Form 8-K - Current report

05 January 2024 - 8:31AM

Edgar (US Regulatory)

FALSE000003408800000340882024-01-042024-01-040000034088us-gaap:CommonStockMember2024-01-042024-01-040000034088xom:ZeroPointOneFourTwoPercentNotesDue2024Member2024-01-042024-01-040000034088xom:ZeroPointFiveTwoFourPercentNotesDue2028Member2024-01-042024-01-040000034088xom:ZeroPointFiveTwoFourPercentNotesDue2032Member2024-01-042024-01-040000034088xom:OnePointFourZeroEightPercentNotesDue2039Member2024-01-042024-01-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 4, 2024

Exxon Mobil Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | 1-2256 | 13-5409005 |

(State or other

jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

22777 Springwoods Village Parkway, Spring, Texas 77389-1425

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 940-6000

| | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | | Name of Each Exchange |

| Title of Each Class | Trading Symbol | on Which Registered |

| Common Stock, without par value | XOM | New York Stock Exchange |

| 0.142% Notes due 2024 | XOM24B | New York Stock Exchange |

| 0.524% Notes due 2028 | XOM28 | New York Stock Exchange |

| 0.835% Notes due 2032 | XOM32 | New York Stock Exchange |

| 1.408% Notes due 2039 | XOM39A | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| |

| Item 7.01 | Regulation FD Disclosure |

| | The following information is furnished pursuant to Item 7.01.

|

INDEX TO EXHIBITS

| | | | | |

| Exhibit No. | Description |

| | |

| Exxon Mobil Corporation 4Q23 Earnings Considerations. |

| | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EXXON MOBIL CORPORATION |

| | | |

| | | |

Date: January 4, 2024 | By: | /s/ LEN M. FOX |

| | | Len M. Fox |

| | | Vice President and Controller |

| | | (Principal Accounting Officer) |

EXHIBIT 99.1

4Q23 Earnings Considerations

To give perspective regarding market and planned factors affecting 4Q 2023 results, we are providing the following summary of items management believes will impact 4Q 2023 results relative to 3Q 2023 results. These factors are generally limited to significant planned activities, market dynamics, and seasonal demand patterns. This is only intended to provide information regarding current estimates of these factors. It is not comprehensive of all changes between 3Q 2023 and 4Q 2023 results and is not an estimate of 4Q 2023 earnings for the Corporation. For example, the table below does not reflect operating performance; ongoing improvement initiatives; impacts from the seasonality of base operating expenses; unscheduled downtime; or foreign exchange fluctuation, among other factors. Further, this list may not account for all adjustments and charges required to fully reflect the changes in industry conditions and are subject to finalization of the Corporation’s financial reporting process for 4Q 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| $ billions | | Upstream | Energy Products | Chemical Products | Specialty Products | Corp & Fin | Total |

3Q23 earnings (loss), U.S. GAAP | | 6.1 | 2.4 | 0.2 | 0.6 | (0.4) | 9.1 |

| | | | | | | |

3Q23 Identified Items | | | | | | | |

| Tax-related items | | (0.0) | (0.0) | | | | (0.0) |

| | | | | | | |

3Q23 earnings (loss) excluding Identified Items (non-GAAP) | | 6.1 | 2.5 | 0.2 | 0.6 | (0.4) | 9.1 |

| | | | | | | |

| Due to rounding, numbers presented above may not add up precisely to the totals indicated. |

| | | | | | | |

Estimated effects of market factors impacting 4Q23 results | | | | |

| Change in liquids prices | | (0.8) - (0.4) | | | | | |

| Change in gas prices | | 0.4 - 0.8 | | | | | |

| Change in industry margins | | | (1.7) - (1.5) | 0.3 - 0.5 | 0.0 - 0.2 | | |

| Change in unsettled derivatives (mark-to-market) | | (0.3) - 0.1 | 1.0 - 1.4 | | | | |

| | | | | | | |

Estimated effects of planned and seasonal factors, and other items impacting 4Q23 results | |

| Change in scheduled maintenance | | (0.1) - 0.1 | (0.2) - 0.0 | (0.1) - 0.1 | (0.1) - 0.1 | | |

| | | | | | | |

| Estimated year-end inventory effects | | (0.4) - (0.2) | 0.1 - 0.3 | (0.1) - 0.1 | 0.0 - 0.2 | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Identified Items | |

| Additional European taxes on the energy sector | | (0.1) - 0.0 | (0.1) - (0.0) | | | | |

| Divestments | | 0.2 - 0.4 | | | | | |

| Impairments ¹ | | (2.6) - (2.4) | | (0.3) - (0.2) | (0.1) - (0.0) | | |

| Tax-related items | | 0.1 - 0.2 | 0.1 - 0.2 | 0.0 - 0.1 | 0.0 - 0.1 | 0.0 - 0.1 | |

| Other | | | | (0.3) - (0.2) | (0.1) - (0.0) | | |

¹ Impairments primarily reflect idle Upstream Santa Ynez Unit assets and associated facilities in California. While the Corporation is progressing efforts to enable a restart of production, continuing challenges in the state regulatory environment have impeded progress in restoring operations.

