0001253176falseNONE00012531762024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 22, 2024 |

Vapotherm, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38740 |

46-2259298 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

100 Domain Drive |

|

Exeter, New Hampshire |

|

03833 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 603 658-0011 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 22, 2024, Vapotherm, Inc. (the “Company”) announced its financial results for the fourth quarter and year ended December 31, 2023. A full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed filed for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Vapotherm, Inc. |

|

|

|

|

Date: |

February 22, 2024 |

By: |

/s/ John Landry |

|

|

|

John Landry

Senior Vice President and Chief Financial Officer |

Vapotherm Reports Fourth Quarter and Fiscal Year 2023 Financial Results

EXETER, N.H., February 22, 2024 /PRNewswire/ -- Vapotherm, Inc. (OTCQX: VAPO), (“Vapotherm” or the “Company”), today announced fourth quarter and fiscal year 2023 financial results and related highlights.

Fourth Quarter 2023 Financial Results and Related Highlights

•Net revenue for the fourth quarter of 2023 was $19.7 million, an increase of 5.7% as compared to the fourth quarter of 2022

oDisposables revenue increased by 10.4% as compared to the fourth quarter of 2022

•Gross margin in the fourth quarter of 2023 was 46.6% as compared to 27.5% in the fourth quarter of 2022 and 39.6% in the third quarter of 2023

•For the fourth quarter of 2023, GAAP operating expenses were $14.2 million and non-GAAP cash operating expenses were $11.9 million. Both decreased compared to the prior year period and third quarter of 2023 as a result of the Company’s Path to Profitability initiatives:

oGAAP operating expenses decreased by $8.6 million from the fourth quarter of 2022 and by $2.1 million from the third quarter of 2023

oNon-GAAP cash operating expenses decreased by $6.1 million from the fourth quarter of 2022 and by $0.4 million from the third quarter of 2023

•Adjusted EBITDA loss in the fourth quarter of 2023 was $2.0 million as compared to an Adjusted EBITDA loss of $12.0 million in the fourth quarter of 2022 and an Adjusted EBITDA loss of $6.1 million in the third quarter of 2023

•The Company’s unrestricted cash and cash equivalents was $9.7 million at the end of the fourth quarter of 2023

•The HYPERACT clinical trial results were presented at the Society of Critical Care Medicine Conference on January 23, 2024, which concluded that our therapy was as effective as the current gold standard at reducing CO2, improving pH and reducing dyspnea in moderate to severe hypercapnic COPD patients. Additionally, this study showed high velocity therapy to have superior patient tolerance than the current gold standard

Fiscal Year 2023 Financial Results and Related Highlights

•Total revenue for 2023 was $68.7 million, an increase of 2.8% as compared to 2022

oNon-GAAP net revenue excluding the Vapotherm Access call center business, which the Company exited in the fourth quarter of 2022, increased by 7.2% as compared to 2022

oNon-GAAP net revenue excluding the Vapotherm Access call center business increased by 17.2% over the last three quarters of 2023 as compared to the last three quarters of 2022

oDisposables revenue increased by 8.0% as compared to 2022

•Gross margin in 2023 was 41.2%, an increase from 25.8% in 2022

•GAAP operating expenses in 2023 were $67.4 million and non-GAAP cash operating expenses were $54.8 million. Both decreased compared to the prior year period as a result of the Company’s Path to Profitability initiatives:

oGAAP operating expenses decreased by $50.3 million from 2022

oNon-GAAP cash operating expenses decreased by $28.8 million from 2022

“We made significant progress on our Path to Profitability Initiatives in 2023,” said Joseph Army, President and CEO. “We saw good improvement in our gross margin, reduced our inventory balances and cash burn, and our Adjusted EBITDA loss in the fourth quarter of 2023 was the lowest it’s been since 2018. Despite the large reductions we made in Non-GAAP cash operating expenses in 2023 we continued to invest in future growth drivers such as HVT 2.0, clinical studies and the home ventilation platform. Our HVT 2.0 installed base is growing nicely and is showing increased disposables utilization versus our workhorse Precision Flow product. I’m excited that we were able to share the results of the HYPERACT clinical trial in late January. We believe the combination of the HVT 2.0 platform with these clinical results will allow us to become the standard of care for patients in respiratory distress who present in

the emergency department. I’d like to thank our entire team for all of their contributions in executing on our Path to Profitability Initiatives in 2023 and I look forward to building on this in 2024 and getting ready for our launch into the home market in early 2025.”

