Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is taking swift action in response to the significant decline in

global oil prices to bolster balance sheet strength and corporate

resiliency, including a $30 million reduction to its 2020 capital

program and proactively curtailing heavy oil production at

Hangingstone.

$30 million Reduction to 2020 Capital

Budget and Operations Update

Athabasca has immediately cancelled $30 million

of capital expenditures, representing a 25% reduction from the

previously announced 2020 budget. The revised $95 million budget

primarily includes the completion of the winter program. The

Company already had a minimal capital program in place with market

uncertainty and has low capital requirements to sustain its liquids

weighted production base.

The Company has completed the tie-in of 10

Placid Montney wells and intends to bring production on-stream in

Q2 2020. The Kaybob Duvernay program is nearing completion with 16

wells expected to be placed on-stream in H1 2020. Athabasca’s

working interest remains protected by the capital carry through Q1

2020 with no activity planned for the balance of the year.

In Thermal Oil, the Company has temporarily

deferred long lead projects for Leismer. At Hangingstone, the

Company has self-curtailed production by approximately 50% to

maximize corporate funds flow and liquidity. The Company is making

plans to defer the Hangingstone turnaround to 2021.

Athabasca expects 2020 annual production of

32,500 – 34,000 boe/d, which reflects a self-curtailment at

Hangingstone for the balance of the year.

The Company has released all non-essential

contract staff effective immediately and is also taking further

actions to optimize operating costs in the near-term.

Balance Sheet and Risk

Management

As at year-end 2019, Athabasca had liquidity of

$340 million ($255 million cash equivalents & $85 million

available credit facilities) providing business flexibility during

commodity price volatility and market egress constraints.

Athabasca’s existing high yield debt has term until February 2022

with no financial or maintenance covenants. The Company has a $120

million reserve based credit facility ($80 million undrawn) with a

term out date of May 31, 2020, which has been routinely extended

with bi-annual reviews, and has a current maturity date of May 31,

2021.

The Company’s risk management program will

mitigate near term pricing volatility. The current 2020 hedge book

has market to market gains of approximately $50 million (Mar.

19).

Athabasca intends to maintain maximum liquidity

through this volatile macro environment.

COVID-19 Update

Athabasca has implemented its Business

Continuity Plan in response to the global pandemic to ensure the

safety of all staff and to mitigate potential risk to operations.

The Company is following Alberta Health Guidelines as it manages

its internal policies.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:Matthew Taylor

Chief Financial Officer

1-403-817-9104

mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “believe”, “view”, ”contemplate”,

“target”, “potential” and similar expressions are intended to

identify forward-looking information. The forward-looking

information is not historical fact, but rather is based on the

Company’s current plans, objectives, goals, strategies, estimates,

assumptions and projections about the Company’s industry, business

and future operating and financial results. This information

involves known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking information. No assurance

can be given that these expectations will prove to be correct and

such forward-looking information included in this News Release

should not be unduly relied upon. This information speaks only as

of the date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: the Company’s 2020 guidance; timing of the

Hangingstone facility turnaround; magnitude and length of

Hangingstone production curtailment; plans to bring Placid Montney

wells on-stream and expected benefits therefrom; drilling plans at

Kaybob Duvernay and plans to bring Kaybob Duvernay wells on-stream;

future credit facility reviews and other matters.

With respect to forward-looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity prices, including for

petroleum, natural gas and blended bitumen; the regulatory

framework governing royalties, taxes and environmental matters in

the jurisdictions in which the Company conducts and will conduct

business and the effects that such regulatory framework will have

on the Company, including on the Company’s financial condition and

results of operations; the Company’s financial and operational

flexibility; Athabasca's cash flow break-even commodity price; the

Company’s ability to obtain qualified staff and equipment in a

timely and cost-efficient manner; the applicability of technologies

for the recovery and production of the Company’s reserves and

resources; future capital expenditures to be made by the Company;

future sources of funding for the Company’s capital programs; the

Company’s future debt levels; future production levels; operating

costs; compliance of counterparties with the terms of contractual

arrangements; collection risk of outstanding accounts receivable

from third parties; geological and engineering estimates in respect

of the Company’s reserves and resources; recoverability of reserves

and resources; the geography of the areas in which the Company is

conducting exploration and development activities and the quality

of its assets.

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated March 4, 2020 available on SEDAR at

www.sedar.com, including, but not limited to: fluctuations in

commodity prices, foreign exchange and interest rates; political

and general economic, market and business conditions in Alberta,

Canada, the United States and globally; changes to royalty regimes,

environmental risks and hazards; the potential for management

estimates and assumptions to be inaccurate; the dependence on

Murphy as the operator of the Company’s Duvernay assets; the

capital requirements of Athabasca’s projects and the ability to

obtain financing; operational and business interruption risks;

failure by counterparties to make payments or perform their

operational or other obligations to Athabasca in compliance with

the terms of contractual arrangements; aboriginal claims; failure

to obtain regulatory approvals or maintain compliance with

regulatory requirements; uncertainties inherent in estimating

quantities of reserves and resources; litigation risk;

environmental risks and hazards; reliance on third party

infrastructure; hedging risks; insurance risks; claims made in

respect of Athabasca’s operations, properties or assets; risks

related to Athabasca’s amended credit facilities and senior secured

notes; and risks related to Athabasca’s common shares.

The risks and uncertainties referred to above

are described in more detail in Athabasca’s most recent AIF, which

is available on the Company’s SEDAR profile at www.sedar.com.

Readers are cautioned that the foregoing list of risk factors

should not be construed as exhaustive. The forward-looking

information included in this News Release is expressly qualified by

this cautionary statement and is made as of the date of this News

Release. The Company does not undertake any obligation to publicly

update or revise any forward-looking information except as required

by applicable securities laws.

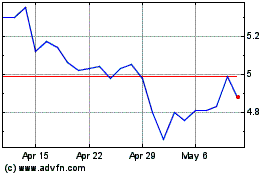

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

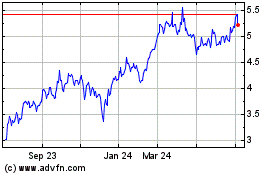

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024