USAA Signs Long Term Lease in Dallas With Brookfield Real Estate Opportunities Fund

13 January 2011 - 6:32AM

Marketwired

Brookfield Asset Management Inc. (TSX: BAM)(NYSE: BAM)(EURONEXT:

BAMA) ("Brookfield") announced today its Real Estate Opportunity

Fund ('the Fund") signed a long term lease with insurance provider

USAA in the Fund's newly acquired office building at Two Addison

Circle in Dallas, Texas.

USAA is the first major tenant in Two Addison Circle, a building

that was vacant when acquired by the Fund from a lender in August

2010. USAA leased a total of 73,000 square feet of space in the

building.

"We are pleased to welcome USAA to a Brookfield building and

excited with the progress we have made in expanding our client base

and creating value in our portfolio," said David Arthur, the Fund's

President and Managing Partner.

Brookfield has strong relationships and market knowledge in

Dallas through the approximately 3.5 million square feet of real

estate it has acquired in the area. The Fund acquired Two Addison

Circle at an attractive price representing approximately half the

building's replacement value. Two Addison Circle is a newly

constructed, approximately 200,000 square foot Class A office

building with structured parking.

USAA provides insurance, banking, investment and retirement

products and services to 7.8 million members of the U.S. military

and their families.

In leasing Two Addison, the Fund used Capstar Commercial Real

Estate Services (Johnny Johnson & Rodney Helm).

Brookfield Asset Management Inc., focused on property, renewable

power and infrastructure assets, has over $100 billion of assets

under management and is co-listed on the New York and Toronto Stock

Exchanges under the symbol BAM and on NYSE Euronext under the

symbol BAMA. For more information, please visit our website at

www.brookfield.com.

About Brookfield Real Estate Opportunity Fund

Brookfield Real Estate Opportunity Fund, established by

Brookfield Asset Management Inc., invests opportunistically in

underperforming real estate in North America, including commercial

office, industrial and mixed-use properties. Since its inception,

the Fund has acquired over 22 million square feet of properties,

mostly in the United States.

For more information, please visit our web site at

www.brookfield.com.

Contacts: Media: Andrew Willis SVP, Communications and Media

(416) 369-8236 (416) 363-2856 (FAX) andrew.willis@brookfield.com

Investor Relations: Katherine Vyse SVP, Investor Relations and

Communication (416) 369-8246 (416) 363-2856 (FAX)

kvyse@brookfield.com www.brookfield.com

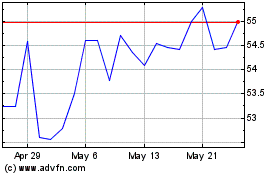

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Dec 2023 to Dec 2024