Results for the Three Months Ended December 31, 2023

The following table reflects the Company’s net revenue for the three months ended December 31, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

|

(in thousands, except percentages) |

|

|

|

Amount |

|

|

% of Revenue |

|

|

Amount |

|

|

% of Revenue |

|

|

$ |

|

|

% |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital (product & lease revenue) |

|

$ |

2,733 |

|

|

|

13.8 |

% |

|

$ |

3,039 |

|

|

|

16.3 |

% |

|

$ |

(306 |

) |

|

|

(10.1 |

)% |

Disposables |

|

|

15,586 |

|

|

|

79.0 |

% |

|

|

14,113 |

|

|

|

75.6 |

% |

|

|

1,473 |

|

|

|

10.4 |

% |

Service and other (1) |

|

|

1,415 |

|

|

|

7.2 |

% |

|

|

1,511 |

|

|

|

8.1 |

% |

|

|

(96 |

) |

|

|

(6.4 |

)% |

Total net revenue |

|

$ |

19,734 |

|

|

|

100.0 |

% |

|

$ |

18,663 |

|

|

|

100.0 |

% |

|

$ |

1,071 |

|

|

|

5.7 |

% |

(1)Includes $70,000 in revenue from Vapotherm Access in the fourth quarter of 2022

Net revenue for the fourth quarter of 2023 was $19.7 million and increased 5.7% over the fourth quarter of 2022 due to an increase in capital and disposables demand in the International markets and higher average selling prices worldwide. Excluding revenue from Vapotherm Access, which the Company exited in the fourth quarter of 2022, non-GAAP net revenue increased by 6.1% as compared to the fourth quarter of 2022.

Revenue information by geography is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

|

(in thousands, except percentages) |

|

|

|

Amount |

|

|

% of Revenue |

|

|

Amount |

|

|

% of Revenue |

|

|

$ |

|

|

% |

|

United States (1) |

|

$ |

14,686 |

|

|

|

74.4 |

% |

|

$ |

15,531 |

|

|

|

83.2 |

% |

|

$ |

(845 |

) |

|

|

(5.4 |

)% |

International |

|

|

5,048 |

|

|

|

25.6 |

% |

|

|

3,132 |

|

|

|

16.8 |

% |

|

|

1,916 |

|

|

|

61.2 |

% |

Total net revenue |

|

$ |

19,734 |

|

|

|

100.0 |

% |

|

$ |

18,663 |

|

|

|

100.0 |

% |

|

$ |

1,071 |

|

|

|

5.7 |

% |

(1)Includes $70,000 in revenue from Vapotherm Access in the fourth quarter of 2022

Gross profit and gross margin for the fourth quarter of 2023 was $9.2 million and 46.6%, respectively, as compared to gross profit of $5.1 million and gross margin of 27.5% for the fourth quarter of 2022. The increases in gross profit and gross margin were primarily due to continued benefits from the transition of the Company’s manufacturing operations to Mexico, higher revenue and production levels, and inventory reserves and write-offs recorded in 2022 that did not recur in the current year period.

Total operating expenses were $14.2 million in the fourth quarter of 2023, a decrease of $8.6 million as compared to the fourth quarter of 2022. Non-GAAP cash operating expenses, excluding impairment charges, loss on disposal of property and equipment, depreciation and amortization, stock-based compensation expense, termination benefits, and loss from deconsolidation were $11.9 million in the fourth quarter of 2023 compared to $18.0 million in the fourth quarter of 2022 and $12.3 million in the third quarter of 2023. The decreases in operating expenses and non-GAAP cash operating expenses were primarily due to the Company’s Path to Profitability initiatives.

Net loss for the fourth quarter of 2023 was $10.2 million, or $1.60 per share, compared to $21.4 million, or $6.28 per share, in the fourth quarter of 2022. Net loss per share was based on 6,366,734 and 3,416,093 weighted average shares outstanding for the fourth quarter of 2023 and 2022, respectively.

Adjusted EBITDA was negative $2.0 million for the fourth quarter of 2023 as compared to negative $12.0 million for the fourth quarter of 2022. The reduction in Adjusted EBITDA loss was primarily due to the Company’s Path to Profitability initiatives.

Results for the Year Ended December 31, 2023

The following table reflects the Company’s net revenue for the years ended December 31, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

|

(in thousands, except percentages) |

|

|

|

Amount |

|

|

% of Revenue |

|

|

Amount |

|

|

% of Revenue |

|

|

$ |

|

|

% |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Equipment (product & lease revenue) |

|

$ |

12,766 |

|

|

|

18.6 |

% |

|

$ |

11,650 |

|

|

|

17.4 |

% |

|

$ |

1,116 |

|

|

|

9.6 |

% |

Disposable |

|

|

50,100 |

|

|

|

73.0 |

% |

|

|

46,368 |

|

|

|

69.4 |

% |

|

|

3,732 |

|

|

|

8.0 |

% |

Service and Other (1) |

|

|

5,803 |

|

|

|

8.4 |

% |

|

|

8,783 |

|

|

|

13.2 |

% |

|

|

(2,980 |

) |

|

|

(33.9 |

)% |

Net revenue |

|

$ |

68,669 |

|

|

|

100.0 |

% |

|

$ |

66,801 |

|

|

|

100.0 |

% |

|

$ |

1,868 |

|

|

|

2.8 |

% |

(1)Includes $2,758,000 in revenue from Vapotherm Access in the year ended December 31, 2022

