASSETS

Cash and cash equivalents

$

649.8

$

648.3

Accounts receivable and unbilled

receivables, net

1,213.2

1,202.1

Inventories, net

914.4

917.7

Prepaid expenses and other current

assets

167.2

213.3

Total current assets

2,944.6

2,981.4

Property, plant and equipment, net

745.2

777.0

Goodwill and acquired intangible assets,

net

10,003.4

10,280.9

Prepaid pension assets

227.6

203.3

Other assets, net

279.7

285.3

Total assets

$

14,200.5

$

14,527.9

LIABILITIES AND EQUITY

Accounts payable

$

416.4

$

384.7

Accrued liabilities

844.9

781.3

Current portion of long-term debt

0.3

600.1

Total current liabilities

1,261.6

1,766.1

Long-term debt, net of current portion

2,648.7

2,644.8

Other long-term liabilities

734.8

891.2

Total liabilities

4,645.1

5,302.1

Redeemable noncontrolling interest

6.0

4.6

Total stockholders’ equity

9,549.4

9,221.2

Total liabilities and equity

$

14,200.5

$

14,527.9

This condensed consolidated financial statements were prepared

in accordance with GAAP.

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

FOR THE FOURTH QUARTER AND

YEAR ENDED

DECEMBER 29, 2024 AND DECEMBER

31, 2023

(Unaudited - $ in millions,

except per share amounts)

Fourth Quarter 2024

Fourth Quarter 2023

Income

(loss)

before

income

taxes

Net (loss)

income

attributable

to Teledyne

Diluted

earnings

per

common

share

Income

(loss)

before

income

taxes

Net (loss)

income

attributable

to Teledyne

Diluted

earnings

per

common

share

GAAP

$

225.6

$

198.5

$

4.20

$

254.2

$

323.1

$

6.75

Adjusted for specified items:

Transaction and integration costs

1.5

1.0

0.02

3.0

2.3

0.05

Non-cash trademark impairments

52.5

40.0

0.85

—

—

—

Acquired intangible asset amortization

49.7

38.0

0.80

48.6

37.3

0.77

FLIR acquisition-related tax matters

—

(16.6

)

(0.35

)

—

(102.2

)

(2.13

)

Non-GAAP

$

329.3

$

260.9

$

5.52

$

305.8

$

260.5

$

5.44

Total Year 2024

Total Year 2023

Income

(loss)

before

income

taxes

Net (loss)

income

attributable

to Teledyne

Diluted

earnings

per

common

share

Income

(loss)

before

income

taxes

Net (loss)

income

attributable

to Teledyne

Diluted

earnings

per

common

share

GAAP

$

937.9

$

819.2

$

17.21

$

958.9

$

885.7

$

18.49

Adjusted for specified items:

Transaction and integration costs

8.4

6.4

0.13

8.8

6.8

0.14

Non-cash trademark impairments

52.5

40.0

0.84

—

—

—

Acquired intangible asset amortization

198.0

151.4

3.18

196.7

151.3

3.16

FLIR acquisition-related tax matters

—

(77.8

)

(1.63

)

—

(100.5

)

(2.10

)

Non-GAAP

$

1,196.8

$

939.2

$

19.73

$

1,164.4

$

943.3

$

19.69

Fourth Quarter 2024

Fourth Quarter 2023

Operating

income (loss)

Operating

margin

Operating

income (loss)

Operating

margin

GAAP

$

237.1

15.8

%

$

271.5

19.1

%

Adjusted for specified items:

Transaction and integration costs

1.5

3.0

Non-cash trademark impairments

52.5

—

Acquired intangible asset amortization

49.7

48.6

Non-GAAP

$

340.8

22.7

%

$

323.1

22.7

%

Total Year 2024

Total Year 2023

Operating

income (loss)

Operating

margin

Operating

income (loss)

Operating

margin

GAAP

$

989.1

17.4

%

$

1,034.4

18.4

%

Adjusted for specified items:

Transaction and integration costs

8.4

8.8

Non-cash trademark impairments

52.5

—

Acquired intangible asset amortization

198.0

196.7

Non-GAAP

$

1,248.0

22.0

%

$

1,239.9

22.0

%

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited - in millions)

Fourth Quarter 2024

GAAP

Operating

Income (loss)

Acquired

intangible asset

amortization

Non-cash

trademark

impairments

Transaction

and integration

costs

Non-GAAP

Operating

Income (loss)

Digital Imaging

$

90.8

$

46.1

$

49.5

$

1.5

$

187.9

Instrumentation

100.8

3.4

3.0

—

107.2

Aerospace and Defense Electronics

56.4

0.2

—

—

56.6

Engineered Systems

9.8

—

—

—

9.8

Corporate expense

(20.7

)

