Amerigo Resources Ltd. (TSX: ARG; OTCQX: ARREF)

(“Amerigo” or the “Company”) is pleased to announce that it has

received approval from the Toronto Stock Exchange (the “TSX”) to

proceed with a new normal course issuer bid (the “NCIB”).

The NCIB will commence on December 2, 2023, and

may continue to December 1, 2024, or at such earlier time as the

NCIB is completed or terminated at the option of the Company.

Under the NCIB, Amerigo may purchase for

cancellation up to 10,900,000 common shares of the Company (the

“Shares”), approximately 10% of Amerigo’s public float as of

November 24, 2023. As of November 24, 2023, there were 164,845,034

issued and outstanding Shares of the Company, of which 109,114,122

were forming the public float.

“We are pleased to announce the renewal of

Amerigo’s ability to buy back shares for cancellation, which is one

of our tools to return capital to shareholders,” said Aurora

Davidson, Amerigo’s President and CEO. “In the last two years, we

retired more than 20.1 million Shares under two NCIBs and one

Substantial Issuer Bid. Under the right market and treasury

conditions, this trend could continue next year,” added Ms.

Davidson. “We look forward to continue showcasing our commitment to

shareholder returns in 2024.”

Amerigo’s average daily trading volume (“ADTV”)

for the six months ending October 31, 2023, was 135,288 Shares, and

therefore, the new NCIB’s daily purchase limit will be 33,822

Shares, 25% of ADTV. However, once per calendar week, Amerigo may

make one block purchase that exceeds the daily purchase

restriction.

Under the NCIB, Shares may be purchased in open

market transactions on the TSX at the prevailing market price at

the time of such trade. All Shares purchased under the NCIB will be

cancelled.

Under Amerigo’s previous NCIB, which commenced

on December 2, 2022, and will expire on December 1, 2023, Amerigo

received TSX approval to purchase up to 11,080,000 Shares in open

market transactions on the TSX. As of the date of this release,

Amerigo had repurchased and cancelled 2,281,187 Shares at a

weighted average purchase price of Cdn$1.57 per Share under that

earlier NCIB.

Amerigo has a multi-year capital allocation

strategy and a Capital Return Strategy that uses quarterly

dividends1, performance dividends and share buybacks to return

capital consistently and flexibly to shareholders. Amerigo believes

that from time to time, the purchase of Shares under NCIBs is an

attractive investment opportunity for Amerigo and accretive to the

value of Amerigo’s Shares.

The actual number of Shares purchased under the

NCIB and the timing of such purchases will be determined by

Amerigo. There cannot be any assurance as to how many Shares, if

any, will ultimately be acquired by the Company.

1 With an annual yield of 9.16%, based on four quarterly

dividends of Cdn$0.03 per share each, divided over Amerigo’s

November 24, 2023, share price of Cdn$1.31.

About Amerigo and Minera Valle Central

(“MVC”)

Amerigo Resources Ltd. is an innovative copper

producer with a long-term relationship with Corporación Nacional

del Cobre de Chile (“Codelco”), the world’s largest copper

producer.

Amerigo produces copper concentrate and

molybdenum concentrate as a by-product at the MVC operation in

Chile by processing fresh and historic tailings from Codelco’s El

Teniente mine, the world's largest underground copper mine. Tel:

(604) 681-2802; Web: www.amerigoresources.com; Listing: ARG:

TSX.

Contact Information

Aurora Davidson

Graham

FarrellPresident and

CEO Investor

Relations(604)

697-6207 (416)

842-9003ad@amerigoresources.com Graham.Farrell@Harbor-Access.com

Forward-Looking Information

Forward-looking information (“forward-looking

statements”) is included in this news release. These

forward-looking statements are identified by the use of terms such

as “anticipate”, “believe”, “could”, “estimate”, “expect”,

“intend”, “may”, “plan”, “predict”, “project”, “will”, “would”, and

“should” and similar terms and phrases, including references to

assumptions. Such statements may involve, but are not limited to,

Amerigo’s plans, objectives, expectations and intentions, including

Amerigo’s objectives and expectations regarding the number of

shares that Amerigo may purchase under the NCIB, Amerigo’s return

of capital policy and other comments concerning strategies,

expectations, planned operations or future actions.

These forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such statements. Inherent in forward-looking

statements are risks and uncertainties beyond Amerigo’s ability to

predict or control, including risks that may affect Amerigo’s

operating or capital plans; risks generally encountered in the

permitting and development of mineral projects such as unusual or

unexpected geological formations, negotiations with government and

other third parties, unanticipated metallurgical difficulties,

delays associated with permits, approvals and permit appeals,

ground control problems, adverse weather conditions, process upsets

and equipment malfunctions; risks associated with labour

disturbances and availability of skilled labour and management;

risks related to the potential impact of global or national health

concerns, and the inability of employees to access sufficient

healthcare; government or regulatory actions or inactions;

fluctuations in the market prices of Amerigo’s principal

commodities, which are cyclical and subject to substantial price

fluctuations; risks created through competition for mining projects

and properties; risks associated with lack of access to markets;

risks associated with availability of and Amerigo’s ability to

obtain both tailings from Codelco’s Division El Teniente’s current

production and historic tailings from tailings deposits; risks with

respect to the ability of Amerigo to draw down funds from lines of

credit and the availability of and ability of Amerigo to obtain

adequate funding on reasonable terms for expansions and

acquisitions; mine plan estimates; risks posed by fluctuations in

exchange rates and interest rates, as well as general economic

conditions; risks associated with environmental compliance and

changes in environmental legislation and regulation; risks

associated with Amerigo’s dependence on third parties for the

provision of critical services; risks associated with

non-performance by contractual counterparties; title risks; social

and political risks associated with operations in foreign

countries; risks of changes in laws affecting Amerigo’s operations

or their interpretation, including foreign exchange controls; and

risks associated with tax reassessments and legal proceedings. Many

of these risks and uncertainties apply to Amerigo and its

operations and Codelco and its operations. Codelco’s ongoing mining

operations provide a significant portion of the materials Amerigo

processes and its resulting metals production. Therefore, these

risks and uncertainties may also affect their operations and have a

material effect on Amerigo.

Actual results and developments are likely to

differ materially from those expressed or implied by the

forward-looking statements in this news release. Such statements

are based on several assumptions which may prove to be incorrect,

including, but not limited to, assumptions about:

- general business and economic

conditions;

- interest rates;

- changes in commodity and power

prices;

- acts of foreign governments and the

outcome of legal proceedings;

- the supply and demand for,

deliveries of, and the level and volatility of prices of copper and

other commodities and products used in Amerigo’s operations;

- the ongoing supply of material for

processing from Codelco’s current mining operations;

- the ability of Amerigo to

profitably extract and process material from the Cauquenes tailings

deposit;

- the timing of the receipt of and

retention of permits and other regulatory and governmental

approvals;

- Amerigo’s costs of production and

its production and productivity levels, as well as those of

Amerigo’s competitors;

- changes in credit market conditions

and conditions in financial markets generally;

- Amerigo’s ability to procure

equipment and operating supplies in sufficient quantities and on a

timely basis;

- the availability of qualified

employees and contractors for Amerigo’s operations;

- Amerigo’s ability to attract and

retain skilled staff;

- the satisfactory negotiation of

collective agreements with unionized employees;

- the impact of changes in foreign

exchange rates and capital repatriation on Amerigo’s costs and

results;

- costs of closure of various

operations;

- market competition;

- tax benefits and tax rates;

- the outcome of Amerigo’s copper

concentrate sales and treatment and refining charge

negotiations;

- the resolution of environmental and

other proceedings or disputes;

- the future supply of reasonably

priced power;

- rainfall in the vicinity of MVC

continuing to trend towards normal levels;

- average recoveries for fresh

tailings and Cauquenes tailings;

- Amerigo’s ability to obtain, comply

with and renew permits and licenses in a timely manner; and

- Amerigo’s ongoing relations with

its employees and entities with which it does business.

Future production levels and cost estimates

assume no adverse mining or other events significantly affecting

budgeted production levels. Although Amerigo believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond Amerigo’s control, Amerigo cannot assure that it will

achieve or accomplish the expectations, beliefs or projections

described in the forward-looking statements.

Amerigo cautions that the preceding list of

important factors and assumptions is not exhaustive. Other events

or circumstances could cause Amerigo’s actual results to differ

materially from those estimated or projected and expressed in or

implied by its forward-looking statements. You should also

carefully consider the matters discussed under Risk Factors in

Amerigo’s Annual Information Form. The forward-looking statements

contained herein speak only as of the date of this news release,

and except as required by law, Amerigo undertakes no obligation to

update publicly or otherwise revise any forward-looking statements

or the preceding list of factors, whether as a result of new

information or future events or otherwise.

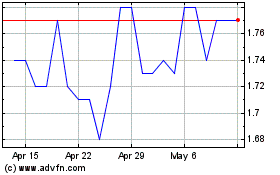

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Mar 2024 to Apr 2024

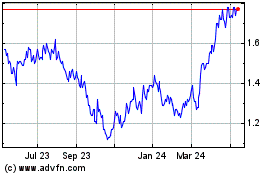

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Apr 2023 to Apr 2024