W&T Offshore Announces Proposed Senior Second Lien Notes Offering

13 January 2025 - 4:01PM

W&T Offshore, Inc. (NYSE: WTI) (“W&T Offshore” or the

“Company”) today announced its intention to offer, subject to

market and other conditions, $350 million in aggregate principal

amount of senior second lien notes due 2029 (the “Notes”) in a

private offering that is exempt from registration under the

Securities Act of 1933, as amended (the “Securities Act”).

The Company intends to use the net proceeds of

the offering, along with cash on hand, to (i) purchase for cash

pursuant to a tender offer, WTI’s outstanding 11.750% Senior Second

Lien Notes due 2026 (the “2026 Senior Second Lien Notes”) that are

properly tendered pursuant to the terms thereof (the “Tender

Offer”), (ii) on or after August 1, 2025, redeem in full any

remaining 2026 Senior Second Lien Notes not validly tendered and

accepted for purchase in the Tender Offer and, pending such

redemption, satisfy and discharge the indenture governing the 2026

Senior Second Lien Notes, (iii) repay outstanding amounts under the

term loan provided by Munich Re Risk Financing, Inc., as lender

(the “MRE Term Loan”), and (iv) pay premiums, fees and expenses

related to the Offering, the Tender Offer, the redemption of any

2026 Senior Second Lien Notes, the satisfaction and discharge of

the indenture governing the 2026 Senior Second Lien Notes and the

repayment and termination of the MRE Term Loan. This announcement

is not an offer to purchase or a solicitation of an offer to sell

the 2026 Senior Second Lien Notes, and it does not constitute a

notice of redemption of the 2026 Senior Second Lien Notes.

The Notes and the related guarantees to be

offered have not been registered under the Securities Act or any

other securities laws, and the Notes and the related guarantees may

not be offered or sold except pursuant to an exemption from, or in

a transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. The Notes

and the related guarantees will be offered only to persons

reasonably believed to be qualified institutional buyers in the

United States under Rule 144A and to non-U.S. investors outside the

United States pursuant to Regulation S.

This press release is being issued pursuant to

Rule 135c under the Securities Act and does not constitute an offer

to sell, a solicitation of an offer to buy, or a sale of the Notes,

the related guarantees, or any other securities, nor does it

constitute an offer to sell, a solicitation of an offer to buy or a

sale in any jurisdiction in which such offer, solicitation or sale

is unlawful.

ABOUT W&T OFFSHORE

W&T Offshore, Inc. is an independent oil and

natural gas producer with operations offshore in the Gulf of Mexico

and has grown through acquisitions, exploration and development. As

of September 30, 2024, the Company had working interests in 53

fields in federal and state waters (which include 46 fields in

federal waters and 7 in state waters). The Company has under lease

approximately 673,100 gross acres (515,400 net acres) spanning

across the outer continental shelf off the coasts of Louisiana,

Texas, Mississippi and Alabama, with approximately 514,000 gross

acres on the conventional shelf, approximately 153,500 gross acres

in the deepwater and 5,600 gross acres in Alabama state waters. A

majority of the Company’s daily production is derived from wells it

operates.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements reflect our

current views with respect to future events, including the

completion, timing and size of the proposed offering, the intended

use of the proceeds, including to fund the Tender Offer, redeem in

full any remaining 2026 Senior Second Lien Notes not validly

tendered and accepted for purchase pursuant to the Tender Offer and

satisfy and discharge the indenture governing the 2026 Senior

Second Lien Notes, repay the MRE Term Loan, and pay premiums, fees

and expenses related to the aforementioned, and the terms of the

Notes being offered, based on what we believe are reasonable

estimates and assumptions. No assurance can be given, however, that

these events will occur or that our estimates will be correct.

These statements are subject to risks and uncertainties that could

cause actual results to differ materially including, among other

things, market conditions, oil and gas price volatility,

uncertainties inherent in oil and gas production operations and

estimating reserves, uncertainties of the timing and impact of

bringing new wells online and repairing and restoring

infrastructure hurricane damage, the ability to achieve leverage

targets, unexpected future capital expenditures, competition, the

success of our risk management activities, governmental

regulations, uncertainties and other factors discussed in our

Annual Report on Form 10-K for the year ended December 31, 2023 and

subsequent Form 10-Q reports found at www.sec.gov. Investors are

urged to consider closely the disclosures and risk factors in these

reports.

CONTACT:

Al PetrieInvestor Relations

Coordinatorinvestorrelations@wtoffshore.com713-297-8024

Sameer ParasnisExecutive Vice President and

Chief Financial Officersparasnis@wtoffshore.com713-513-8654

Source: W&T Offshore, Inc.

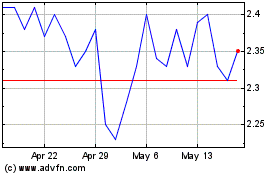

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

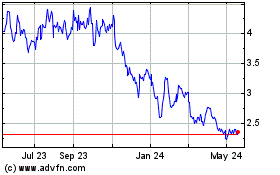

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Mar 2024 to Mar 2025