Net revenue for 2023 was $68.7 million and increased 2.8% over 2022 due to an increase in capital and disposables demand and higher average selling prices. These increases were partially offset by our exit from the Vapotherm Access call center business, which the Company exited in the fourth quarter of 2022. Excluding revenue from Vapotherm Access, non-GAAP net revenue increased by 7.2% as compared to 2022.

Revenue information by geography is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

|

(in thousands, except percentages) |

|

|

|

Amount |

|

|

% of Revenue |

|

|

Amount |

|

|

% of Revenue |

|

|

$ |

|

|

% |

|

United States (1) |

|

$ |

51,023 |

|

|

|

74.3 |

% |

|

$ |

52,591 |

|

|

|

78.7 |

% |

|

$ |

(1,568 |

) |

|

|

(3.0 |

)% |

International |

|

|

17,646 |

|

|

|

25.7 |

% |

|

|

14,210 |

|

|

|

21.3 |

% |

|

|

3,436 |

|

|

|

24.2 |

% |

Net Revenue |

|

$ |

68,669 |

|

|

|

100.0 |

% |

|

$ |

66,801 |

|

|

|

100.0 |

% |

|

$ |

1,868 |

|

|

|

2.8 |

% |

(1)Includes $2,758,000 in revenue from Vapotherm Access in the year ended December 31, 2022

Gross profit and gross margin for the year ended December 31, 2023 was $28.3 million and 41.2%, respectively, as compared to gross profit of $17.2 million and gross margin of 25.8% for 2022. The increases in gross profit and gross margin were primarily due to continued benefits from the transition of the Company’s manufacturing operations to Mexico, higher revenue and production levels, and inventory reserves and write-offs recorded in 2022 that did not recur in 2023.

Total operating expenses were $67.4 million in 2023, a decrease of $50.3 million as compared to 2022. Non-GAAP cash operating expenses, excluding impairment charges, loss on disposal of property and equipment, depreciation and amortization, stock-based compensation expense, termination benefits, loss from deconsolidation, and change in fair value of contingent consideration were $54.8 million in 2023 compared to $83.6 million in 2022. The decreases in operating expenses and non-GAAP cash operating expenses were primarily due to the Company’s Path to Profitability initiatives.

Net loss for the year ended December 31, 2023 was $58.2 million, or $9.64 per share, compared to $113.3 million, or $33.89 per share, in 2022. Net loss per share was based on 6,037,468 and 3,341,617 weighted average shares outstanding in 2023 and 2022, respectively.

Adjusted EBITDA was negative $23.2 million for the year ended December 31, 2023 as compared to negative $65.2 million in 2022. The reduction in Adjusted EBITDA loss was primarily due to the Company’s Path to Profitability initiatives.

Cash Position

Unrestricted cash and cash equivalents were $9.7 million as of December 31, 2023 compared to $14.4 million as of September 30, 2023.

Website Information

Vapotherm routinely posts important information for investors on the Investor Relations section of its website, http:// investors.vapotherm.com/. Vapotherm intends to use this website as a means of disclosing material, non-public information and for complying with Vapotherm’s disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of Vapotherm’s website, in addition to following Vapotherm’s press releases, Securities and Exchange Commission (“SEC”) filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, Vapotherm’s website is not incorporated by reference into, and is not a part of, this document.

Non-GAAP Financial Measures

This press release includes non-GAAP financial measures, including non-GAAP net revenue excluding Vapotherm Access, EBITDA, Adjusted EBITDA, non-GAAP operating expenses excluding impairment of goodwill, impairment of long-lived and intangible assets and gain (loss) on disposal of property and equipment, and non-GAAP cash operating expenses excluding additional items, including stock-based compensation expense, depreciation and amortization, termination benefits, loss from deconsolidation, and change in fair value of contingent consideration, which differ from operating expenses calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP net revenue excluding Vapotherm Access represents net revenue less net revenue of Vapotherm Access, which the Company exited in the fourth quarter of 2022. EBITDA represents net loss less interest expense, net, income tax provision or benefit, and depreciation and amortization, and Adjusted EBITDA represents EBITDA as further adjusted for the impact of foreign currency loss or gain, change in fair value of contingent consideration, stock-based compensation expense, impairment of goodwill, impairment of long-lived and intangible assets, and loss on disposal of property and equipment. The Company has reconciled all historical non-GAAP financial measures with the most directly comparable GAAP financial measures in tables accompanying this release.