—

—

—

(20.7

)

Total

$

237.1

$

49.7

$

52.5

$

1.5

$

340.8

Fourth Quarter 2023

GAAP

Operating

Income (loss)

Acquired

intangible asset

amortization

Transaction

and integration

costs

Non-GAAP

Operating

Income (loss)

Digital Imaging

$

134.3

$

44.9

$

3.0

$

182.2

Instrumentation

90.7

3.5

—

94.2

Aerospace and Defense Electronics

50.0

0.2

—

50.2

Engineered Systems

12.3

—

—

12.3

Corporate expense

(15.8

)

—

—

(15.8

)

Total

$

271.5

$

48.6

$

3.0

$

323.1

Total Year 2024

GAAP

Operating

Income (loss)

Acquired

intangible asset

amortization

Non-cash

trademark

impairments

Transaction

and integration

costs

Non-GAAP

Operating

Income (loss)

Digital Imaging

$

442.0

$

183.3

$

49.5

$

8.4

$

683.2

Instrumentation

370.3

13.9

3.0

—

387.2

Aerospace and Defense Electronics

221.7

0.8

—

—

222.5

Engineered Systems

32.9

—

—

—

32.9

Corporate expense

(77.8

)

—

—

—

(77.8

)

Total

$

989.1

$

198.0

$

52.5

$

8.4

$

1,248.0

Total Year 2023

GAAP

Operating

Income (loss)

Acquired

intangible asset

amortization

Transaction

and integration

costs

Non-GAAP

Operating

Income (loss)

Digital Imaging

$

517.4

$

181.7

$

8.8

$

707.9

Instrumentation

338.3

14.2

—

352.5

Aerospace and Defense Electronics

199.6

0.8

—

200.4

Engineered Systems

44.7

—

—

44.7

Corporate expense

(65.6

)

—

—

(65.6

)

Total

$

1,034.4

$

196.7

$

8.8

$

1,239.9

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited - in millions, except

per share amounts)

December 29, 2024

December 31, 2023

Current portion of long-term debt

$

0.3

$

600.1

Long-term debt

2,648.7

2,644.8

Total debt - non-GAAP

2,649.0

3,244.9

Less cash and cash equivalents

(649.8

)

(648.3

)

Net debt - non-GAAP

$

1,999.2

$

2,596.6

First Quarter 2025

Total Year 2025

Low

High

Low

High

GAAP Diluted Earnings Per Common Share

Outlook

$

3.90

$

4.04

$

17.70

$

18.20

Adjusted for specified items:

Transaction and integration costs

$

0.07

$

0.05

$

0.07

$

0.05

Acquired intangible asset amortization

$

0.83

$

0.81

$

3.33

$

3.25

Non-GAAP Diluted Earnings Per Common

Share Outlook

$

4.80

$

4.90

$

21.10

$

21.50

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with GAAP.

However, management believes that, in order to more fully

understand our short-term and long-term financial and operational

trends, and to aid in comparability with our competitors, investors

and financial analysts may wish to consider the impact of certain

items resulting from our acquisitions which have an infrequent or

non-recurring impact on operations or assist in understanding our

operations pre-acquisition. Accordingly, we present non-GAAP

financial measures as a supplement to the financial measures we

present in accordance with GAAP. These non-GAAP financial measures

provide management, investors and financial analysts with

additional means to understand and evaluate the operating results

and trends in our ongoing business by adjusting for certain

expenses and benefits. Management believes these non-GAAP financial

measures also provide additional means of evaluating

period-over-period operating performance. In addition, management

understands that some investors and financial analysts find this

information helpful in analyzing our financial and operational

performance and comparing this performance to our peers and

competitors. The company’s diluted earnings per common share

outlook guidance is also presented on a non-GAAP basis.

The non-GAAP financial measures are not meant to be considered

superior to, or a substitute for, our financial statements prepared

in accordance with GAAP. There are material limitations associated

with non-GAAP financial measures because they exclude charges that

have an effect on our reported results and, therefore, should not

be relied upon as the sole financial measures by which to evaluate

our financial results. Management compensates and believes that

investors should compensate for these limitations by viewing the

non-GAAP financial measures in conjunction with the GAAP financial

measures. In addition, the non-GAAP financial measures included in

this earnings announcement may be different from, and therefore may

not be comparable to, similar measures used by other companies. The

non-GAAP financial measures are also used by our management to

evaluate our operating performance and benchmark our results

against our historical performance and the performance of our

peers.

Our non-GAAP measures are as follows:

Non-GAAP income before income taxes, net income and diluted

earnings per common share

These non-GAAP measures provided a supplemental view of income

before taxes, net income, and diluted earnings per common share.

