Baytex Energy Corp. (“Baytex”)(TSX, NYSE: BTE) and Raging River

Exploration Inc. (“Raging River”)(TSX: RRX) are pleased to announce

that shareholders of Raging River (“Raging River Shareholders”) and

Baytex (“Baytex Shareholders”) have today approved their previously

announced strategic combination (the “Transaction”). The

Transaction will see the combined company emerge as a

well-capitalized, oil-weighted company with an attractive growth

and free cash flow profile provided by its world class assets

across North America.

The Transaction was structured as a plan of

arrangement (the "Arrangement") under the Business Corporations Act

(Alberta) and as such also required the approval of the Alberta

Court of Queen's Bench, which was also received today. The

Arrangement provides that, among other things, each Raging River

Shareholder will receive, directly or indirectly, 1.36 common

shares of Baytex for each common share of Raging River.

The Transaction is expected to close on August

22, 2018.

Raging River Meeting

At a special meeting held on August 21, 2018,

Raging River Shareholders approved the Arrangement.

|

Resolution |

Outcome of Vote |

Percentage of Votes For |

Percentage of Votes Against |

| Plan of

Arrangement |

Passed |

96.18 |

% |

3.82 |

% |

Baytex Meeting

At a special meeting held on August 21, 2018,

Baytex Shareholders approved the issuance of the Baytex shares to

be issued to Raging River Shareholders pursuant to the

Arrangement.

|

Resolution |

Outcome of Vote |

Percentage of Votes For |

Percentage of Votes Against |

| Share Issuance |

Passed |

88.11 |

% |

11.89 |

% |

Advisory Regarding Forward-Looking

Statements

In the interest of providing the shareholders of

Baytex and Raging River and potential investors with information

regarding Baytex, Raging River and the combined company resulting

from the Transaction, including management's assessment of future

plans and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can be

identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

expectation that the combined organization will be

well-capitalized, oil-weighted and have an attractive growth and

free cash flow profile; and the timing and anticipated closing date

for the Transaction; and certain other matters relating to the

Transaction.

These forward-looking statements are based on

certain key assumptions regarding, among other things: the time

necessary to satisfy the remaining conditions to the closing of the

Arrangement; the ability of the combined company to realize the

anticipated benefits of the Transaction; petroleum and natural gas

prices and differentials between light, medium and heavy oil

prices; well production rates and reserve volumes; the ability to

add production and reserves through exploration and development

activities; capital expenditure levels; the ability to borrow under

credit agreements; the receipt, in a timely manner, of regulatory

and other required approvals for operating activities; the

availability and cost of labour and other industry services;

interest and foreign exchange rates; the continuance of existing

and, in certain circumstances, proposed tax and royalty regimes;

the ability to develop crude oil and natural gas properties in the

manner currently contemplated; and current industry conditions,

laws and regulations continuing in effect (or, where changes are

proposed, such changes being adopted as anticipated). Readers are

cautioned that such assumptions, although considered reasonable by

Baytex and Raging River at the time of preparation, may prove to be

incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: completion of the Transaction

could be delayed if parties are unable to satisfy the remaining

conditions to closing on the timeline planned; the Transaction will

not be completed if all of remaining conditions to closing are not

obtained or waived; the volatility of oil and natural gas prices

and price differentials; the availability and cost of capital or

borrowing; that credit facilities may not provide sufficient

liquidity or may not be renewed; failure to comply with the

covenants in debt agreements; risks associated with a third-party

operating the combined company's Eagle Ford properties;

availability and cost of gathering, processing and pipeline

systems; public perception and its influence on the regulatory

regime; changes in government regulations that affect the oil and

gas industry; changes in environmental, health and safety

regulations; restrictions or costs imposed by climate change

initiatives; variations in interest rates and foreign exchange

rates; risks associated with hedging activities; the cost of

developing and operating assets; depletion of reserves; risks

associated with the exploitation of properties and ability to

acquire reserves; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of operations; risks associated with large projects;

risks related to thermal heavy oil projects; risks associated with

use of information technology systems; risks associated with the

ownership of Baytex, Raging River or the combined company

securities, including changes in market-based factors; risks for

United States and other non-resident shareholders, including the

ability to enforce civil remedies, differing practices for

reporting reserves and production, additional taxation applicable

to non-residents and foreign exchange risk; and other factors, many

of which are beyond control. These and additional risk factors are

discussed in the the joint management information circular and

proxy statement dated July 12, 2018 of Baytex and Raging River,

Baytex's Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2017, filed with Canadian securities regulatory authorities and

the U.S. Securities and Exchange Commission and in Raging River's

Annual Information Form for the year ended December 31, 2017, filed

with Canadian securities regulatory authorities and in Baytex's and

Raging River's other public filings.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on the combined company's current and future operations

and such information may not be appropriate for other purposes.

There is no representation by Baytex or Raging

River that actual results achieved will be the same in whole or in

part as those referenced in the forward-looking statements and

neither Baytex nor Raging River undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

law.

Baytex Energy Corp.

Baytex is an oil and gas corporation based in

Calgary, Alberta. The company is engaged in the acquisition,

development and production of crude oil and natural gas in the

Western Canadian Sedimentary Basin and in the Eagle Ford in the

United States. Approximately 80% of Baytex’s production is weighted

toward crude oil and natural gas liquids. Baytex’s common shares

trade on the Toronto Stock Exchange and the New York Stock Exchange

under the symbol BTE.

For further information about Baytex, please

visit the company website at www.baytexenergy.com or contact:

Brian Ector, Senior Vice President,

Capital Markets and Public Affairs

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

Raging River Exploration Inc.

Raging River is a crude oil and natural gas

exploration, development and production company based in Calgary,

Alberta, Canada. The Company’s operations are in the Viking light

oil resource play in western Canada in addition to the recently

added East Duvernay Shale oil play. Raging River’s common shares

trade on the Toronto Stock Exchange under the symbol RRX.

For further information about Raging River,

please visit the company website at www.rrexploration.com or

contact:

| Mr. Neil

Roszell, P. Eng. CEO and Executive Chairman

Tel: (403) 767-1250 |

|

Mr. Bruce

Beynon, P. Geol President

Tel: (403) 767-1251 |

|

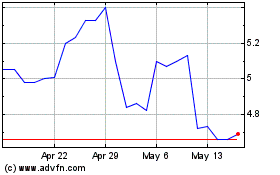

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

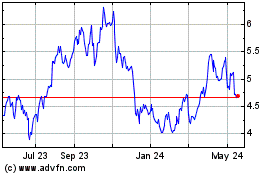

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025