Western Midstream Announces Closing of Meritage Midstream Acquisition

14 October 2023 - 5:30AM

Business Wire

Western Midstream Partners, LP (NYSE: WES) (“WES” or the

“Partnership”) today announced the closing of the previously

announced acquisition of Meritage Midstream Services II, LLC

(“Meritage”). The consideration was funded with cash on hand and

WES’s recent $600 million investment grade senior notes issuance.

The Meritage acquisition transforms WES’s existing asset footprint

in the Powder River Basin with expanded gathering and processing

facilities, a diversified customer base, and long-term contracts

supported by minimum volume commitments and acreage

dedications.

As previously announced, for the third quarter 2023, management

intends to recommend a Base Distribution increase of $0.0125, or

$0.05 annualized, resulting in a total annualized distribution of

$2.30 per common unit.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a Delaware master

limited partnership formed to acquire, own, develop, and operate

midstream assets. With midstream assets located in the Rocky

Mountains, North-central Pennsylvania, Texas, and New Mexico, WES

is engaged in the business of gathering, compressing, treating,

processing, and transporting natural gas; gathering, stabilizing,

and transporting condensate, NGLs, and crude oil; and gathering and

disposing of produced water for its customers. In addition, in its

capacity as a processor of natural gas, WES also buys and sells

natural gas, NGLs, and condensate on behalf of itself and as an

agent for its customers under certain of its contracts.

For more information about Western Midstream Partners, LP and

Western Midstream Flash Feed updates, please visit

www.westernmidstream.com.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements. WES’s

management believes that its expectations are based on reasonable

assumptions. No assurance, however, can be given that such

expectations will prove correct. A number of factors could cause

actual results to differ materially from the expectations expressed

in this news release. These factors include our ability to realize

the expected benefits from the Meritage acquisition; meet financial

guidance or distribution expectations; our ability to safely and

efficiently operate WES’s assets and integrate the Meritage assets

into our portfolio; the supply of, demand for, and price of oil,

natural gas, NGLs, and related products or services; our ability to

meet projected in-service dates for capital-growth projects;

construction costs or capital expenditures exceeding estimated or

budgeted costs or expenditures; and the other factors described in

the “Risk Factors” section of WES’s most-recent Form 10-K filed

with the Securities and Exchange Commission and other public

filings and press releases. WES undertakes no obligation to

publicly update or revise any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231012497947/en/

WESTERN MIDSTREAM CONTACTS

Daniel Jenkins Director, Investor Relations

Investors@westernmidstream.com 866-512-3523

Rhianna Disch Manager, Investor Relations

Investors@westernmidstream.com 866-512-3523

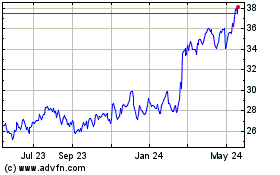

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Feb 2025 to Mar 2025

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Mar 2024 to Mar 2025