These non-GAAP financial measures are presented because the Company believes they are useful indicators of its operating performance. Management uses these non-GAAP financial measures, as measures of the Company’s operating performance and for planning purposes, including the preparation of the Company’s annual operating budget and financial projections. The Company believes these measures are useful to investors as supplemental information because they are frequently used by analysts, investors and other interested parties to evaluate companies in its industry. The Company believes Adjusted EBITDA is useful to its management and investors as a measure of comparative operating performance from period to period.

These non-GAAP financial measures should not be considered alternatives to, or superior to, net income or loss as a measure of financial performance or cash flows from operations as a measure of liquidity, or any other performance measure derived in accordance with GAAP. They should not be construed to imply that the Company’s future results will be unaffected by unusual or non-recurring items. In addition, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not reflect certain cash requirements such as tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future. Adjusted EBITDA contains certain other limitations, including the failure to reflect our capital expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. In evaluating Adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in the Adjusted EBITDA presentation. The Company’s presentation of Adjusted EBITDA should not be construed to imply that its future results will be unaffected by any such adjustments. Management compensates for these limitations by primarily relying on the Company’s GAAP results in addition to using Adjusted EBITDA and other non-GAAP financial measures on a supplemental basis. The Company’s definitions of Adjusted EBITDA, non-GAAP operating expenses and non-GAAP cash operating expenses are not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

About Vapotherm

Vapotherm, Inc. (OTCQX: VAPO) is a publicly traded developer and manufacturer of advanced respiratory technology based in Exeter, New Hampshire, USA. The Company develops innovative, comfortable, non-invasive technologies for respiratory support of patients with chronic or acute breathing disorders. Over 4.2 million patients have been treated with the use of Vapotherm high velocity therapy® systems. For more information, visit www.vapotherm.com.

Vapotherm high velocity therapy is mask-free non-invasive respiratory support and is a front-line tool for relieving respiratory distress—including hypercapnia, hypoxemia, and dyspnea. It allows for the fast, safe treatment of undifferentiated respiratory distress with one tool. The HVT 2.0 and Precision Flow systems’ mask-free interface delivers optimally conditioned breathing gases, making it comfortable for patients and reducing the risks and care complexities associated with mask therapies. While being treated, patients can talk, eat, drink and take oral medication.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements under the Private Securities Litigation Reform Act of 1995, including statements about the anticipated continued success of HVT 2.0 and the Company’s ability to become the standard of care for patients in respiratory distress who present in the emergency department. In some cases, you can identify forward-looking statements by terms such as “believe,” “expect,” “continue,” “plan,” “intend,” “will,” “outlook,” or “typically,” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words, and the use of future dates. Each forward-looking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statement. Applicable risks and uncertainties include, but are not limited to the following: Vapotherm’s ability to raise additional capital to fund its existing operations and debt service obligations; Vapotherm’s ability to comply with its financial covenants, execute on its path to profitability initiative, convert excess inventory into cash and fund its business and otherwise continue as a going concern through 2024; Vapotherm’s has incurred losses in the past and may be unable to achieve or sustain profitability in the future; risks associated with its manufacturing operations in Mexico; Vapotherm’s dependence on sales generated from its High Velocity Therapy systems, competition from multi-national corporations who have significantly greater resources than

Vapotherm and are more established in the respiratory market; the ability for High Velocity Therapy systems to gain increased market acceptance; Vapotherm’s inexperience directly marketing and selling its products; the potential loss of one or more suppliers and dependence on its new third party manufacturer; Vapotherm’s susceptibility to seasonal fluctuations; Vapotherm’s failure to comply with applicable United States and foreign regulatory requirements; the failure to obtain U.S. Food and Drug Administration or other regulatory authorization to market and sell future products or its inability to secure, maintain or enforce patent or other intellectual property protection for its products; the impact of COVID on its business, including its supply chain; risks in holding Vapotherm stock in light of trading on the OTCQX tier of the OTC Markets; and the other risks and uncertainties included under the heading “Risk Factors” in Vapotherm’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on February 22, 2024. The forward-looking statements contained in this press release reflect Vapotherm’s views as of the date hereof, and Vapotherm does not assume and specifically disclaims any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Financial Statements:

VAPOTHERM, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,725 |

|

|

$ |

15,738 |

|

Accounts receivable, net of expected credit losses

of $160 and $227, respectively |

|

|

10,672 |

|

|

|

9,102 |

|

Inventories |

|

|

22,968 |

|

|

|

32,980 |

|

Prepaid expenses and other current assets |

|

|

3,058 |

|

|

|

2,081 |

|

Total current assets |

|

|

46,423 |

|

|

|

59,901 |

|

Property and equipment, net |

|

|

23,703 |

|

|

|

26,636 |

|

Operating lease right-of-use assets |

|

|

3,372 |

|

|

|

5,805 |

|

Restricted cash |

|

|

1,109 |

|

|

|

1,109 |

|

Goodwill |

|

|

565 |

|

|

|

536 |

|

Intangible assets, net |

|

|

- |

|

|

|

- |

|

Deferred income tax assets |

|

|

57 |

|

|

|

96 |

|

Other long-term assets |

|

|

2,388 |

|

|

|

2,112 |

|

Total assets |

|

$ |

77,617 |

|

|

$ |

96,195 |

|

Liabilities and Stockholders’ Deficit |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

5,053 |

|

|

$ |

2,739 |

|

Contract liabilities |

|

|

1,237 |

|

|

|

1,216 |

|

Accrued expenses and other current liabilities |

|

|

12,805 |

|

|

|

15,609 |

|

Revolving loan facility |

|

|

- |

|

|

|

- |

|

Total current liabilities |

|

|

19,095 |

|

|

|

19,564 |

|

Long-term loans payable, net |

|

|

107,059 |

|

|

|

96,994 |

|

Other long-term liabilities |

|

|

6,797 |

|

|

|

7,827 |

|

Total liabilities |

|

|

132,951 |

|

|

|

124,385 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ deficit |

|

|

|

|

|

|

Preferred stock ($0.001 par value) 25,000,000 shares authorized; no shares issued

and outstanding as of December 31, 2023 and 2022 |

|

|

- |

|

|

|

- |

|

Common stock ($0.001 par value) 21,875,000 shares authorized as of

December 31, 2023 and 2022, 6,165,806 and 3,564,505 shares

issued and outstanding as of December 31, 2023 and 2022, respectively (1) |

|

|

6 |

|

|

|

4 |

|

Additional paid-in capital |

|

|

492,764 |

|

|

|

461,965 |

|

Accumulated other comprehensive income (loss) |

|

|

91 |

|

|

|

(157 |

) |

Accumulated deficit |

|

|

(548,195 |

) |

|

|

(490,002 |

) |

Total stockholders’ deficit |

|

|

(55,334 |

) |

|

|

(28,190 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

77,617 |

|

|

$ |

96,195 |

|

(1) On August 18, 2023, the Company effected a 1:8 reverse stock split for each share of common stock issued

and outstanding. All shares and associated amounts have been retroactively restated to reflect the stock split.

VAPOTHERM, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(unaudited) |

|

|

|

|

Net revenue |

|

$ |

19,734 |

|

|

$ |

18,663 |

|

|

$ |

68,669 |

|

|

$ |

66,801 |

|

Cost of revenue |

|

|

10,536 |

|

|

|

13,540 |

|

|

|

40,386 |

|

|

|

49,558 |

|

Gross profit |

|

|

9,198 |

|

|

|

5,123 |

|

|

|

28,283 |

|

|

|

17,243 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

3,371 |

|

|

|

4,561 |

|

|

|

14,213 |

|

|

|

20,802 |

|

Sales and marketing |

|

|

6,717 |

|

|

|

9,476 |

|

|

|

32,552 |

|

|

|

46,091 |

|

General and administrative |

|

|

4,041 |

|

|

|

7,042 |

|

|

|

19,260 |

|

|

|

27,796 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

14,701 |

|

Impairment of long-lived and intangible assets |

|

|

- |

|

|

|

1,501 |

|

|

|

1,187 |

|

|

|

7,676 |

|

Loss on disposal of property and equipment |

|

|

98 |

|

|

|

247 |

|

|

|

151 |

|

|

|

568 |

|

Total operating expenses |

|

|

14,227 |

|

|

|

22,827 |

|

|

|

67,363 |

|

|

|

117,634 |

|

Loss from operations |

|

|

(5,029 |

) |

|

|

(17,704 |

) |

|

|

(39,080 |

) |

|

|

(100,391 |

) |

Other (expense) income |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(4,932 |