These non-GAAP measures exclude certain acquisition and

integration-related costs, acquired intangible asset amortization,

the remeasurement of deferred taxes related to acquired intangible

assets due to changes in tax laws, and the tax benefits or costs

related to the settlement or other resolution of the FLIR tax

reserves. We also adjust for any post-acquisition interest on

certain income tax reserves related to FLIR. We adjust for any

income tax impact related to these items to take into account the

tax treatment and related tax rate and changes in tax rates that

apply to each adjustment in the applicable tax jurisdiction.

Generally, this results in the tax impact at the U.S. marginal tax

rate for certain adjustments, including the majority of

amortization of intangible assets, whereas the tax impact of other

adjustments, including transaction expenses, depend on whether the

amounts are deductible in the respective tax jurisdictions and the

applicable tax rates in those jurisdictions. We believe these

measures provide investors and management with additional means to

understand and evaluate the operating results of our business by

adjusting for certain expenses and benefits and present an

alternative view of our performance compared to prior periods.

Non-GAAP operating income and operating margin

We define non-GAAP operating margin as non-GAAP operating income

divided by net sales. These non-GAAP measures exclude certain

acquisition and integration-related costs and acquired intangible

asset amortization. We believe these measures provide investors and

management with additional means to understand and evaluate the

operating results of our business by adjusting for certain expenses

and other items and present an alternative view of our performance

compared to prior periods.

Non-GAAP total debt and net debt

We define non-GAAP total debt as the sum of current portion of

long-term debt and other debt and long-term debt. We define net

debt as the difference between non-GAAP total debt less cash and

cash equivalents. The company believes that this non-GAAP

information is useful to assist investors and management in

analyzing the company’s liquidity.

Non-GAAP diluted earnings per common share outlook

These non-GAAP measures represent our earnings per common share

outlook for the first quarter of 2025 and total year 2025 on a

fully diluted basis, excluding certain acquisition and integration

costs, acquired intangible asset amortization for all acquisitions

and FLIR acquisition-related tax matters.

Non-GAAP cash provided by operations and free cash

flow

We define free cash flow as cash provided by operating

activities (a measure prescribed by GAAP) less capital expenditures

for property, plant and equipment. We believe that this non-GAAP

information is useful to assist management and the investment

community in analyzing the company’s ability to generate cash

flow.

Non-GAAP line items used in tables

Management excludes the effect of each of the

acquisition-related items identified below to arrive at the

applicable non-GAAP financial measure referenced in the tables for

the reasons set forth below with respect to that item:

- Acquired intangible asset

amortization – We believe that excluding the amortization of

acquired intangible assets, which primarily represents purchased

technology and customer relationships, as well as purchase order

and contract backlog, provides an alternative way for investors to

compare our operations pre-acquisition to those post-acquisition

and to those of our competitors that have pursued internal growth

strategies. However, we note that companies that grow internally

will incur costs to develop intangible assets that will be expensed

in the period incurred, which may make a direct comparison more

difficult.

- Non-cash trademark impairments –

Included in selling, general and administrative expenses is

non-cash trademark impairment expense. Similar to the amortization

of acquired intangible assets, we believe excluding the non-cash

trademark impairments provides an alternative way for investors to

compare our operations.

- Transaction and integration costs

– Included in our GAAP presentation of cost of sales and selling,

general and administrative expenses are substantial expenses (or

benefits) incurred with acquisitions and primarily include legal,

accounting, other professional fees as well as integration-related

costs such as employee separation costs, facility consolidation

costs and facility lease impairments. Employee separation costs

include required change-in-control payments, cash settlement of

employee and director stock awards, as well as other employee

severance amounts. We exclude these costs from our non-GAAP

measures because we believe it does not reflect our ongoing

financial performance.

- FLIR acquisition-related tax

matters – Included in our tax provision is post-acquisition

interest on certain income tax reserves related to FLIR, as well as

the tax benefits or costs related to the settlement or other

resolution of the FLIR tax reserves. We exclude these impacts from

our non-GAAP measures because we believe it does not reflect our

ongoing financial performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122535885/en/

Jason VanWees (805) 373-4542

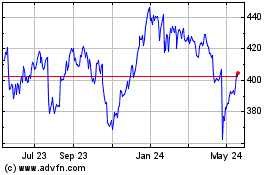

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Dec 2024 to Jan 2025

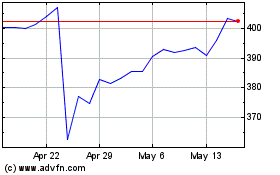

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Jan 2024 to Jan 2025