Outlooks, estimates, projections, and other statements of future financial impacts of certain factors as provided in this publication are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Actual future impacts of these certain factors for 4Q 2023 may vary from our estimates for a number of reasons, including additional unidentified factors related to: sales volume and sales mix numbers; supply and demand imbalances including as a result of direct or indirect restrictions on production; regional pricing differentials and refining and chemical margins; seasonal impacts on product demand and operating expenses; resolution of trading and derivative positions for the quarter; global and regional hostilities, including border disputes, nationalizations, war, terrorism, or civil unrest and its impact on markets and our assets around the world; price impacts and the broader government responses to inflationary pressures; changes in interest and exchange rates; supply chain disruptions; planned cash and operating expense reductions; total capital expenditures and mix; maintenance costs and incidents; production shut-ins and mix; financing costs; the resolution of any contingencies and uncertain tax positions; environmental expenditures; impact of fiscal, contractual, and commercial terms applicable to the quarter; the outcome of commercial negotiations related to the quarter; the timing and regulatory approval of any acquisitions or divestments; regional differences for product demand; changes in consumer behavior including the impact of inflation and/or recession; actions by governments or independent administrative bureaucracies to increase our costs, decrease our ability to produce or replenish reserves, or prevent the expansion of our low carbon solutions businesses; changes in asset valuation or estimates of fair value as of a certain date; updates or corrections of any estimate used herein; and other market conditions in the oil, natural gas, petroleum, and petrochemical industries. Furthermore, additional factors may exist that will be relevant to 4Q 2023 results that are not currently known or fully understood, including our participation in joint ventures or developments operated by third parties and other factors cited in Item 1A. Risk Factors of our most recent Annual and Quarterly Reports available on the Investors page of our website at www.exxonmobil.com. All forward-looking statements and the assumptions in this filing speak only as of the date hereof. We do not assume or undertake any obligation to update these forward-looking statements or assumptions as of any future date. Any future update or expansion of the forward-looking statements in this filing will be provided only through a public disclosure indicating that fact.

Earnings (loss) excluding Identified Items (non-GAAP) is defined as earnings (loss) excluding individually significant non-operational events with, typically, an absolute corporate total earnings impact of at least $250 million in a given quarter. The earnings (loss) impact of an identified item for an individual segment may be less than $250 million when the item impacts several periods or several segments. Earnings (loss) excluding Identified Items does include non-operational earnings events or impacts that are generally below the $250 million threshold utilized for identified items. When the effect of these events is material in aggregate, it is indicated in analysis of period results as part of quarterly earnings press release and teleconference materials. Management uses these figures to improve comparability of the underlying business across multiple periods by isolating and removing significant non-operational events from business results. The Corporation believes this view provides investors increased transparency into business results and trends and provides investors with a view of the business as seen through the eyes of management. Earnings (loss) excluding Identified Items is not meant to be viewed in isolation or as a substitute for net income (loss) attributable to ExxonMobil as prepared in accordance with U.S. GAAP.

In accordance with Regulation FD, we are hereby providing notice the Company currently intends to furnish its 4Q 2023 financial results both (1) by posting them on our website at www.exxonmobil.com and (2) in a filing on Form 8-K in the Securities and Exchange Commission EDGAR system, each at approximately 5:30 a.m. CT Friday, February 2, 2024. In the event the EDGAR system experiences technical difficulties or the Company is unable to successfully complete its 8-K filing at the intended time, investors and the public should look for this information at that time on our website. In case of a failed filing, the Company intends to furnish the information on EDGAR as soon as possible after 5:30 a.m. CT Friday, February 2, 2024.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=xom_ZeroPointOneFourTwoPercentNotesDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=xom_ZeroPointFiveTwoFourPercentNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=xom_ZeroPointFiveTwoFourPercentNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=xom_OnePointFourZeroEightPercentNotesDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

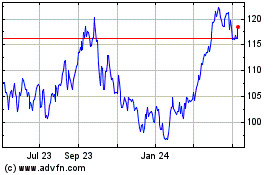

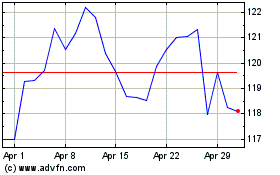

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024