) |

|

|

(3,771 |

) |

|

|

(18,733 |

) |

|

|

(11,643 |

) |

Interest income |

|

|

8 |

|

|

|

26 |

|

|

|

78 |

|

|

|

139 |

|

Foreign currency loss |

|

|

(158 |

) |

|

|

(51 |

) |

|

|

(332 |

) |

|

|

(239 |

) |

Loss on extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,114 |

) |

Net loss before income taxes |

|

$ |

(10,111 |

) |

|

$ |

(21,500 |

) |

|

$ |

(58,067 |

) |

|

$ |

(113,248 |

) |

Provision (benefit) for income taxes |

|

|

74 |

|

|

|

(63 |

) |

|

|

126 |

|

|

|

11 |

|

Net loss |

|

$ |

(10,185 |

) |

|

$ |

(21,437 |

) |

|

$ |

(58,193 |

) |

|

$ |

(113,259 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

280 |

|

|

|

229 |

|

|

|

248 |

|

|

|

(183 |

) |

Total other comprehensive income (loss) |

|

|

280 |

|

|

|

229 |

|

|

|

248 |

|

|

|

(183 |

) |

Total comprehensive loss |

|

$ |

(9,905 |

) |

|

$ |

(21,208 |

) |

|

$ |

(57,945 |

) |

|

$ |

(113,442 |

) |

Net loss per share basic and diluted |

|

$ |

(1.60 |

) |

|

$ |

(6.28 |

) |

|

$ |

(9.64 |

) |

|

$ |

(33.89 |

) |

Weighted-average number of shares used in calculating net

loss per share, basic and diluted (1) |

|

|

6,366,734 |

|

|

|

3,416,093 |

|

|

|

6,037,468 |

|

|

|

3,341,617 |

|

(1) On August 18, 2023, the Company effected a 1:8 reverse stock split for each share of common stock issued

and outstanding. All shares and associated amounts have been retroactively restated to reflect the stock split.

VAPOTHERM, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net loss |

|

$ |

(58,193 |

) |

|

$ |

(113,259 |

) |

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

Stock-based compensation expense |

|

|

9,611 |

|

|

|

10,385 |

|

Depreciation and amortization |

|

|

4,977 |

|

|

|

5,180 |

|

Provision for credit losses |

|

|

(18 |

) |

|

|

224 |

|

Provision for inventory valuation |

|

|

744 |

|

|

|

3,083 |

|

Non-cash lease expense |

|

|

937 |

|

|

|

2,127 |

|

Change in fair value of contingent consideration |

|

|

- |

|

|

|

(3,351 |

) |

Impairment of goodwill |

|

|

- |

|

|

|

14,701 |

|

Impairment of long-lived and intangible assets |

|

|

1,187 |

|

|

|

7,676 |

|

Loss on disposal of property and equipment |

|

|

151 |

|

|

|

568 |

|

Placed unit reserve |

|

|

758 |

|

|

|

646 |

|

Interest paid in-kind |

|

|

9,488 |

|

|

|

- |

|

Amortization of discount on debt |

|

|

736 |

|

|

|

686 |

|

Loss from deconsolidation |

|

|

- |

|

|

|

35 |

|

Deferred income taxes |

|

|

38 |

|

|

|

11 |

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

1,114 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(1,511 |

) |

|

|

1,162 |

|

Inventories |

|

|

9,361 |

|

|

|

449 |

|

Prepaid expenses and other assets |

|

|

(913 |

) |

|

|

(1,771 |

) |

Accounts payable |

|

|

2,454 |

|

|

|

(3,347 |

) |

Contract liabilities |

|

|

21 |

|

|

|

(844 |

) |

Accrued expenses and other liabilities |

|

|

(1,850 |

) |

|

|

(3,285 |

) |

Operating lease liabilities, current and long-term |

|

|

(2,250 |

) |

|

|

(2,347 |

) |

Net cash used in operating activities |

|

|

(24,272 |

) |

|

|

(80,157 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(2,994 |

) |

|

|

(11,610 |

) |

Net cash used in investing activities |

|

|

(2,994 |

) |

|

|

(11,610 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from issuance of common stock and pre-funded warrants and

accompanying warrants in private placement, net of issuance costs |

|

|

20,943 |

|

|

|

- |

|

Proceeds from loans, net of discount |

|

|

- |

|

|

|

99,094 |

|

Repayment of loans |

|

|

- |

|

|

|

(40,000 |

) |

Payments of debt extinguishment costs |

|

|

- |

|

|

|

(817 |

) |

Payment of debt issuance costs |

|

|

- |

|

|

|

(1,567 |

) |

Repayments on revolving loan facility |

|

|

- |

|

|

|

(6,608 |

) |

Payment of contingent consideration |

|

|

- |

|

|

|

(135 |

) |

Proceeds from issuance of common stock in connection with at-the-market offerings, net |

