Altus Group Releases Q3 2024 CRE Industry Conditions & Sentiment Survey Findings

25 September 2024 - 11:00PM

Altus Group Limited (“Altus” or “the Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate (“CRE”), today released the findings from its Q3 2024 CRE

Industry Conditions & Sentiment Survey, a quarterly survey that

collects insights on current market conditions and future

expectations. The latest survey draws on feedback from 437 seasoned

CRE professionals representing over 163 firms in the U.S. and

Canada from July 11 to August 6, 2024.

The Q3 2024 CRE Industry Conditions &

Sentiment Survey highlights participants’ perspectives on several

topics, including:

- Operating environment

expectations: the majority of respondents (69% in the U.S.

and 67% in Canada) described the near-term operating environment as

“somewhat challenging” – consistent with the sentiment expressed

the prior quarter in both markets.

- Current focus

areas: primary focus over the next six months remains on

managing existing portfolios and exposures, with an uptick in

respondents indicating they plan to deploy capital (up 11

percentage points in the U.S. and up 2 percentage points in Canada

over the prior quarter).

- Transaction intentions over

the next six months: a significant majority of respondents

(89% in the U.S. and 75% in Canada) signalled intent to transact,

nearly 10 percentage points higher than last quarter for both

countries.

- Perception of pricing

shifts: across the largest property sectors in the U.S.,

participants increasingly described current pricing as being

“priced about right”, while in Canada respondents still

characterized much of the market as largely “overpriced”.

- Property performance

expectations: industrial and multifamily asset classes

continued to be top ranked as best performers, with office

consistently ranked as a worst performer.

- Priority issues:

the cost of capital/interest rates remained as the top concern,

reflecting overall low expectations for capital availability.

“The survey results revealed lingering concerns

in the commercial real estate market in Q3, though there was

increasing optimism about future improvements,” commented Omar

Eltorai, Director of Research, Altus Group. “While CRE transaction

activity remained muted in the face of high borrowing costs and

expectations of impending interest rate cuts, last week’s rate cut

in the U.S. should boost investor sentiment, potentially

encouraging those on the sidelines to re-engage with the

market.”

To download the full reports by country, please

use the following links:

- U.S. Q3 2024 CRE Industry

Conditions & Sentiment Survey

- Canada Q3 2024

CRE Industry Conditions & Sentiment Survey

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 2,900 employees across North America, EMEA and

Asia Pacific. For more information about Altus (TSX: AIF) please

visit www.altusgroup.com.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Elizabeth LambeDirector, Global Communications,

Altus Group1-416-641-9787Elizabeth.Lambe@altusgroup.com

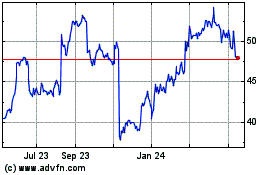

Altus (TSX:AIF)

Historical Stock Chart

From Jan 2025 to Feb 2025

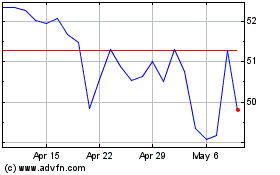

Altus (TSX:AIF)

Historical Stock Chart

From Feb 2024 to Feb 2025