W&T Offshore Prices $350 Million Senior Second Lien Notes Offering

15 January 2025 - 9:15AM

W&T Offshore, Inc. (NYSE: WTI) (“W&T Offshore” or the

“Company”) today announced the pricing of its previously announced

offering of $350 million in aggregate principal amount of 10.750%

senior second lien notes due 2029 (the “Notes”) at par in a private

offering that is exempt from registration under the Securities Act

of 1933, as amended (the “Securities Act”). The closing of the

offering of the Notes is expected to occur on January 28, 2025,

subject to customary closing conditions.

The Company intends to use the net proceeds of

the offering, along with cash on hand, to (i) purchase for cash

pursuant to a tender offer, the Company’s outstanding 11.750%

Senior Second Lien Notes due 2026 (the “2026 Senior Second Lien

Notes”) that are validly tendered pursuant to the terms thereof

(the “Tender Offer”), (ii) on or after August 1, 2025, redeem in

full any remaining 2026 Senior Second Lien Notes not validly

tendered and accepted for purchase in the Tender Offer and, pending

such redemption, satisfy and discharge the indenture governing the

2026 Senior Second Lien Notes, (iii) repay outstanding amounts

under the term loan provided by Munich Re Risk Financing, Inc., as

lender (the “MRE Term Loan”), and (iv) pay premiums, fees and

expenses related to the offering of Notes, the Tender Offer, the

redemption of any 2026 Senior Second Lien Notes, the satisfaction

and discharge of the indenture governing the 2026 Senior Second

Lien Notes and the repayment and termination of the MRE Term Loan.

This announcement is not an offer to purchase or a solicitation of

an offer to sell the 2026 Senior Second Lien Notes, and it does not

constitute a notice of redemption of the 2026 Senior Second Lien

Notes.

The Notes and the related guarantees to be

offered have not been registered under the Securities Act or any

other securities laws, and the Notes and the related guarantees may

not be offered or sold except pursuant to an exemption from, or in

a transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. The Notes

and the related guarantees are being offered only to persons

reasonably believed to be qualified institutional buyers in the

United States under Rule 144A and to non-U.S. investors outside the

United States pursuant to Regulation S.

This press release is being issued pursuant to

Rule 135c under the Securities Act and does not constitute an offer

to sell, a solicitation of an offer to buy, or a sale of the Notes,

the related guarantees, or any other securities, nor does it

constitute an offer to sell, a solicitation of an offer to buy or a

sale in any jurisdiction in which such offer, solicitation or sale

is unlawful.

ABOUT W&T OFFSHORE

W&T Offshore, Inc. is an independent oil and

natural gas producer with operations offshore in the Gulf of Mexico

and has grown through acquisitions, exploration and development. As

of September 30, 2024, the Company had working interests in 53

fields in federal and state waters (which include 46 fields in

federal waters and 7 in state waters). The Company has under lease

approximately 673,100 gross acres (515,400 net acres) spanning

across the outer continental shelf off the coasts of Louisiana,

Texas, Mississippi and Alabama, with approximately 514,000 gross

acres on the conventional shelf, approximately 153,500 gross acres

in the deepwater and 5,600 gross acres in Alabama state waters. A

majority of the Company’s daily production is derived from wells it

operates.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements reflect our

current views with respect to future events, including the

completion, timing and size of the proposed offering, the intended

use of the proceeds, including to fund the Tender Offer, redeem in

full any remaining 2026 Senior Second Lien Notes not validly

tendered and accepted for purchase pursuant to the Tender Offer and

satisfy and discharge the indenture governing the 2026 Senior

Second Lien Notes, repay the MRE Term Loan, and pay premiums, fees

and expenses related to the aforementioned, and the terms of the

Notes being offered, based on what we believe are reasonable

estimates and assumptions. No assurance can be given, however, that

these events will occur or that our estimates will be correct.

These statements are subject to risks and uncertainties that could

cause actual results to differ materially including, among other

things, market conditions, oil and gas price volatility,

uncertainties inherent in oil and gas production operations and

estimating reserves, uncertainties of the timing and impact of

bringing new wells online and repairing and restoring

infrastructure hurricane damage, the ability to achieve leverage

targets, unexpected future capital expenditures, competition, the

success of our risk management activities, governmental

regulations, uncertainties and other factors discussed in our

Annual Report on Form 10-K for the year ended December 31, 2023 and

subsequent Form 10-Q reports found at www.sec.gov. Investors

are urged to consider closely the disclosures and risk factors in

these reports.

CONTACT:

Al PetrieInvestor Relations

Coordinatorinvestorrelations@wtoffshore.com713-297-8024

Sameer ParasnisExecutive Vice President and

Chief Financial

Officersparasnis@wtoffshore.com 713-513-8654

Source: W&T Offshore, Inc.

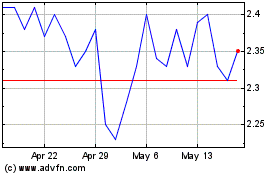

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

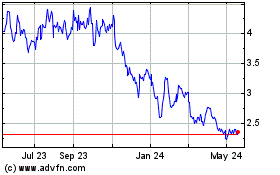

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Mar 2024 to Mar 2025