|

|

- |

|

|

|

1,064 |

|

Proceeds from exercise of warrants |

|

|

2 |

|

|

|

- |

|

Proceeds from issuance of common stock under Employee Stock Purchase Plan |

|

|

93 |

|

|

|

228 |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

65 |

|

Net cash provided by financing activities |

|

|

21,038 |

|

|

|

51,324 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

215 |

|

|

|

(34 |

) |

Net decrease in cash, cash equivalents and restricted cash |

|

|

(6,013 |

) |

|

|

(40,477 |

) |

Cash, cash equivalents and restricted cash |

|

|

|

|

|

|

Beginning of period |

|

|

16,847 |

|

|

|

57,324 |

|

End of period |

|

$ |

10,834 |

|

|

$ |

16,847 |

|

Supplemental disclosures of cash flow information |

|

|

|

|

|

|

Interest paid during the period |

|

$ |

5,857 |

|

|

$ |

8,834 |

|

Property and equipment purchases in accounts payable and accrued expenses |

|

$ |

809 |

|

|

$ |

702 |

|

Issuance of common stock to satisfy contingent consideration |

|

$ |

- |

|

|

$ |

5,630 |

|

Issuance of common stock warrants in conjunction with long term debt |

|

$ |

152 |

|

|

$ |

1,201 |

|

Issuance of common stock for services |

|

$ |

232 |

|

|

$ |

360 |

|

Issuance of common stock upon vesting of restricted stock units |

|

$ |

- |

|

|

$ |

12 |

|

Non-GAAP Financial Measures

The following tables contains a reconciliation of GAAP net revenue to Non-GAAP net revenue excluding Vapotherm Access for the three months and years ended December 31, 2023 and 2022, respectively, and the growth of such GAAP net revenue and Non-GAAP net revenue excluding Vapotherm Access over the prior year period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

(Unaudited) |

|

(in thousands, except percentages) |

|

GAAP net revenue |

|

$ |

19,734 |

|

|

$ |

18,663 |

|

|

$ |

1,071 |

|

|

|

5.7 |

% |

Vapotherm Access net revenue |

|

|

- |

|

|

|

(70 |

) |

|

|

70 |

|

|

|

(100.0 |

)% |

Non-GAAP net revenue excluding Vapotherm Access |

|

$ |

19,734 |

|

|

$ |

18,593 |

|

|

$ |

1,141 |

|

|

|

6.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

(Unaudited) |

|

(in thousands, except percentages) |

|

GAAP net revenue |

|

$ |

68,669 |

|

|

$ |

66,801 |

|

|

$ |

1,868 |

|

|

|

2.8 |

% |

Vapotherm Access net revenue |

|

|

- |

|

|

|

(2,758 |

) |

|

|

2,758 |

|

|

|

(100.0 |

)% |

Non-GAAP net revenue excluding Vapotherm Access |

|

$ |

68,669 |

|

|

$ |

64,043 |

|

|

$ |

4,626 |

|

|

|

7.2 |

% |

The following table contains a reconciliation of net loss to Adjusted EBITDA for the three months and years ended December 31, 2023 and 2022, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

(Unaudited) |

|

(in thousands) |

|

Net loss |

|

$ |

(10,185 |

) |

|

$ |

(21,437 |

) |

|

$ |

(58,193 |

) |

|

$ |

(113,259 |

) |

Interest expense, net |

|

|

4,924 |

|

|

|

3,745 |

|

|

|

18,655 |

|

|

|

11,504 |

|

Provision (benefit) for income taxes |

|

|

74 |

|

|

|

(63 |

) |

|

|

126 |

|

|

|

11 |

|

Depreciation and amortization |

|

|

971 |

|

|

|

1,174 |

|

|

|

4,977 |

|

|

|

5,180 |

|

EBITDA |

|

$ |

(4,216 |

) |

|

$ |

(16,581 |

) |

|

$ |

(34,435 |

) |

|

$ |

(96,564 |

) |

Foreign currency |

|

|

158 |

|

|

|

51 |

|

|

|

332 |

|

|

|

239 |

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,114 |

|

Change in fair value of contingent consideration |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,351 |

) |

Stock-based compensation |

|

|

1,986 |

|

|

|

2,760 |

|

|

|

9,611 |

|

|

|

10,385 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

14,701 |

|

Impairment of long-lived and intangible assets |

|

|

- |

|

|

|

1,501 |

|

|

|

1,187 |

|

|

|

7,676 |

|

Loss on disposal of property and equipment |

|

|

98 |

|

|

|

247 |

|

|

|

151 |

|

|

|

568 |

|

Adjusted EBITDA |

|

$ |

(1,974 |

) |

|

$ |

(12,022 |

) |

|

$ |

(23,154 |

) |

|

$ |

(65,232 |

) |

The following table contains a reconciliation of operating expenses to Non-GAAP operating expenses and Non-GAAP cash operating expenses for the three months ended December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

(Unaudited) |

|

(in thousands) |

|

GAAP operating expenses |

|

$ |

14,227 |

|

|

$ |

16,284 |

|

|

$ |

22,827 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Impairment of long-lived and intangible assets |

|

|

- |

|

|

|

(755 |

) |

|

|

(1,501 |

) |

Loss on disposal of property and equipment |

|

|

(98 |

) |

|

|

- |

|

|

|

(247 |

) |

Non-GAAP operating expenses |

|

|

14,129 |

|

|

|

15,529 |

|

|

|

21,079 |

|

Stock-based compensation |

|

|

(1,967 |

) |

|

|

(2,161 |

) |

|

|

(2,663 |

) |

Depreciation and amortization |

|

|

(286 |

) |

|

|

(754 |

) |

|

|

(342 |

) |

Termination benefits |

|

|

- |

|

|

|

(312 |

) |

|

|

(30 |

) |

Loss from deconsolidation |

|

|

- |

|

|

|

- |

|

|

|

(35 |

) |

Non-GAAP cash operating expenses |

|

$ |

11,876 |

|

|

$ |

12,302 |

|

|

$ |

18,009 |

|

The following table contains a reconciliation of operating expenses to Non-GAAP operating expenses and Non-GAAP cash operating expenses for the years ended December 31, 2023 and 2022, respectively.

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

(Unaudited) |

|

(in thousands) |

|

GAAP operating expenses |

|

$ |

67,363 |

|

|

$ |

117,634 |

|

Impairment of goodwill |

|

|

- |

|

|

|

(14,701 |

) |

Impairment of long-lived and intangible assets |

|

|

(1,187 |

) |

|

|

(7,676 |

) |

Loss on disposal of property and equipment |

|

|

(151 |

) |

|

|

(568 |

) |

Non-GAAP operating expenses |

|

|

66,025 |

|

|

|

94,689 |

|

Stock-based compensation |

|

|

(9,435 |

) |

|

|

(9,668 |

) |

Depreciation and amortization |

|

|

(1,195 |

) |

|

|

(1,709 |

) |

Termination benefits |

|

|

(754 |

) |

|

|

(3,060 |

) |

Loss from deconsolidation |

|

|

119 |

|

|

|

(35 |

) |

Change in fair value of contingent consideration |

|

|

- |

|

|

|

3,351 |

|

Non-GAAP cash operating expenses |

|

$ |

54,760 |

|

|

$ |

83,568 |

|

Supplemental Operating Metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

Amount |

|

|

Amount |

|

|

Amount |

|

|

% |

|

HVT 2.0 and precision flow units installed base |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

24,617 |

|

|

|

24,327 |

|

|

|

290 |

|

|

|

1.2 |

% |

International |

|

12,892 |

|

|

|

12,439 |

|

|

|

453 |

|

|

|

3.6 |

% |

Total |

|

37,509 |

|

|

|

36,766 |

|

|

|

743 |

|

|

|

2.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

Amount |

|

|

Amount |

|

|

Amount |

|

|

% |

|

HVT 2.0 and precision flow units sold and leased |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

178 |

|

|

|

239 |

|

|

|

(61 |

) |

|

|

(25.5 |

)% |

International |

|

88 |

|

|

|

75 |

|

|

|

13 |

|

|

|

17.3 |

% |

Total |

|

266 |

|

|

|

314 |

|

|

|

(48 |

) |

|

|

(15.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

Disposable patient circuits sold |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

98,749 |

|

|

|

104,302 |

|

|

|

(5,553 |

) |

|

|

(5.3 |

)% |

International |

|

45,137 |

|

|

|

24,551 |

|

|

|

20,586 |

|

|

|

83.8 |

% |

Total |

|

143,886 |

|

|

|

128,853 |

|

|

|

15,033 |

|

|

|

11.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

Amount |

|

|

Amount |

|

|

Amount |

|

|

% |

|

HVT 2.0 and precision flow units sold and leased |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

874 |

|

|

|

813 |

|

|

|

61 |

|

|

|

7.5 |

% |

International |

|

489 |

|

|

|

531 |

|

|

|

(42 |

) |

|

|

(7.9 |

)% |

Total |

|

1,363 |

|

|

|

1,344 |

|

|

|

19 |

|

|

|

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Disposable patient circuits sold |

|

|

|

|

|

|

|

|

|

|

|

United States |

|

319,641 |

|

|

|

331,044 |

|

|

|

(11,403 |

) |

|

|

(3.4 |

)% |

International |

|

153,396 |

|

|

|

118,226 |

|

|

|

35,170 |

|

|

|

29.7 |

% |

Total |

|

473,037 |

|

|

|

449,270 |

|

|

|

23,767 |

|

|

|

5.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

SOURCE: Vapotherm, Inc.

Investor Relations Contacts:

John Landry, SVP & CFO, ir@vtherm.com, +1 (603) 658-0011

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

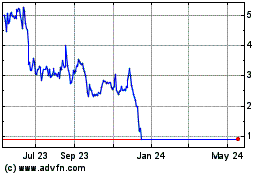

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Apr 2024 to May 2024

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From May 2023 to May 2024